This version of the form is not currently in use and is provided for reference only. Download this version of

Form 70-018

for the current year.

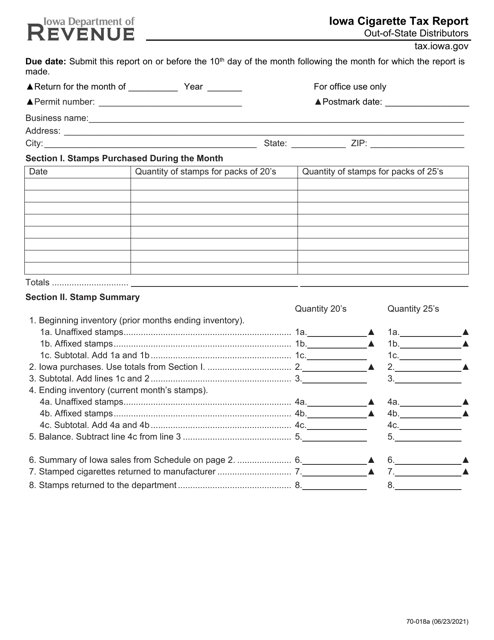

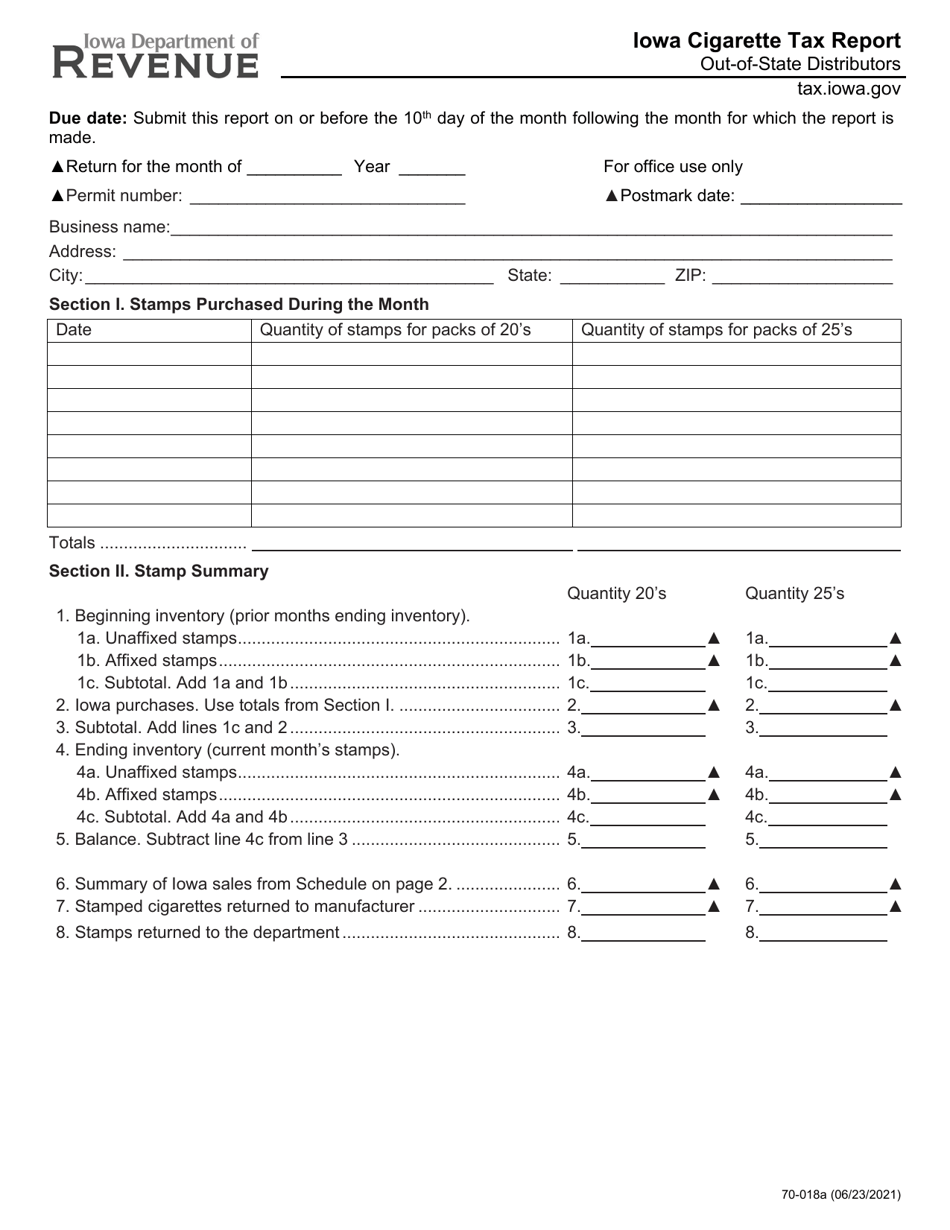

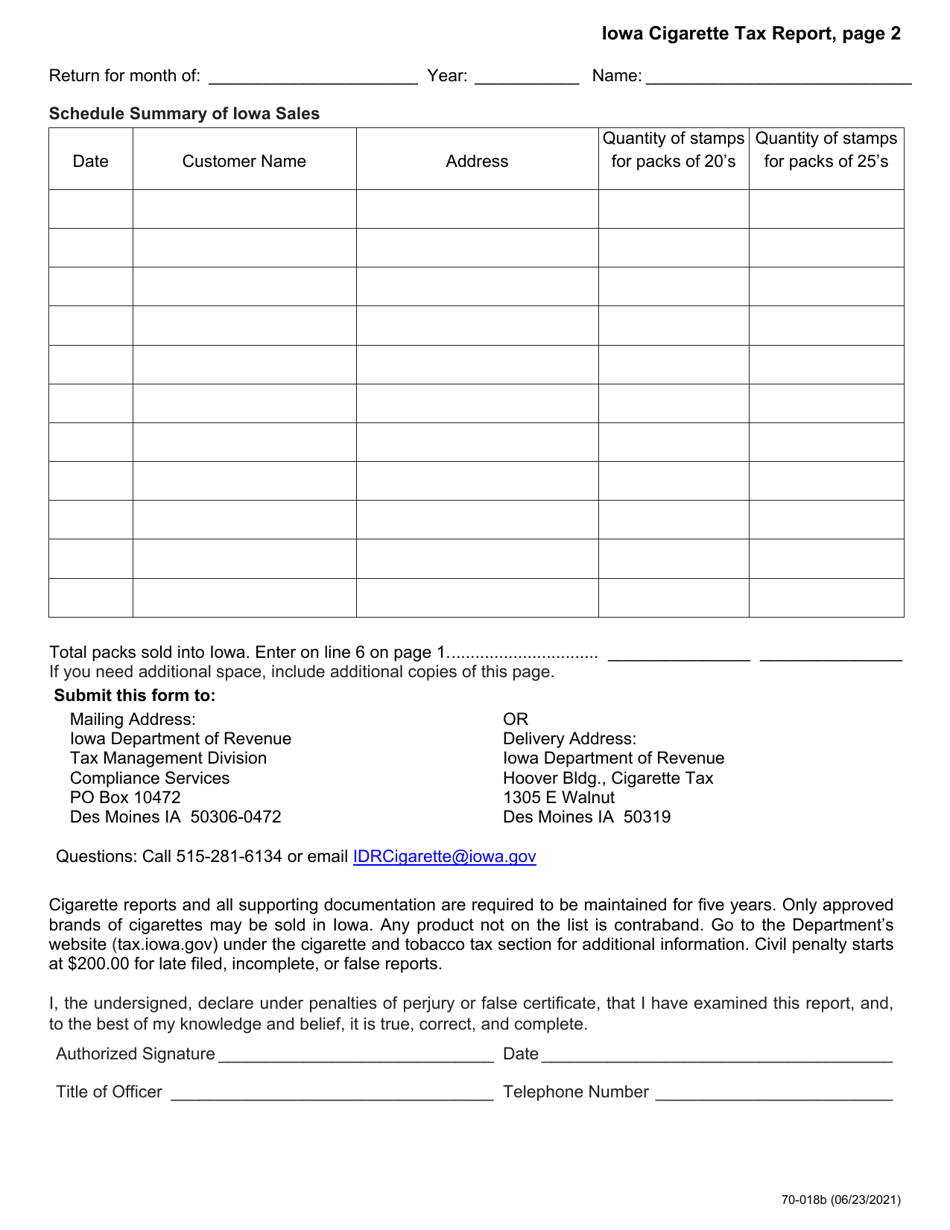

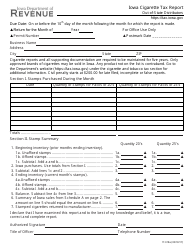

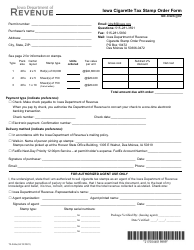

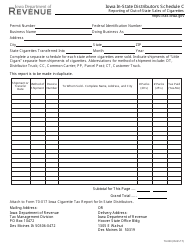

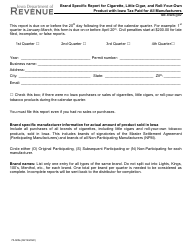

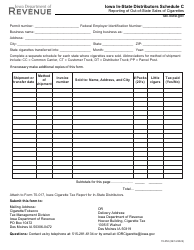

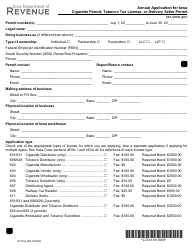

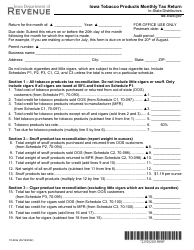

Form 70-018 Iowa Cigarette Tax Report - Out-of-State Distributors - Iowa

What Is Form 70-018?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 70-018?

A: Form 70-018 is the Iowa Cigarette Tax Report for Out-of-State Distributors.

Q: Who should file Form 70-018?

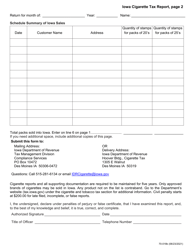

A: Out-of-state distributors of cigarettes who sell cigarettes in Iowa should file Form 70-018.

Q: What is the purpose of Form 70-018?

A: The purpose of Form 70-018 is to report the sales and distribution of cigarettes in Iowa by out-of-state distributors, for the assessment and collection of cigarette taxes.

Q: When should Form 70-018 be filed?

A: Form 70-018 should be filed monthly, on or before the 20th day of the month following the reporting period.

Q: Are there any penalties for not filing Form 70-018?

A: Yes, failure to file Form 70-018 or pay the required taxes can result in penalties and interest.

Q: Are there any other requirements for out-of-state distributors selling cigarettes in Iowa?

A: Yes, out-of-state distributors must also obtain a Cigarette Distributor License from the Iowa Department of Revenue.

Form Details:

- Released on June 23, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 70-018 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.