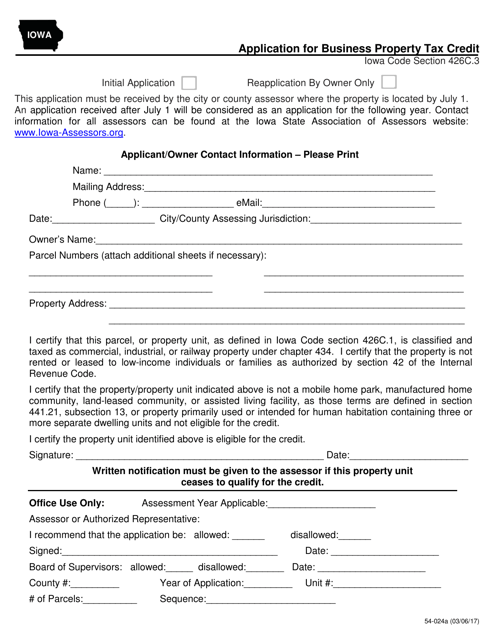

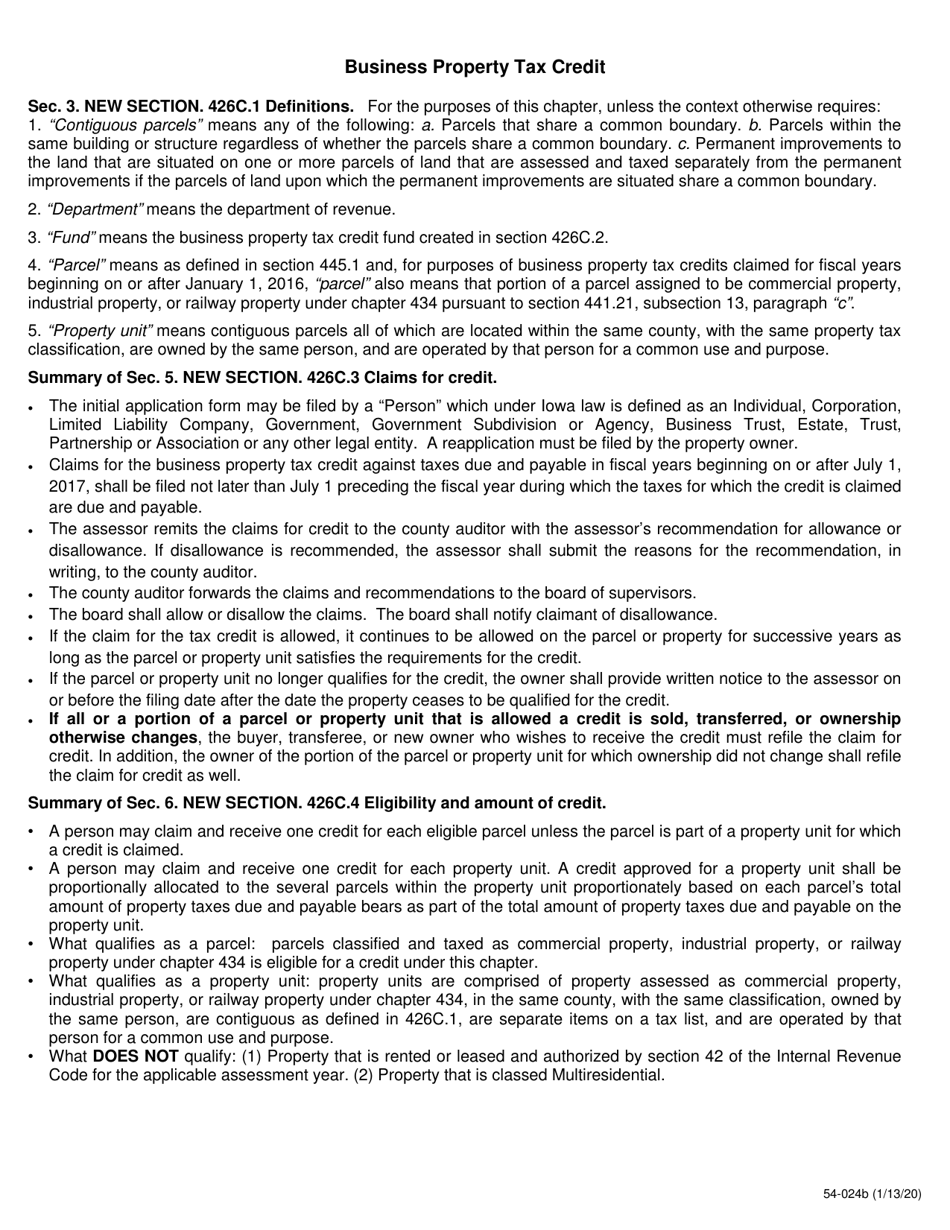

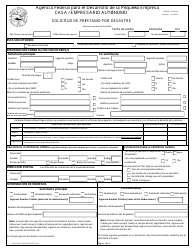

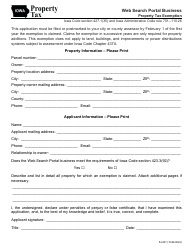

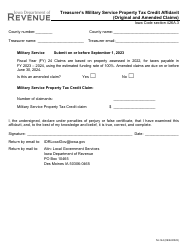

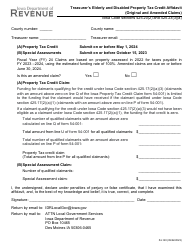

Form 54-024 Application for Business Property Tax Credit - Iowa

What Is Form 54-024?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54-024?

A: Form 54-024 is an application for the Business PropertyTax Credit in Iowa.

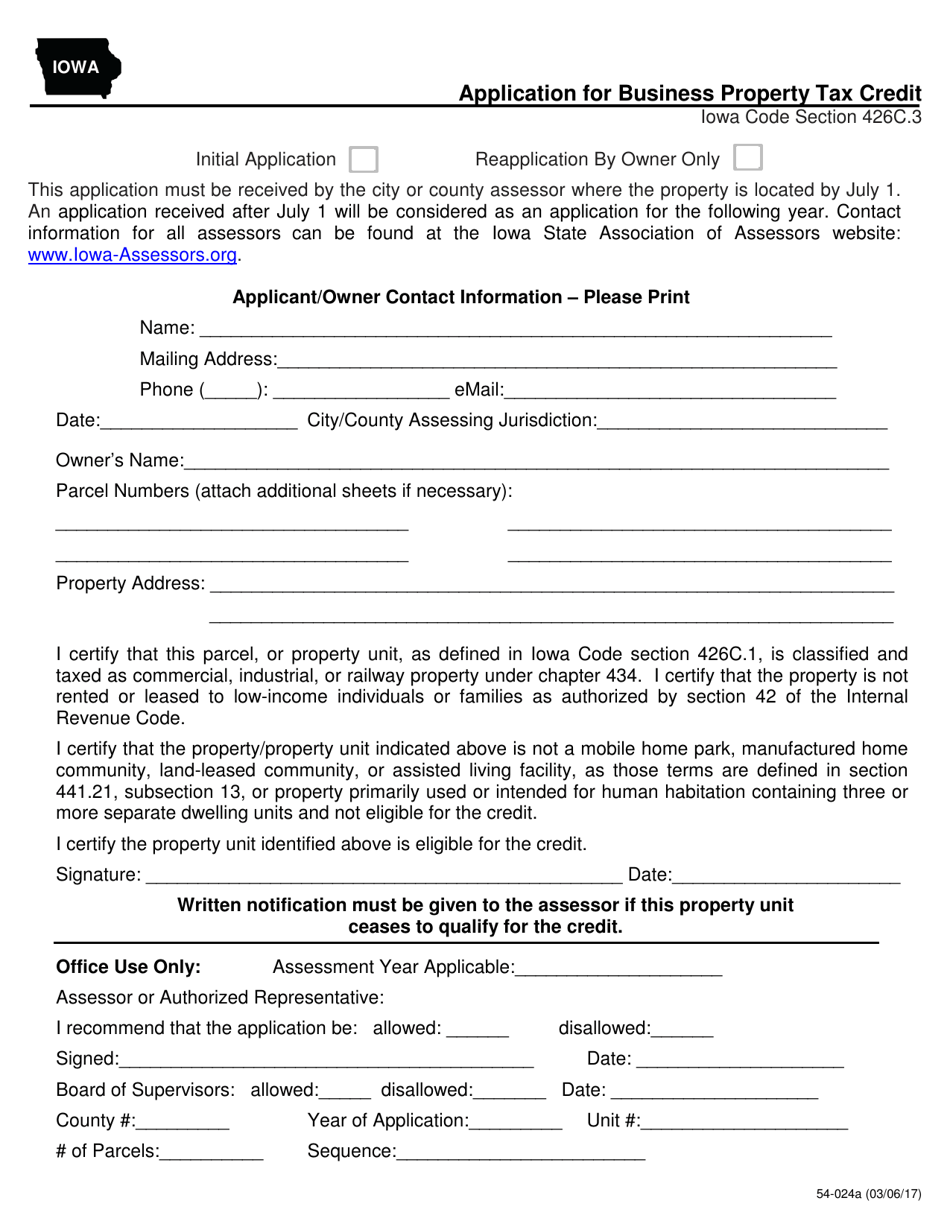

Q: Who is eligible to file Form 54-024?

A: Iowa businesses that meet certain criteria are eligible to file Form 54-024.

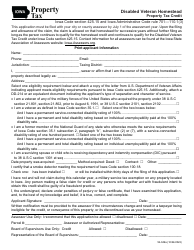

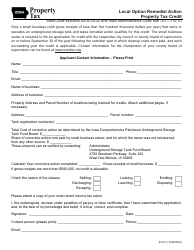

Q: What is the purpose of the Business Property Tax Credit?

A: The Business Property Tax Credit provides tax relief for eligible businesses by reducing their property tax liability.

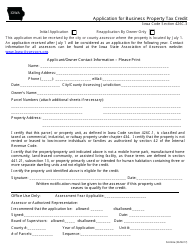

Q: What information do I need to complete Form 54-024?

A: To complete Form 54-024, you will need to provide information about your business, property, and tax liability.

Q: Are there any filing deadlines for Form 54-024?

A: Yes, Form 54-024 must be filed with the Iowa Department of Revenue by the designated due date, which is usually April 30th.

Q: What should I do if I have questions or need assistance with Form 54-024?

A: If you have questions or need assistance with Form 54-024, you can contact the Iowa Department of Revenue for guidance.

Q: Can the Business Property Tax Credit be claimed for multiple years?

A: Yes, eligible businesses can claim the Business Property Tax Credit for multiple tax years, as long as they continue to meet the criteria.

Q: Are there any limitations or restrictions on the Business Property Tax Credit?

A: Yes, there are certain limitations and restrictions on the Business Property Tax Credit, so it's important to review the instructions and guidelines provided with Form 54-024.

Q: What are the possible outcomes of filing Form 54-024?

A: The possible outcomes of filing Form 54-024 include receiving a tax credit, reducing your property tax liability, or being denied the credit if you do not meet the eligibility requirements.

Form Details:

- Released on January 13, 2020;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 54-024 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.