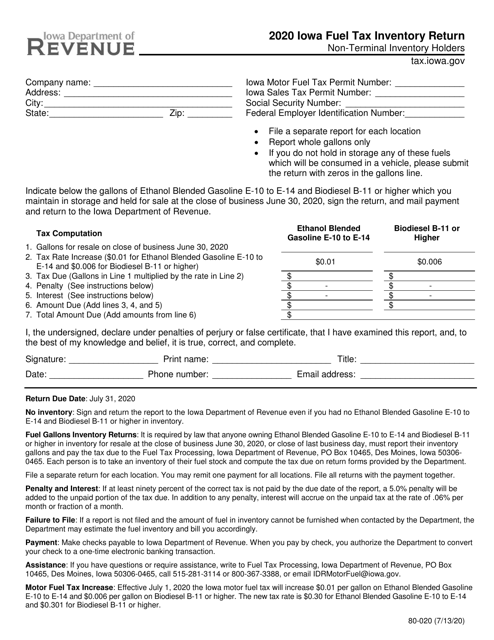

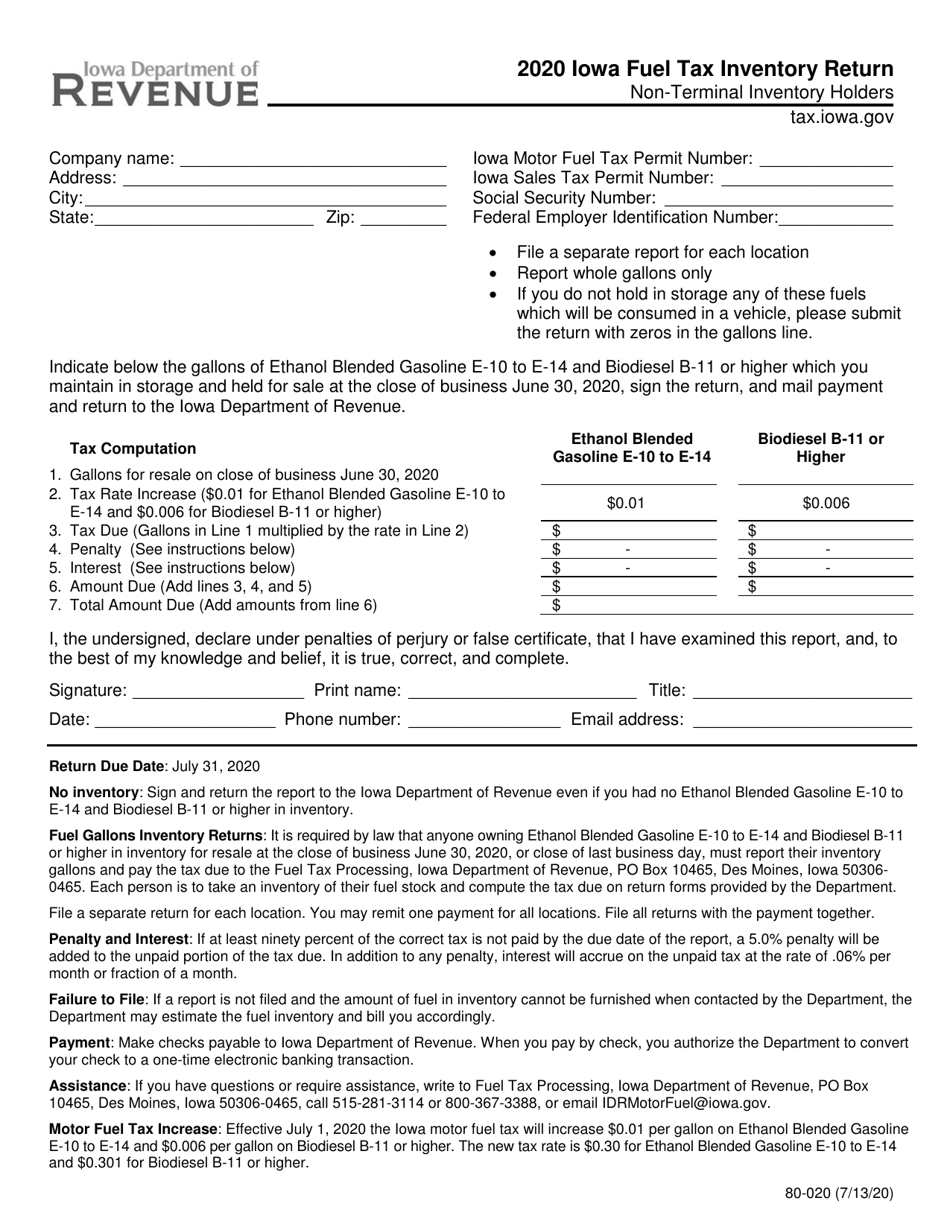

Form 80-020 Iowa Fuel Tax Inventory Return - Non-terminal Inventory Holders - Iowa

What Is Form 80-020?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 80-020?

A: Form 80-020 is the Iowa Fuel Tax Inventory Return - Non-terminal Inventory Holders.

Q: Who needs to file Form 80-020?

A: Non-terminal inventory holders in Iowa need to file Form 80-020.

Q: What is the purpose of Form 80-020?

A: The purpose of Form 80-020 is to report and pay fuel tax for non-terminal inventory holders in Iowa.

Q: When is Form 80-020 due?

A: Form 80-020 is due on the last day of the month following the reporting period.

Q: Are there any penalties for not filing Form 80-020?

A: Yes, there can be penalties for not filing or late filing of Form 80-020. It is important to make sure it is filed on time.

Form Details:

- Released on July 13, 2020;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-020 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.