This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA2848 (14-101)

for the current year.

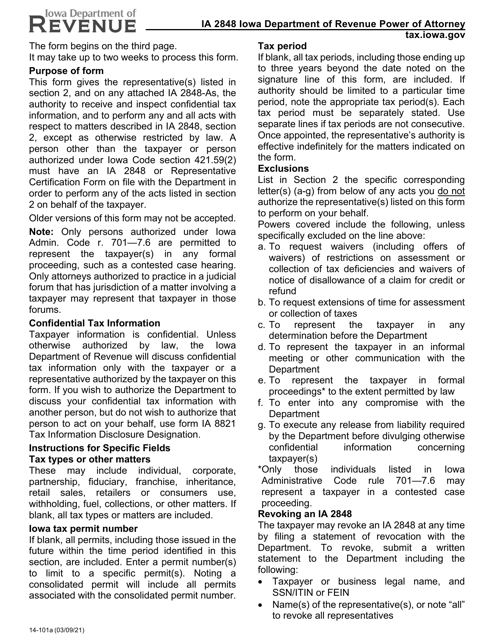

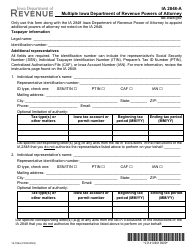

Form IA2848 (14-101) Iowa Department of Revenue Power of Attorney - Iowa

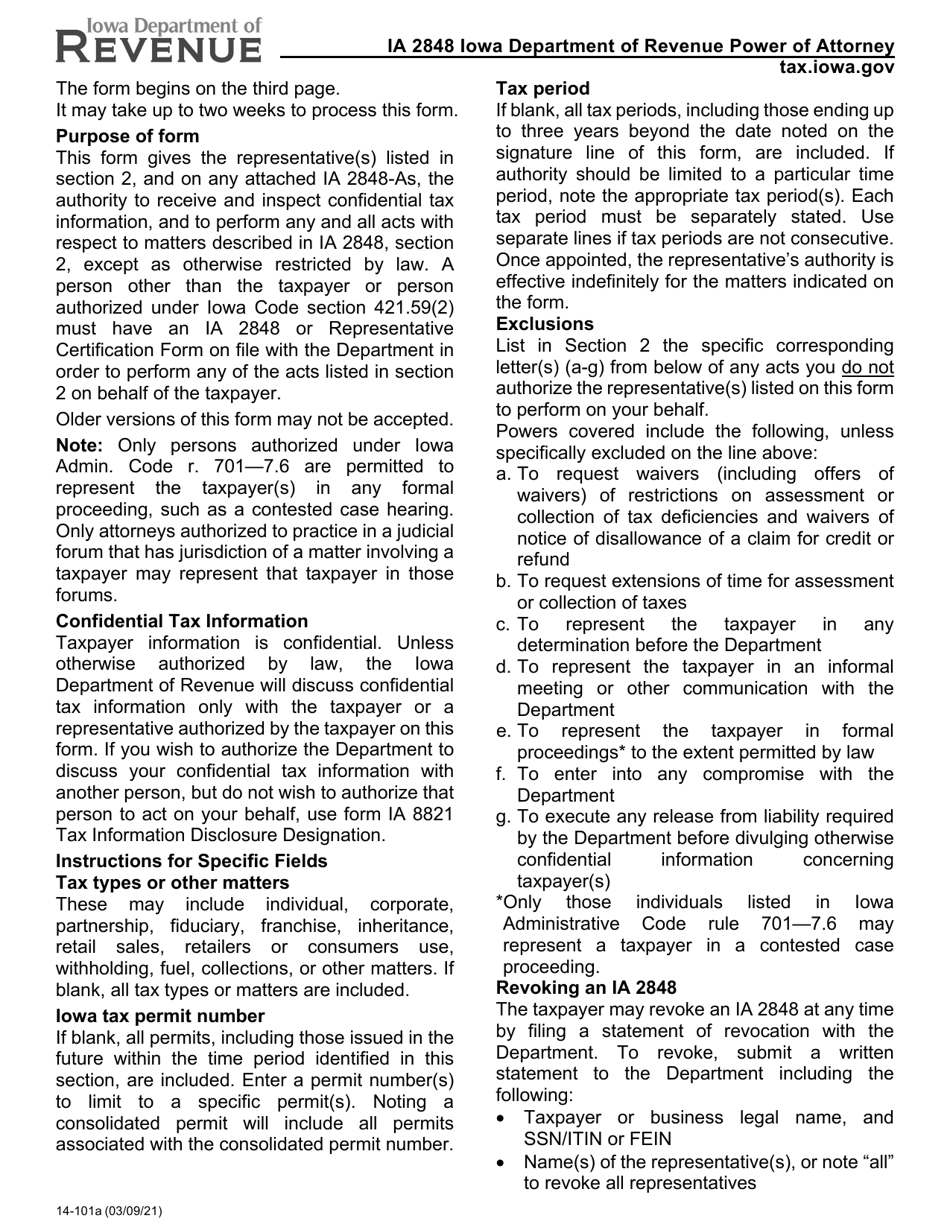

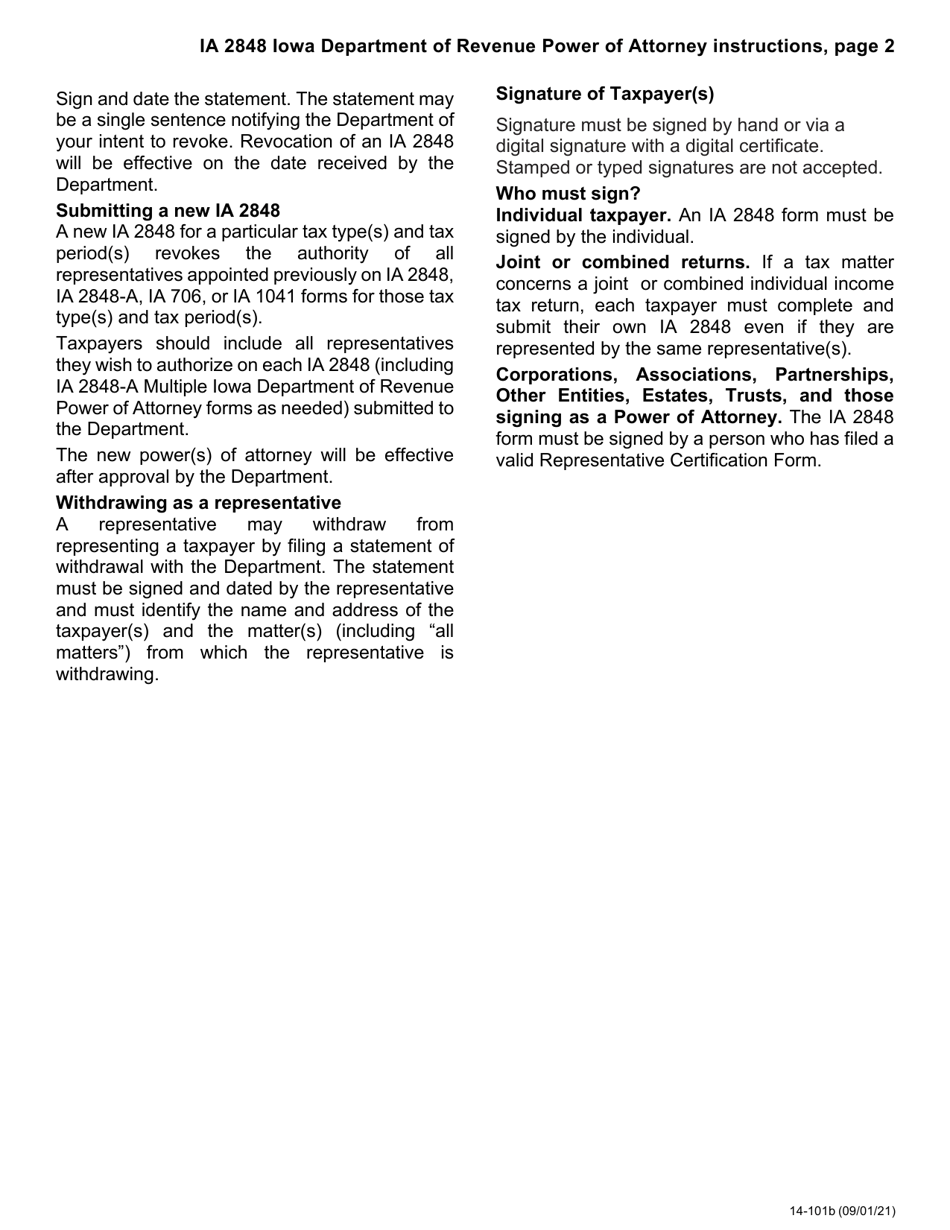

What Is Form IA2848 (14-101)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA2848?

A: Form IA2848 is a power of attorney form used by the Iowa Department of Revenue.

Q: What is the purpose of Form IA2848?

A: The purpose of Form IA2848 is to authorize another person to act on your behalf in tax matters with the Iowa Department of Revenue.

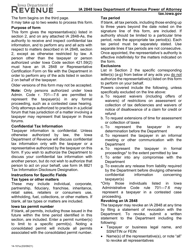

Q: Who can use Form IA2848?

A: Any individual or business entity who wants to grant power of attorney to someone else for tax matters with the Iowa Department of Revenue can use Form IA2848.

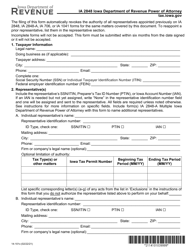

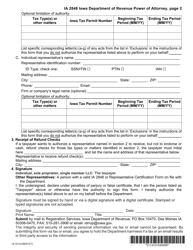

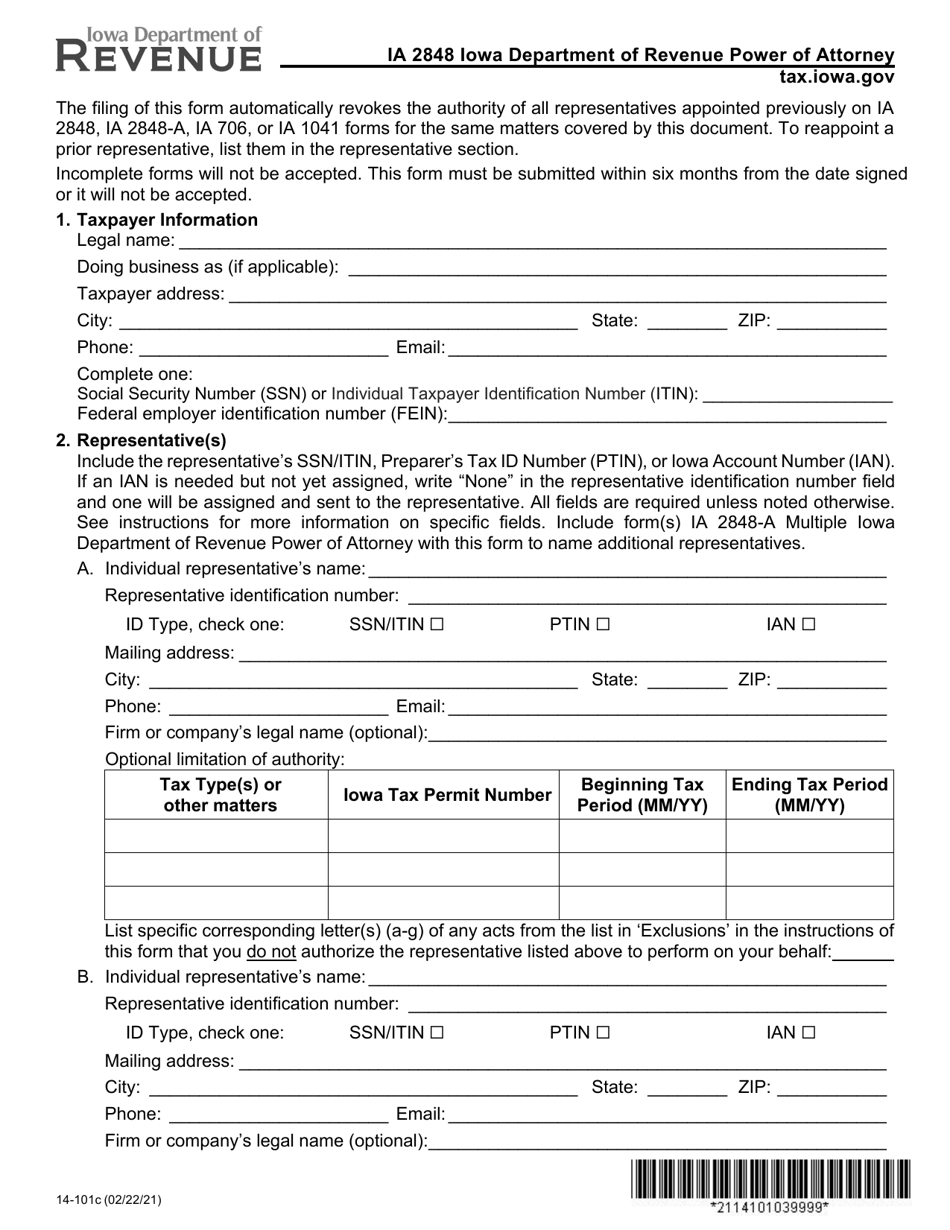

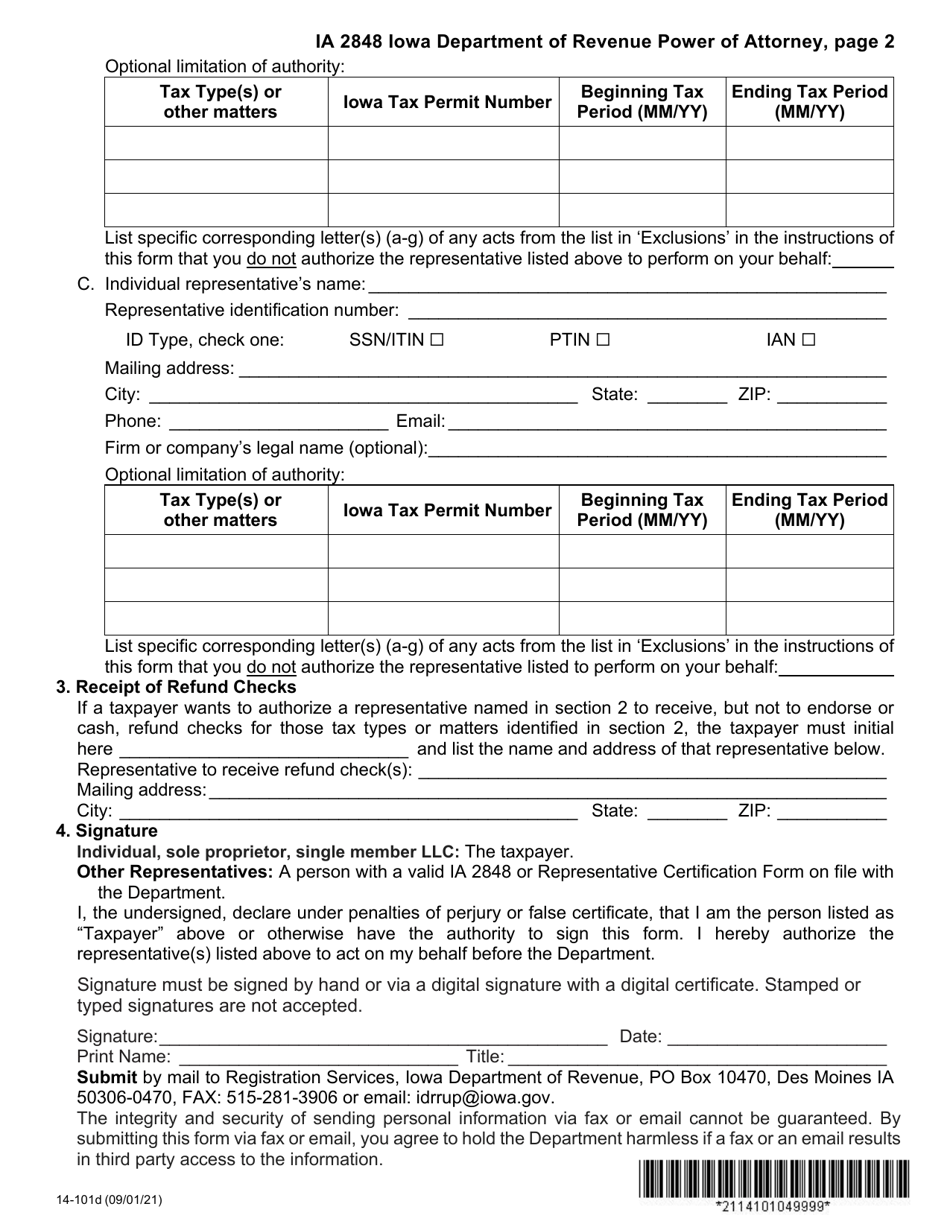

Q: What information is required on Form IA2848?

A: Form IA2848 requires the taxpayer's identification information, the representative's information, details about the tax matters covered by the power of attorney, and the taxpayer's signature.

Q: Are there any fees for submitting Form IA2848?

A: No, there are no fees for submitting Form IA2848.

Q: How long is the power of attorney valid on Form IA2848?

A: The power of attorney on Form IA2848 is valid until revoked by the taxpayer or terminated by the Iowa Department of Revenue.

Q: Can I revoke or terminate the power of attorney granted on Form IA2848?

A: Yes, you can revoke or terminate the power of attorney granted on Form IA2848 by submitting a written notice to the Iowa Department of Revenue.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA2848 (14-101) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.