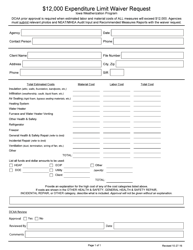

This version of the form is not currently in use and is provided for reference only. Download this version of

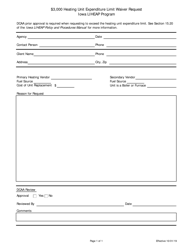

Form 78-629

for the current year.

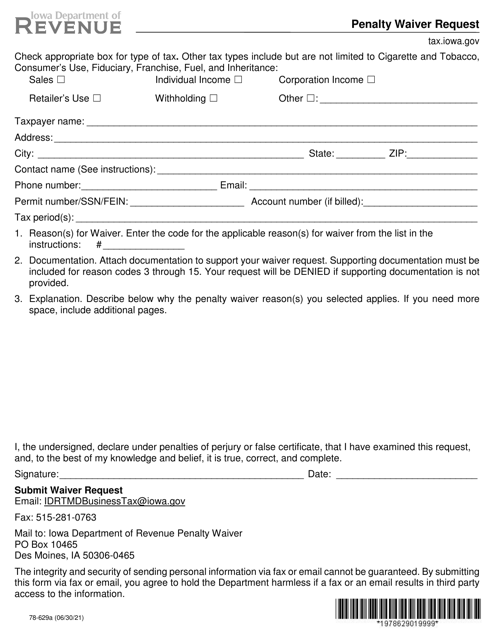

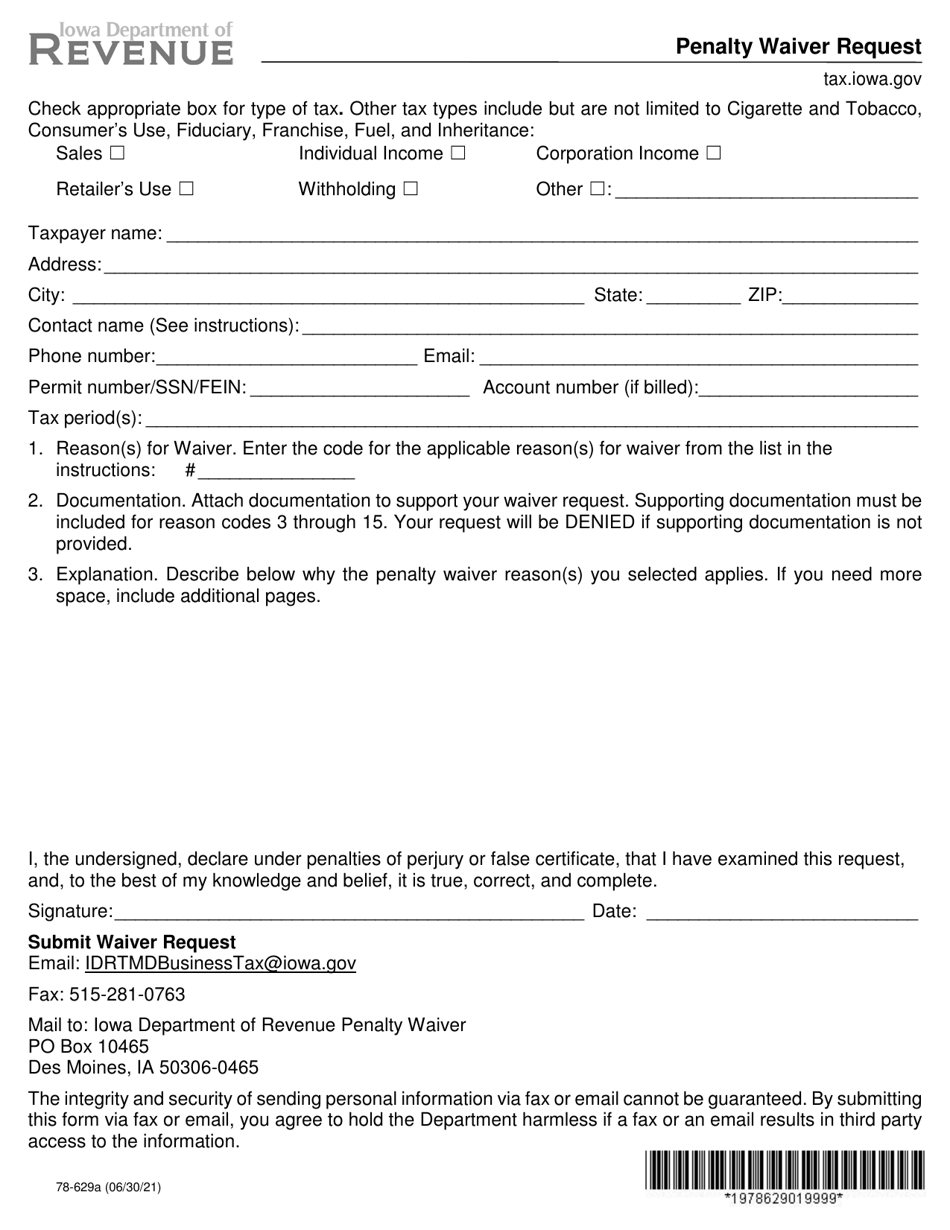

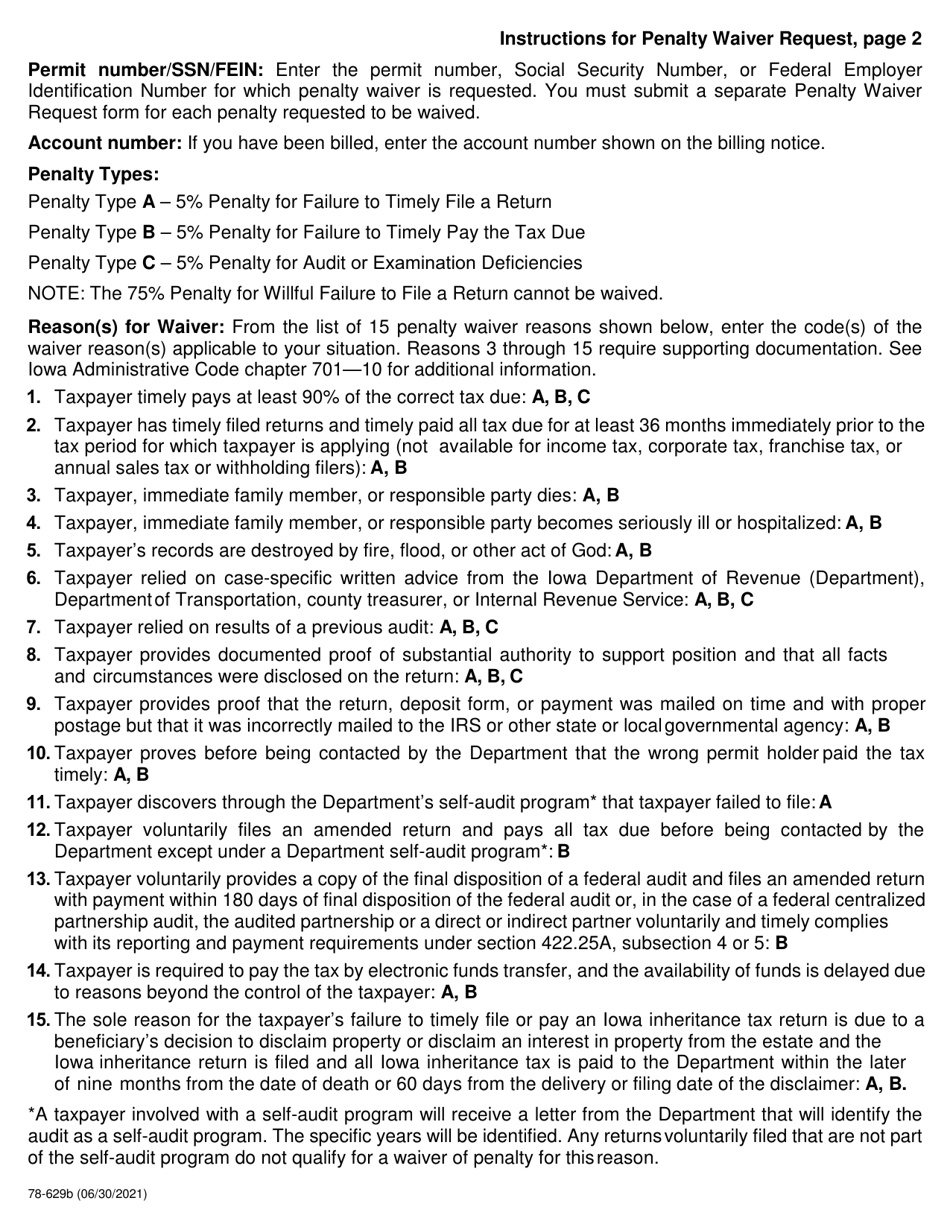

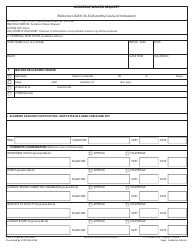

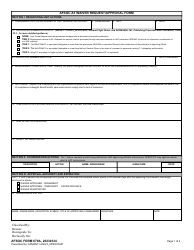

Form 78-629 Penalty Waiver Request - Iowa

What Is Form 78-629?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

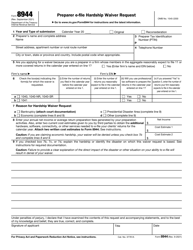

Q: What is Form 78-629?

A: Form 78-629 is a Penalty Waiver Request form in Iowa.

Q: What is the purpose of Form 78-629?

A: The purpose of Form 78-629 is to request a waiver of penalties imposed by the Iowa Department of Revenue.

Q: Who can use Form 78-629?

A: Individuals, businesses, and other entities who have incurred penalties from the Iowa Department of Revenue can use Form 78-629 to request a waiver.

Q: What penalties can be waived using Form 78-629?

A: Form 78-629 can be used to request a waiver for penalties related to various taxes administered by the Iowa Department of Revenue, such as income tax, sales tax, and withholding tax.

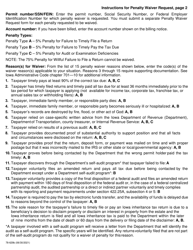

Q: How do I fill out Form 78-629?

A: The form requires you to provide your identification information, details about the penalty you incurred, and a written explanation for your request. Refer to the instructions provided with the form for guidance on filling it out.

Q: What happens after submitting Form 78-629?

A: After submitting Form 78-629, the Iowa Department of Revenue will review your request and make a decision on whether to grant or deny the penalty waiver. You will be notified of their decision in writing.

Form Details:

- Released on June 30, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 78-629 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.