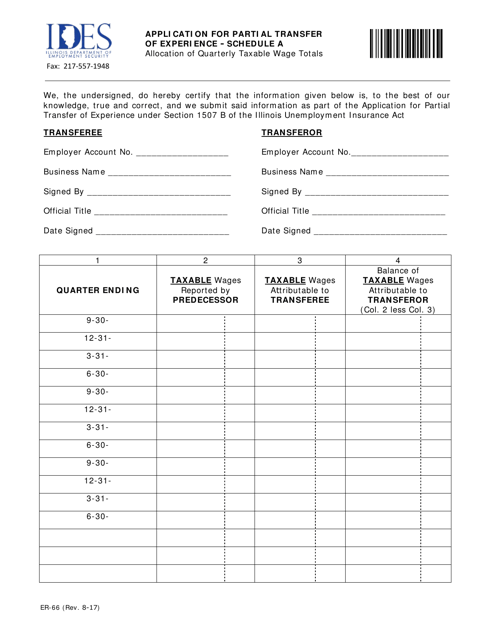

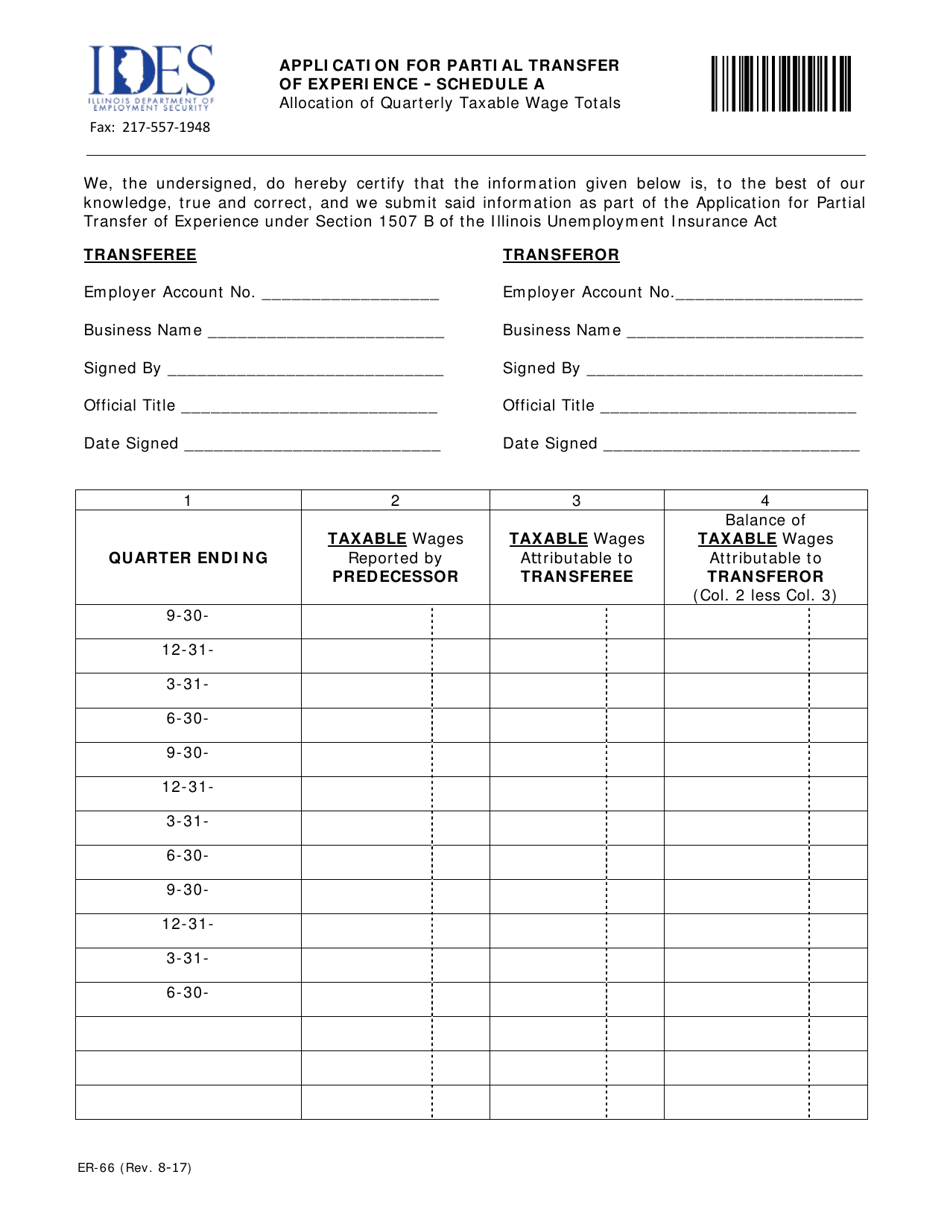

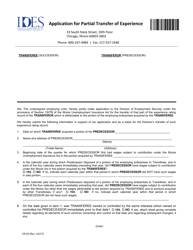

Form ER-66 Schedule A Application for Partial Transfer of Experience - Allocation of Quarterly Taxable Wage Totals - Illinois

What Is Form ER-66 Schedule A?

This is a legal form that was released by the Illinois Department of Employment Security - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ER-66 Schedule A?

A: Form ER-66 Schedule A is an application for partial transfer of experience for allocation of quarterly taxable wage totals in Illinois.

Q: What is the purpose of Form ER-66 Schedule A?

A: The purpose of Form ER-66 Schedule A is to request the transfer of experience for allocation of quarterly taxable wage totals in Illinois.

Q: Who needs to use Form ER-66 Schedule A?

A: Employers in Illinois who want to transfer experience for allocation of quarterly taxable wage totals need to use Form ER-66 Schedule A.

Q: How do I fill out Form ER-66 Schedule A?

A: You need to provide accurate and complete information about your business and the requested transfer of experience on Form ER-66 Schedule A.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Illinois Department of Employment Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ER-66 Schedule A by clicking the link below or browse more documents and templates provided by the Illinois Department of Employment Security.