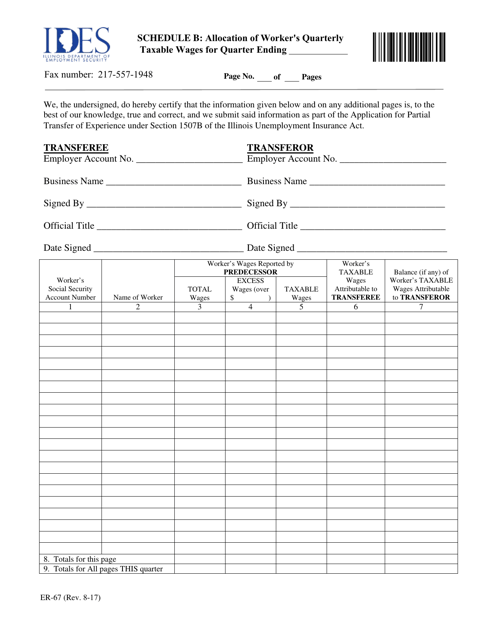

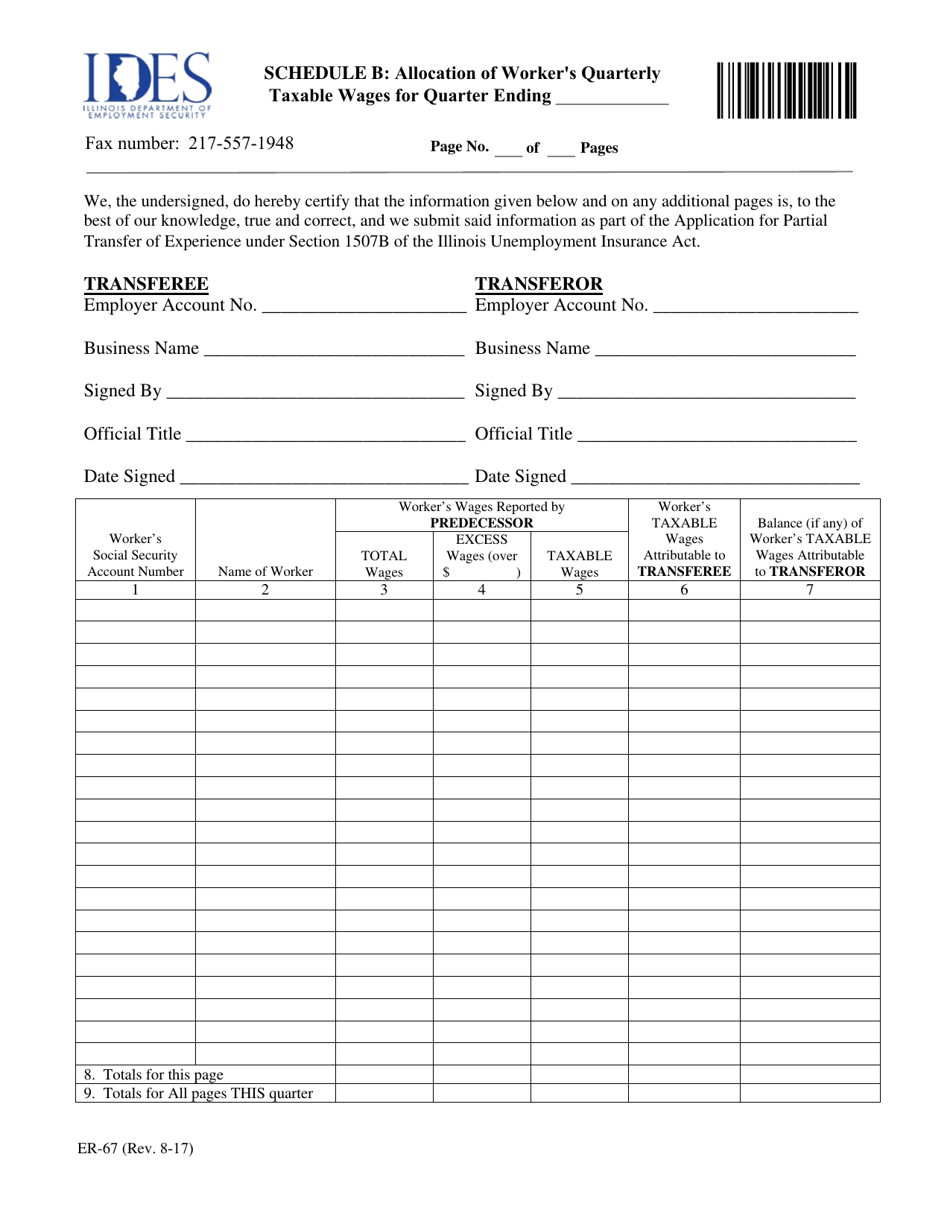

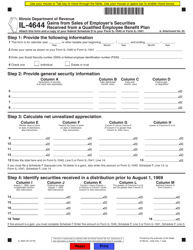

Form ER-67 Schedule B Allocation of Worker's Quarterly Taxable Wages - Illinois

What Is Form ER-67 Schedule B?

This is a legal form that was released by the Illinois Department of Employment Security - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ER-67?

A: Form ER-67 is a tax form used in Illinois to allocate worker's quarterly taxable wages.

Q: What is the purpose of Form ER-67?

A: The purpose of Form ER-67 is to allocate worker's quarterly taxable wages in Illinois.

Q: Who needs to file Form ER-67?

A: Employers in Illinois who have workers with taxable wages need to file Form ER-67.

Q: When is Form ER-67 due?

A: Form ER-67 is due on a quarterly basis in Illinois.

Q: What information do I need to complete Form ER-67?

A: To complete Form ER-67, you will need information about your workers' wages and their allocations.

Q: Are there any penalties for not filing Form ER-67?

A: Yes, there may be penalties for not filing Form ER-67 or for filing it late in Illinois.

Q: Can Form ER-67 be filed electronically?

A: Yes, Form ER-67 can be filed electronically in Illinois.

Q: Is Form ER-67 only for employers in Illinois?

A: Yes, Form ER-67 is specifically for employers in Illinois to allocate worker's quarterly taxable wages.

Q: Are there any exemptions for filing Form ER-67?

A: There may be exemptions for filing Form ER-67 in Illinois. It is best to check with the Illinois Department of Revenue for specific details.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Illinois Department of Employment Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ER-67 Schedule B by clicking the link below or browse more documents and templates provided by the Illinois Department of Employment Security.