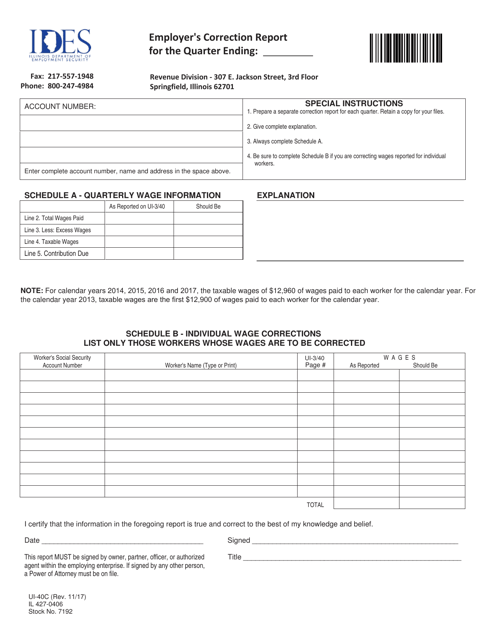

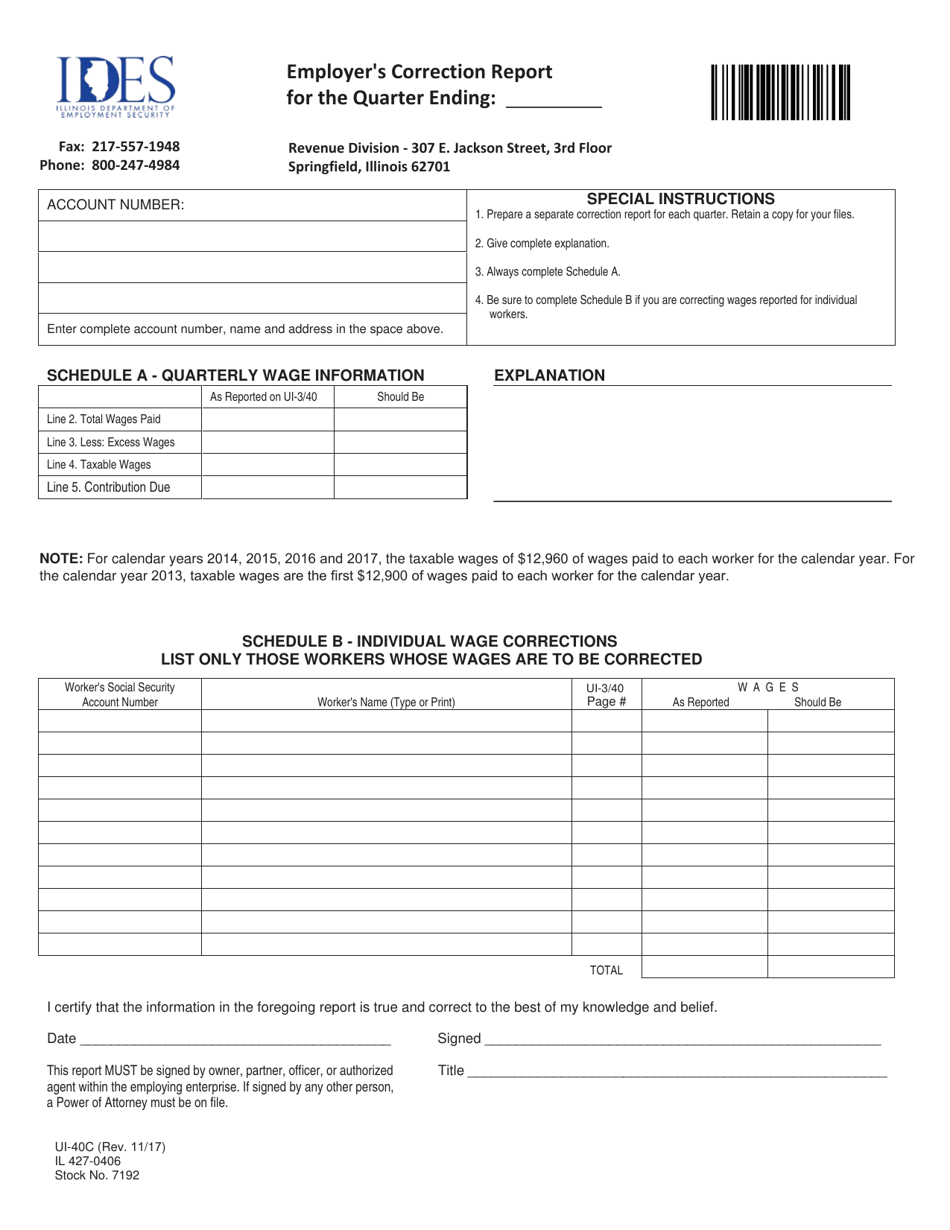

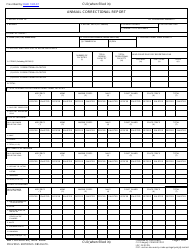

Form UI-40C (IL427-0406) Employer's Correction Report - Illinois

What Is Form UI-40C (IL427-0406)?

This is a legal form that was released by the Illinois Department of Employment Security - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UI-40C (IL427-0406)?

A: Form UI-40C (IL427-0406) is the Employer's Correction Report in Illinois.

Q: What is the purpose of Form UI-40C (IL427-0406)?

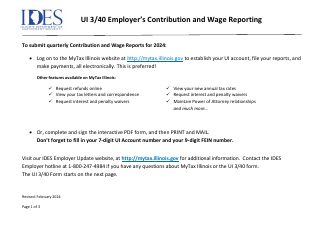

A: The purpose of Form UI-40C (IL427-0406) is to correct any errors or omissions on previously filed quarterly wage reports.

Q: Who needs to file Form UI-40C (IL427-0406)?

A: Employers in Illinois who need to correct errors or omissions on previously filed quarterly wage reports must file Form UI-40C (IL427-0406).

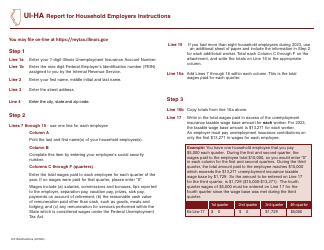

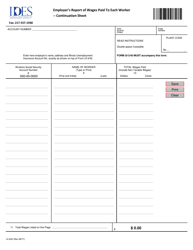

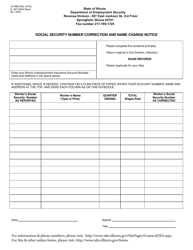

Q: What information is required on Form UI-40C (IL427-0406)?

A: Form UI-40C (IL427-0406) requires information such as the employer's name, address, registration number, the quarter being corrected, and details of the correction.

Q: When should Form UI-40C (IL427-0406) be filed?

A: Form UI-40C (IL427-0406) should be filed as soon as errors or omissions are discovered on previously filed quarterly wage reports. It should be filed within 30 days of the discovery.

Q: Is there a fee for filing Form UI-40C (IL427-0406)?

A: No, there is no fee for filing Form UI-40C (IL427-0406). It is free to correct errors or omissions on previously filed quarterly wage reports.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Illinois Department of Employment Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UI-40C (IL427-0406) by clicking the link below or browse more documents and templates provided by the Illinois Department of Employment Security.