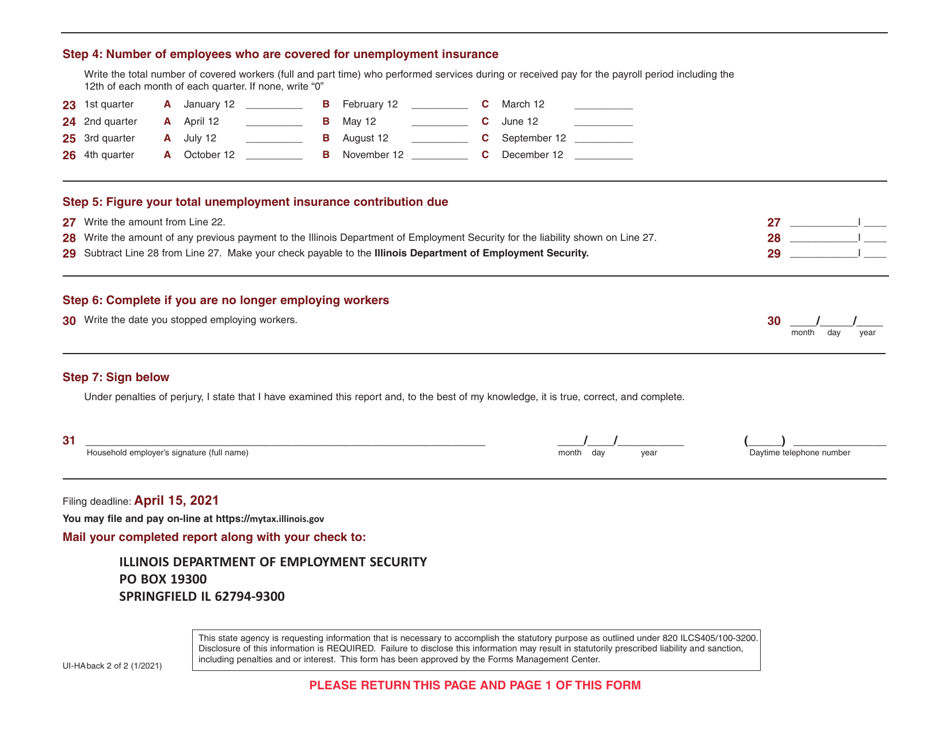

This version of the form is not currently in use and is provided for reference only. Download this version of

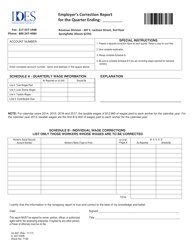

Form UI-HA

for the current year.

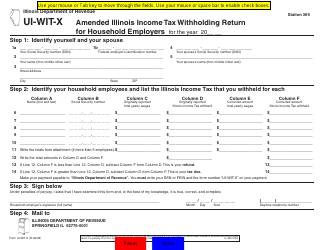

Form UI-HA Report for Household Employers - Illinois

What Is Form UI-HA?

This is a legal form that was released by the Illinois Department of Employment Security - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

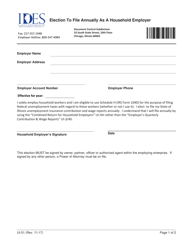

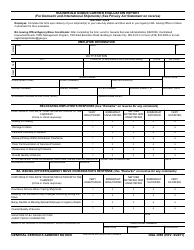

Q: What is a UI-HA Report?

A: A UI-HA Report is a report that household employers in Illinois are required to file.

Q: Who needs to file a UI-HA Report?

A: Household employers in Illinois need to file a UI-HA Report.

Q: What is a household employer?

A: A household employer is an individual who employs someone to work in their private residence.

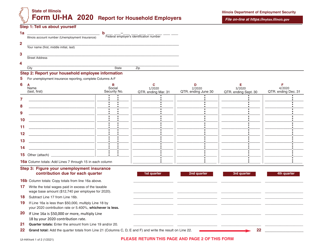

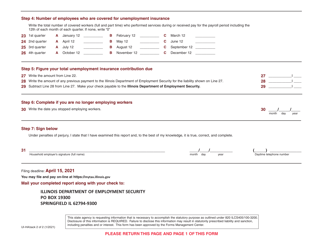

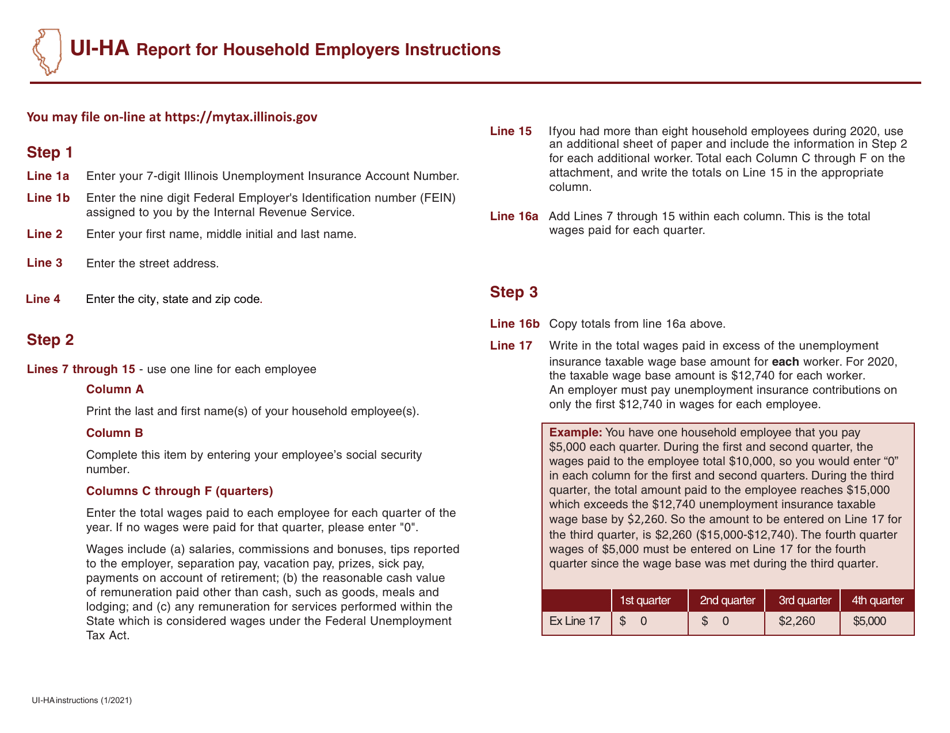

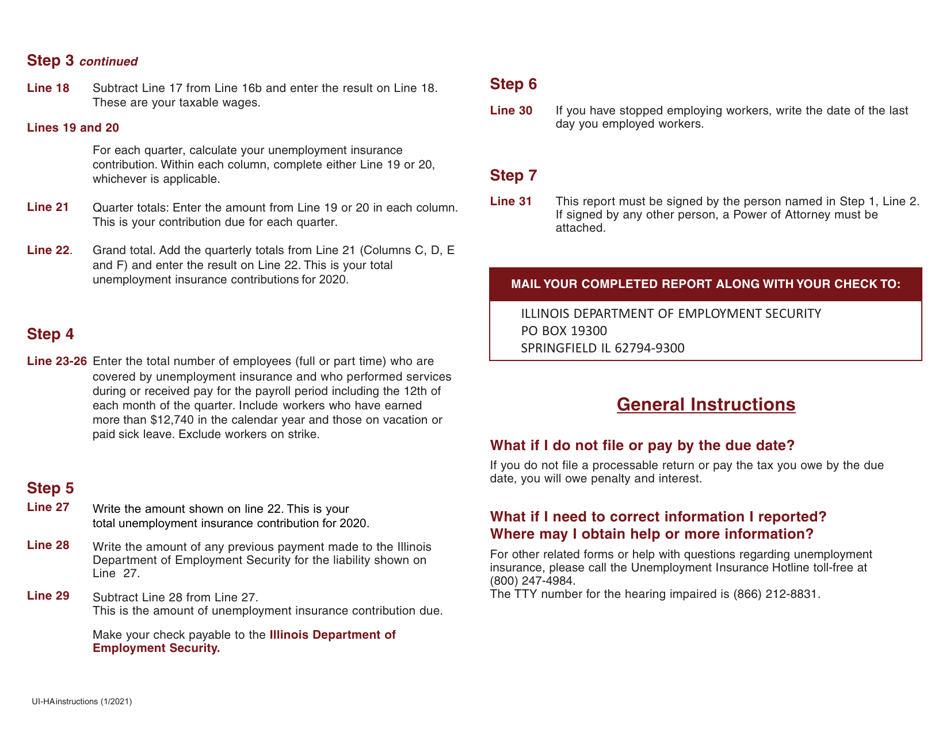

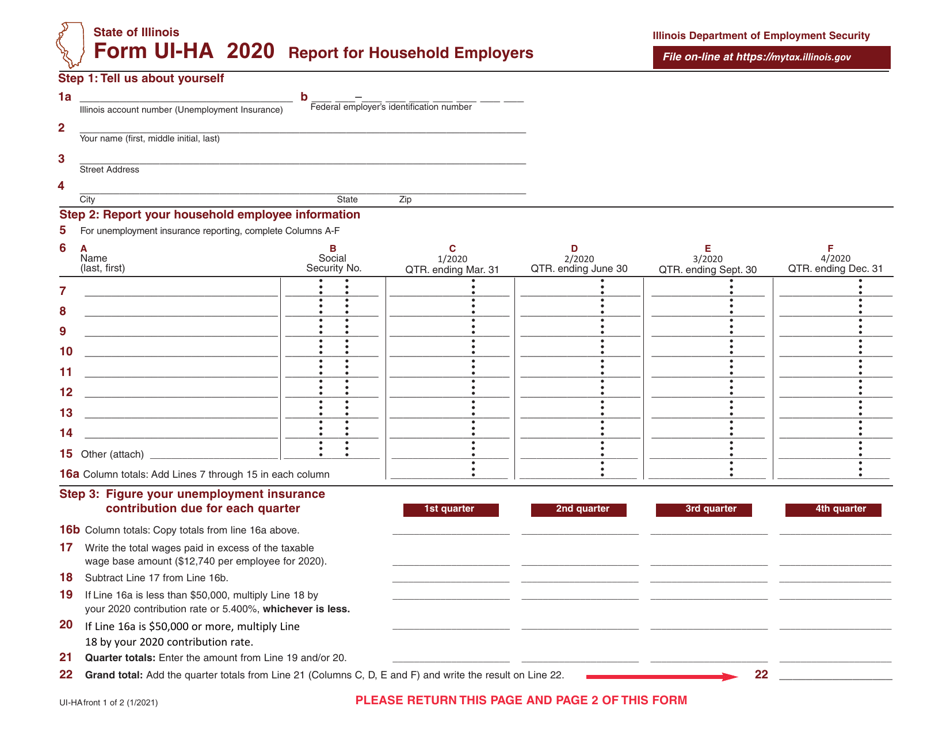

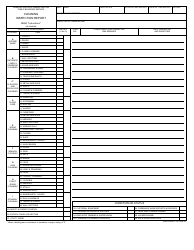

Q: What information is required on the UI-HA Report?

A: The UI-HA Report requires information such as the employer's name, address, and federal employer identification number, as well as the employee's name, Social Security number, and wages.

Q: When is the UI-HA Report due?

A: The UI-HA Report is due by January 31st of each year.

Q: What are the consequences of not filing a UI-HA Report?

A: Failure to file a UI-HA Report may result in penalties and fines.

Q: Is there a minimum wage requirement for household employees in Illinois?

A: Yes, household employees in Illinois must be paid at least the minimum wage set by the state.

Form Details:

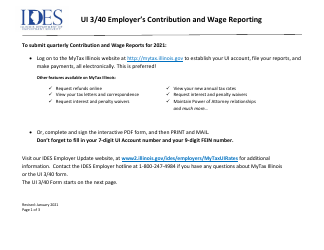

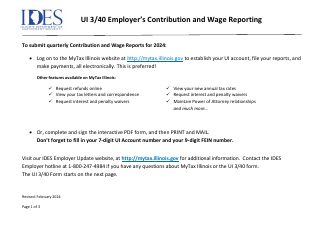

- Released on January 1, 2021;

- The latest edition provided by the Illinois Department of Employment Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UI-HA by clicking the link below or browse more documents and templates provided by the Illinois Department of Employment Security.