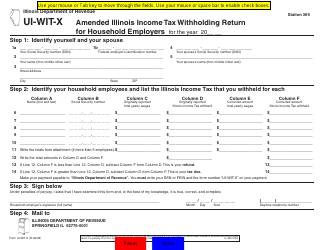

This version of the form is not currently in use and is provided for reference only. Download this version of

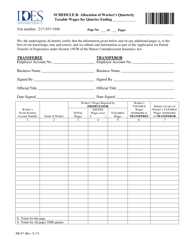

Form UI-3/40

for the current year.

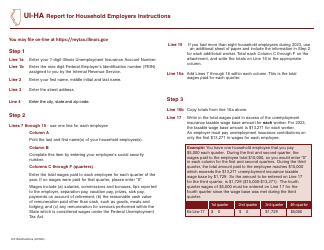

Form UI-3 / 40 Employer's Contribution and Wage Report - Illinois

What Is Form UI-3/40?

This is a legal form that was released by the Illinois Department of Employment Security - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

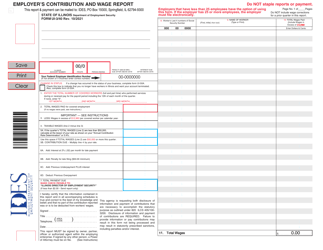

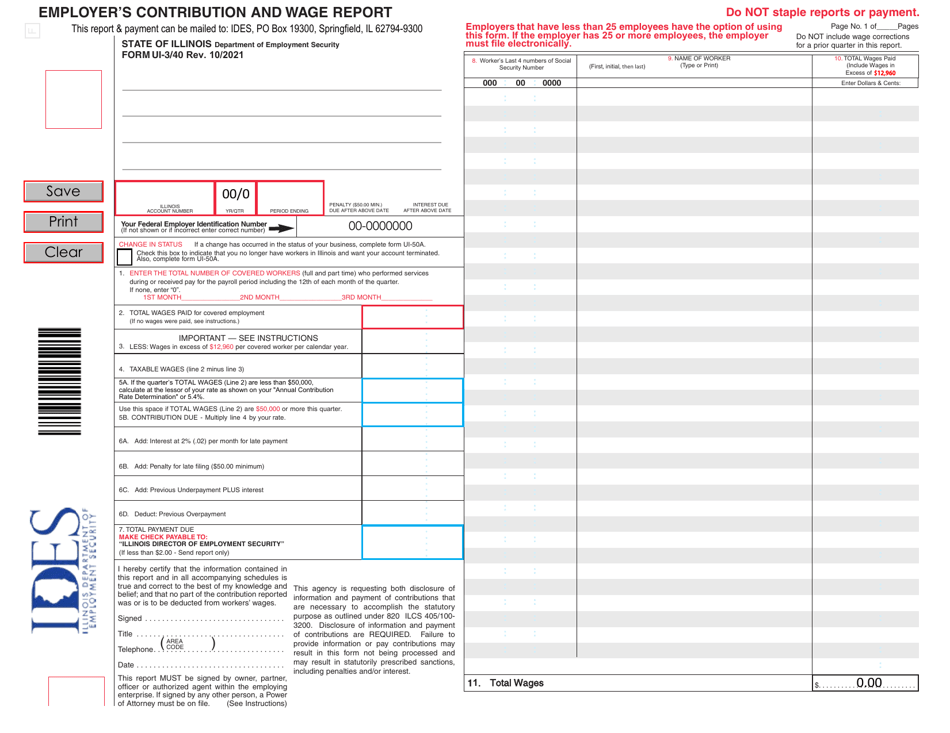

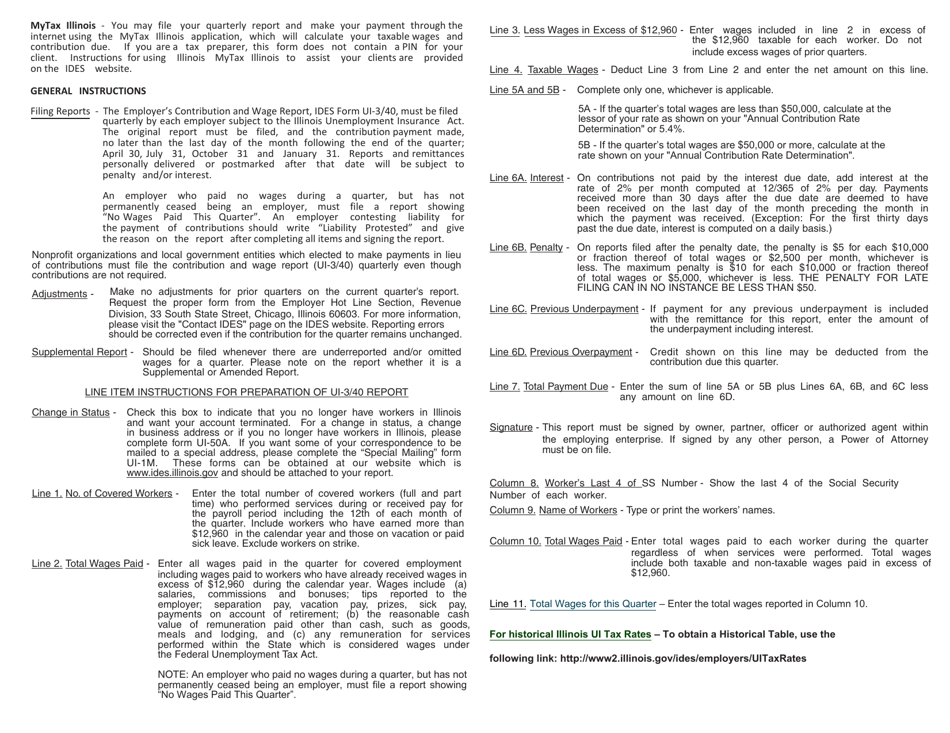

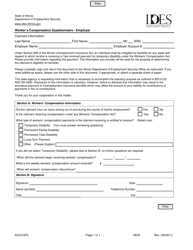

Q: What is the UI-3/40 Employer's Contribution and Wage Report?

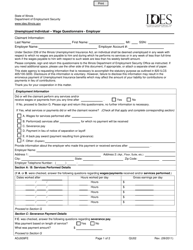

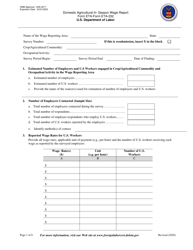

A: The UI-3/40 Employer's Contribution and Wage Report is a form used by employers in Illinois to report their contributions and wages to the Illinois Department of Employment Security (IDES).

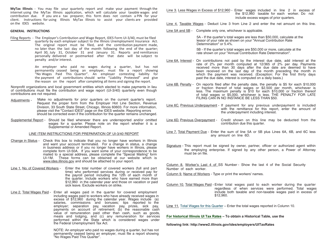

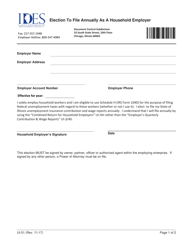

Q: Who needs to file the UI-3/40 Employer's Contribution and Wage Report?

A: All employers subject to unemployment insurance tax in Illinois need to file the UI-3/40 Employer's Contribution and Wage Report.

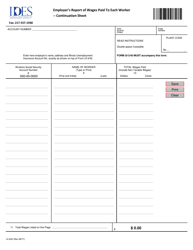

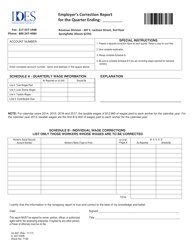

Q: What information is required on the UI-3/40 Employer's Contribution and Wage Report?

A: The UI-3/40 Employer's Contribution and Wage Report requires employers to provide information about their contributions, wages paid to employees, and employee details, such as Social Security numbers.

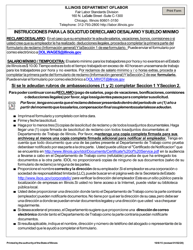

Q: When is the deadline to file the UI-3/40 Employer's Contribution and Wage Report?

A: The UI-3/40 Employer's Contribution and Wage Report must be filed quarterly, with specific due dates for each quarter. Check with the Illinois Department of Employment Security for the current year's deadlines.

Q: Are there any penalties for not filing the UI-3/40 Employer's Contribution and Wage Report?

A: Yes, failure to file the UI-3/40 Employer's Contribution and Wage Report or filing it late may result in penalties and interest charges.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Illinois Department of Employment Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UI-3/40 by clicking the link below or browse more documents and templates provided by the Illinois Department of Employment Security.