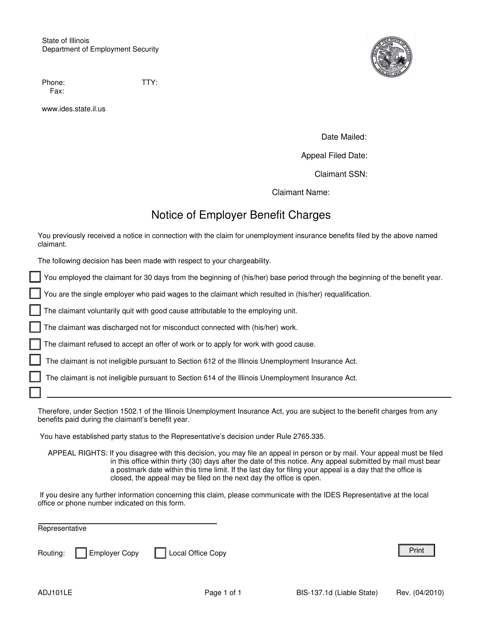

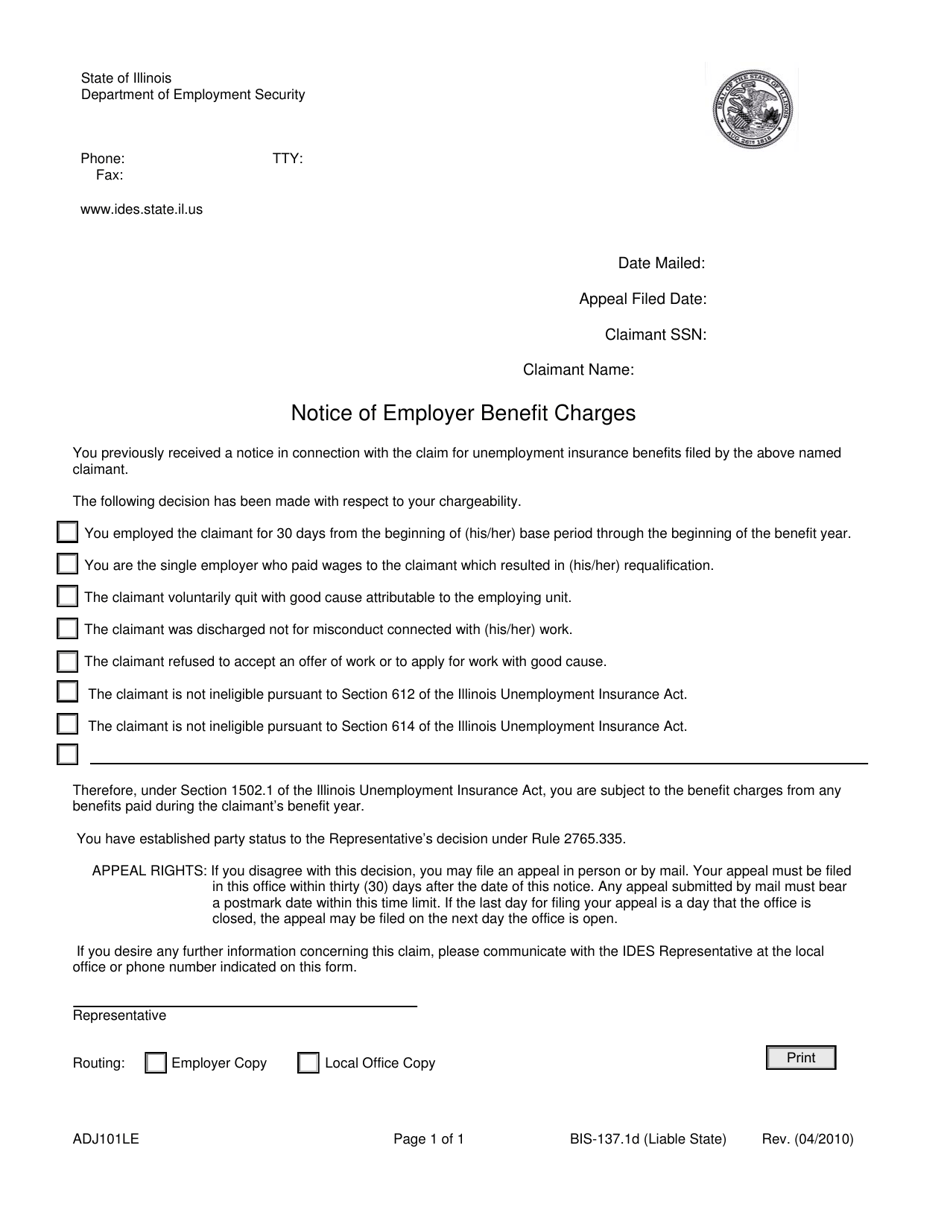

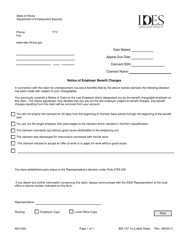

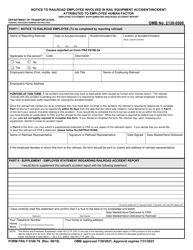

Form ADJ101LE Notice of Employer Benefit Charges - Illinois

What Is Form ADJ101LE?

This is a legal form that was released by the Illinois Department of Employment Security - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADJ101LE?

A: Form ADJ101LE is the Notice of Employer Benefit Charges specifically for employers in Illinois.

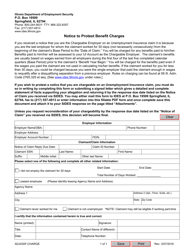

Q: Who needs to file Form ADJ101LE?

A: Employers in Illinois who have received unemployment benefit charges are required to file Form ADJ101LE.

Q: What is the purpose of Form ADJ101LE?

A: The purpose of Form ADJ101LE is to notify employers about the unemployment benefit charges that have been assigned to their account.

Q: How often do employers need to file Form ADJ101LE?

A: Form ADJ101LE needs to be filed on a quarterly basis, typically within 30 days after the end of the quarter.

Q: Are there any penalties for not filing Form ADJ101LE?

A: Yes, failure to file Form ADJ101LE or filing it late can result in penalties and interest being assessed to the employer's account.

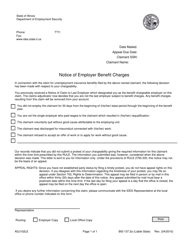

Form Details:

- Released on April 1, 2010;

- The latest edition provided by the Illinois Department of Employment Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADJ101LE by clicking the link below or browse more documents and templates provided by the Illinois Department of Employment Security.