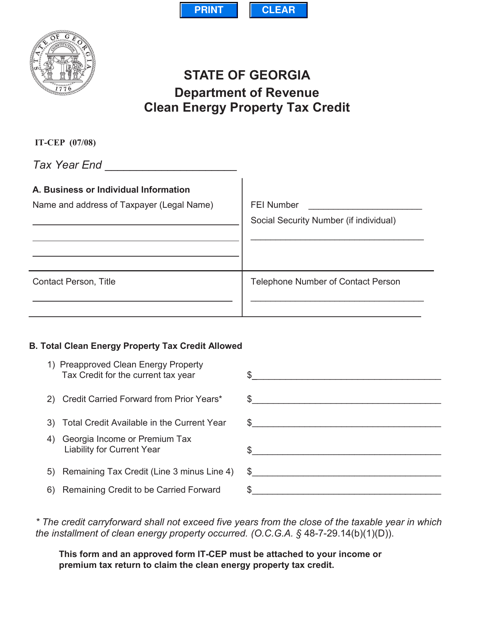

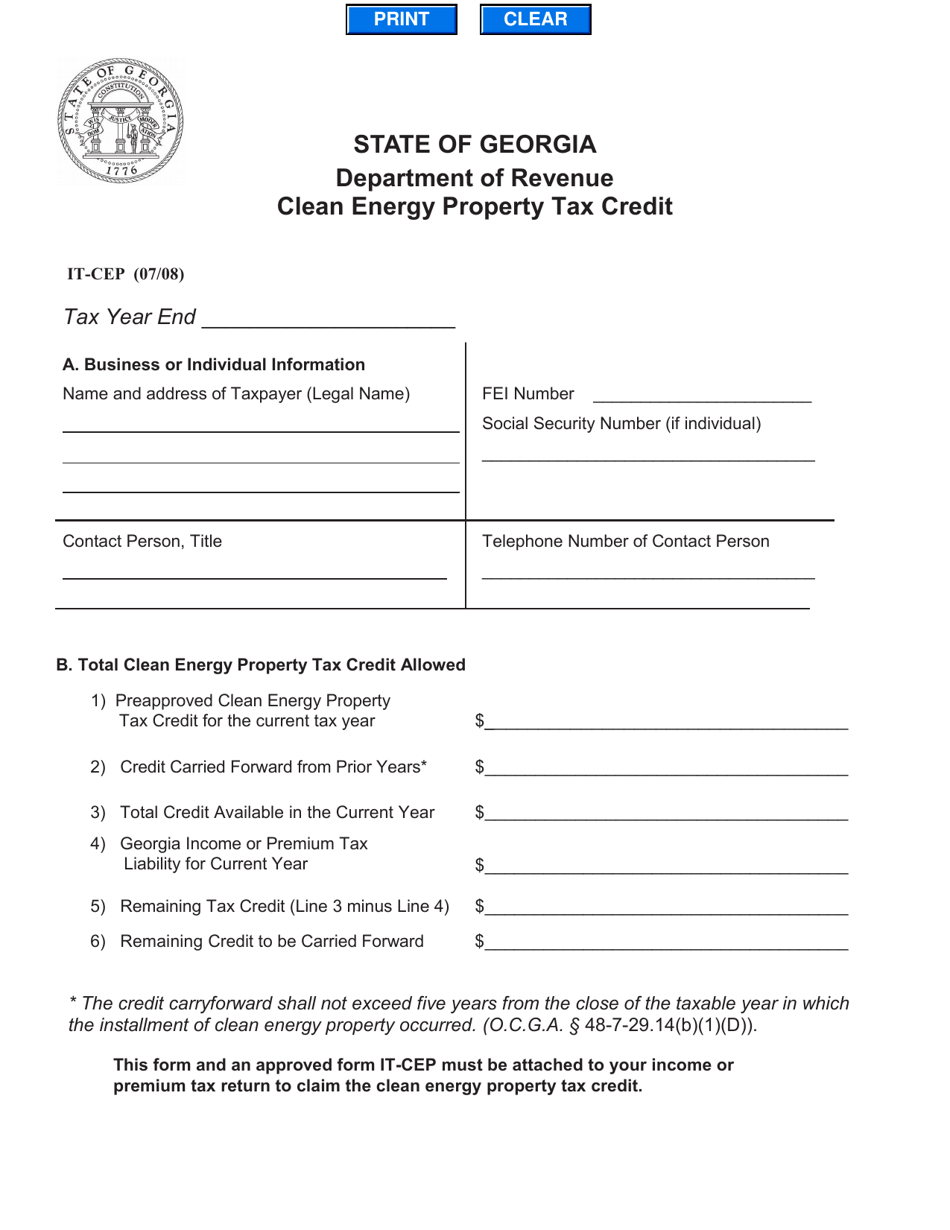

Form IT-CEP Clean Energy Property Tax Credit - Georgia (United States)

What Is Form IT-CEP?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IT-CEP Clean Energy Property Tax Credit?

A: The IT-CEP Clean Energy Property Tax Credit is a tax credit offered in Georgia for qualifying clean energy property.

Q: Who is eligible for the IT-CEP Clean Energy Property Tax Credit?

A: Property owners in Georgia who install qualified clean energy property may be eligible for the tax credit.

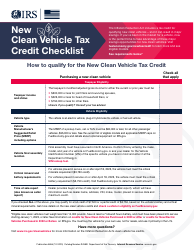

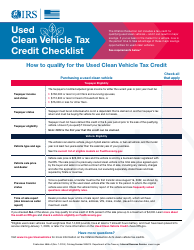

Q: What qualifies as clean energy property for the IT-CEP Tax Credit?

A: Clean energy property includes solar electric systems, wind turbines, geothermal heat pumps, and more.

Q: How much is the IT-CEP Clean Energy Property Tax Credit?

A: The tax credit is worth 35% of the cost of the clean energy property, up to a maximum credit amount.

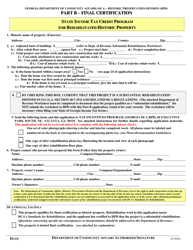

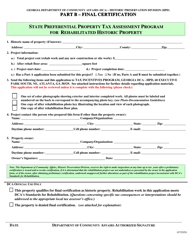

Q: How do I apply for the IT-CEP Clean Energy Property Tax Credit?

A: You can apply for the tax credit by completing Form IT-CEP and submitting it with your state income tax return.

Q: Is the IT-CEP Clean Energy Property Tax Credit refundable?

A: No, the tax credit is non-refundable, but any excess credit can be carried forward for up to five years.

Q: Are there any deadlines for applying for the IT-CEP Clean Energy Property Tax Credit?

A: Yes, the tax credit must be claimed in the year in which the property was placed in service.

Form Details:

- Released on July 1, 2008;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-CEP by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.