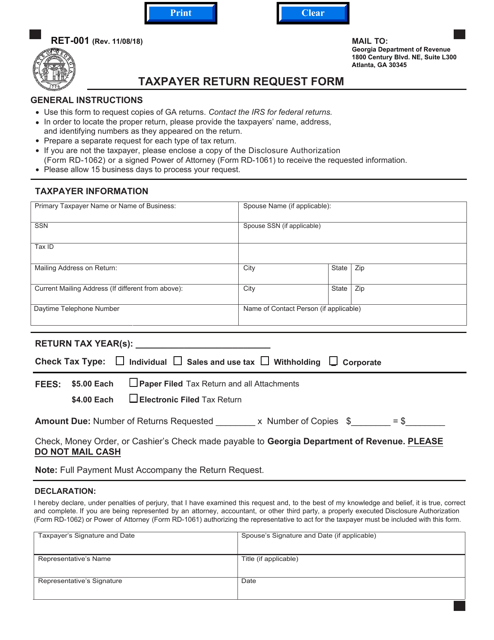

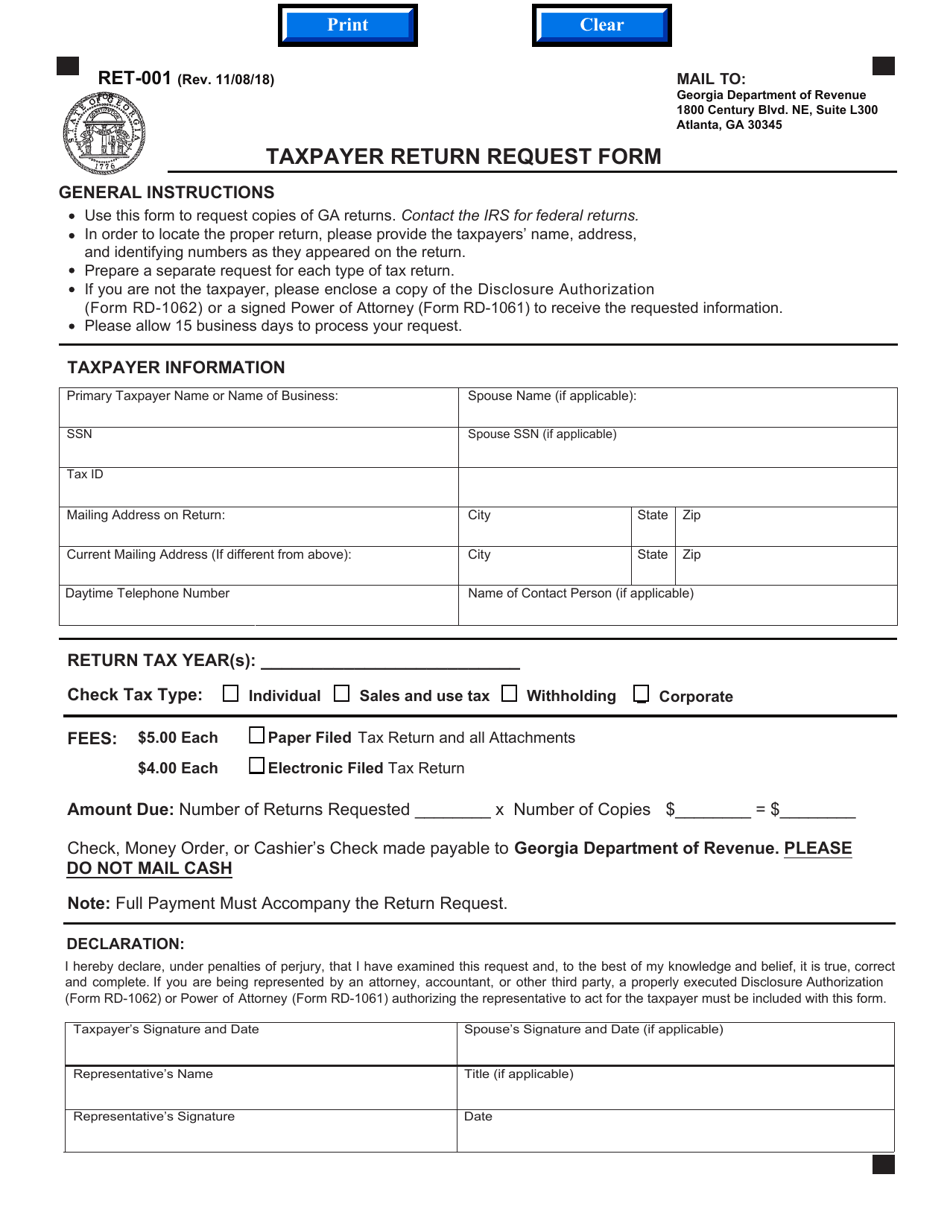

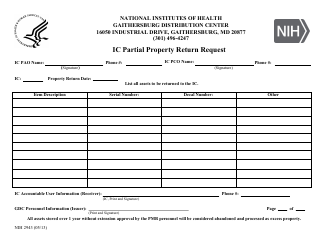

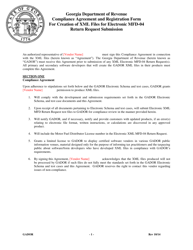

Form RET-001 Taxpayer Return Request Form - Georgia (United States)

What Is Form RET-001?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RET-001?

A: Form RET-001 is the Taxpayer Return Request form used in Georgia, United States.

Q: Who is required to use Form RET-001?

A: Taxpayers in Georgia who need to request a return can use Form RET-001.

Q: What is the purpose of Form RET-001?

A: The purpose of Form RET-001 is to request a return for taxpayers in Georgia.

Q: How do I fill out Form RET-001?

A: You need to provide your taxpayer information and the reason for requesting a return on Form RET-001.

Q: Are there any filing fees for Form RET-001?

A: No, there are no filing fees associated with Form RET-001.

Q: When is Form RET-001 due?

A: The due date for Form RET-001 depends on the specific instructions provided by the Georgia Department of Revenue.

Q: Can I file Form RET-001 electronically?

A: It is recommended to check with the Georgia Department of Revenue for the available filing options for Form RET-001.

Q: What if I need help with Form RET-001?

A: If you need assistance with Form RET-001, you can contact the Georgia Department of Revenue for support.

Form Details:

- Released on November 8, 2018;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RET-001 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.