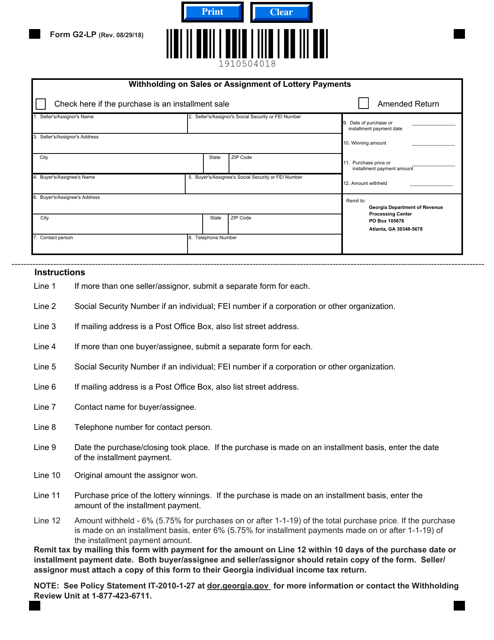

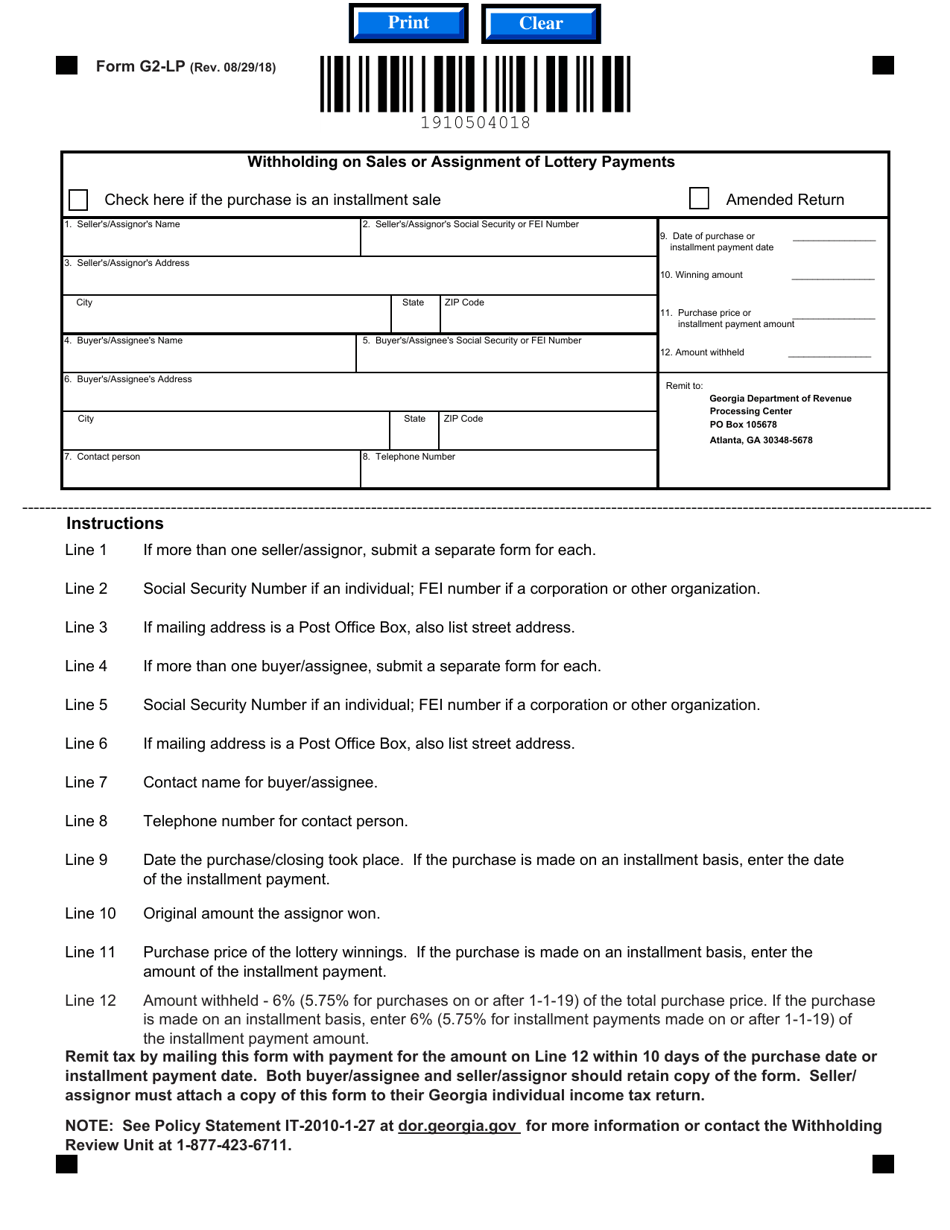

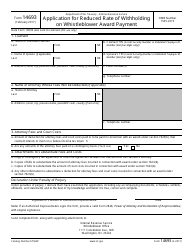

Form G2-LP Withholding on Sales or Assignment of Lottery Payments - Georgia (United States)

What Is Form G2-LP?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G2-LP?

A: Form G2-LP is a form used in Georgia (United States) for withholding on sales or assignment of lottery payments.

Q: Who needs to fill out Form G2-LP?

A: Any individual or entity who is purchasing or receiving lottery payments as a result of a lottery prize win in Georgia may need to fill out Form G2-LP.

Q: What is the purpose of Form G2-LP?

A: Form G2-LP is used to report and withhold state income tax on the sale or assignment of lottery payments in Georgia.

Q: What information do I need to fill out Form G2-LP?

A: You will need to provide your personal information, information about the lottery payments being sold or assigned, and any applicable tax withholding information.

Q: When is the deadline to file Form G2-LP?

A: The deadline for filing Form G2-LP in Georgia varies depending on the specific circumstances. It is recommended to consult the Georgia Department of Revenue for the most up-to-date deadline information.

Q: Do I need to include any supporting documents when submitting Form G2-LP?

A: It may be necessary to include supporting documents, such as purchase agreements or assignment documents, when submitting Form G2-LP. Consult the instructions on the form or the Georgia Department of Revenue for specific requirements.

Q: What happens after I submit Form G2-LP?

A: After submitting Form G2-LP, the Georgia Department of Revenue will review the form and process any applicable tax withholding. They may contact you if additional information or documentation is needed.

Form Details:

- Released on August 29, 2018;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G2-LP by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.