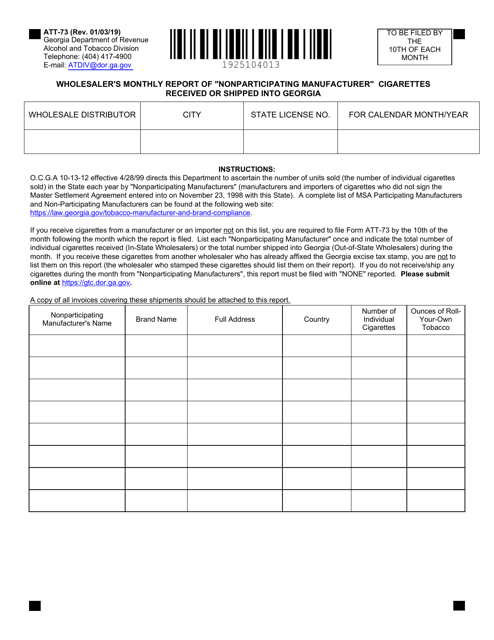

Form ATT-73 Wholesaler's Monthly Report of "nonparticipating Manufacturer" Cigarettes Received or Shipped Into Georgia - Georgia (United States)

What Is Form ATT-73?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ATT-73?

A: Form ATT-73 is the Wholesaler's Monthly Report of 'nonparticipating Manufacturer' Cigarettes Received or Shipped Into Georgia.

Q: Who needs to fill out Form ATT-73?

A: Wholesalers of cigarettes who receive or ship 'nonparticipating Manufacturer' cigarettes into Georgia need to fill out Form ATT-73.

Q: What is the purpose of Form ATT-73?

A: The purpose of Form ATT-73 is to report the receipt or shipment of 'nonparticipating Manufacturer' cigarettes by wholesalers in Georgia.

Q: When is Form ATT-73 due?

A: Form ATT-73 is due by the 20th day of the month following the reporting period.

Q: Are there any penalties for not filing Form ATT-73?

A: Yes, failure to file Form ATT-73 or filing it incorrectly may result in penalties imposed by the Georgia Department of Revenue.

Form Details:

- Released on January 3, 2019;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ATT-73 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.