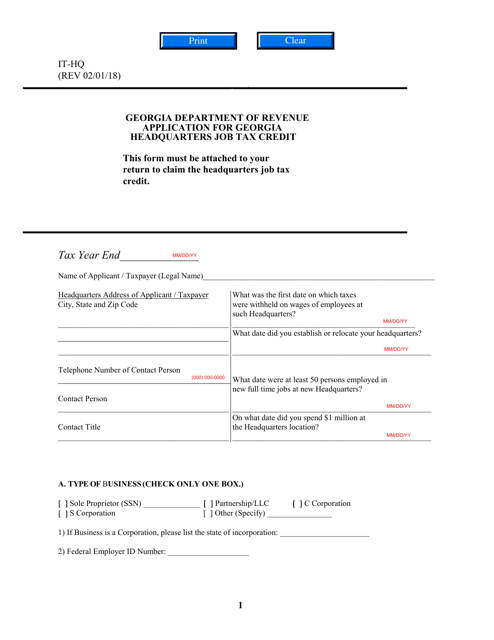

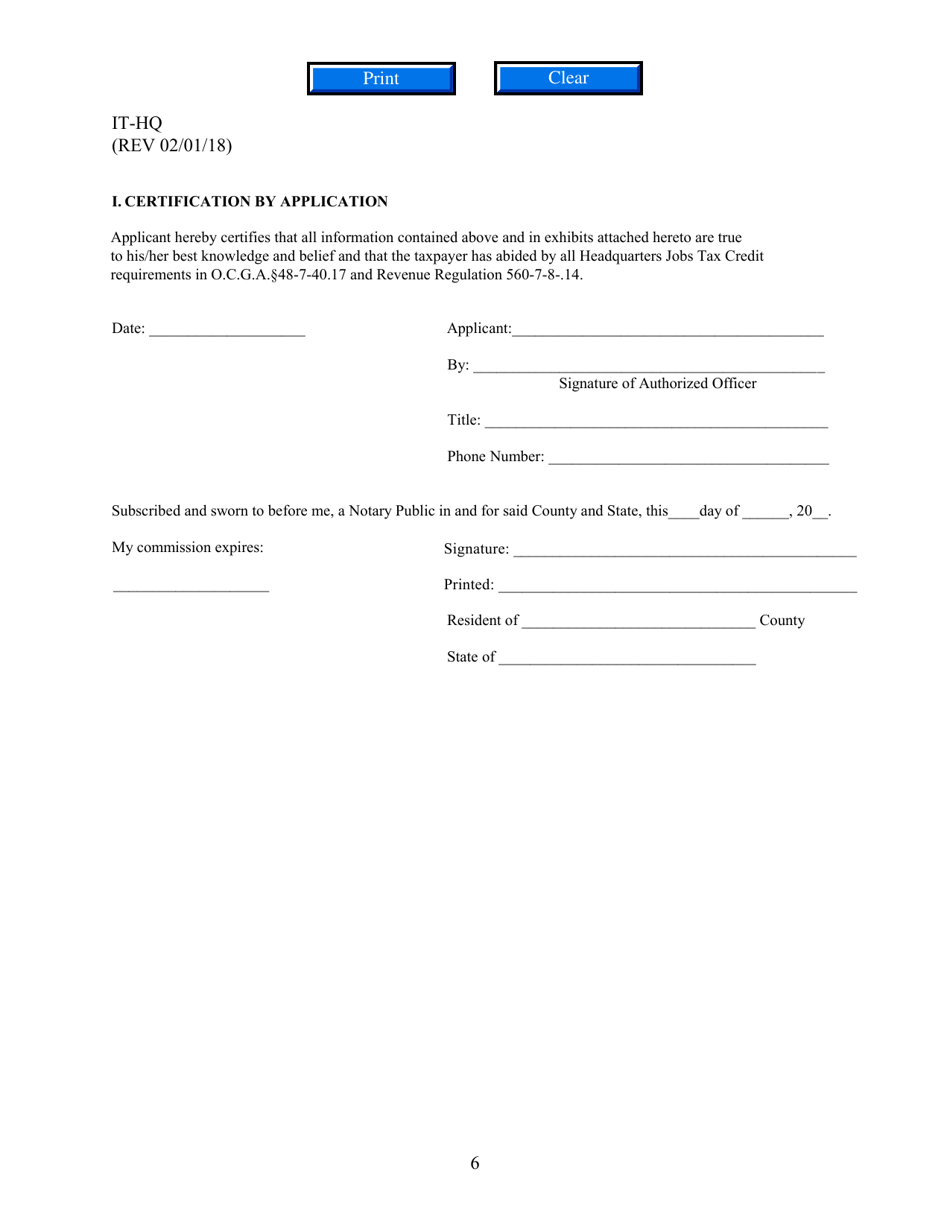

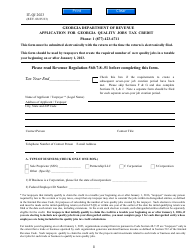

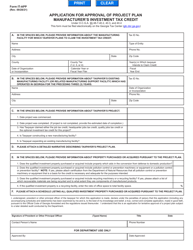

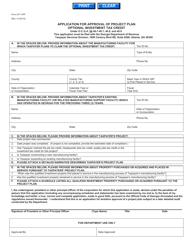

Form IT-HQ Application for Georgia Headquarters Job Tax Credit - Georgia (United States)

What Is Form IT-HQ?

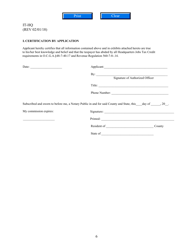

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

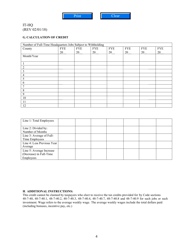

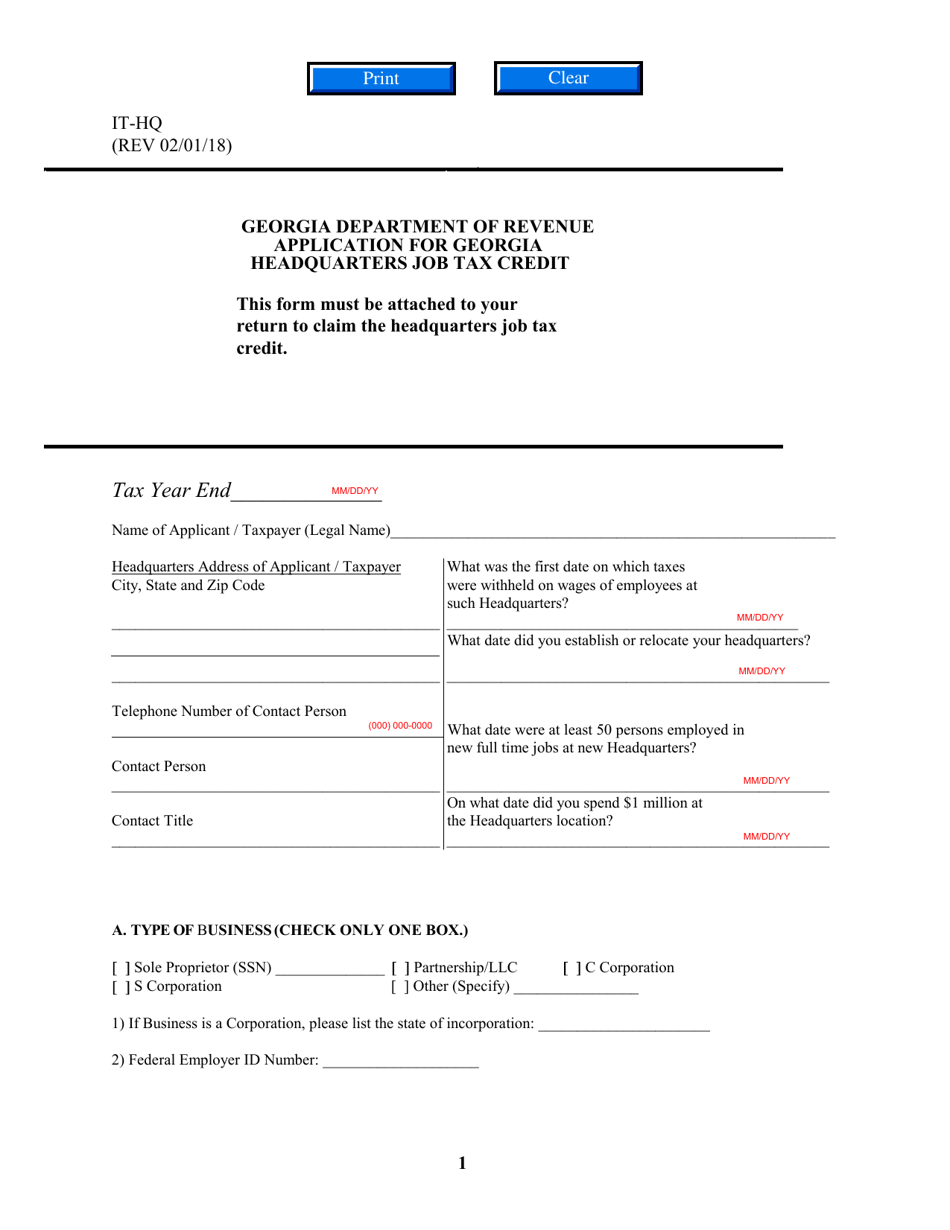

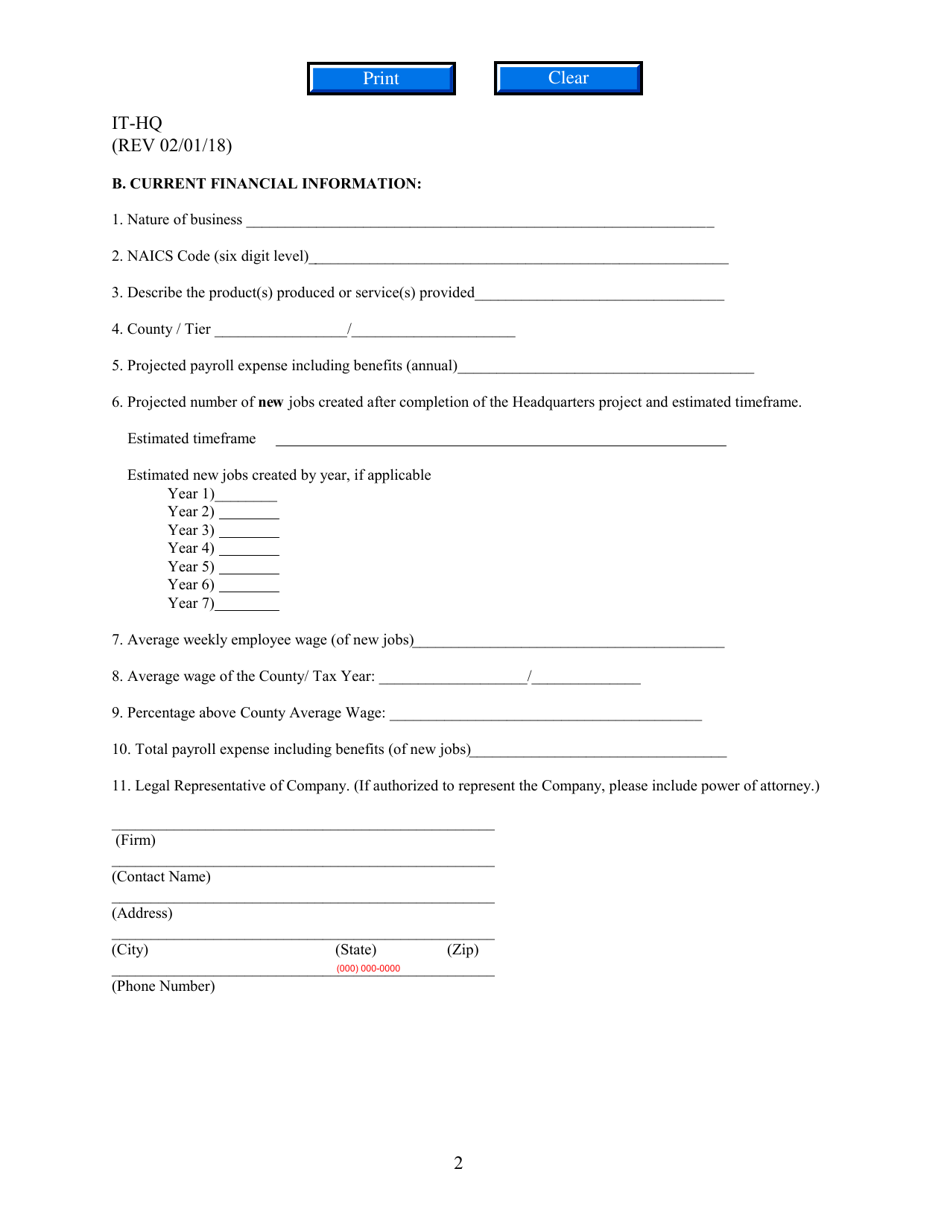

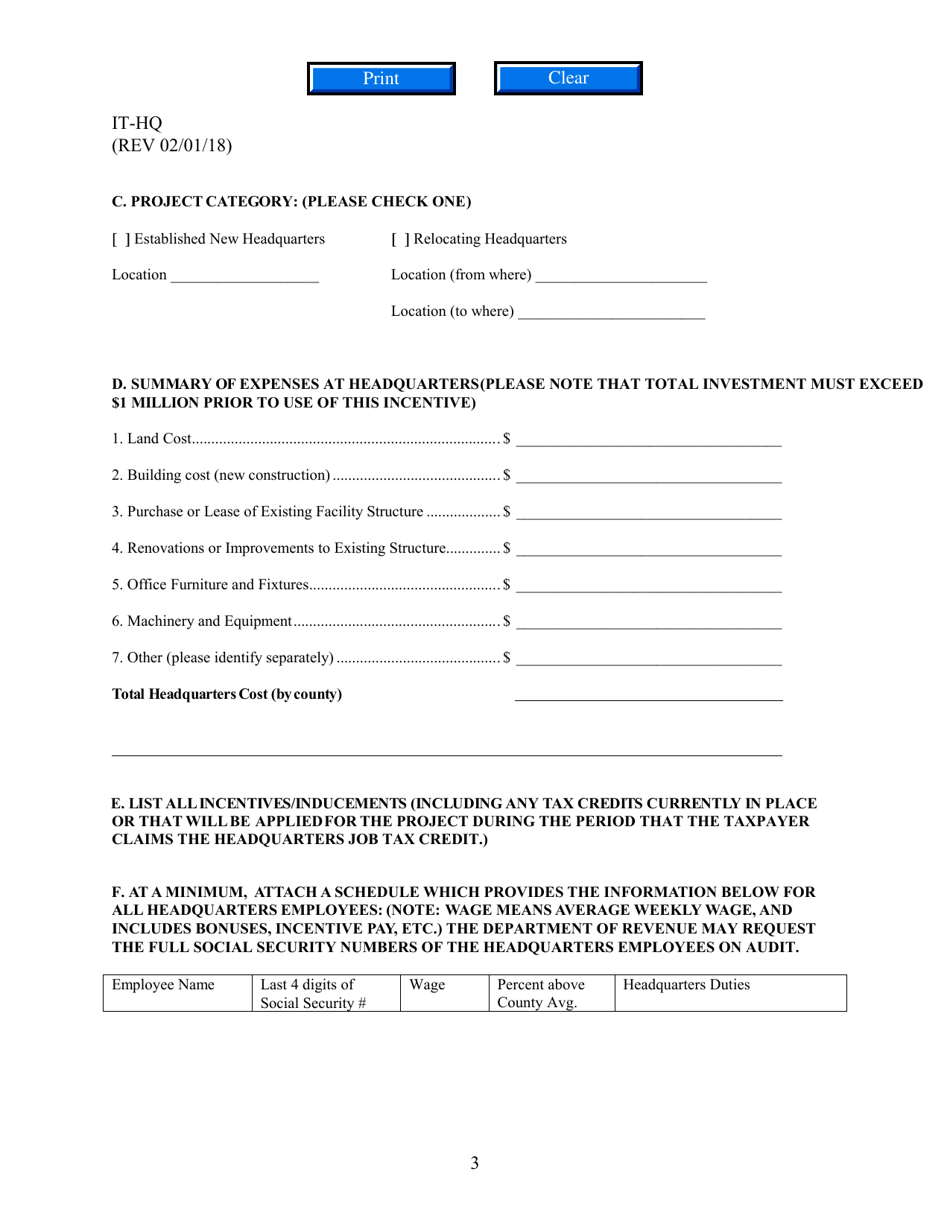

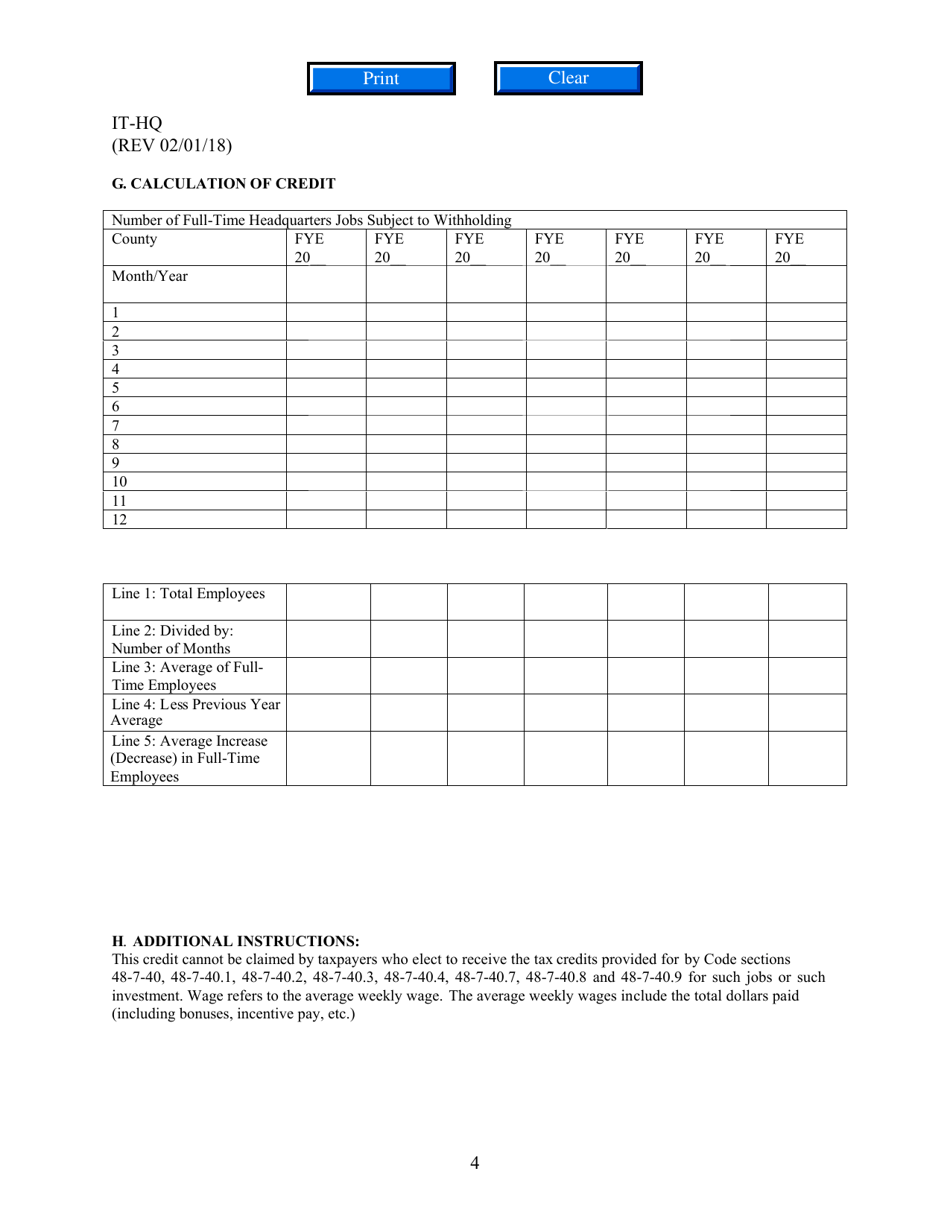

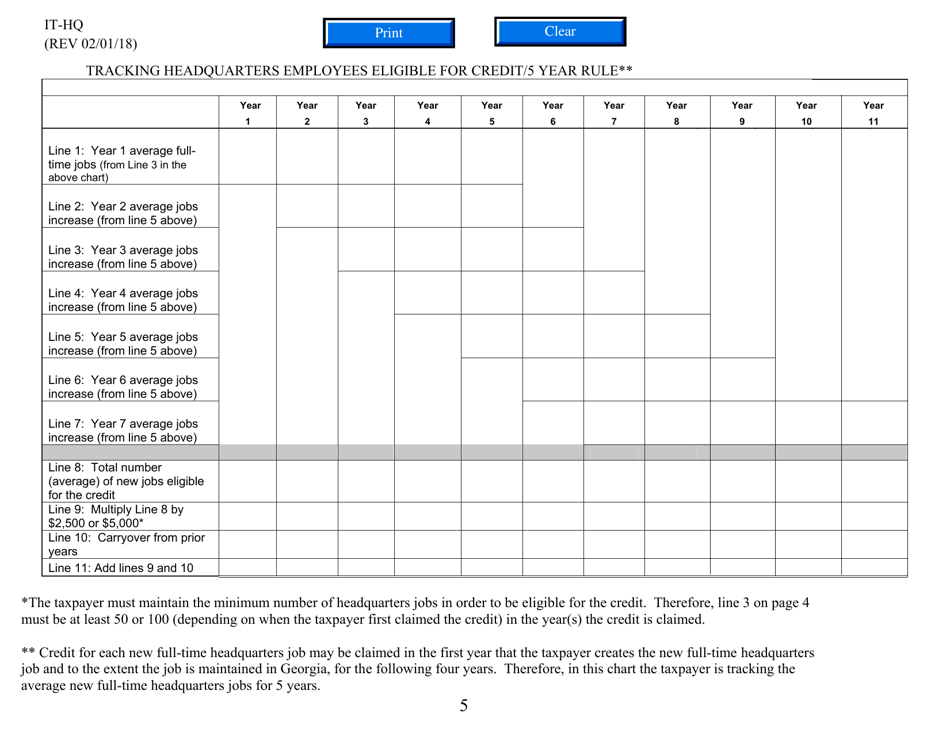

Q: What is the IT-HQ Application for Georgia Headquarters Job Tax Credit?

A: The IT-HQ Application is a form used to apply for the Georgia Headquarters Job Tax Credit.

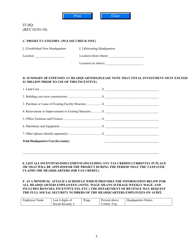

Q: What is the Georgia Headquarters Job Tax Credit?

A: The Georgia Headquarters Job Tax Credit is a tax credit that incentivizes businesses to establish and maintain their headquarters in Georgia.

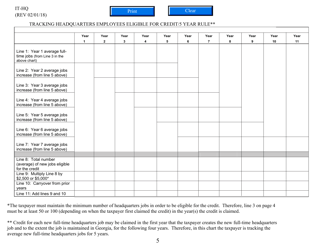

Q: Who is eligible for the Georgia Headquarters Job Tax Credit?

A: Businesses that establish or maintain qualifying headquarters in Georgia may be eligible for the tax credit.

Q: What are the benefits of the Georgia Headquarters Job Tax Credit?

A: The tax credit provides financial incentives to businesses, including a credit for each new job created as a result of the headquarters location.

Q: How can I apply for the Georgia Headquarters Job Tax Credit?

A: You can apply for the tax credit by completing the IT-HQ Application form for Georgia Headquarters Job Tax Credit.

Q: Are there any deadlines for submitting the IT-HQ Application?

A: Yes, there are specific deadlines for submitting the application, which can vary. It is important to check the latest guidelines and deadlines provided by the Georgia Department of Economic Development.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-HQ by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.