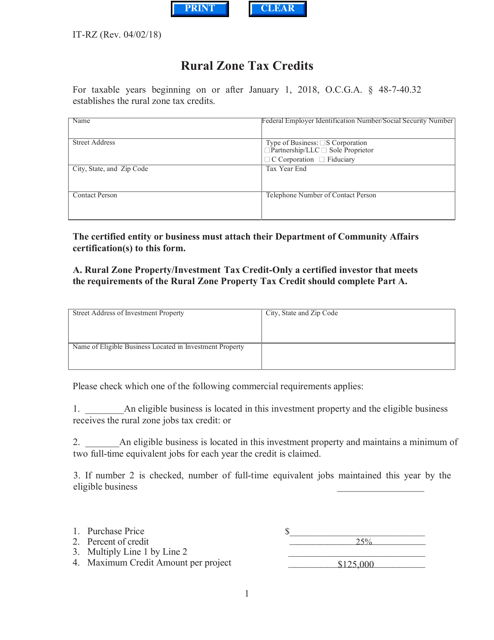

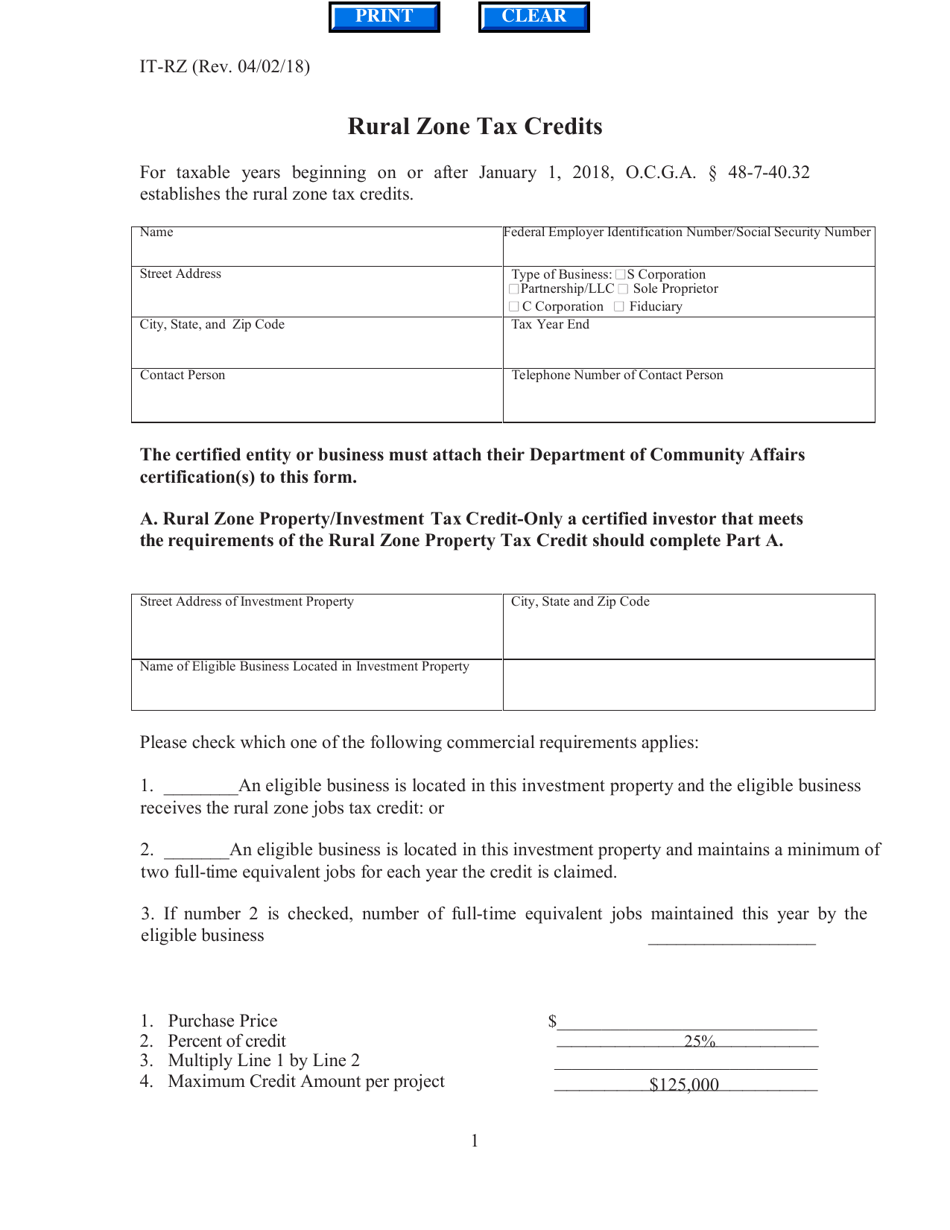

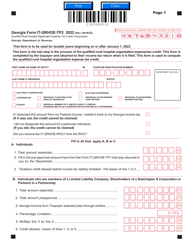

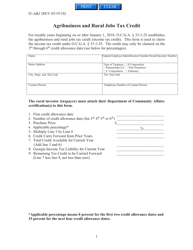

Form IT-RZ Rural Zone Tax Credits - Georgia (United States)

What Is Form IT-RZ?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

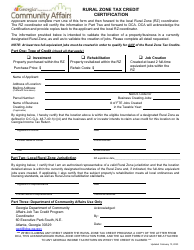

Q: What is the form IT-RZ for?

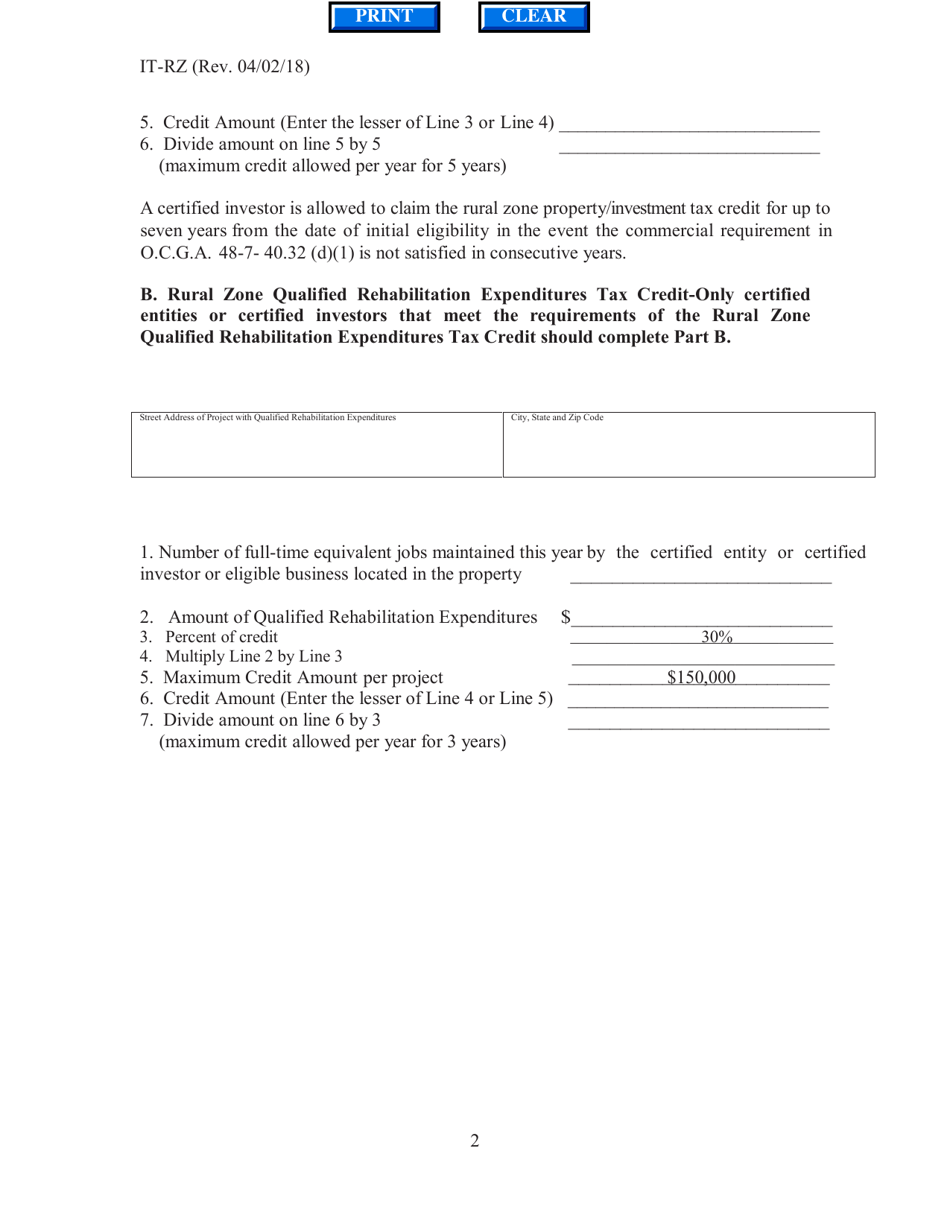

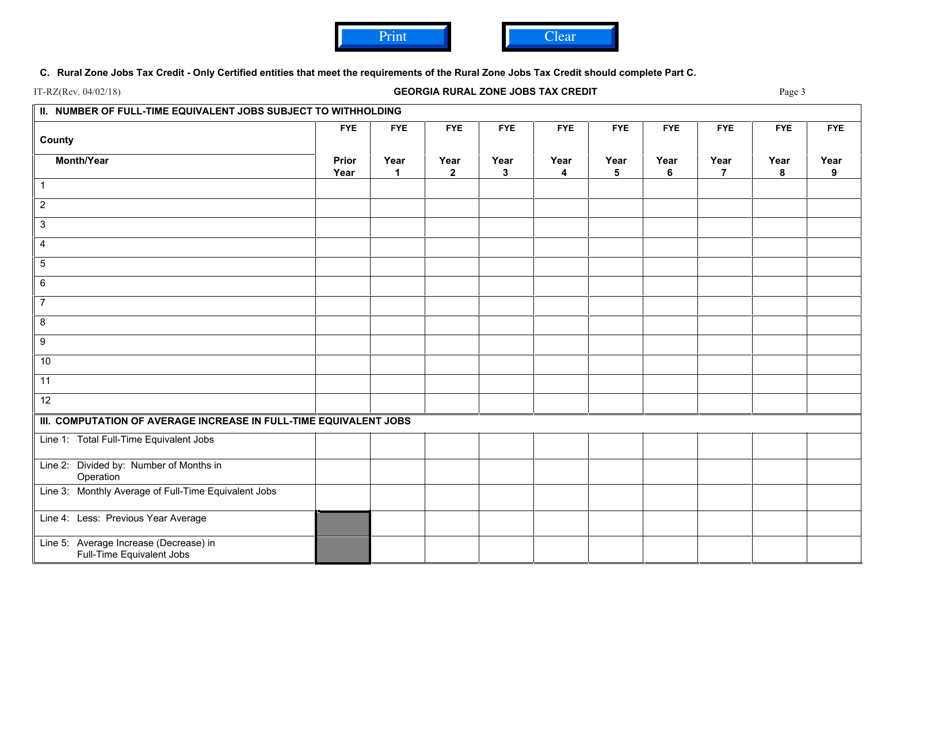

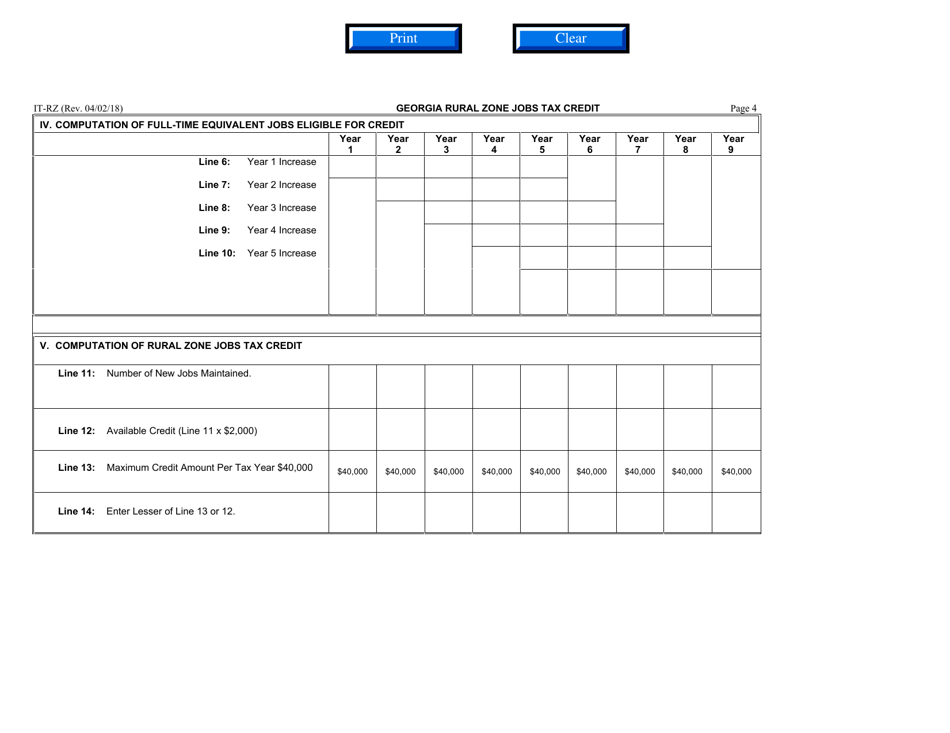

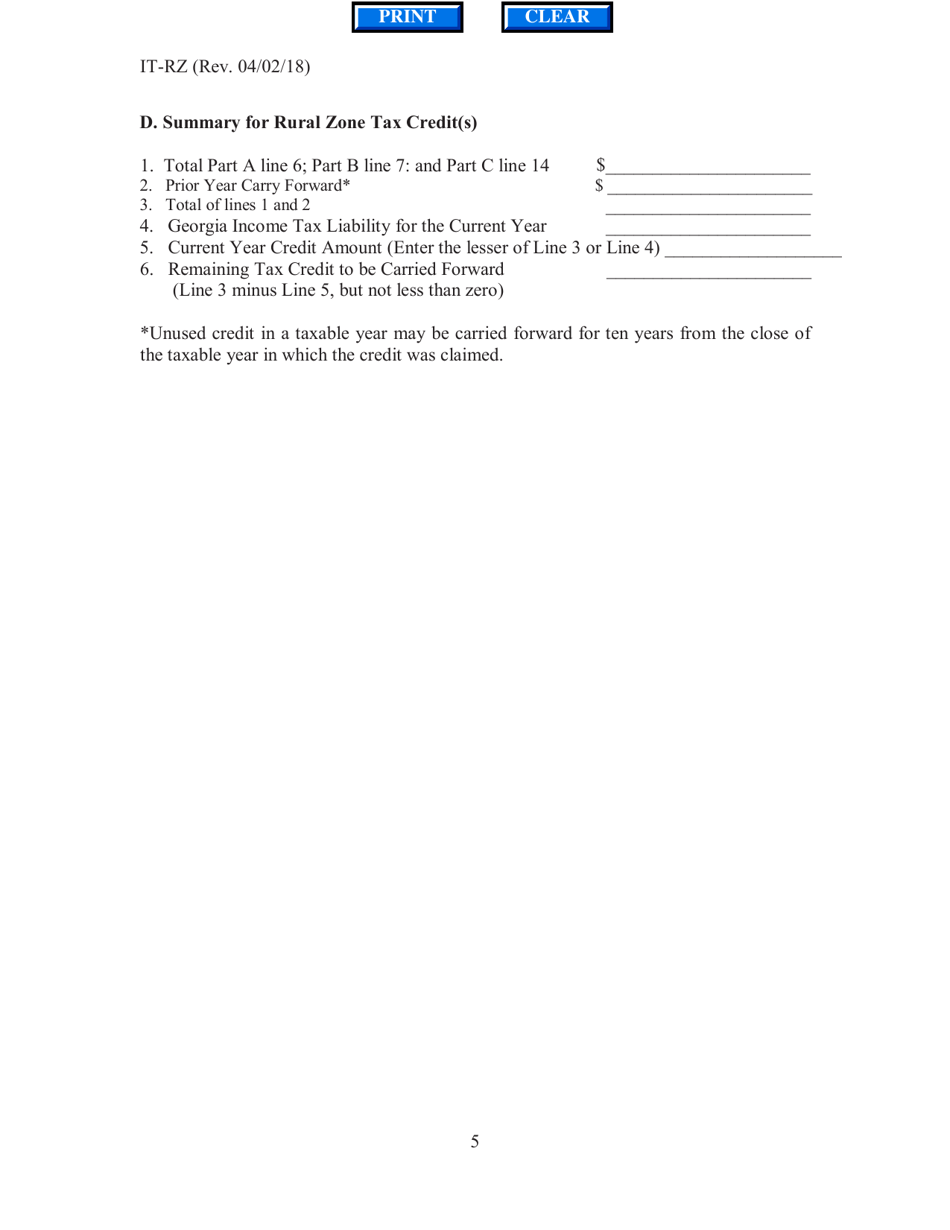

A: The form IT-RZ is for claiming Rural Zone Tax Credits in Georgia.

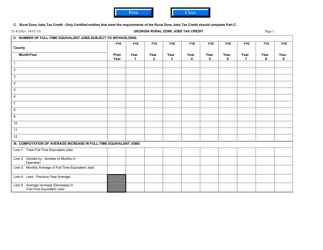

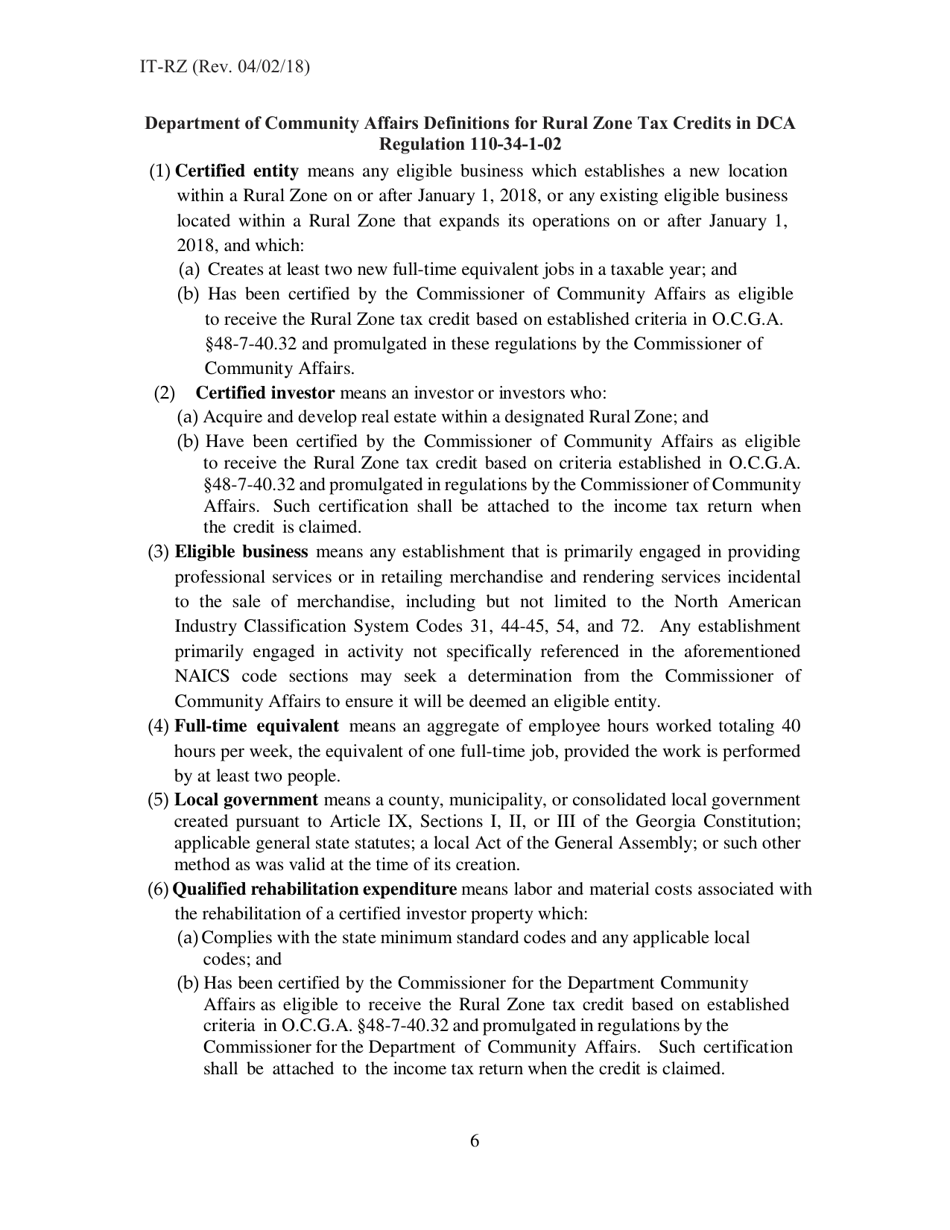

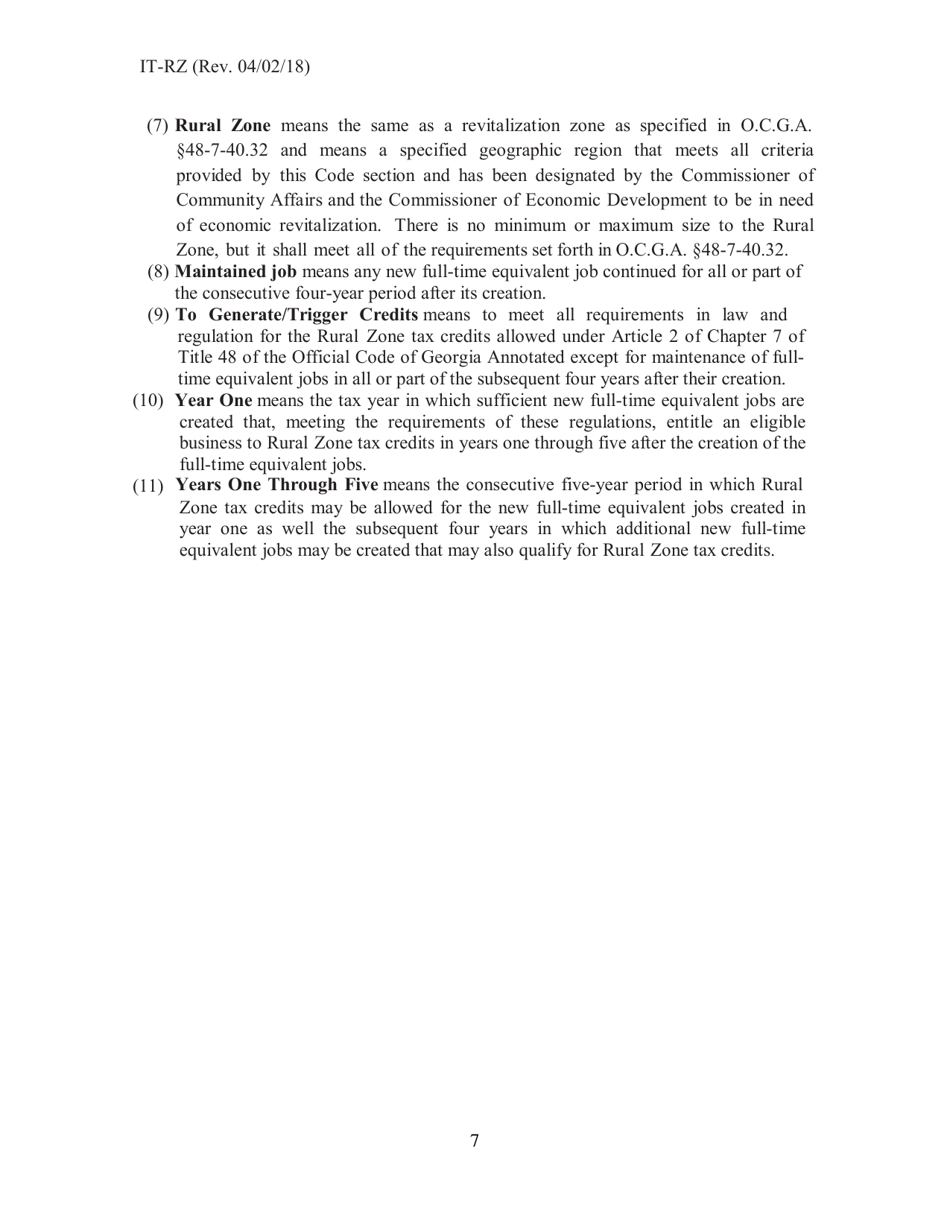

Q: Who is eligible for Rural Zone Tax Credits in Georgia?

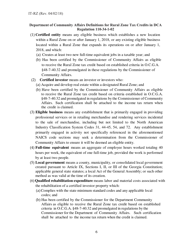

A: Individuals and businesses that meet certain criteria set by the Georgia Department of Community Affairs (DCA) may be eligible for Rural Zone Tax Credits.

Q: What are Rural Zone Tax Credits?

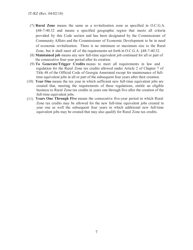

A: Rural Zone Tax Credits are tax incentives provided to individuals and businesses that invest in designated rural areas in Georgia.

Q: How do I apply for Rural Zone Tax Credits in Georgia?

A: You can apply for Rural Zone Tax Credits by filling out and submitting the form IT-RZ to the Georgia Department of Community Affairs (DCA).

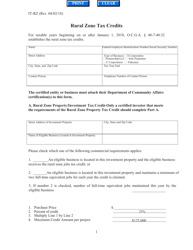

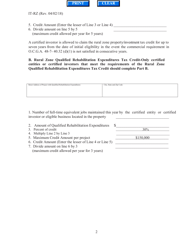

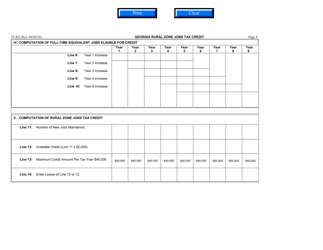

Q: What expenses qualify for Rural Zone Tax Credits?

A: Expenses related to the construction, renovation, or purchase of real property located within a designated Rural Zone may qualify for Rural Zone Tax Credits.

Q: When is the deadline to file form IT-RZ?

A: The deadline to file form IT-RZ is determined by the Georgia Department of Revenue and may vary from year to year.

Q: Are there any additional requirements for claiming Rural Zone Tax Credits?

A: Yes, there are additional requirements such as obtaining certification from the Georgia Department of Community Affairs (DCA) and meeting the minimum investment threshold.

Q: Are Rural Zone Tax Credits refundable?

A: No, Rural Zone Tax Credits are non-refundable, but they can be carried forward for up to 10 years.

Form Details:

- Released on April 2, 2018;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-RZ by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.