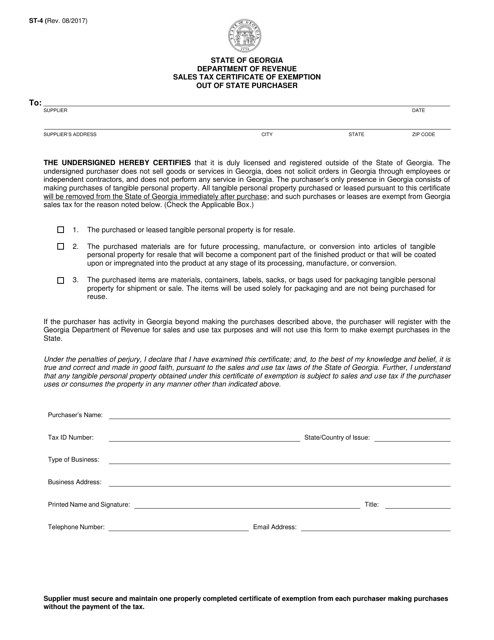

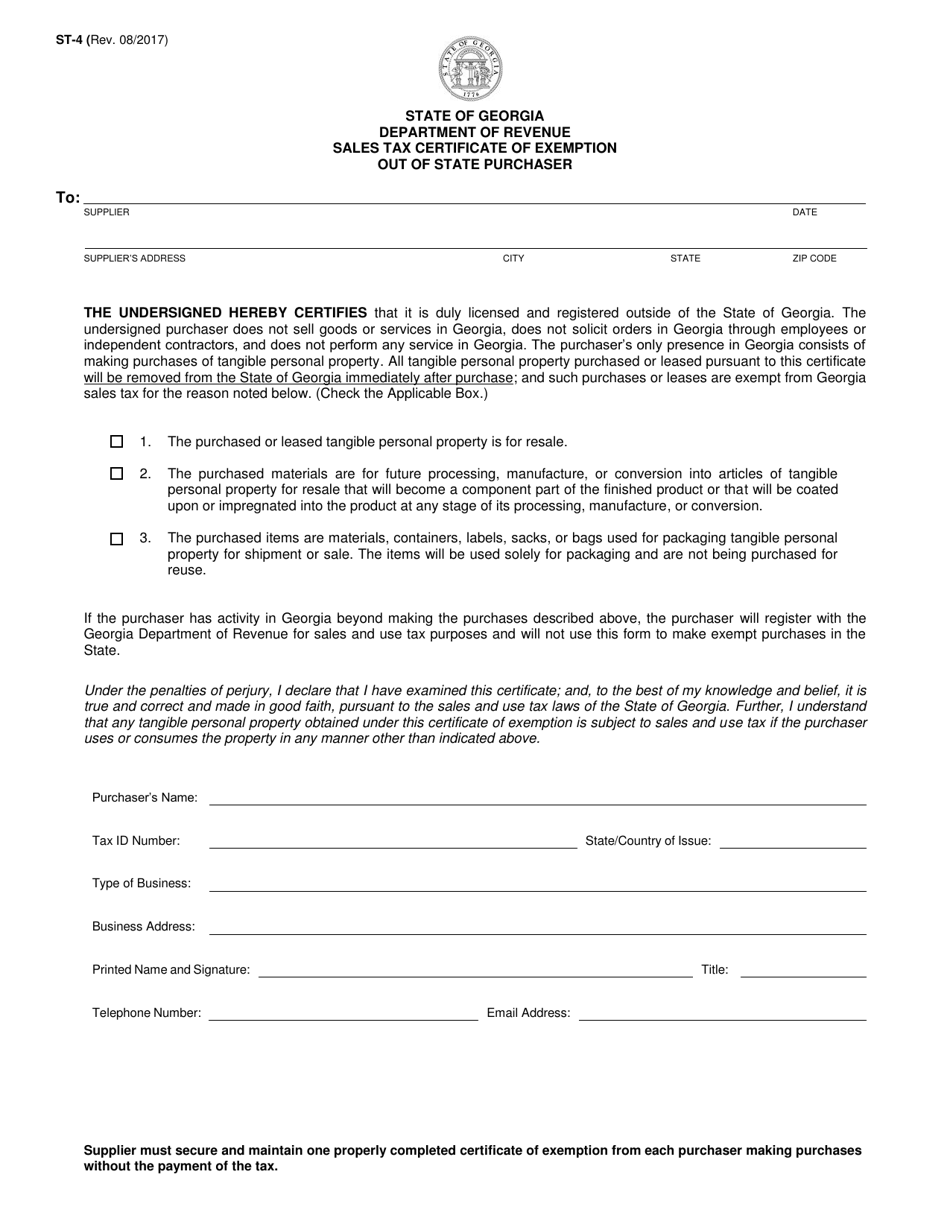

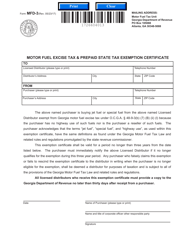

Form ST-4 Sales Tax Certificate of Exemption for out of State Purchaser - Georgia (United States)

What Is Form ST-4?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-4?

A: Form ST-4 is a Sales Tax Certificate of Exemption for out of State Purchaser.

Q: Who uses Form ST-4?

A: Out of state purchasers in Georgia (United States) use Form ST-4.

Q: What is the purpose of Form ST-4?

A: The purpose of Form ST-4 is to claim exemption from sales tax for out of state purchasers.

Q: Do I need to fill out Form ST-4 if I am a resident of Georgia?

A: No, Form ST-4 is only for out of state purchasers.

Q: What information do I need to provide on Form ST-4?

A: On Form ST-4, you will need to provide your name, address, and reason for claiming exemption.

Q: How long is Form ST-4 valid for?

A: Form ST-4 is valid for one year from the date of issuance.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-4 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.