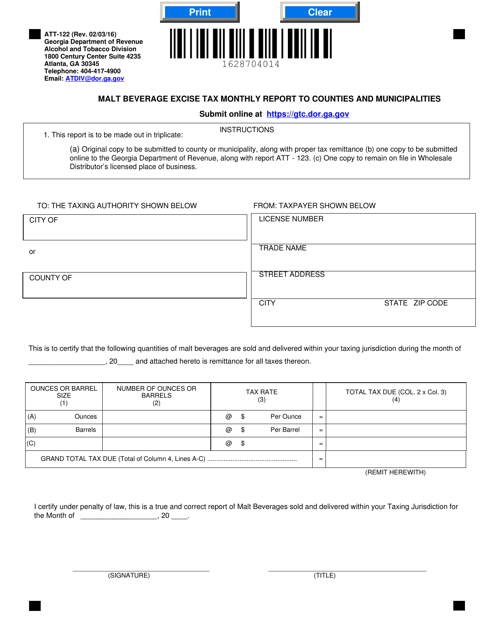

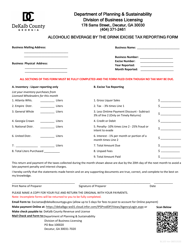

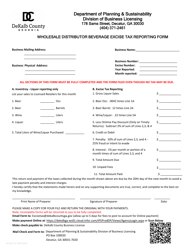

Form ATT-122 Malt Beverage Excise Tax Monthly Report to Counties and Municipalities - Georgia (United States)

What Is Form ATT-122?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ATT-122?

A: Form ATT-122 is the Malt Beverage Excise Tax Monthly Report to Counties and Municipalities in Georgia.

Q: Who needs to file Form ATT-122?

A: Businesses engaged in the sale of malt beverages are required to file Form ATT-122 in Georgia.

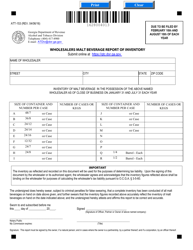

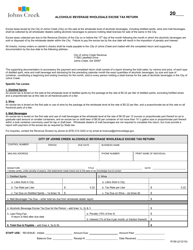

Q: What is the purpose of Form ATT-122?

A: The purpose of Form ATT-122 is to report and pay the malt beverage excise tax to the respective counties and municipalities in Georgia.

Q: How often do I need to file Form ATT-122?

A: Form ATT-122 should be filed on a monthly basis.

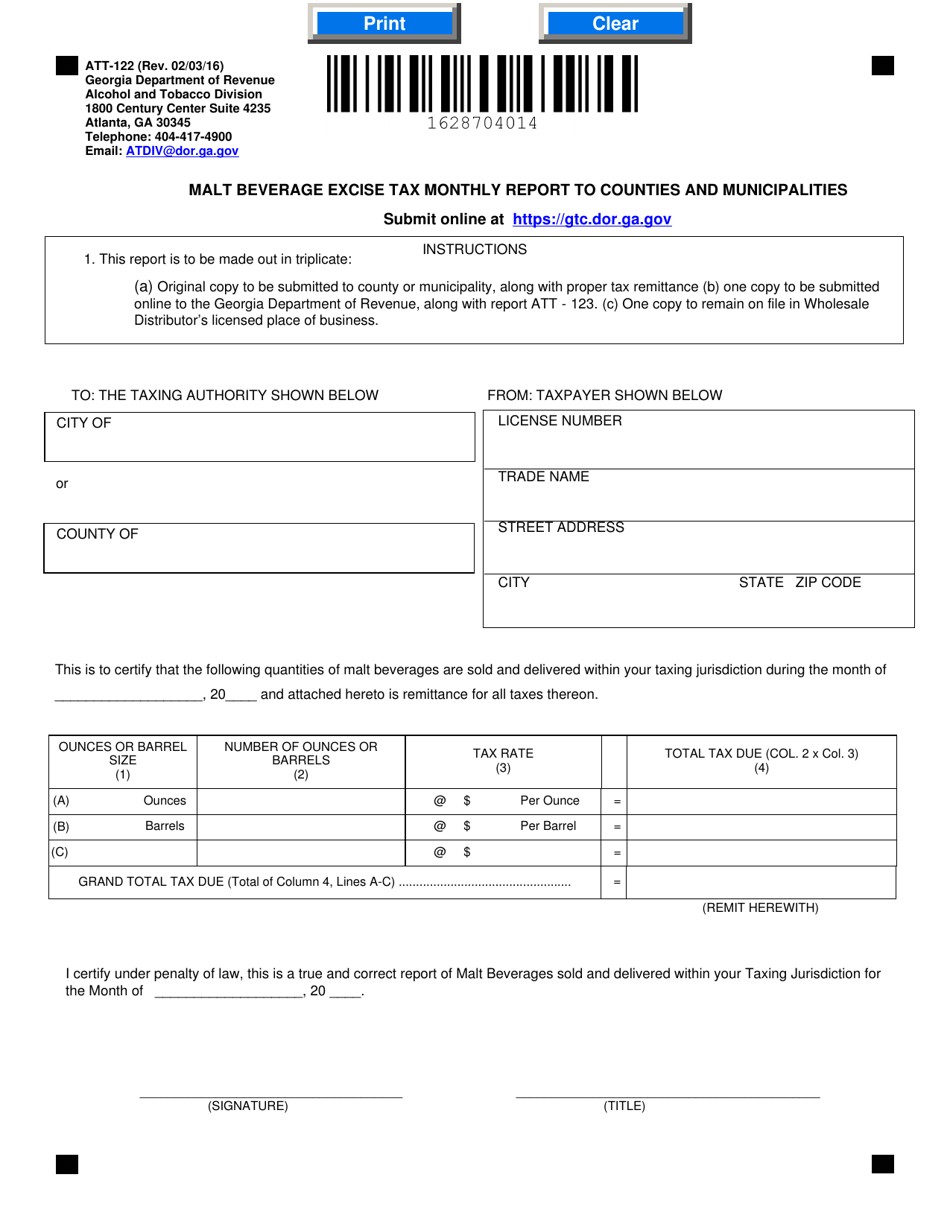

Q: What information is required on Form ATT-122?

A: Form ATT-122 requires information such as the total volume of malt beverages sold, the amount of excise tax due, and other relevant business details.

Q: When is the due date for filing Form ATT-122?

A: Form ATT-122 must be filed by the 25th day of the month following the reporting period.

Q: Are there any penalties for late or incorrect filing of Form ATT-122?

A: Yes, there may be penalties for late or incorrect filing of Form ATT-122. It is important to ensure timely and accurate submission.

Form Details:

- Released on February 3, 2016;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ATT-122 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.