This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-QJ

for the current year.

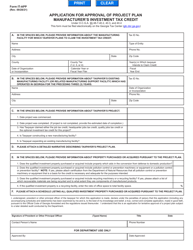

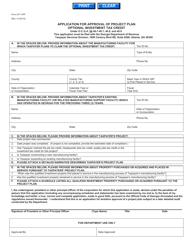

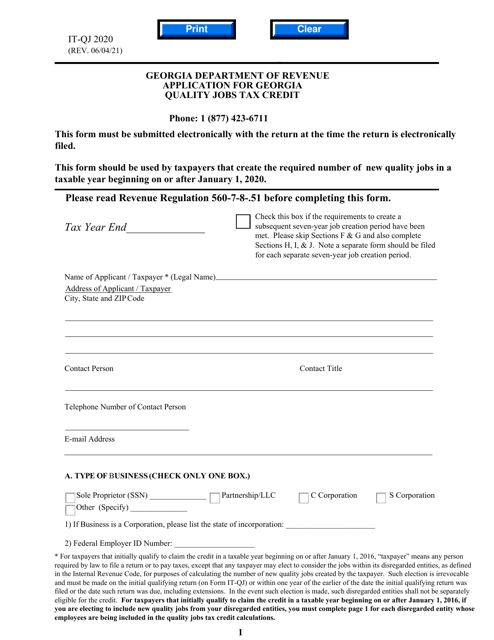

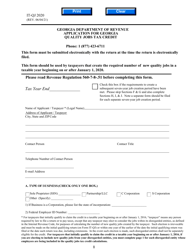

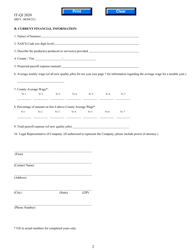

Form IT-QJ Application for Georgia Quality Jobs Tax Credit - Georgia (United States)

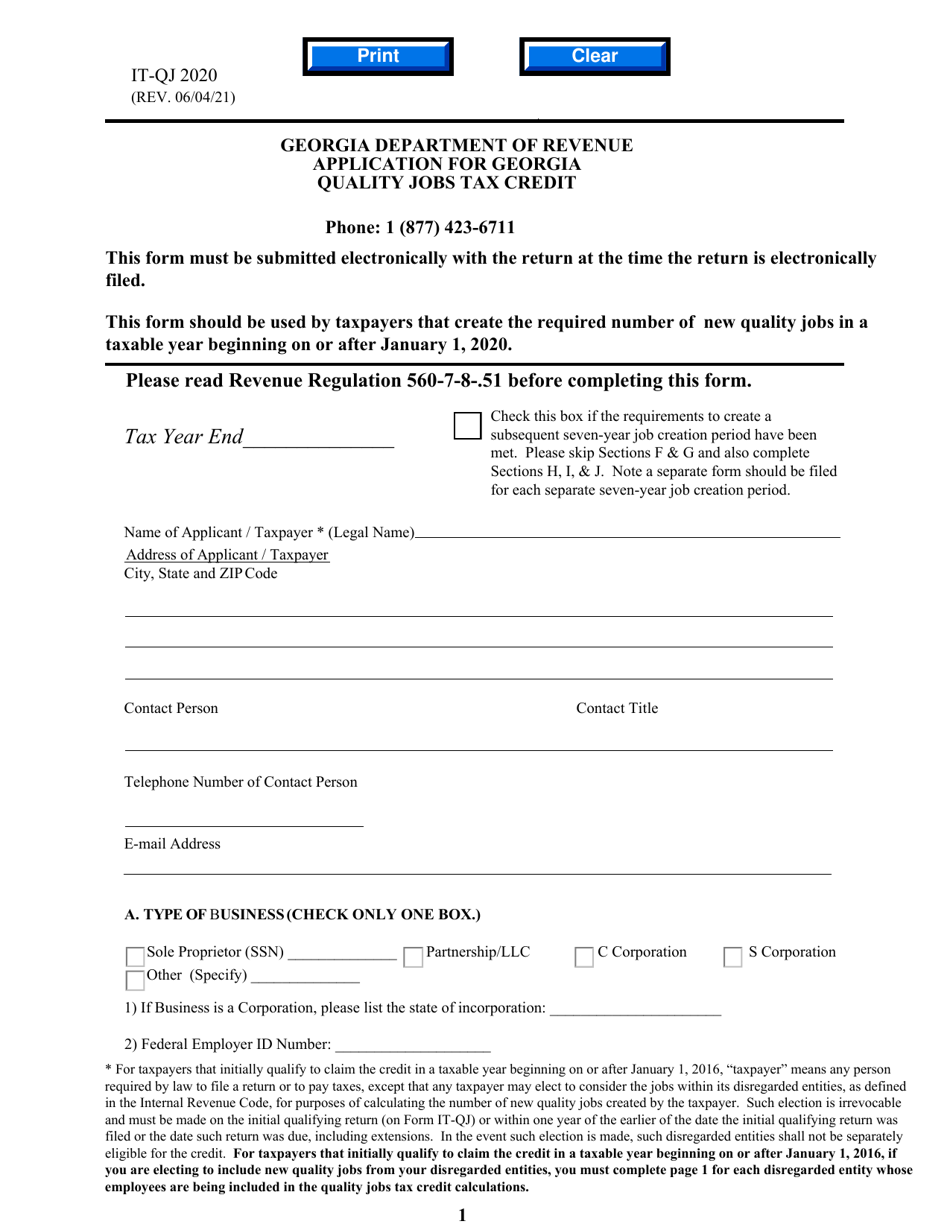

What Is Form IT-QJ?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IT-QJ application?

A: The IT-QJ application is a form used to apply for the Georgia Quality Jobs Tax Credit in Georgia, United States.

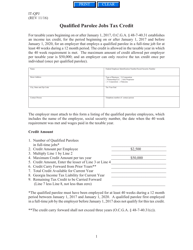

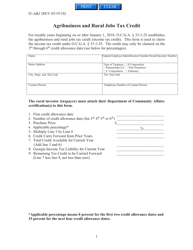

Q: What is the Georgia Quality Jobs Tax Credit?

A: The Georgia Quality Jobs Tax Credit is a tax incentive program offered in Georgia to encourage businesses to create jobs in the state.

Q: Who is eligible to apply for the Georgia Quality Jobs Tax Credit?

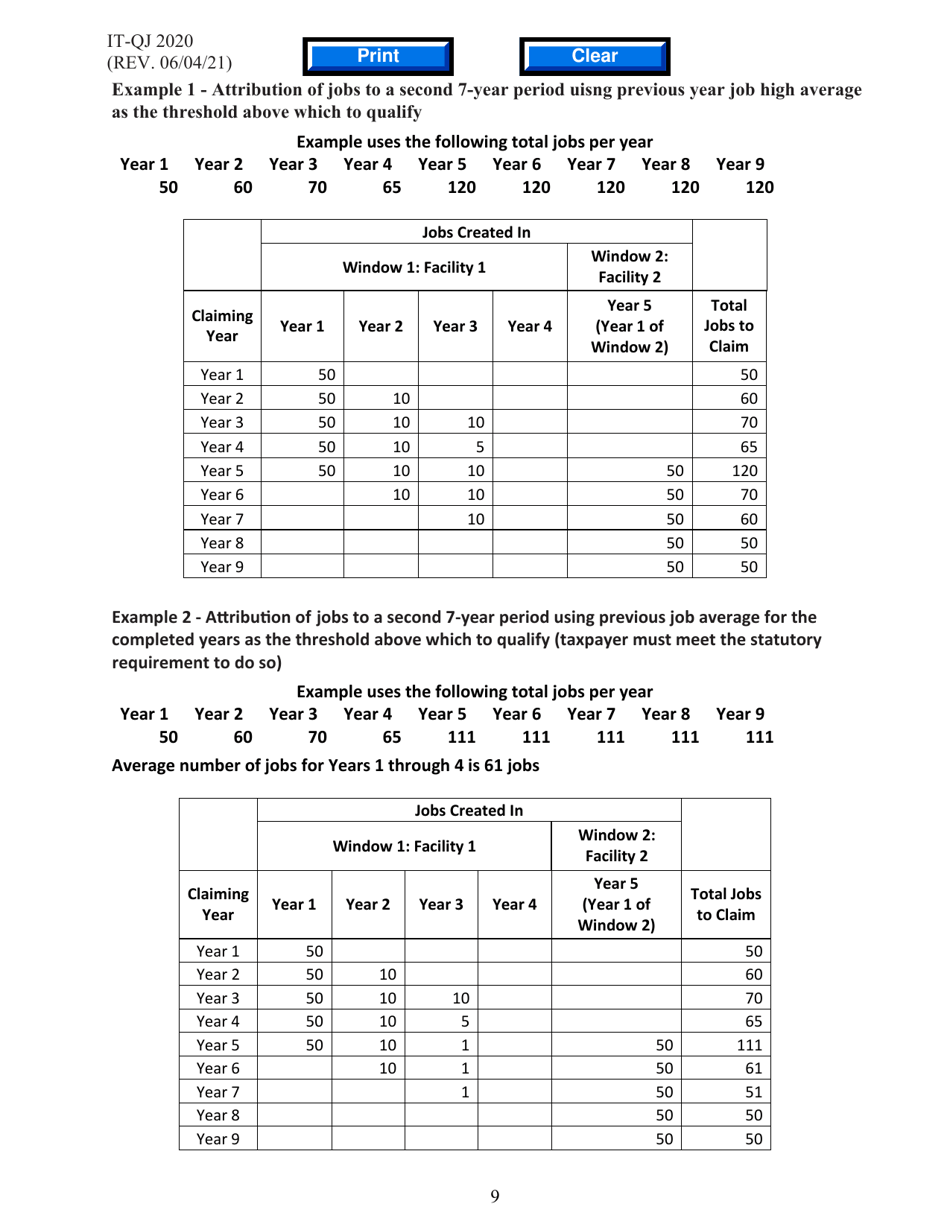

A: Businesses that meet certain criteria, including job creation and wage requirements, are eligible to apply for the Georgia Quality Jobs Tax Credit.

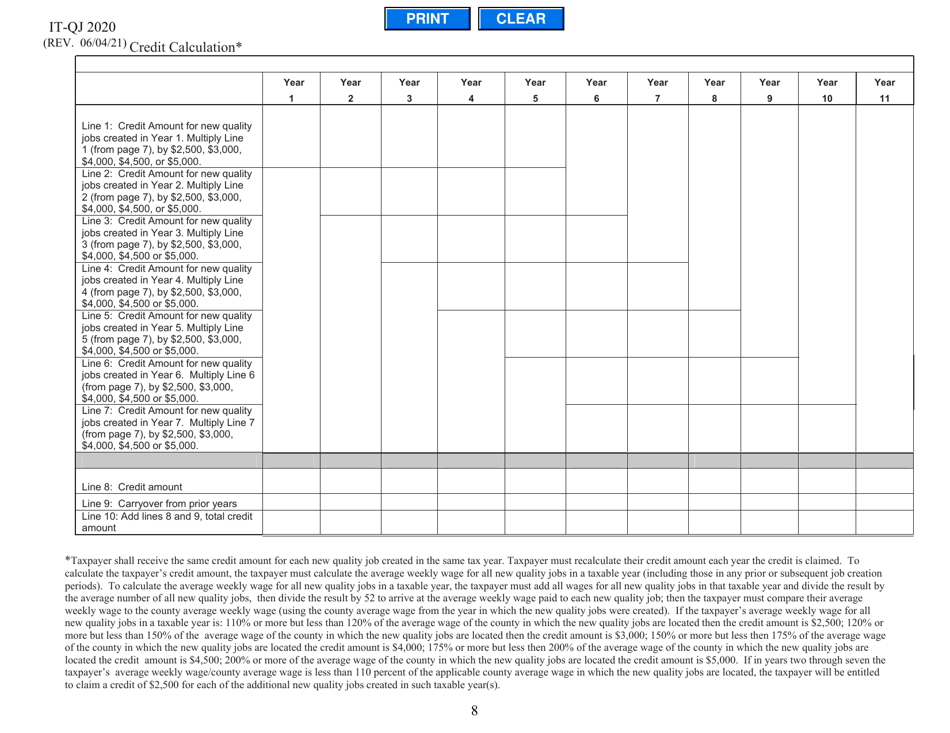

Q: What are the benefits of the Georgia Quality Jobs Tax Credit?

A: The Georgia Quality Jobs Tax Credit provides businesses with a tax credit for each job created that meets the program's requirements, which can help reduce a company's tax liability.

Q: Are there any deadlines for submitting the IT-QJ application?

A: Yes, there are specific deadlines for submitting the IT-QJ application. It is recommended to consult the Georgia Department of Revenue or the application form itself for the most up-to-date deadline information.

Form Details:

- Released on June 4, 2021;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-QJ by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.

![Document preview: Form ERC-1 Application to Certify and Bank Emission Reduction Credits [georgia Rules for Air Quality Control Chapter 391-3-1-.03(13)] - Georgia (United States)](https://data.templateroller.com/pdf_docs_html/1801/18019/1801950/form-erc-1-application-to-certify-and-bank-emission-reduction-credits-georgia-rules-air-quality-control-chapter-391-3-1-03-13-georgia-united-states.png)