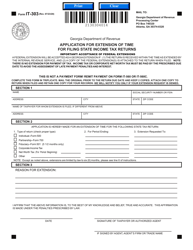

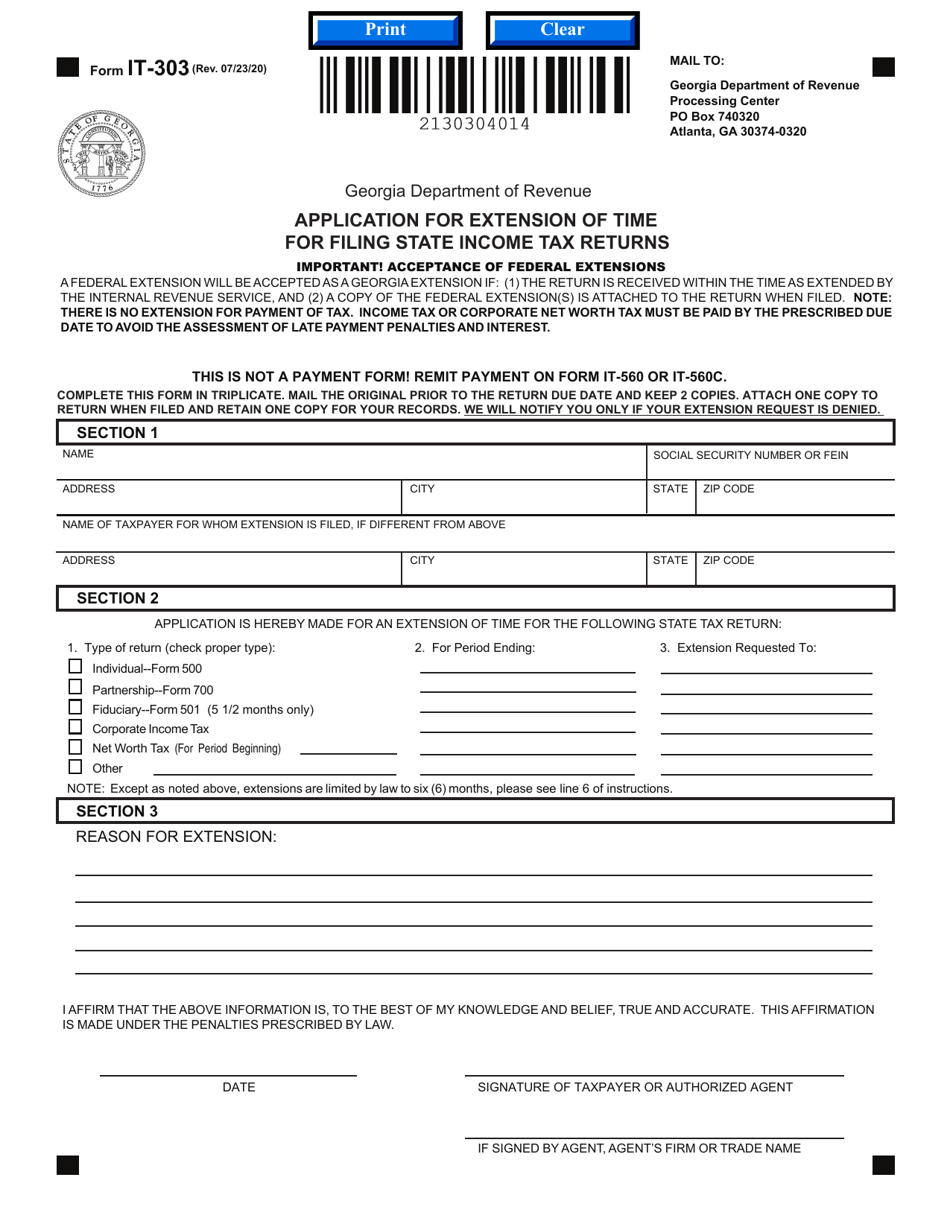

Form IT-303 Application for Extension of Time for Filing State Income Tax Returns - Georgia (United States)

What Is Form IT-303?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-303?

A: Form IT-303 is the application used in Georgia to request an extension of time for filing state income tax returns.

Q: How do I apply for an extension of time to file my state income tax return in Georgia?

A: You can apply for an extension of time by submitting Form IT-303 to the Georgia Department of Revenue.

Q: Can anyone apply for an extension of time to file their state income tax return?

A: Yes, any individual or business who needs additional time to file their state income tax return can apply for an extension using Form IT-303.

Q: Is there a fee to apply for an extension of time to file the state income tax return in Georgia?

A: No, there is no fee to apply for an extension of time using Form IT-303 in Georgia.

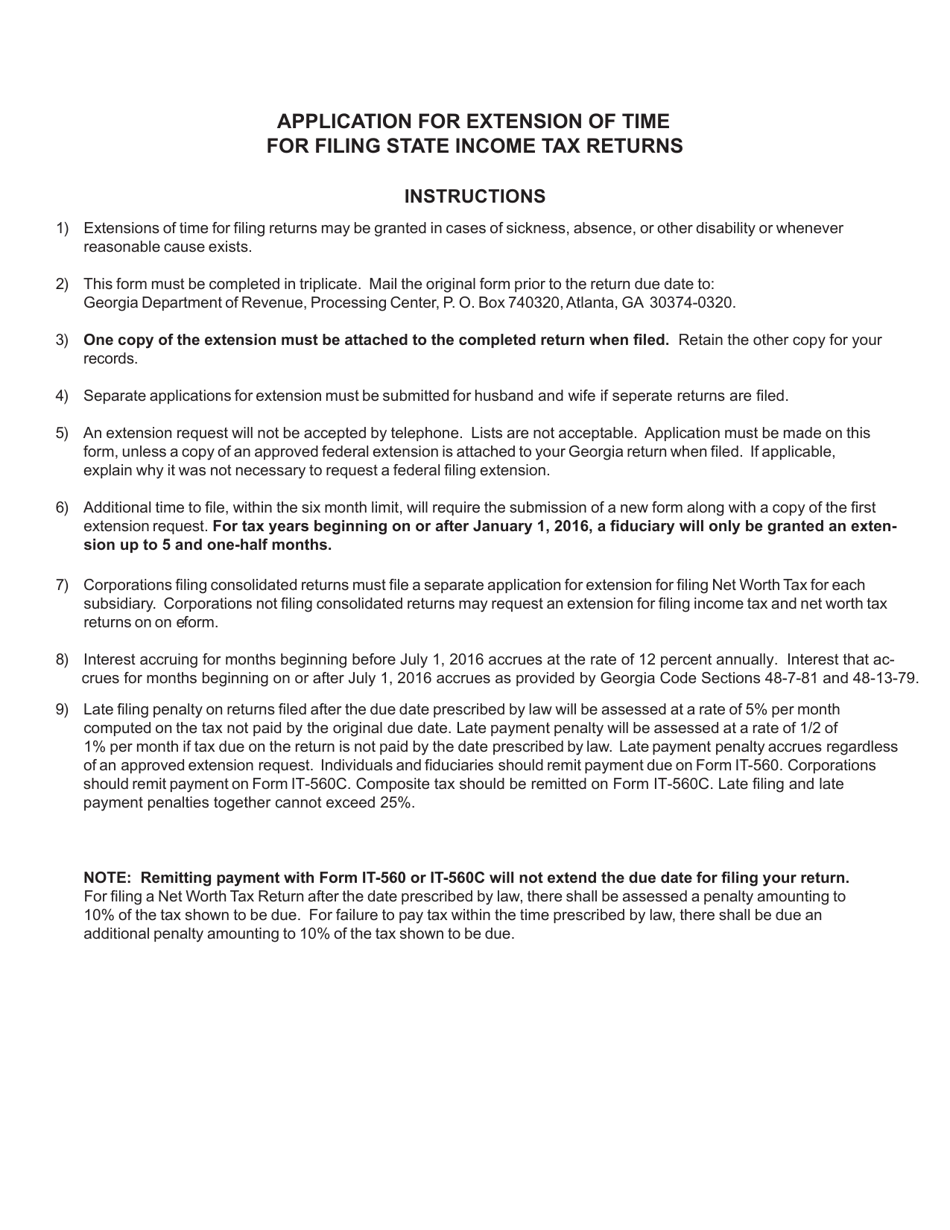

Q: How long is the extension of time granted by filing Form IT-303?

A: If approved, the extension will provide an additional six months to file your state income tax return in Georgia.

Q: Can the extension of time granted through Form IT-303 be further extended?

A: No, the extension granted through Form IT-303 cannot be further extended.

Q: When is the deadline to file Form IT-303 in Georgia?

A: Form IT-303 must be filed on or before the original due date of your state income tax return in Georgia.

Q: What happens if I file Form IT-303 but fail to file my state income tax return by the extended deadline?

A: If you fail to file your state income tax return by the extended deadline, you may be subject to penalties and interest on any tax due.

Form Details:

- Released on July 23, 2020;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-303 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.