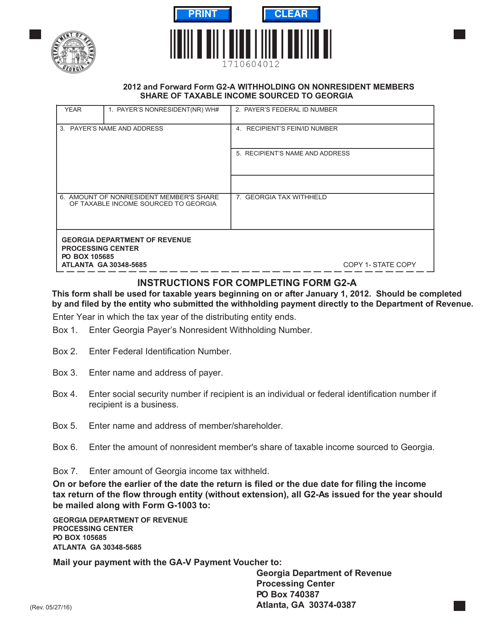

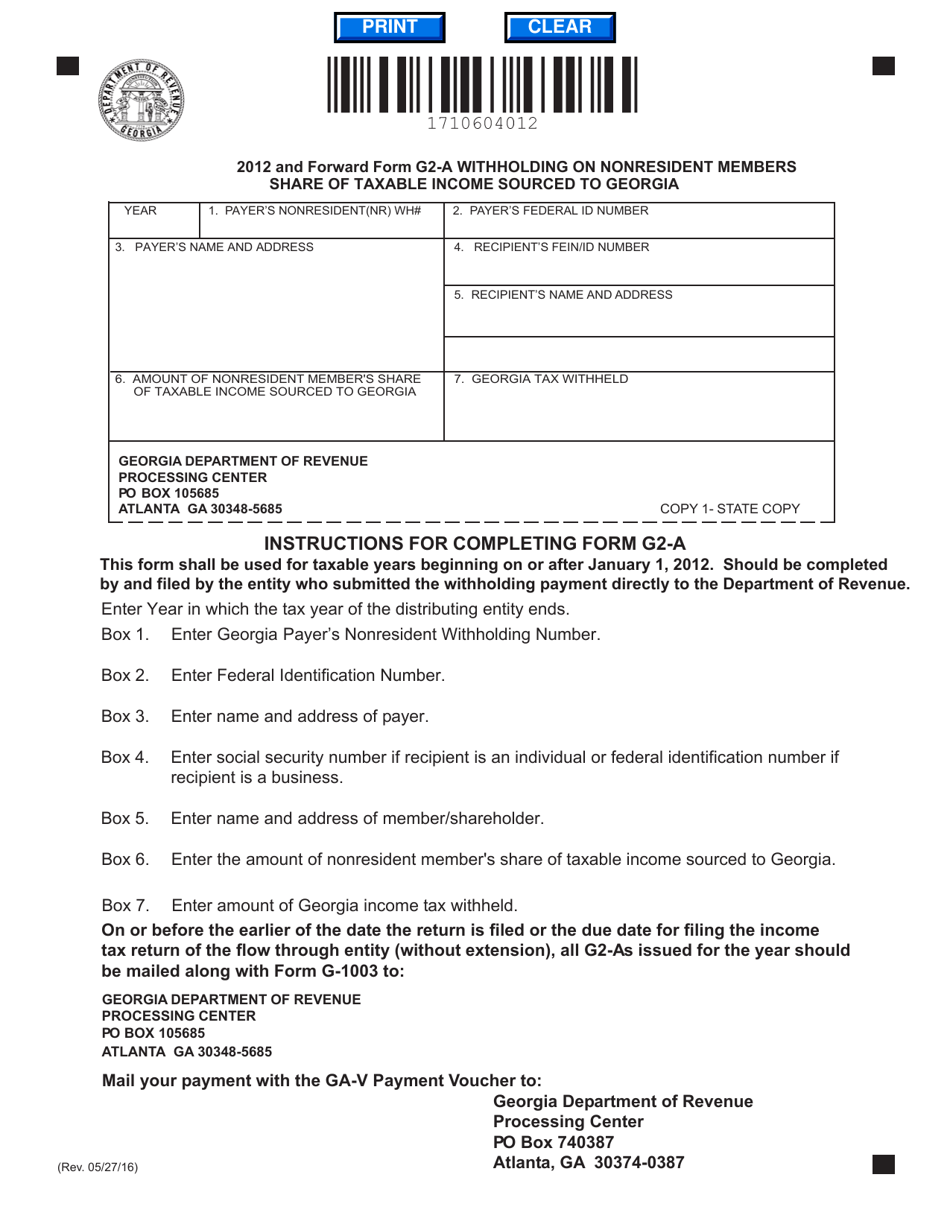

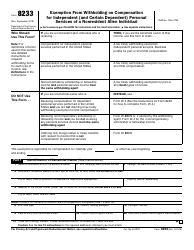

Form G2-A Withholding on Nonresident Members Share of Taxable Income Sourced to Georgia - Georgia (United States)

What Is Form G2-A?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G2-A?

A: Form G2-A is a form used for withholding on nonresident members' share of taxable income sourced to Georgia.

Q: Who is required to fill out Form G2-A?

A: Form G2-A is filled out by nonresident members who have taxable income sourced to Georgia.

Q: What is the purpose of Form G2-A?

A: The purpose of Form G2-A is to ensure appropriate tax withholding for nonresident members' share of taxable income sourced to Georgia.

Q: Which state is Form G2-A specific to?

A: Form G2-A is specific to the state of Georgia.

Q: What is the significance of withholding on nonresident members' share of taxable income?

A: Withholding ensures that taxes are deducted from the income of nonresident members to meet their tax obligations in Georgia.

Form Details:

- Released on May 27, 2016;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G2-A by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.