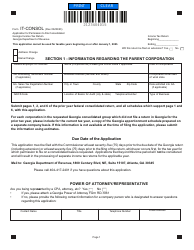

This version of the form is not currently in use and is provided for reference only. Download this version of

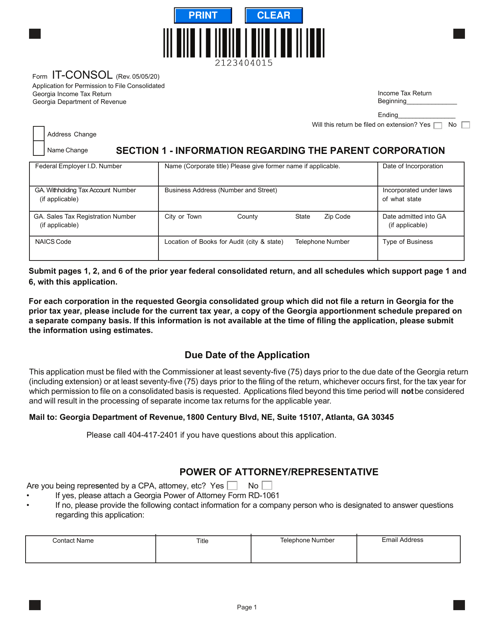

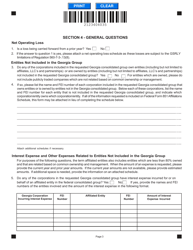

Form IT-CONSOL

for the current year.

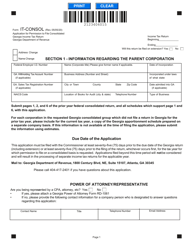

Form IT-CONSOL Application for Permission to File Consolidated Georgia Income Tax Return - Georgia (United States)

What Is Form IT-CONSOL?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). Check the official instructions before completing and submitting the form.

FAQ

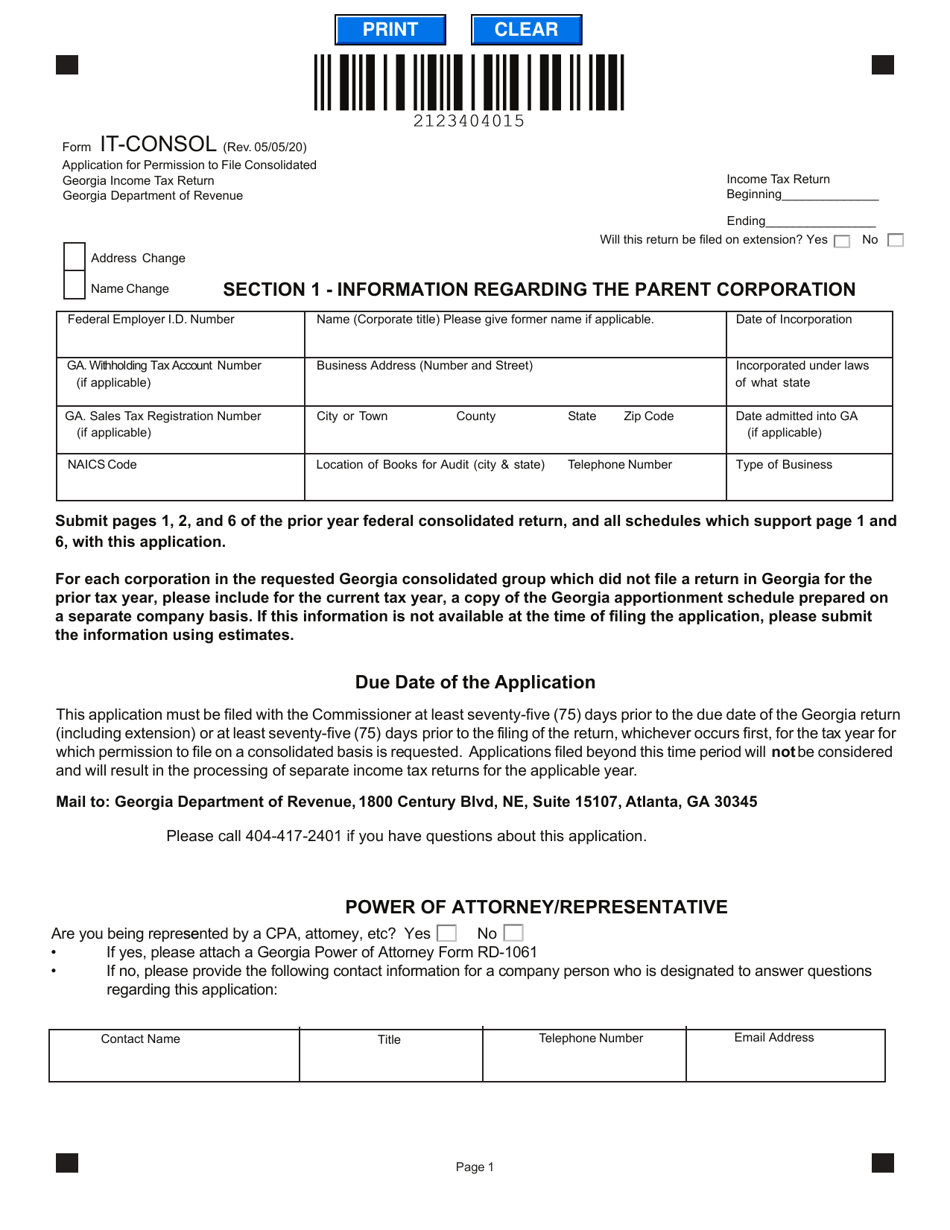

Q: What is Form IT-CONSOL?

A: Form IT-CONSOL is used to apply for permission to file a consolidated Georgia income tax return.

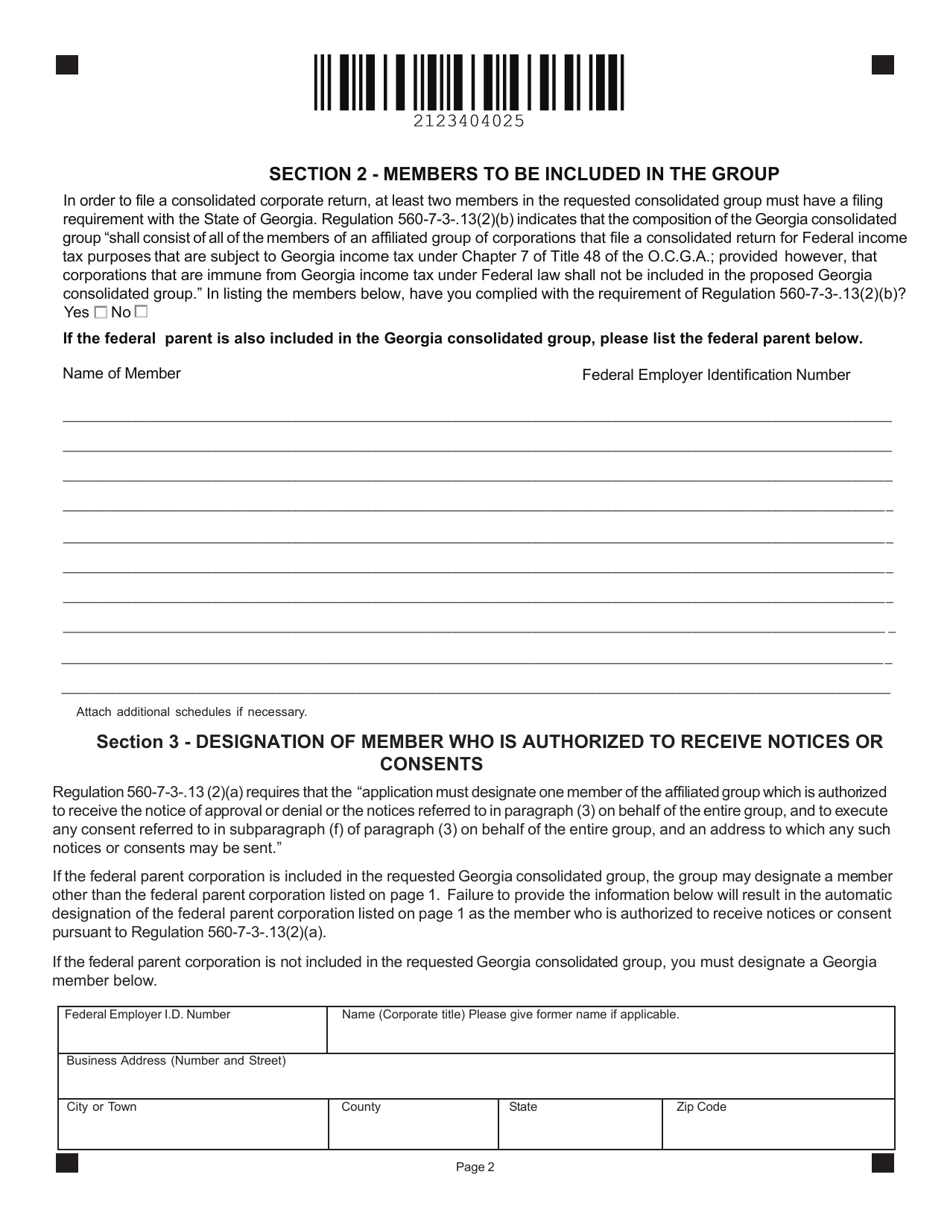

Q: Who needs to file Form IT-CONSOL?

A: Form IT-CONSOL needs to be filed by corporations that want to consolidate their income tax returns for Georgia.

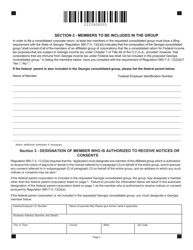

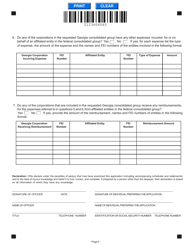

Q: What is a consolidated Georgia income tax return?

A: A consolidated Georgia income tax return is a single return that combines the income, deductions, and credits of two or more affiliated corporations.

Q: How do I apply for permission to file a consolidated Georgia income tax return?

A: You can apply for permission by completing and submitting Form IT-CONSOL to the Georgia Department of Revenue.

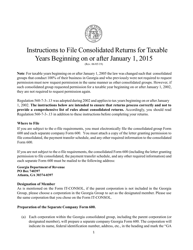

Q: Is there a deadline for filing Form IT-CONSOL?

A: Yes, Form IT-CONSOL must be filed on or before the original due date of the Georgia income tax return for the preceding tax year.

Q: Are there any fees associated with filing Form IT-CONSOL?

A: No, there are no fees associated with filing Form IT-CONSOL.

Q: Is it mandatory to file a consolidated Georgia income tax return?

A: No, filing a consolidated Georgia income tax return is optional for corporations.

Q: Can I apply for permission to file a consolidated Georgia income tax return for multiple tax years?

A: Yes, you can apply for permission to file a consolidated Georgia income tax return for multiple tax years by indicating the tax years on the form.

Form Details:

- Released on May 5, 2020;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-CONSOL by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.