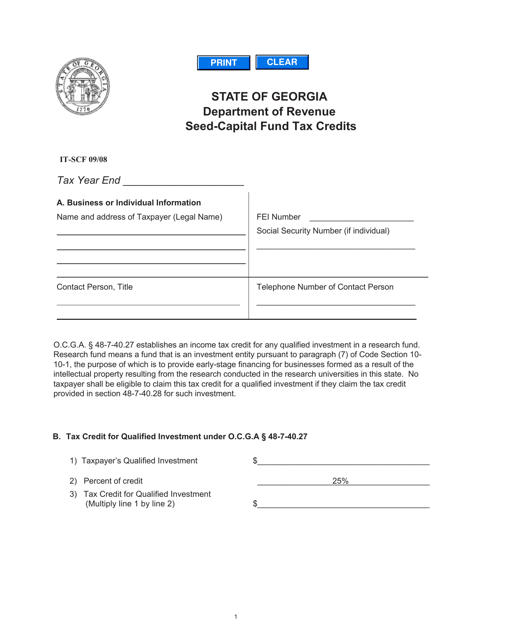

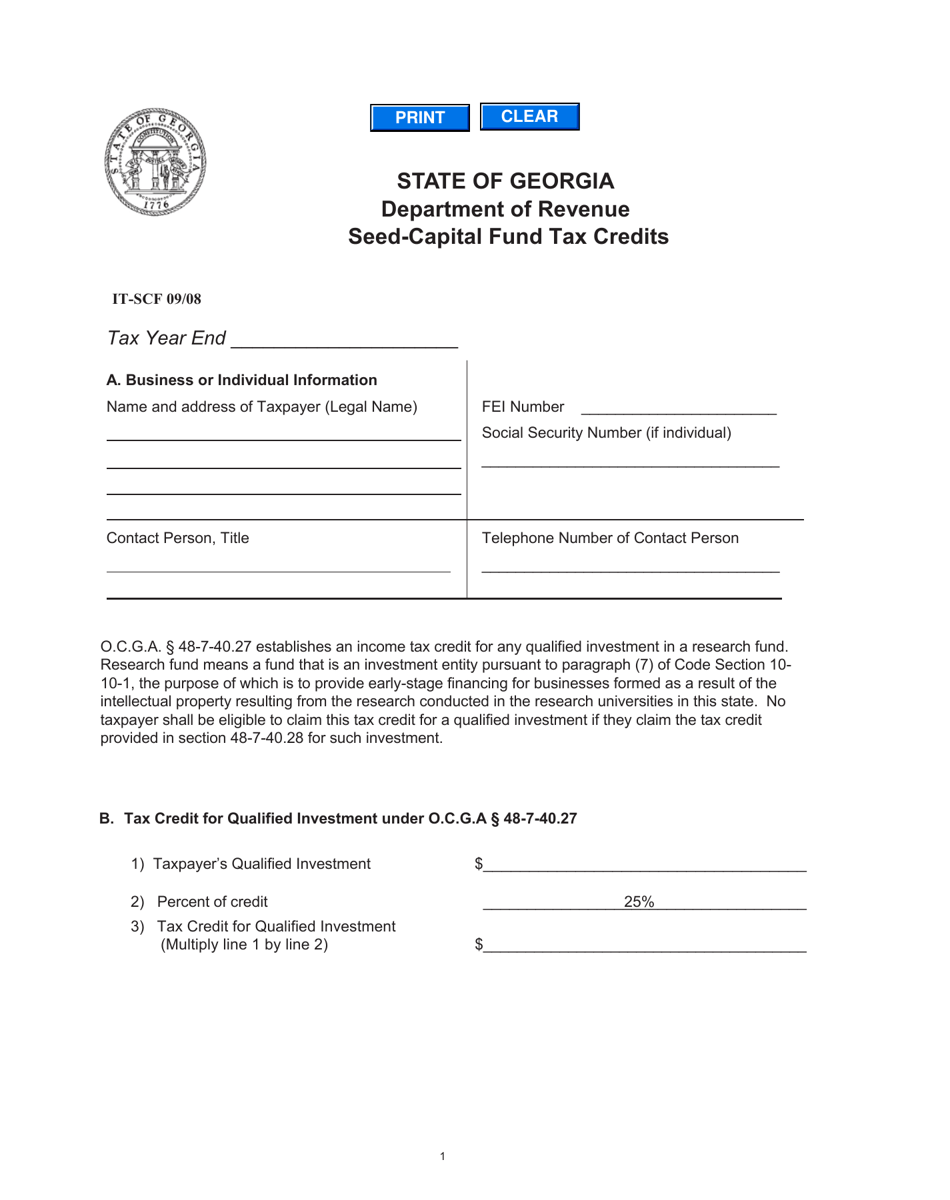

Form IT-SCF Seed-Capital Fund Tax Credits - Georgia (United States)

What Is Form IT-SCF?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

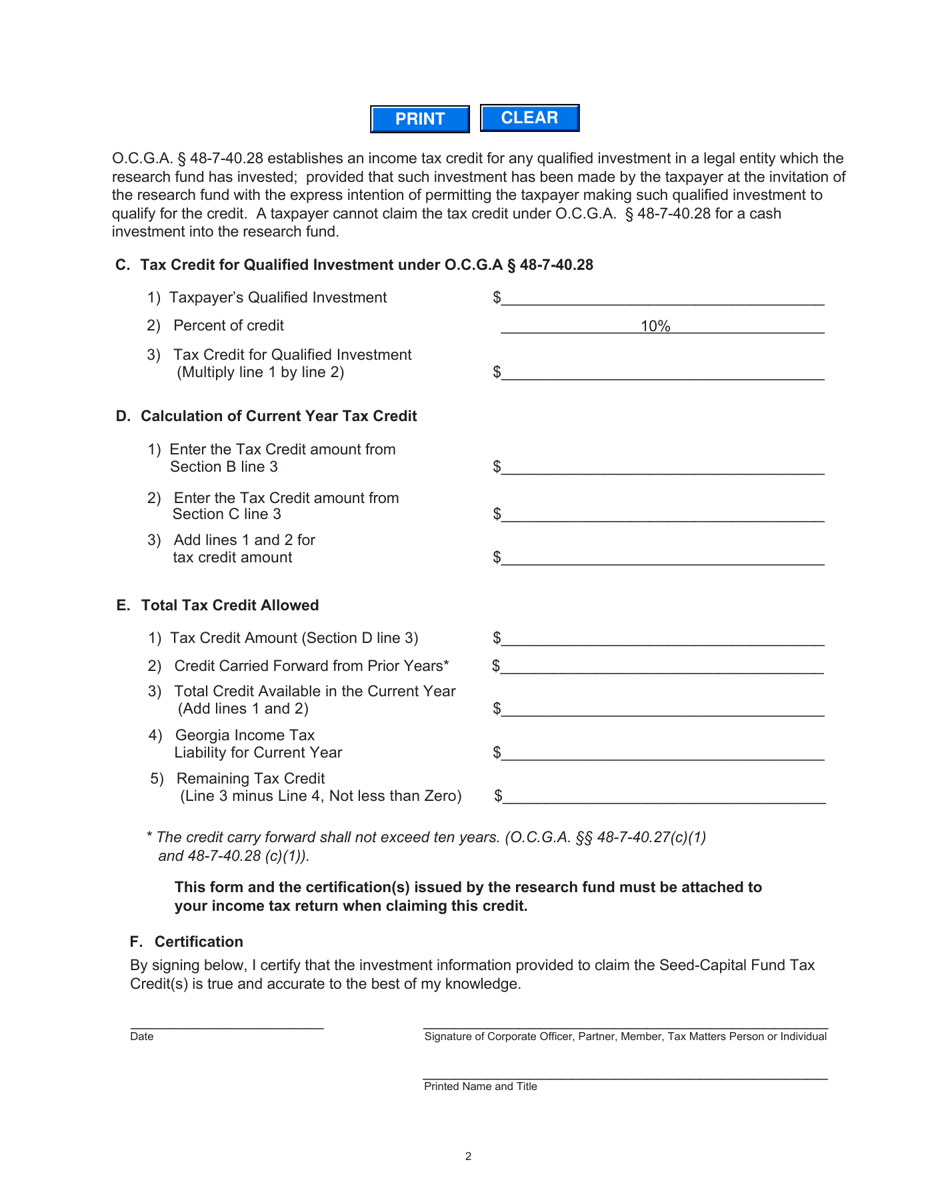

Q: What is Form IT-SCF?

A: Form IT-SCF is a tax form in Georgia (United States) related to Seed-Capital Fund Tax Credits.

Q: What are Seed-Capital Fund Tax Credits?

A: Seed-Capital Fund Tax Credits are tax credits provided to individuals or businesses that invest in approved Georgia seed-capital funds.

Q: What is the purpose of Form IT-SCF?

A: Form IT-SCF is used to claim the Seed-Capital Fund Tax Credits.

Q: Who can claim the Seed-Capital Fund Tax Credits?

A: Individuals or businesses who have invested in approved Georgia seed-capital funds can claim the tax credits.

Q: Are there any eligibility requirements for claiming the tax credits?

A: Yes, there are eligibility requirements. The investment must be made in an approved Georgia seed-capital fund and certain investment thresholds must be met.

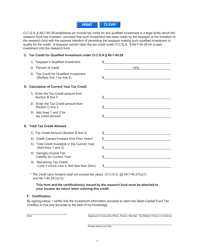

Q: How much tax credit can be claimed?

A: The tax credit amount is equal to 35% of the investment made in an approved Georgia seed-capital fund.

Q: When is the deadline for filing Form IT-SCF?

A: The deadline for filing Form IT-SCF is the same as the deadline for filing the Georgia income tax return, which is usually April 15th of each year.

Q: Can the tax credits be carried forward or back?

A: Yes, any unused tax credits can be carried forward for up to 10 years or carried back for up to 5 years.

Form Details:

- Released on September 1, 2008;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-SCF by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.