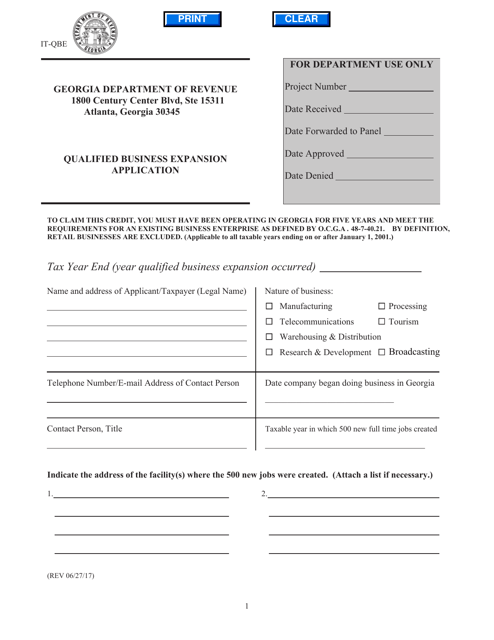

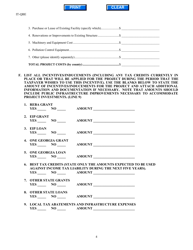

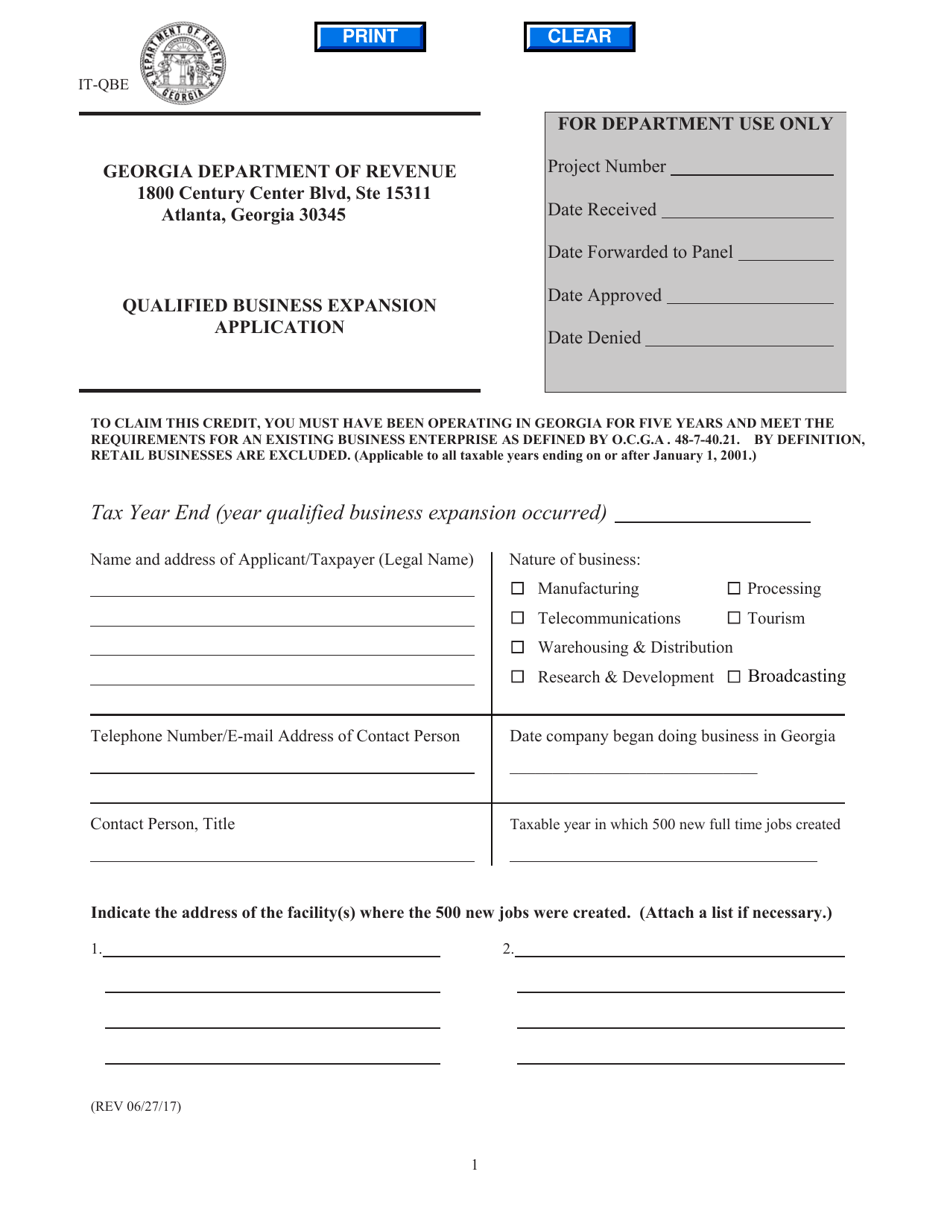

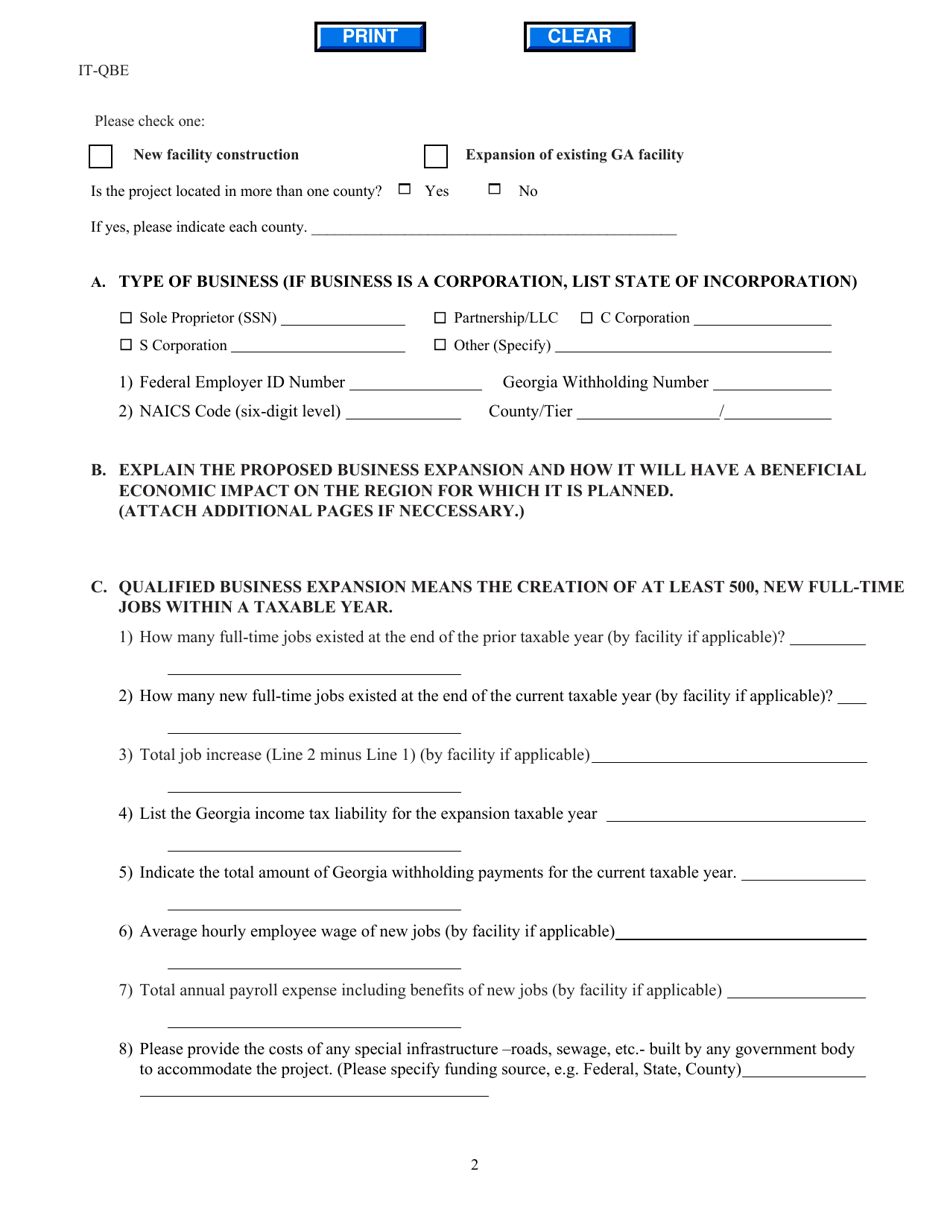

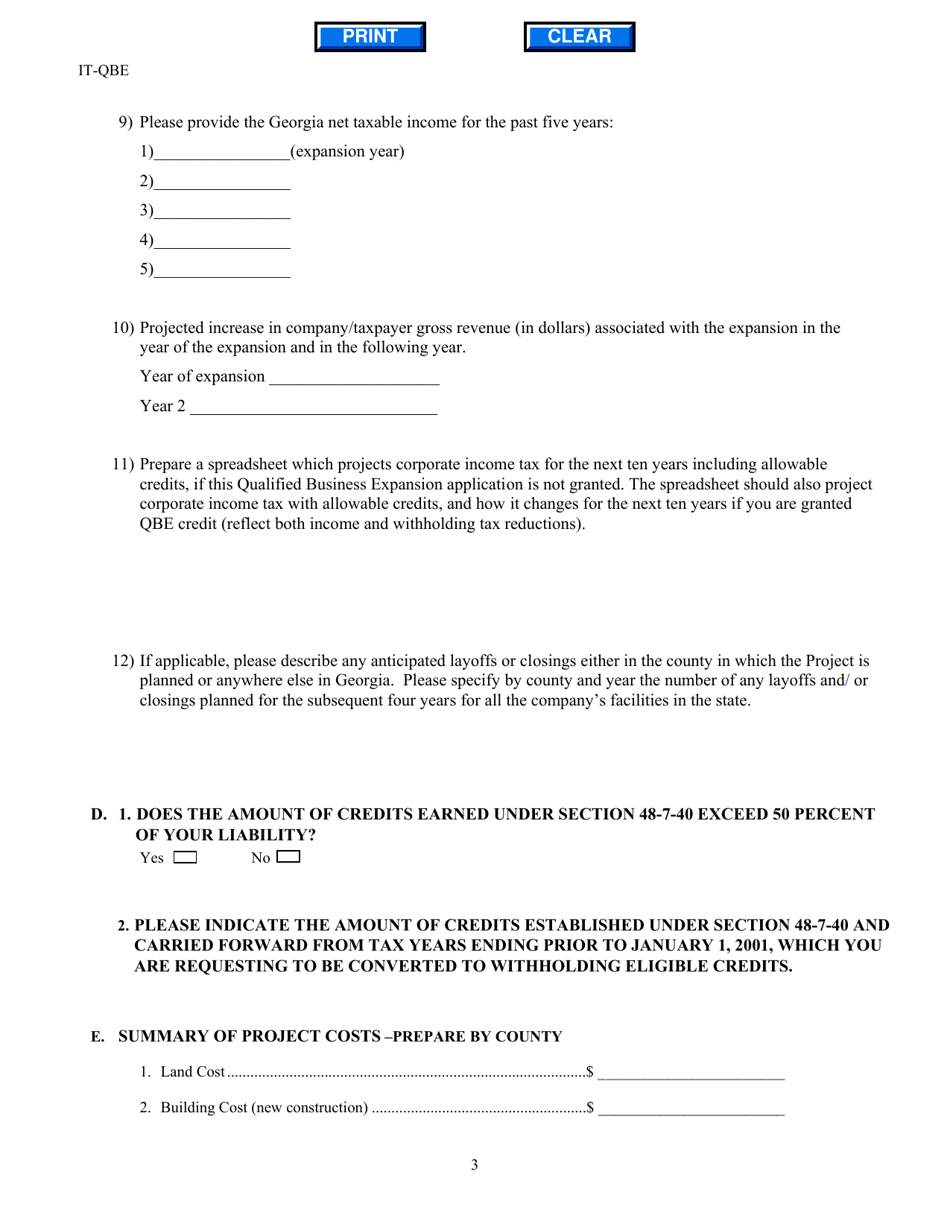

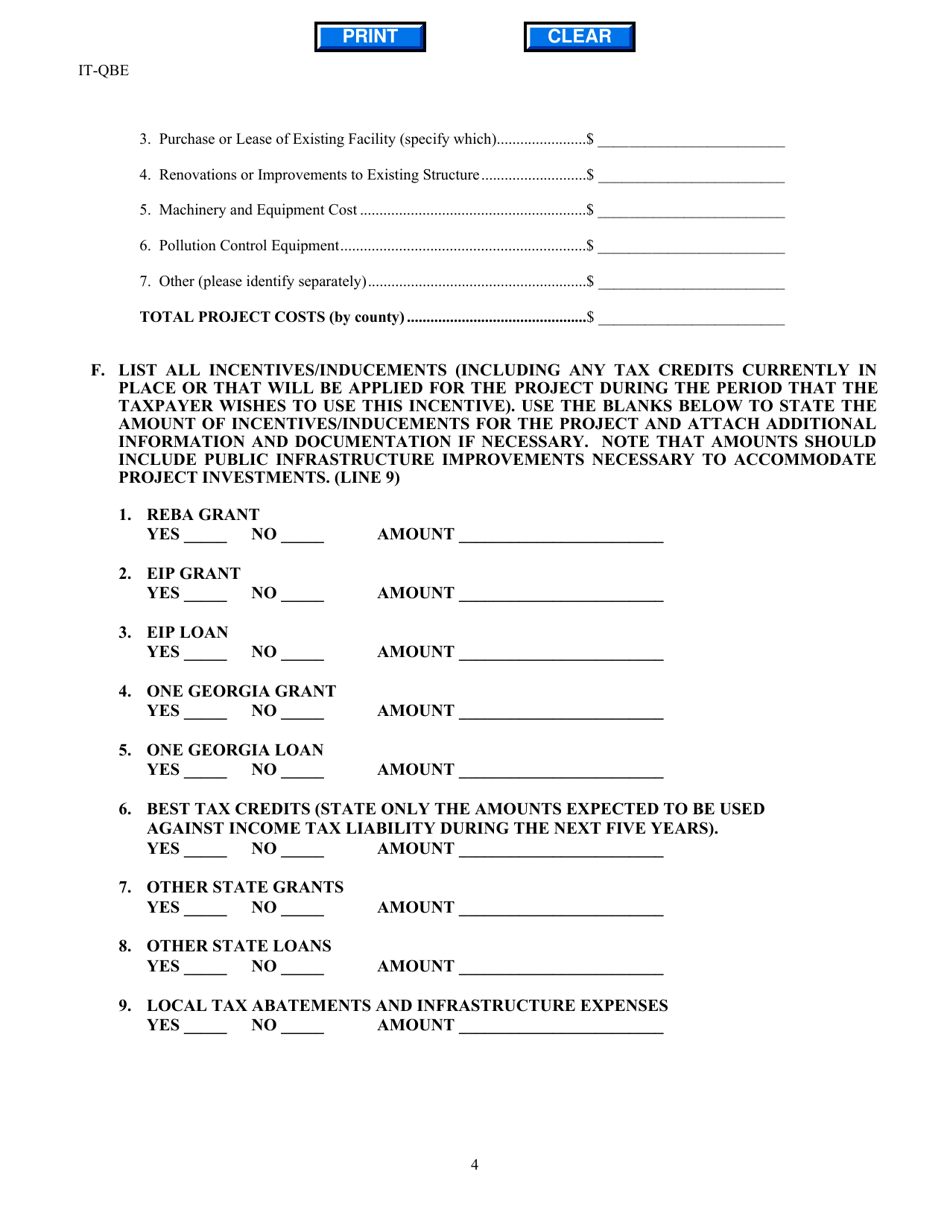

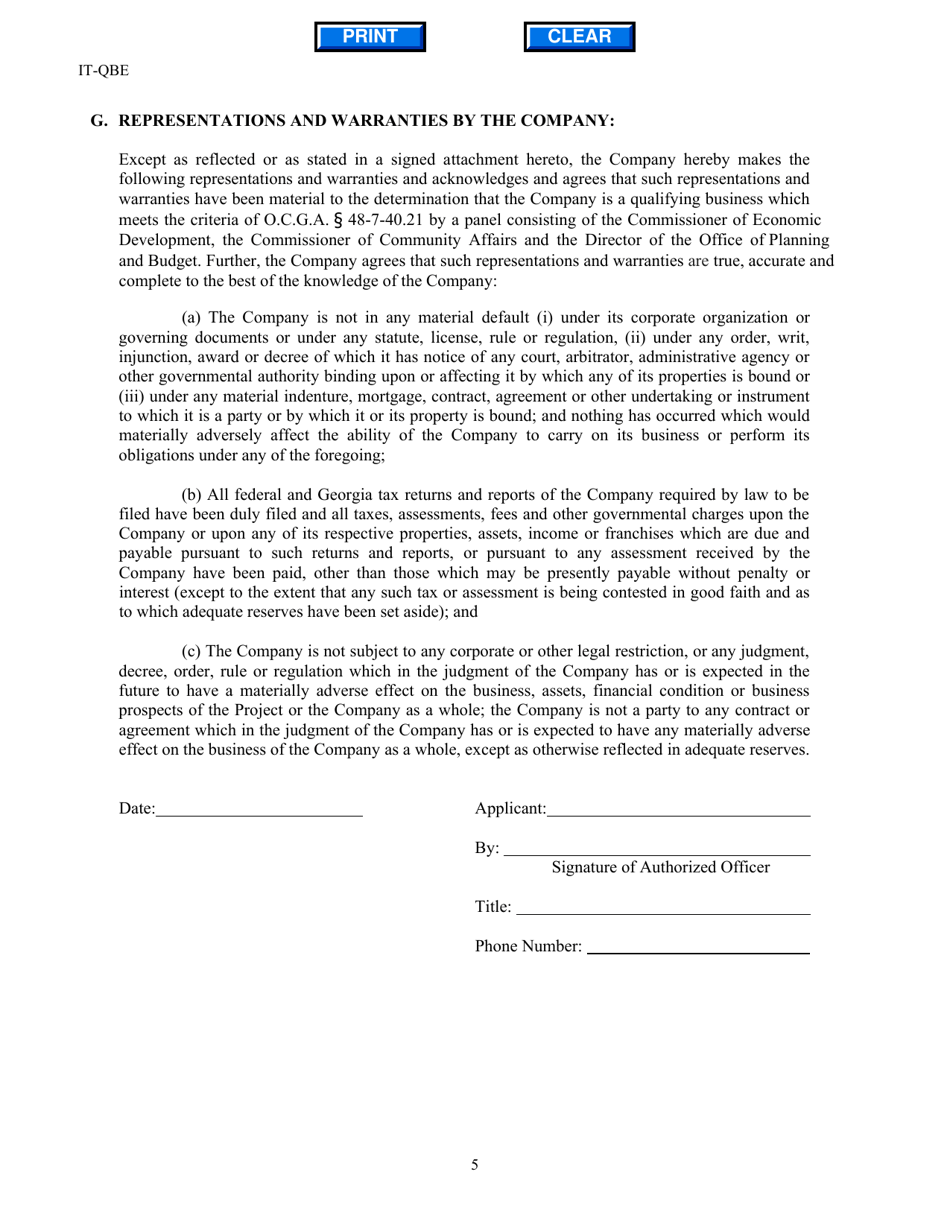

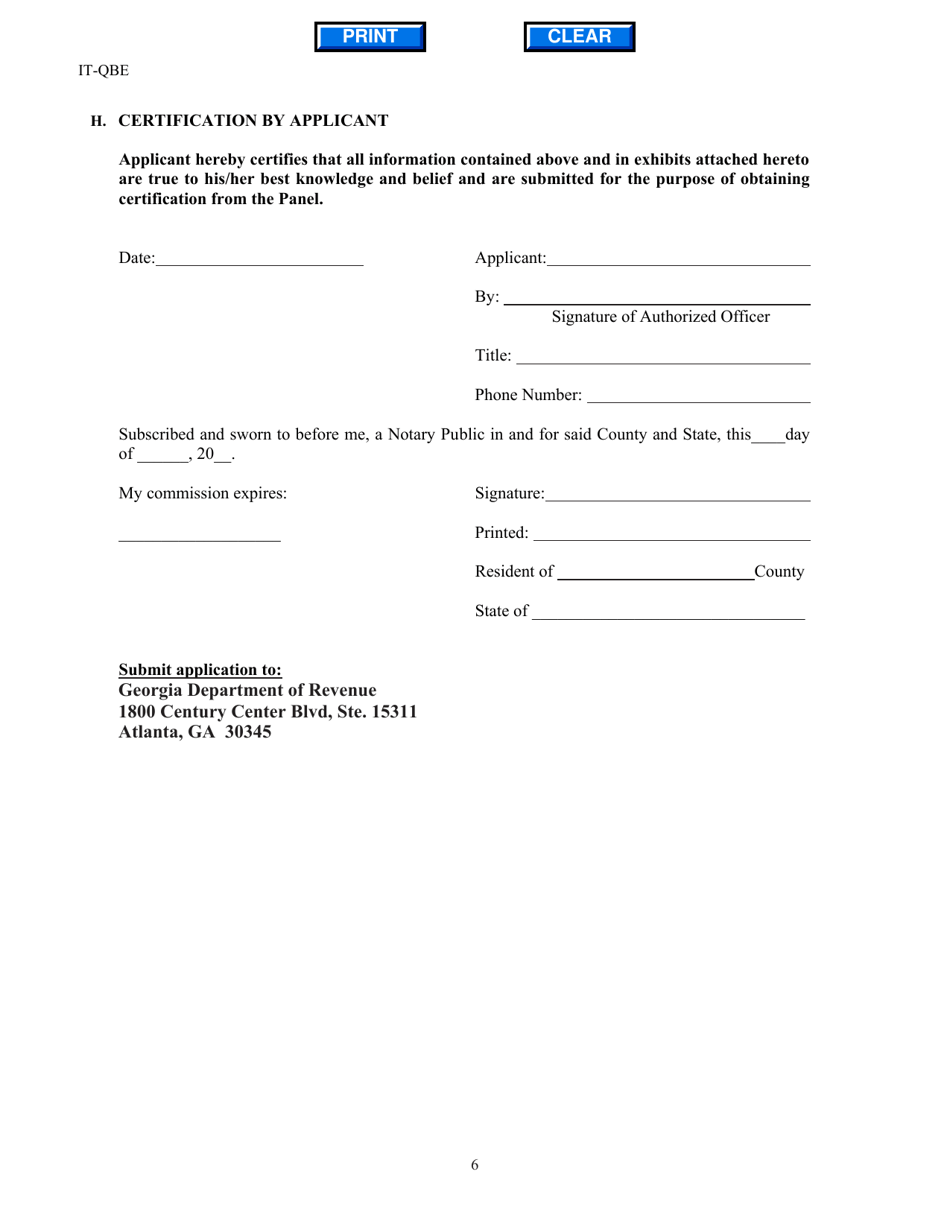

Form IT-QBE Qualified Business Expansion Application - Georgia (United States)

What Is Form IT-QBE?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

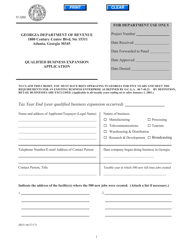

Q: What is the Form IT-QBE?

A: Form IT-QBE is the Qualified Business Expansion Application.

Q: What is the purpose of Form IT-QBE?

A: The purpose of Form IT-QBE is to apply for the Qualified Business Expansion (QBE) tax credit in Georgia.

Q: Who is eligible to use Form IT-QBE?

A: Businesses that meet the criteria for the Qualified Business Expansion tax credit in Georgia are eligible to use Form IT-QBE.

Q: What information do I need to complete Form IT-QBE?

A: To complete Form IT-QBE, you will need information about your business, including the expansion project details and employment information.

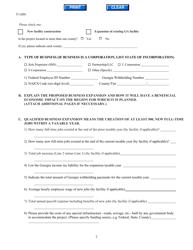

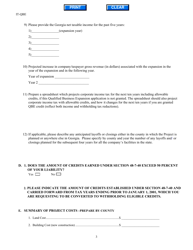

Q: What is the benefit of the Qualified Business Expansion tax credit?

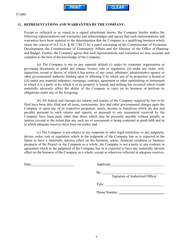

A: The Qualified Business Expansion tax credit provides eligible businesses with a tax credit for certain expenses related to expanding their operations in Georgia.

Q: Are there any limitations or restrictions on the QBE tax credit?

A: Yes, there are certain limitations and restrictions on the QBE tax credit. It is advisable to review the specific eligibility requirements and guidelines provided by the Georgia Department of Revenue.

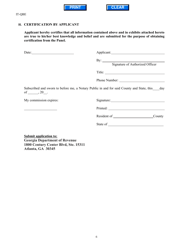

Q: Can I claim the QBE tax credit for previous years?

A: No, the QBE tax credit can only be claimed for the tax year in which the qualified business expansion occurred.

Q: Who should I contact if I have questions about Form IT-QBE or the QBE tax credit?

A: If you have questions about Form IT-QBE or the QBE tax credit, you should contact the Georgia Department of Revenue for further assistance.

Form Details:

- Released on June 27, 2017;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-QBE by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.