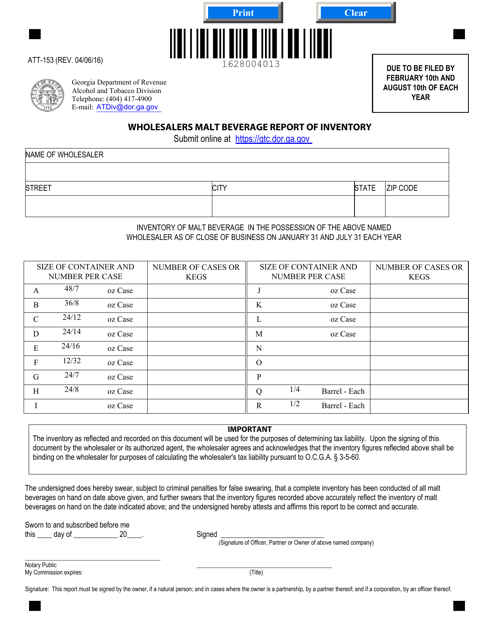

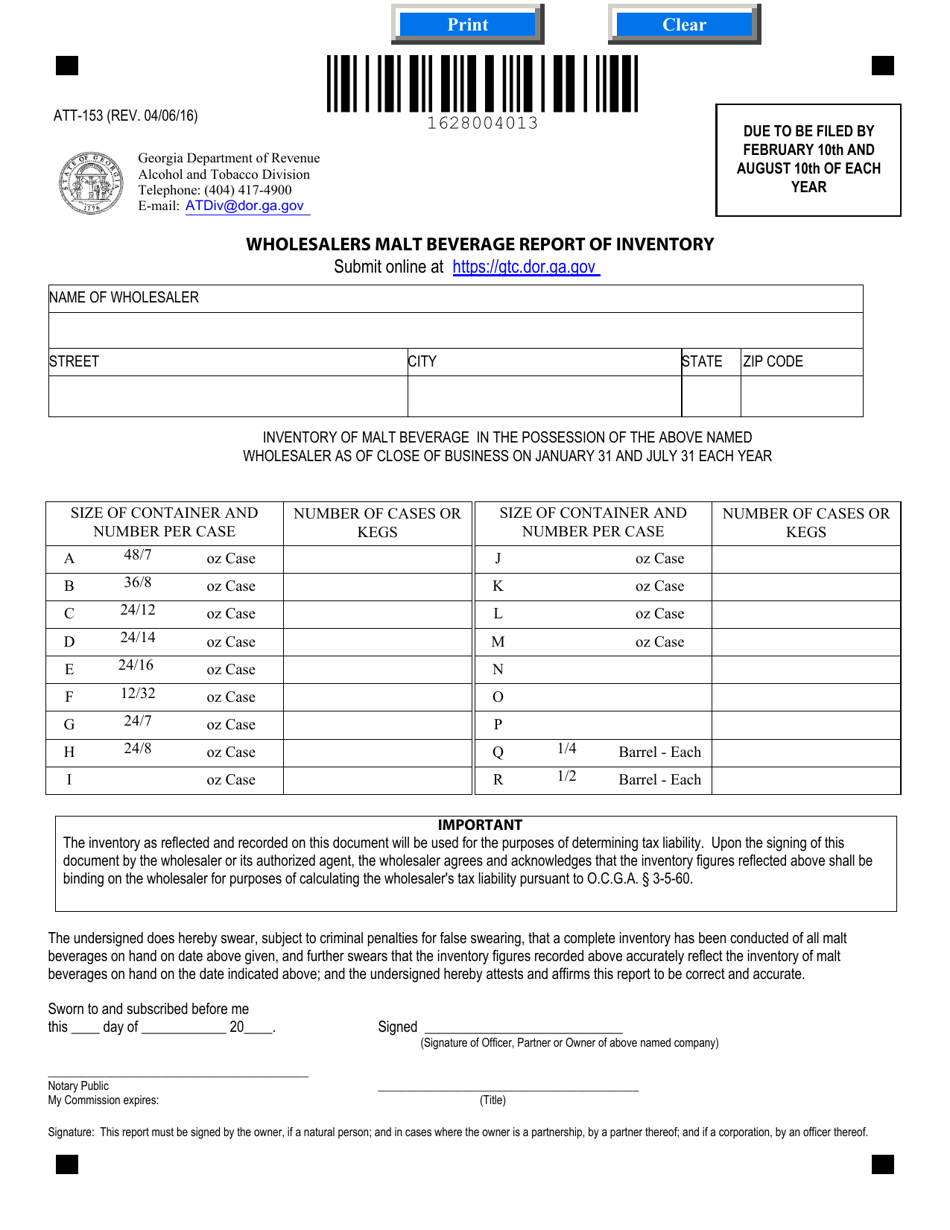

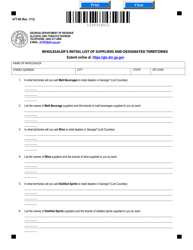

Form ATT-153 Wholesaler Malt Beverage Report of Inventory - Georgia (United States)

What Is Form ATT-153?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ATT-153?

A: ATT-153 is a Wholesaler Malt Beverage Report of Inventory form.

Q: Who is required to file ATT-153?

A: Wholesalers of malt beverages in Georgia (United States) are required to file ATT-153.

Q: What information does ATT-153 require?

A: ATT-153 requires wholesalers to report their inventory of malt beverages.

Q: Why is ATT-153 filed?

A: ATT-153 is filed to track the inventory of malt beverages in Georgia and ensure compliance with regulations.

Q: Are there any penalties for not filing ATT-153?

A: Failure to file ATT-153 may result in penalties and non-compliance with Georgia's malt beverage regulations.

Q: Is ATT-153 specific to Georgia only?

A: Yes, ATT-153 is specific to Georgia (United States) and its malt beverage inventory reporting requirements.

Form Details:

- Released on April 6, 2016;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ATT-153 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.