This version of the form is not currently in use and is provided for reference only. Download this version of

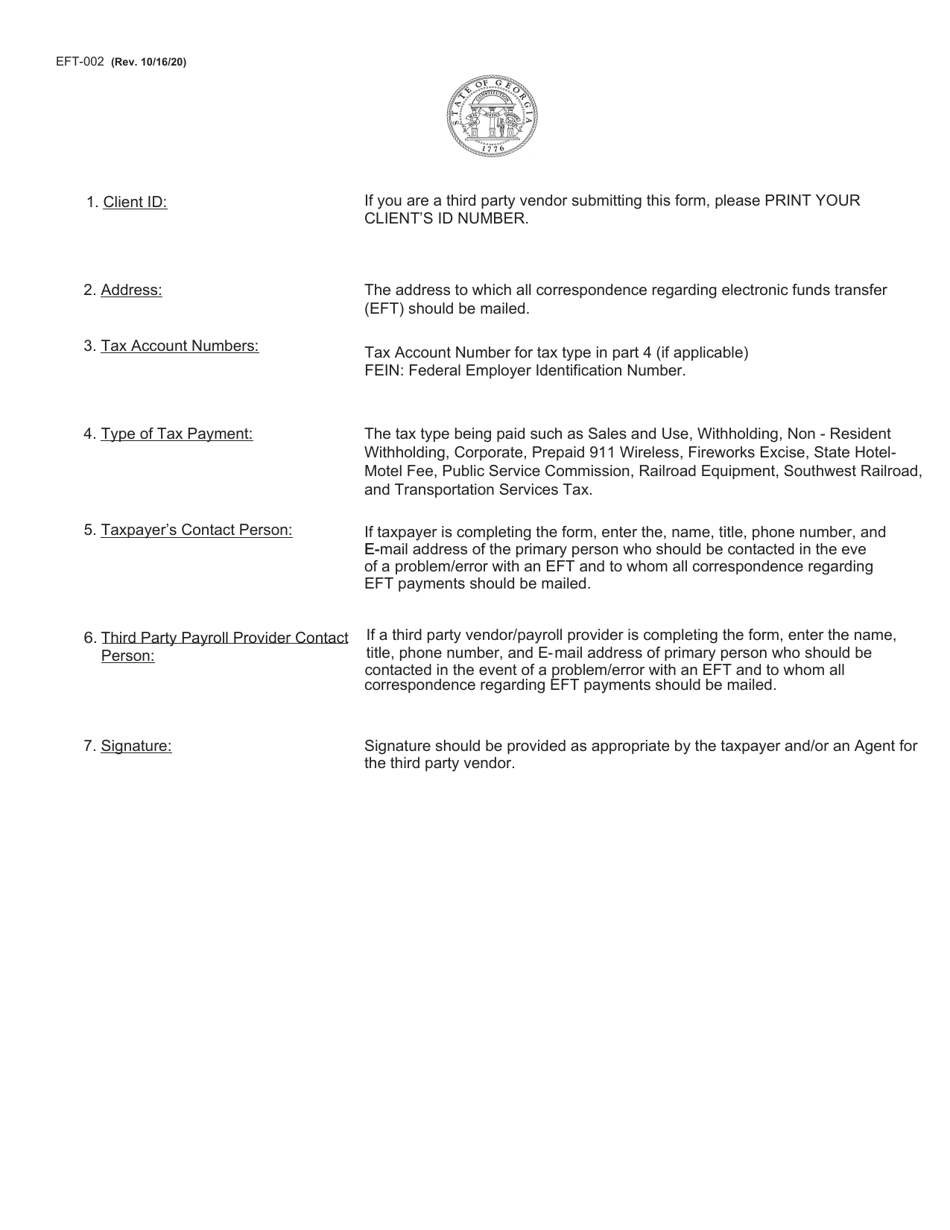

Form EFT-002

for the current year.

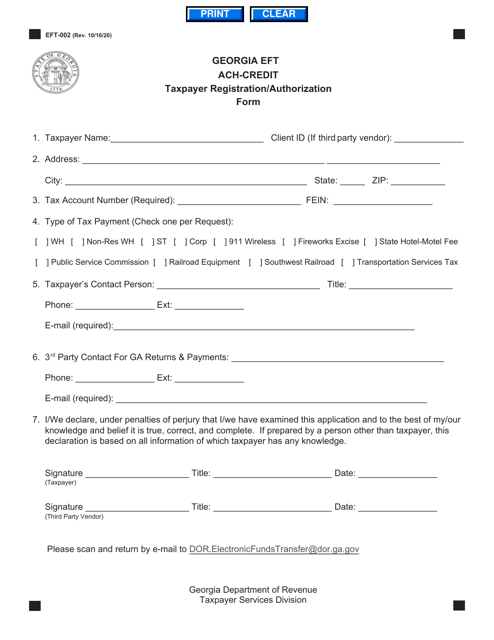

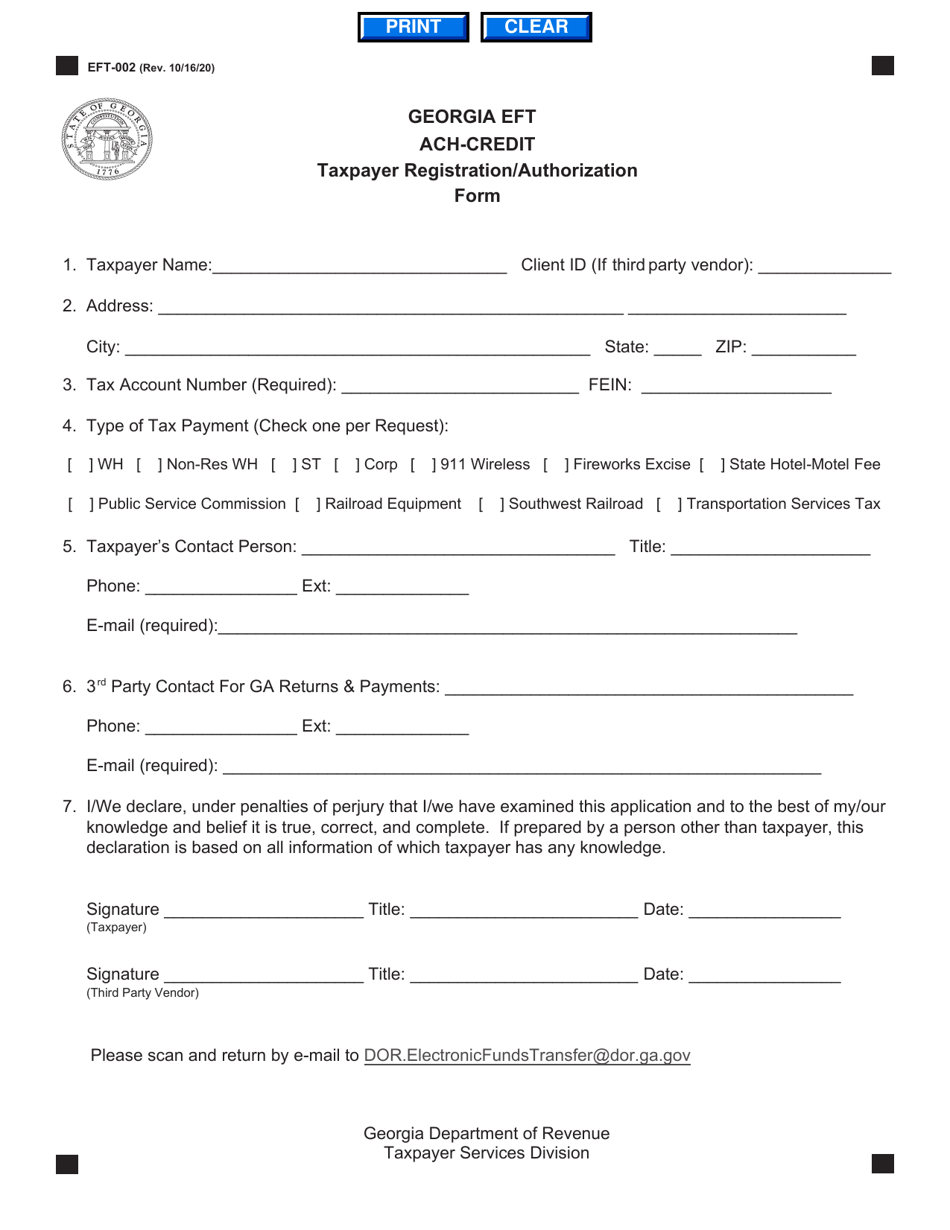

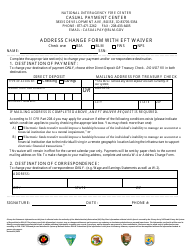

Form EFT-002 Georgia Eft ACH-Credit Taxpayer Registration / Authorization Form - Georgia (United States)

What Is Form EFT-002?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EFT-002?

A: Form EFT-002 is the Georgia Eft ACH-Credit Taxpayer Registration/Authorization Form.

Q: What is the purpose of Form EFT-002?

A: The purpose of Form EFT-002 is to register as a taxpayer and authorize ACH-credit payments in the state of Georgia.

Q: Who needs to fill out Form EFT-002?

A: Taxpayers who want to make ACH-credit payments in Georgia need to fill out Form EFT-002.

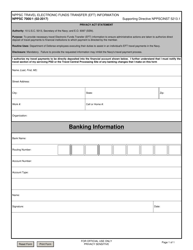

Q: What is ACH-credit payment?

A: ACH-credit payment is a type of electronic funds transfer.

Q: Do I need to submit Form EFT-002 every year?

A: No, you do not need to submit Form EFT-002 every year. Once you have registered and authorized ACH-credit payments, it remains valid until you cancel or update the authorization.

Q: Are there any fees associated with ACH-credit payments?

A: The Georgia Department of Revenue does not charge any fees for ACH-credit payments. However, check with your financial institution as they may have their own fees.

Q: Can I cancel or update my ACH-credit payment authorization?

A: Yes, you can cancel or update your ACH-credit payment authorization by submitting a new Form EFT-002 with the updated information.

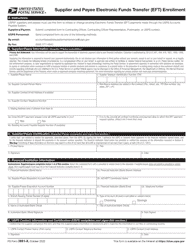

Q: Can I use Form EFT-002 for other states?

A: No, Form EFT-002 is specific to the state of Georgia. Other states may have their own taxpayer registration/authorization forms.

Q: What should I do if I have questions about Form EFT-002?

A: If you have questions about Form EFT-002, you can contact the Georgia Department of Revenue for assistance.

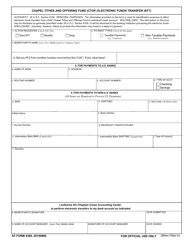

Form Details:

- Released on October 16, 2020;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EFT-002 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.