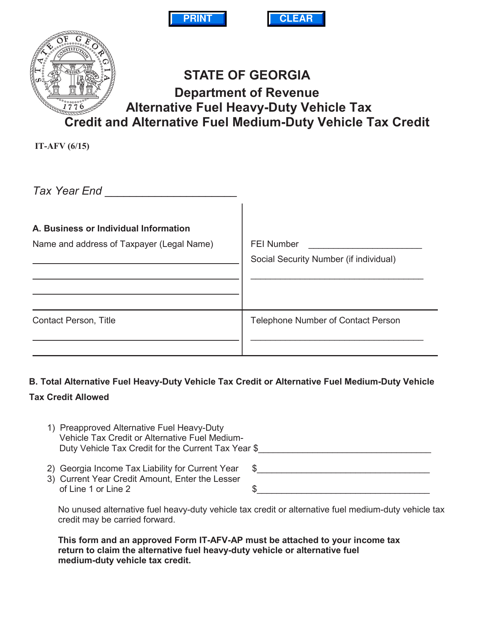

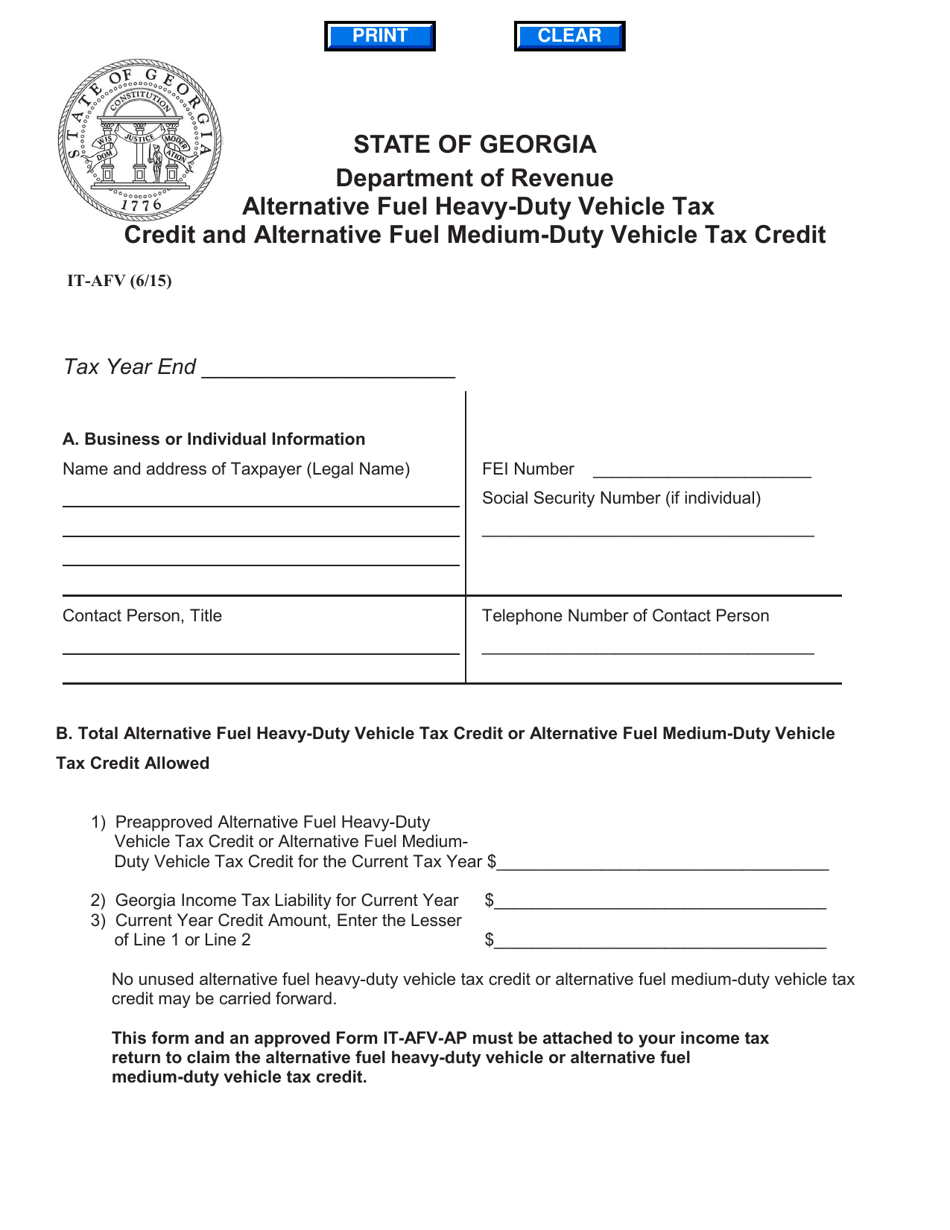

Form IT-AFV Alternative Fuel Heavy-Duty Vehicle Tax Credit and Alternative Fuel Medium-Duty Vehicle Tax Credit - Georgia (United States)

What Is Form IT-AFV?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IT-AFV?

A: IT-AFV stands for Alternative Fuel Heavy-Duty Vehicle Tax Credit and Alternative Fuel Medium-Duty Vehicle Tax Credit.

Q: What is the purpose of IT-AFV?

A: The purpose of IT-AFV is to provide tax credits for purchasing alternative fuel heavy-duty and medium-duty vehicles.

Q: What vehicles are eligible for IT-AFV?

A: Alternative fuel heavy-duty and medium-duty vehicles are eligible for IT-AFV.

Q: What is the tax credit amount?

A: The tax credit amount varies depending on the vehicle's weight and type of alternative fuel used.

Q: Who can apply for IT-AFV?

A: Individuals, corporations, partnerships, and other entities that purchase eligible vehicles can apply for IT-AFV.

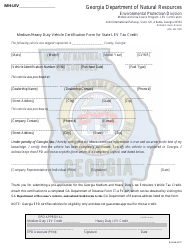

Q: How can I apply for IT-AFV?

A: You can apply for IT-AFV by completing and submitting the necessary forms to the Georgia Department of Revenue.

Q: Are there any limitations or restrictions for IT-AFV?

A: Yes, there are limitations and restrictions such as maximum credit amounts and annual credit caps.

Q: Can I claim the tax credit for multiple vehicles?

A: Yes, you can claim the tax credit for multiple eligible vehicles.

Q: When is the deadline to apply for IT-AFV?

A: The deadline to apply for IT-AFV is typically December 31st of the year following the purchase of the vehicle.

Form Details:

- Released on June 1, 2015;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-AFV by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.