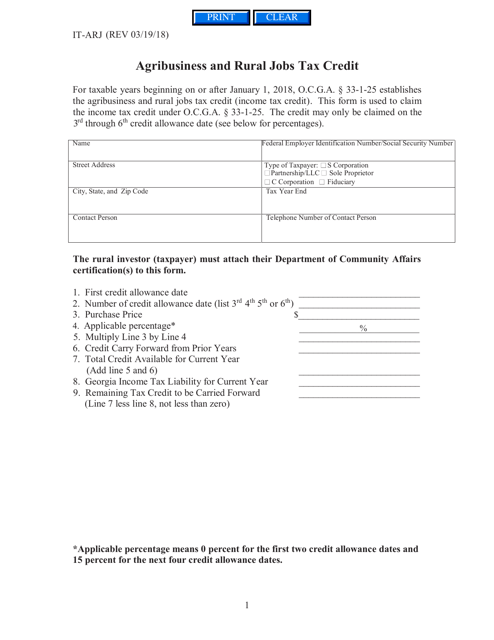

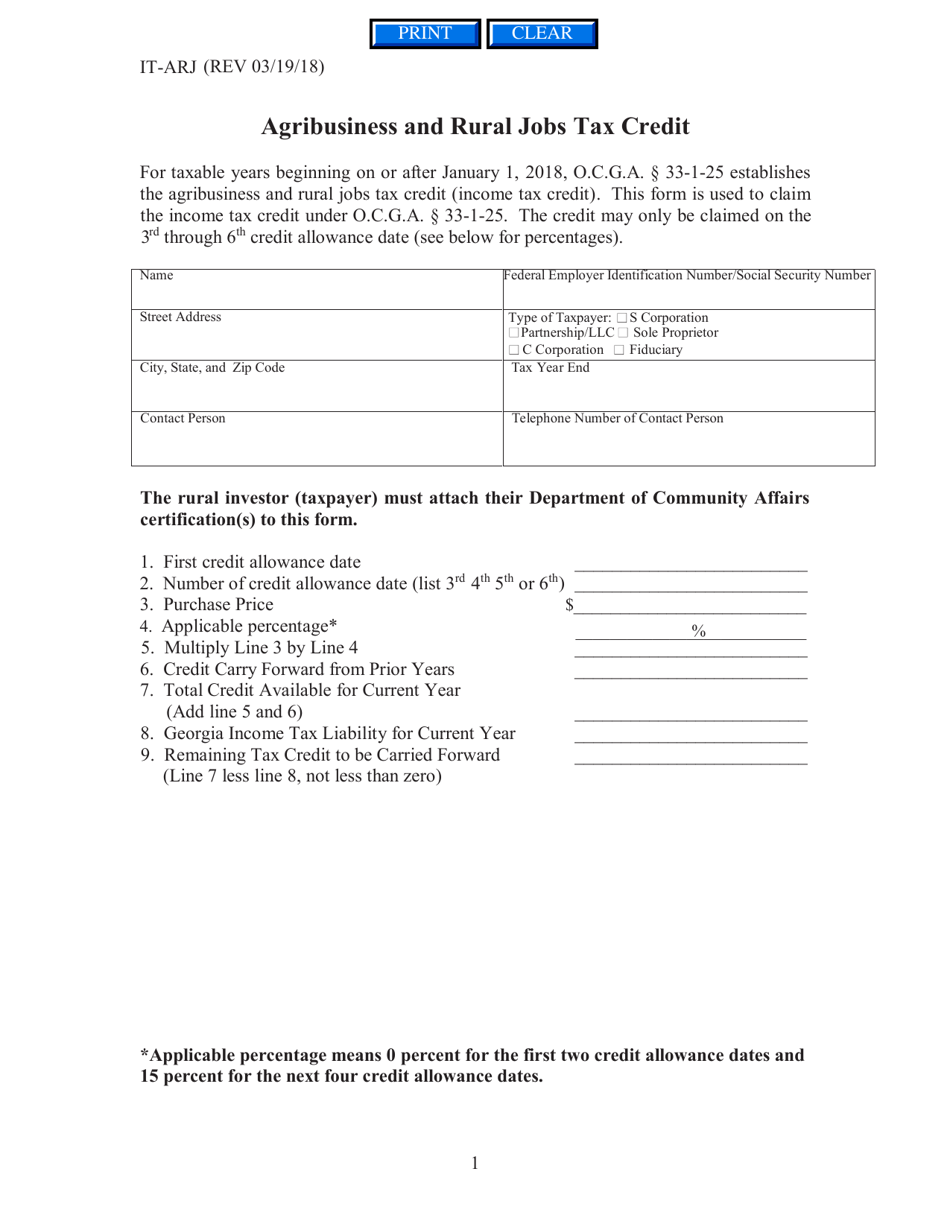

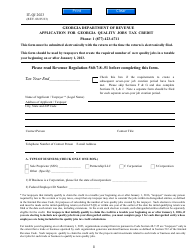

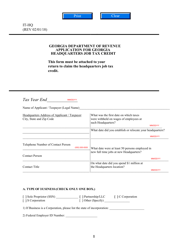

Form IT-ARJ Agribusiness and Rural Jobs Tax Credit - Georgia (United States)

What Is Form IT-ARJ?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-ARJ?

A: Form IT-ARJ is the Agribusiness and Rural Jobs Tax Credit form in Georgia, United States.

Q: What is the purpose of Form IT-ARJ?

A: The purpose of Form IT-ARJ is to claim the Agribusiness and Rural Jobs Tax Credit in Georgia for eligible expenses.

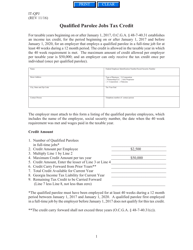

Q: Who is eligible to claim the Agribusiness and Rural Jobs Tax Credit?

A: Eligible taxpayers include individuals, corporations, partnerships, and trusts that have incurred qualified expenses related to agribusiness and rural job creation.

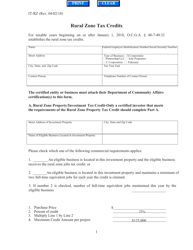

Q: What are qualified expenses?

A: Qualified expenses include costs related to the purchase of property, construction of facilities, and the creation of new agribusiness and rural jobs.

Q: How is the Agribusiness and Rural Jobs Tax Credit calculated?

A: The tax credit is calculated as a percentage, ranging from 15% to 30%, of eligible expenses incurred.

Q: Is there a limit to the amount of tax credit that can be claimed?

A: Yes, the maximum tax credit that can be claimed is $2 million per taxpayer per year.

Q: When is Form IT-ARJ due?

A: Form IT-ARJ is generally due on the same date as the taxpayer's Georgia income tax return, which is April 15th for calendar year filers.

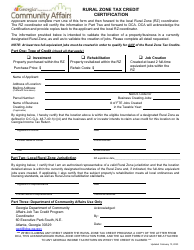

Q: Are there any supporting documents required to be submitted with Form IT-ARJ?

A: Yes, you must submit the Agribusiness and Rural Jobs Tax Credit Summary Schedule along with Form IT-ARJ.

Q: Can the Agribusiness and Rural Jobs Tax Credit be carried forward?

A: Yes, any unused tax credit can be carried forward for up to 10 years.

Form Details:

- Released on March 19, 2018;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-ARJ by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.