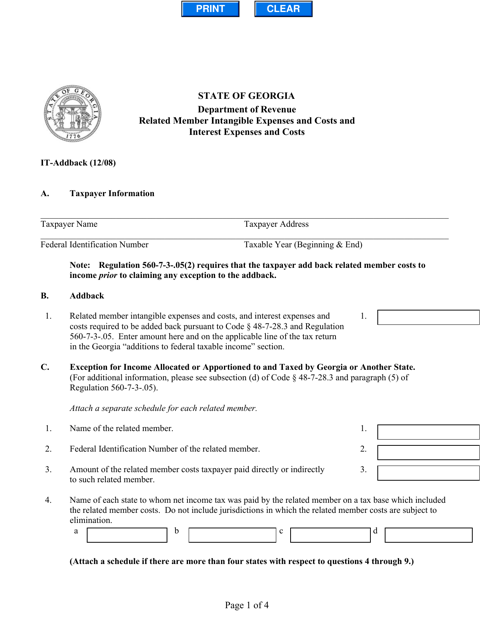

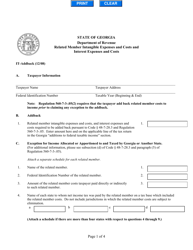

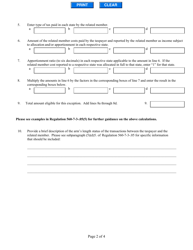

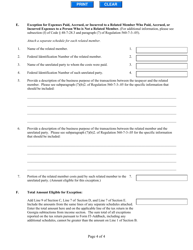

Form IT-ADDBACK Related Member Intangible Expenses and Costs and Interest Expenses and Costs - Georgia (United States)

What Is Form IT-ADDBACK?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-ADDBACK?

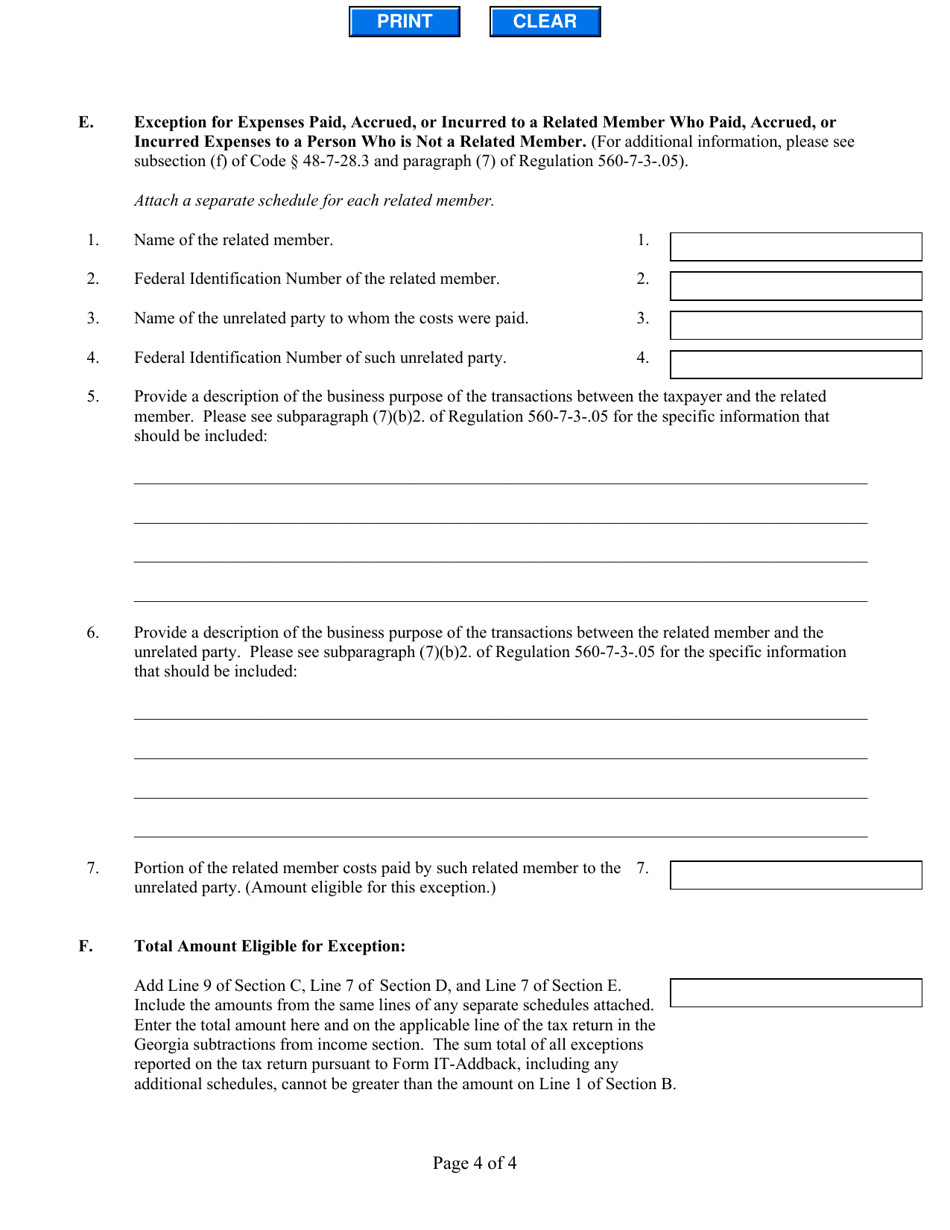

A: Form IT-ADDBACK is a tax form used in Georgia to report the addback of member intangible expenses and costs and interest expenses and costs.

Q: Who needs to file Form IT-ADDBACK?

A: Any business entity that has member intangible expenses and costs or interest expenses and costs must file Form IT-ADDBACK in Georgia.

Q: What are member intangible expenses and costs?

A: Member intangible expenses and costs refer to expenses and costs incurred by a business entity that are related to intangible assets held by its members.

Q: What are interest expenses and costs?

A: Interest expenses and costs refer to expenses and costs incurred by a business entity related to the interest it pays on borrowed funds.

Q: When is Form IT-ADDBACK due?

A: Form IT-ADDBACK is due on or before the due date of the entity's Georgia income tax return.

Q: What happens if I don't file Form IT-ADDBACK?

A: Failure to file Form IT-ADDBACK or including incorrect information on the form may result in penalties or interest charges.

Q: Can I file Form IT-ADDBACK electronically?

A: Yes, you can file Form IT-ADDBACK electronically through the Georgia Department of Revenue's e-Services system.

Q: Are there any exemptions or deductions for member intangible expenses and costs or interest expenses and costs?

A: No, there are no exemptions or deductions available for member intangible expenses and costs or interest expenses and costs in Georgia.

Form Details:

- Released on December 1, 2008;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-ADDBACK by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.