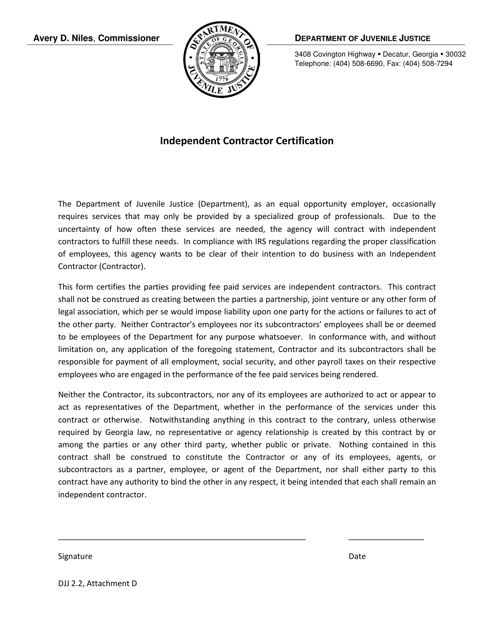

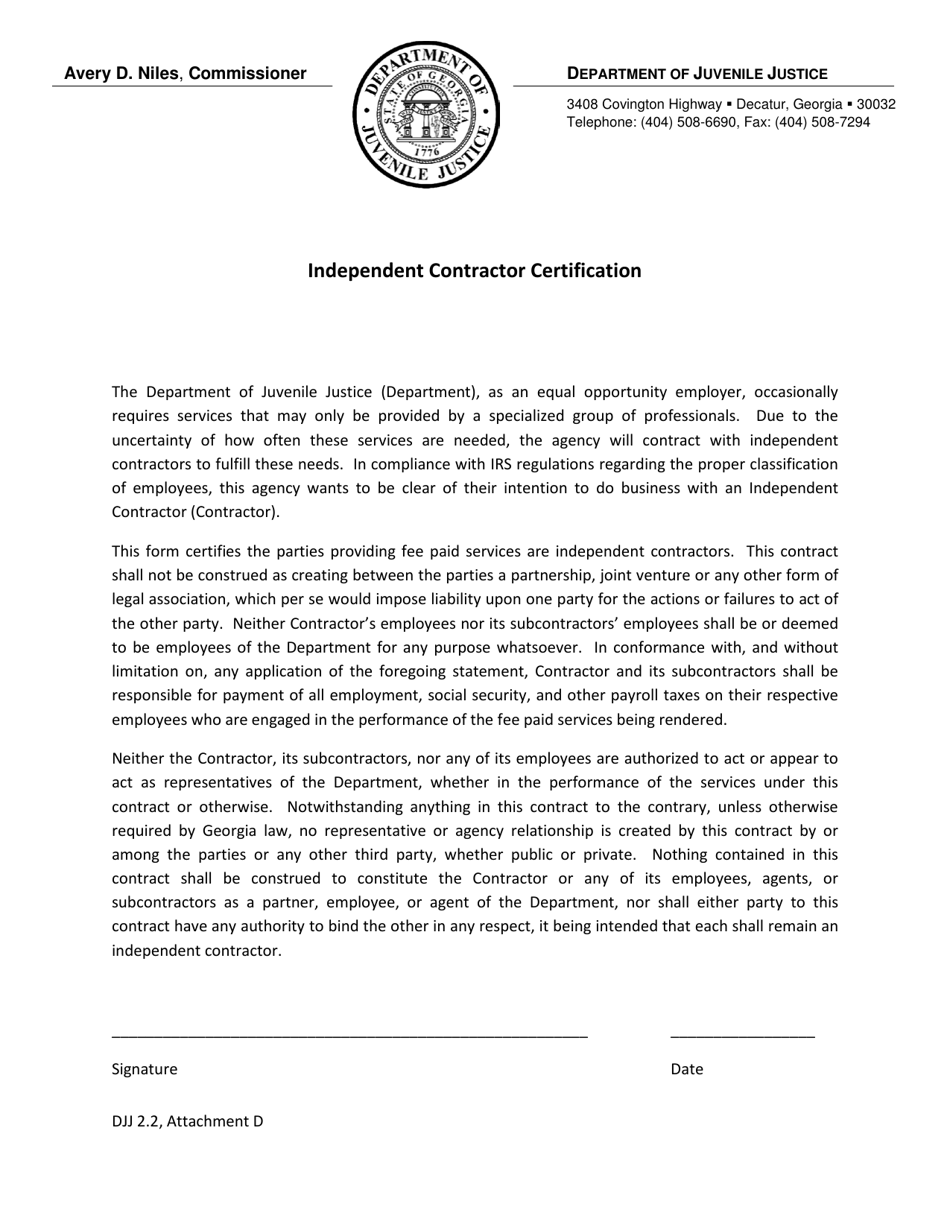

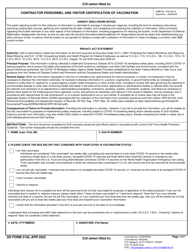

Attachment D Independent Contractor Certification - Georgia (United States)

What Is Attachment D?

This is a legal form that was released by the Georgia Department of Juvenile Justice - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Independent Contractor Certification?

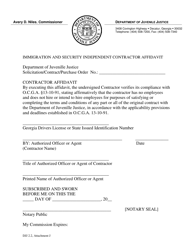

A: The Independent Contractor Certification is a document required by the state of Georgia (United States) for independent contractors.

Q: Who needs to fill out the Independent Contractor Certification?

A: Independent contractors in Georgia (United States) need to fill out the Independent Contractor Certification.

Q: Why is the Independent Contractor Certification required?

A: The Independent Contractor Certification is required to ensure compliance with state laws regarding independent contractors and to determine the eligibility for certain benefits.

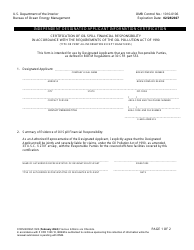

Q: What information is required in the Independent Contractor Certification?

A: The Independent Contractor Certification requires basic information such as the contractor's name, address, Social Security Number, and business details.

Q: Are there any penalties for not submitting the Independent Contractor Certification?

A: Yes, there may be penalties for not submitting the Independent Contractor Certification, including fines and loss of certain benefits.

Q: Can an independent contractor work for multiple clients?

A: Yes, an independent contractor can work for multiple clients.

Q: Do independent contractors receive benefits?

A: No, independent contractors are not eligible for employee benefits such as health insurance or paid time off.

Q: What is the difference between an employee and an independent contractor?

A: The main difference is that an employee works under the control and direction of an employer, while an independent contractor has more control over how and when they perform their work.

Q: Do independent contractors pay their own taxes?

A: Yes, independent contractors are responsible for paying their own taxes, including self-employment taxes.

Form Details:

- The latest edition provided by the Georgia Department of Juvenile Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Attachment D by clicking the link below or browse more documents and templates provided by the Georgia Department of Juvenile Justice.