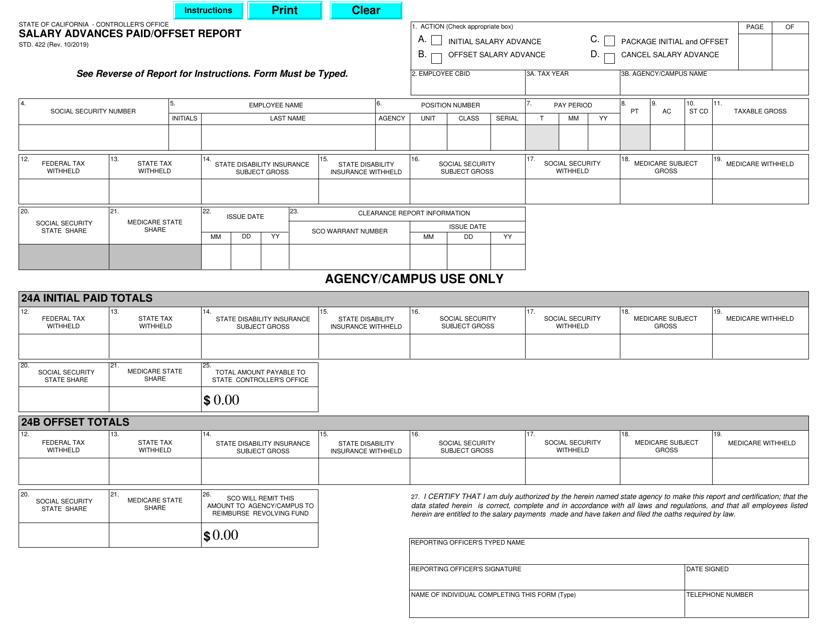

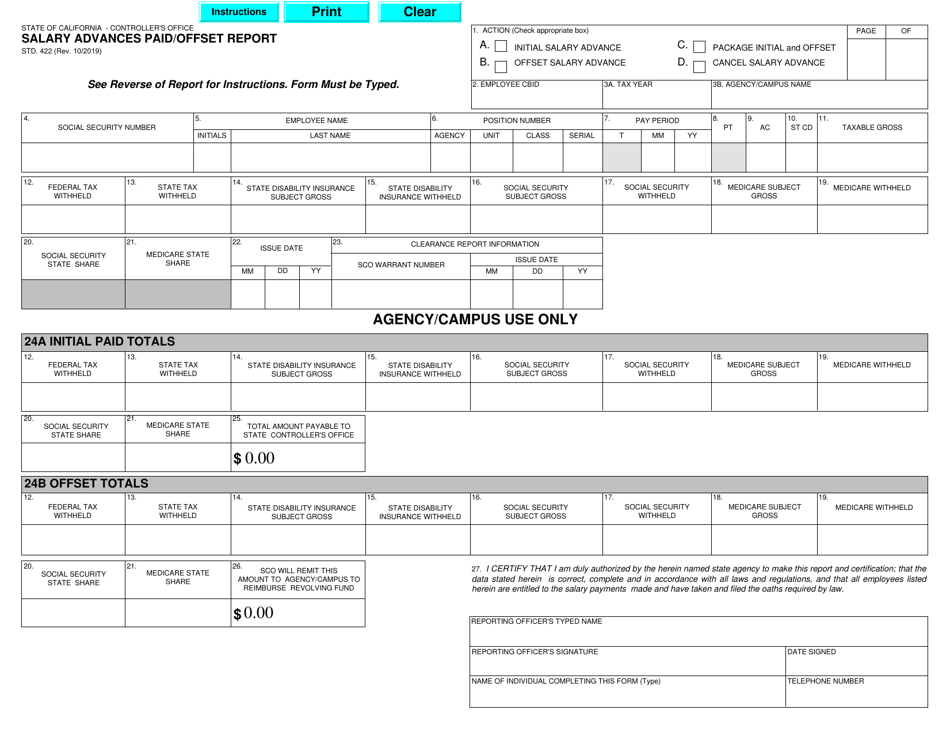

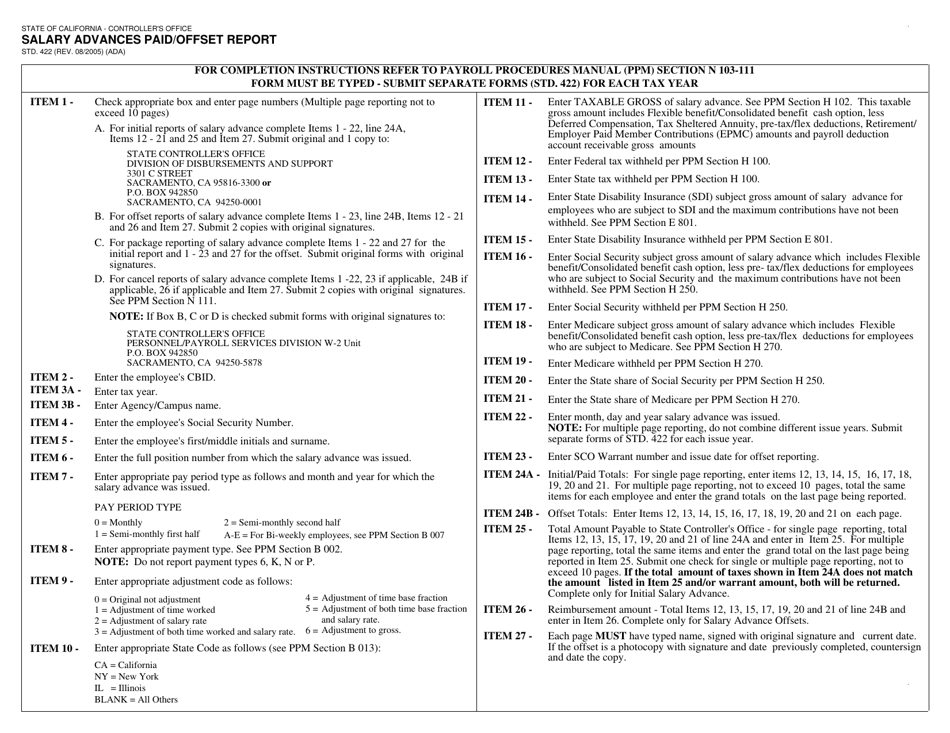

Form STD.422 Salary Advances Paid / Offset Report - California

What Is Form STD.422?

This is a legal form that was released by the California State Controller’s Office - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STD.422?

A: Form STD.422 is the Salary Advances Paid/Offset Report specific to the state of California.

Q: What is the purpose of Form STD.422?

A: Form STD.422 is used to report any salary advances paid or salary offsets taken from an employee's wages in California.

Q: Who is required to submit Form STD.422?

A: Employers in California who have provided salary advances or taken salary offsets from their employees' wages are required to submit Form STD.422.

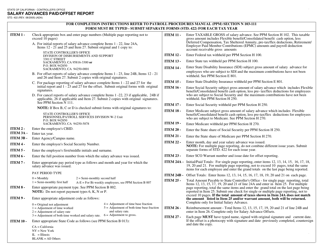

Q: What information is included in Form STD.422?

A: Form STD.422 includes details about the employee, the amount of salary advance paid or offset taken, as well as the reason for the advance or offset.

Q: When should Form STD.422 be submitted?

A: Form STD.422 should be submitted on a quarterly basis, within 20 days after the close of each calendar quarter.

Q: Are there any penalties for not submitting Form STD.422?

A: Yes, failure to timely submit Form STD.422 or providing false or inaccurate information may result in penalties and fines imposed by the EDD.

Q: Are there any exceptions to filing Form STD.422?

A: Employers who have not provided any salary advances or taken salary offsets during the reporting period are exempt from filing Form STD.422.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the California State Controller’s Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STD.422 by clicking the link below or browse more documents and templates provided by the California State Controller’s Office.