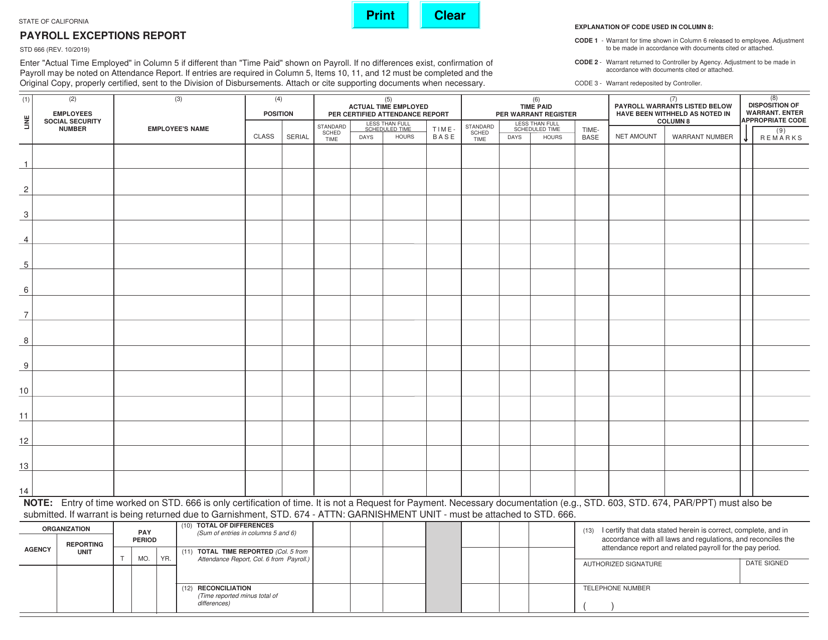

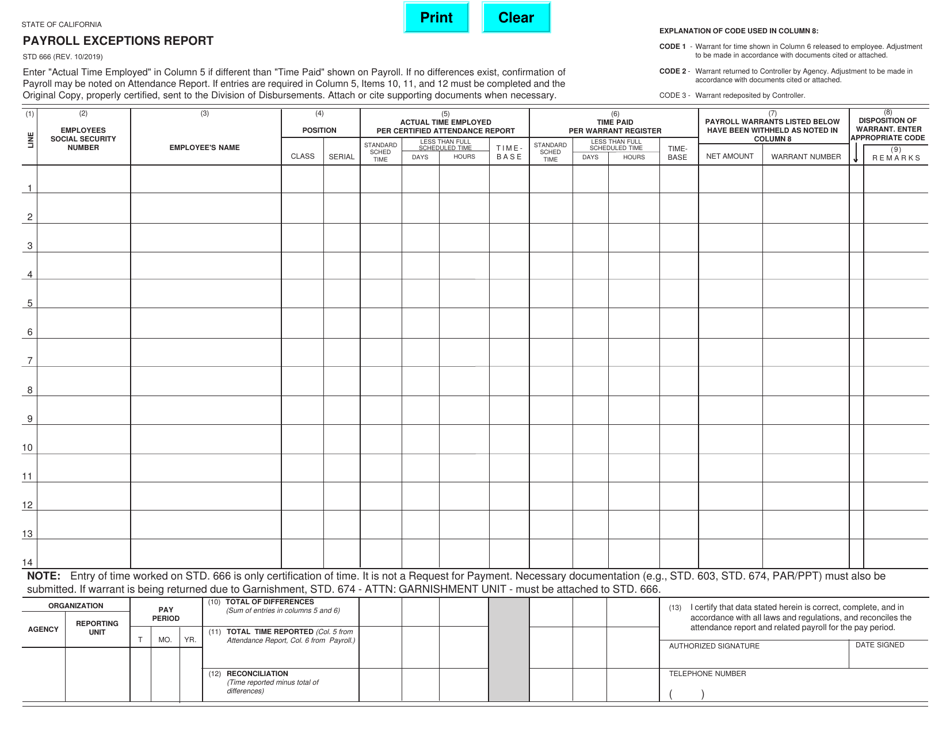

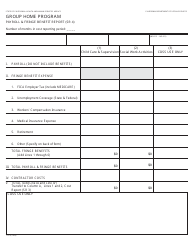

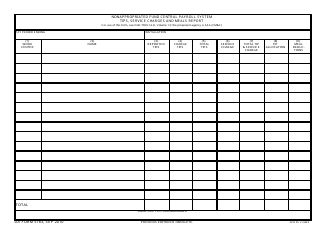

Form STD666 Payroll Exceptions Report - California

What Is Form STD666?

This is a legal form that was released by the California State Controller’s Office - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is STD666?

A: STD666 is a form used to report payroll exceptions in California.

Q: What are payroll exceptions?

A: Payroll exceptions refer to any deviations or discrepancies in regular payroll processes.

Q: How do I fill out STD666?

A: To fill out STD666, provide details of the payroll exceptions, including the employees affected, the reason for the exception, and the corrective action taken.

Q: Is there a deadline for submitting STD666?

A: Yes, the STD666 form must be submitted within a specific timeframe as specified by the California Employment Development Department.

Q: Are there any penalties for not submitting STD666?

A: Failure to submit STD666 or providing false information may result in penalties imposed by the California Employment Development Department.

Q: Are there any other payroll reporting requirements in California?

A: Yes, there may be additional payroll reporting requirements in California, such as the submission of payroll tax returns and wage statements.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the California State Controller’s Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STD666 by clicking the link below or browse more documents and templates provided by the California State Controller’s Office.