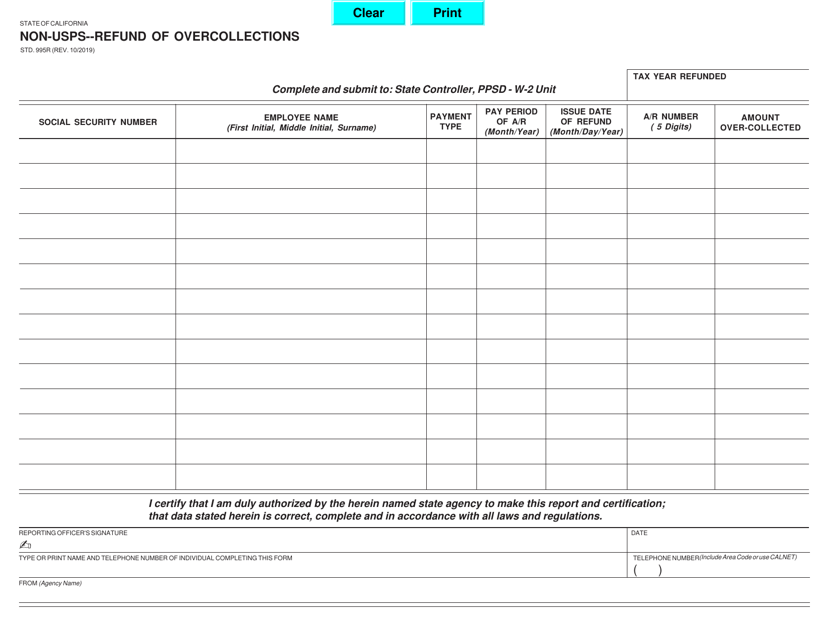

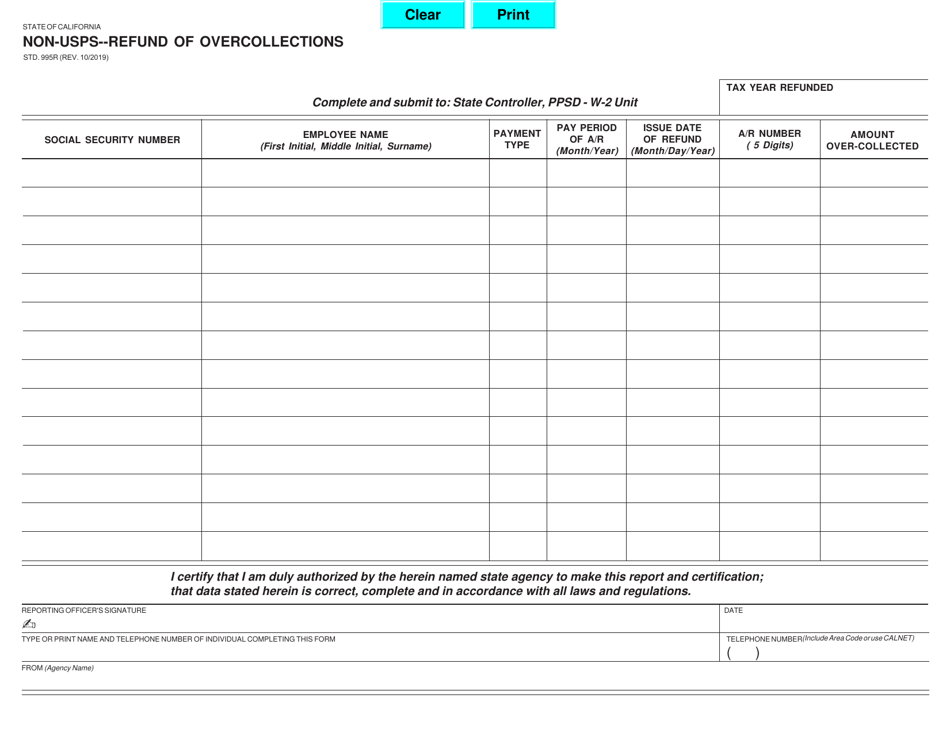

Form STD.995R Non-USPS--refund of Overcollections - California

What Is Form STD.995R?

This is a legal form that was released by the California State Controller’s Office - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STD.995R?

A: Form STD.995R is a form used in California for requesting a refund of overcollections.

Q: Who can use Form STD.995R?

A: Any non-USPS entity in California that believes they have overpaid can use Form STD.995R.

Q: What is the purpose of Form STD.995R?

A: The purpose of Form STD.995R is to request a refund for overpaid amounts.

Q: What is the process for submitting Form STD.995R?

A: The completed Form STD.995R should be submitted to the California Department of Tax and Fee Administration.

Q: Is there a deadline for submitting Form STD.995R?

A: Yes, Form STD.995R must be submitted within three years from the date the amount was paid.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the California State Controller’s Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STD.995R by clicking the link below or browse more documents and templates provided by the California State Controller’s Office.