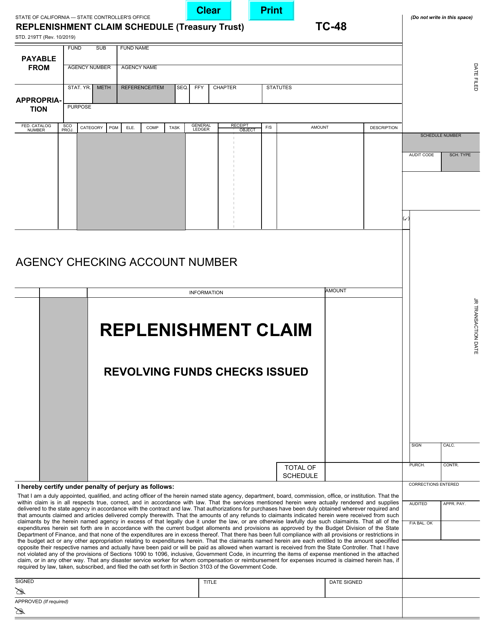

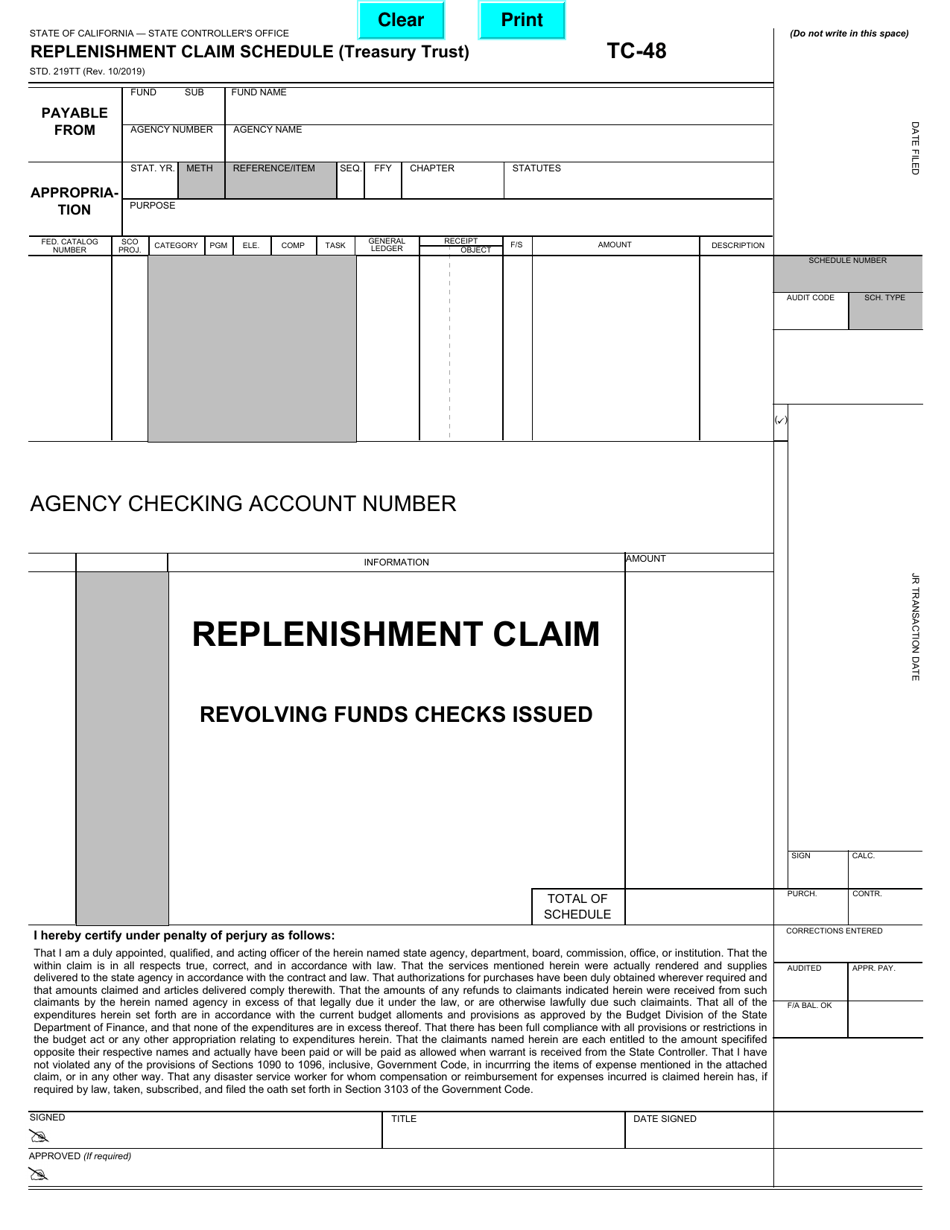

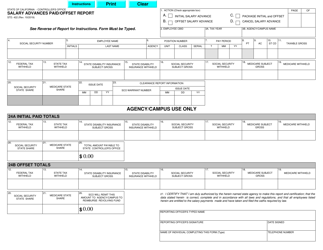

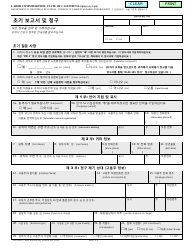

Form TC-48 (STD.219TT) Salary Advances Paid / Offset Report - California

What Is Form TC-48 (STD.219TT)?

This is a legal form that was released by the California State Controller’s Office - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-48 (STD.219TT)?

A: Form TC-48 (STD.219TT) is the Salary Advances Paid/Offset Report in California.

Q: What is the purpose of Form TC-48 (STD.219TT)?

A: The purpose of Form TC-48 (STD.219TT) is to report salary advances paid or offset by an employer in California.

Q: Who needs to file Form TC-48 (STD.219TT)?

A: Employers in California who have paid or offset salary advances to their employees need to file Form TC-48 (STD.219TT).

Q: When is Form TC-48 (STD.219TT) due?

A: Form TC-48 (STD.219TT) is due on or before the last day of February following the end of the calendar year.

Q: Are there any penalties for not filing Form TC-48 (STD.219TT)?

A: Yes, there are penalties for not filing Form TC-48 (STD.219TT) or for filing it late. It is important to file the form on time to avoid these penalties.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the California State Controller’s Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-48 (STD.219TT) by clicking the link below or browse more documents and templates provided by the California State Controller’s Office.