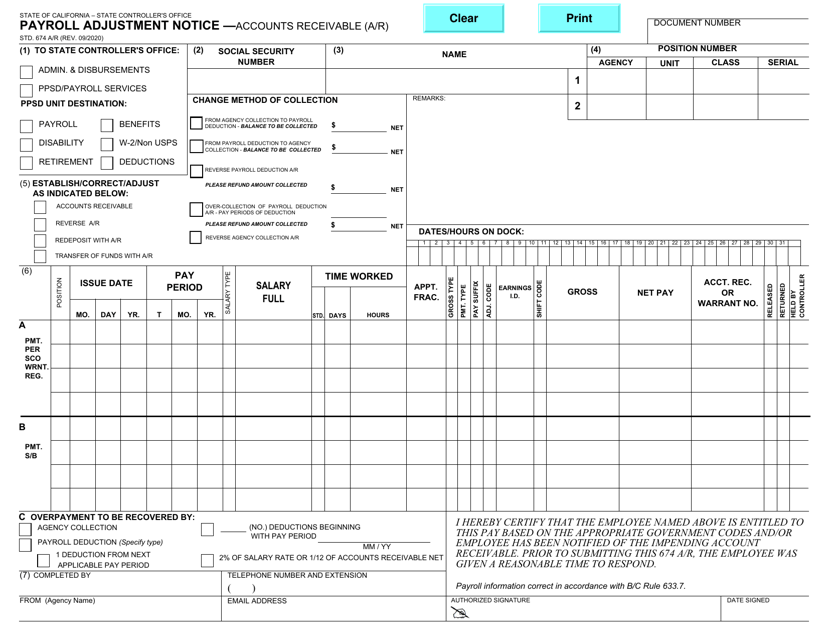

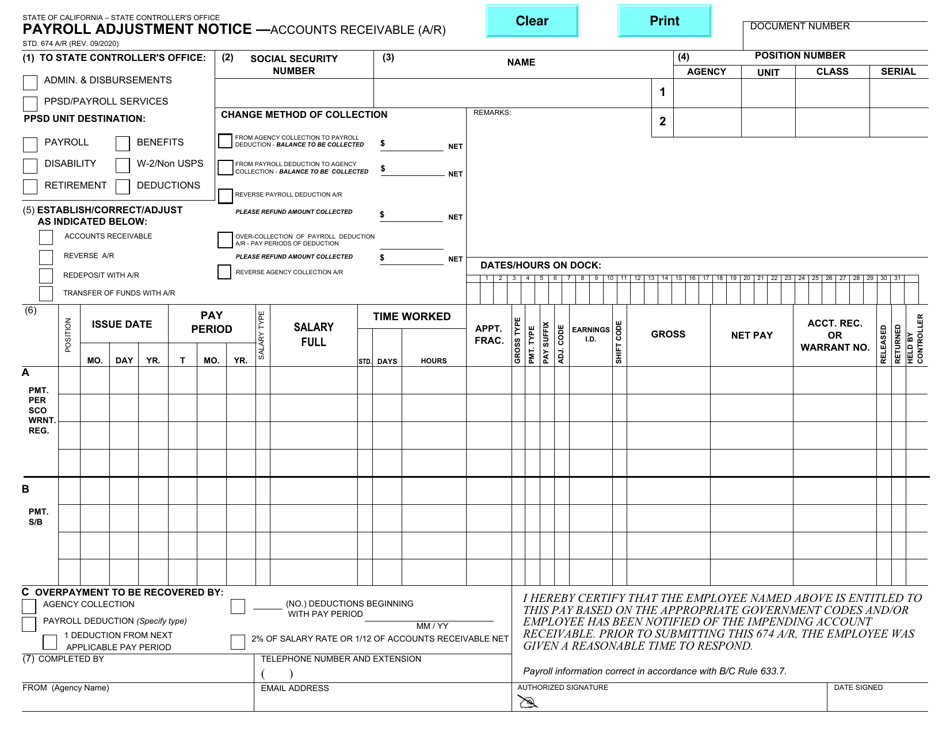

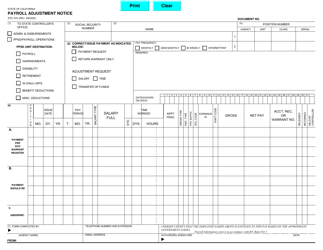

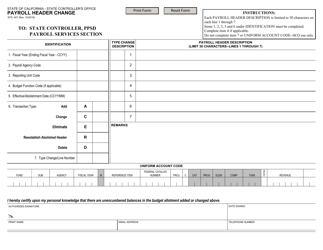

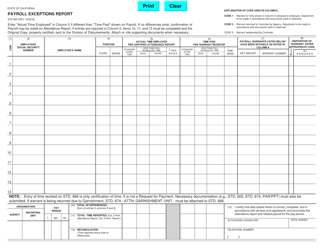

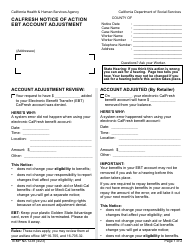

Form STD.674 A / R Payroll Adjustment Notice - Accounts Receivable (A / R) - California

What Is Form STD.674 A/R?

This is a legal form that was released by the California State Controller’s Office - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STD.674 A/R Payroll Adjustment Notice?

A: Form STD.674 A/R Payroll Adjustment Notice is a document used for accounts receivable (A/R) purposes in California.

Q: What does the A/R in Form STD.674 A/R Payroll Adjustment Notice stand for?

A: A/R stands for accounts receivable.

Q: Who uses Form STD.674 A/R Payroll Adjustment Notice?

A: Form STD.674 A/R Payroll Adjustment Notice is used by businesses or organizations in California for payroll adjustment related to accounts receivable.

Q: What is the purpose of Form STD.674 A/R Payroll Adjustment Notice?

A: The purpose of this form is to notify the accounts receivable department of any necessary adjustments to payroll.

Q: Is Form STD.674 A/R Payroll Adjustment Notice specific to California?

A: Yes, Form STD.674 A/R Payroll Adjustment Notice is specific to California.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the California State Controller’s Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STD.674 A/R by clicking the link below or browse more documents and templates provided by the California State Controller’s Office.