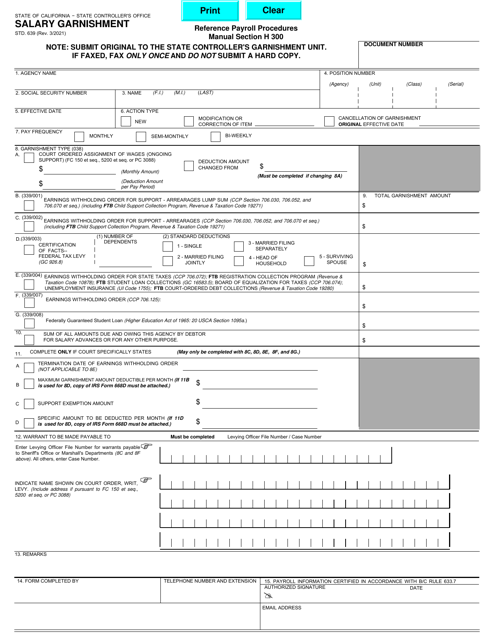

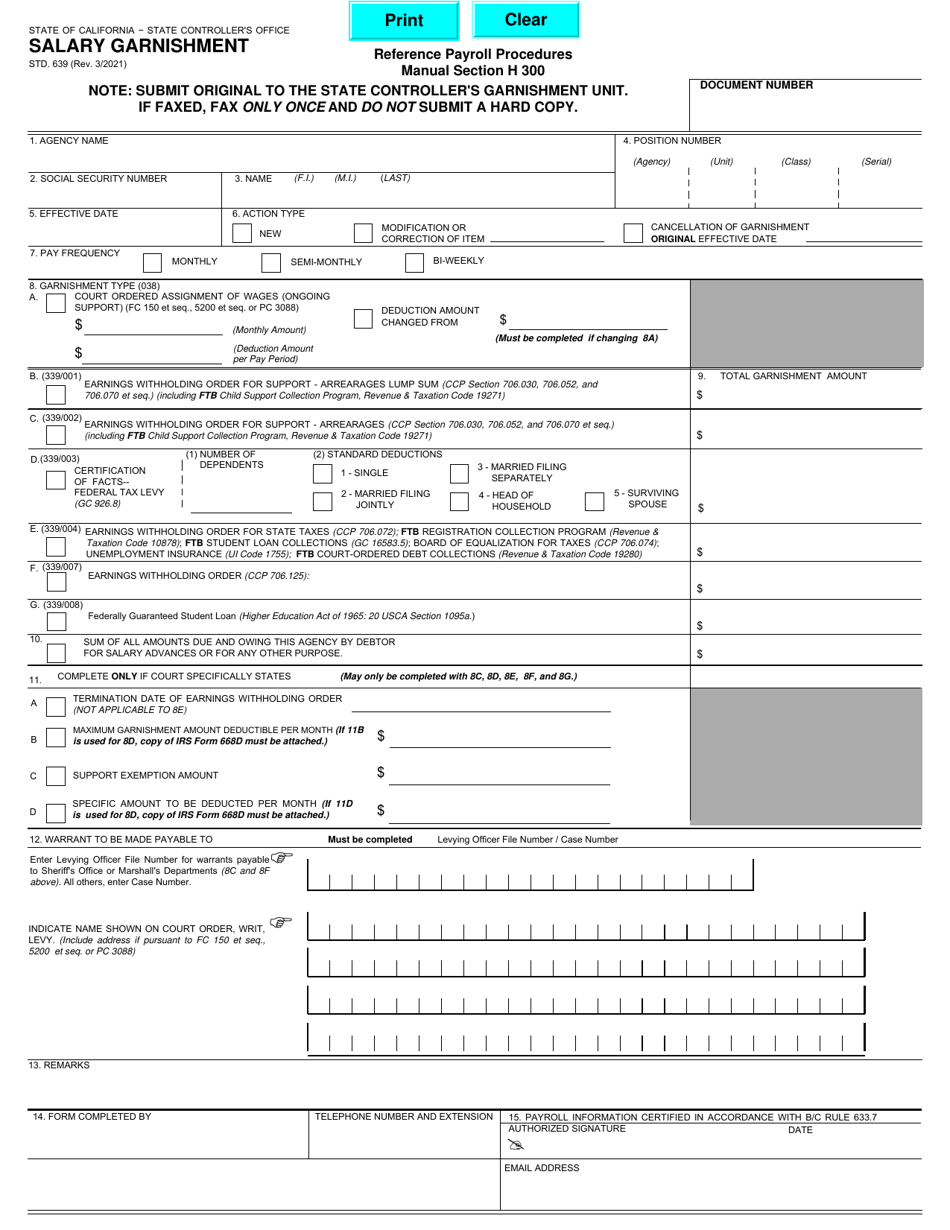

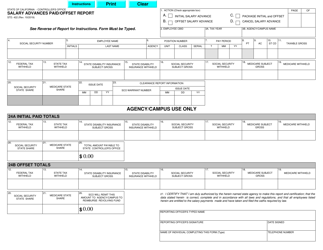

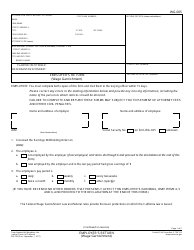

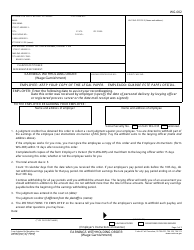

Form STD.639 Salary Garnishment - California

What Is Form STD.639?

This is a legal form that was released by the California State Controller’s Office - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STD.639?

A: Form STD.639 is a form used for salary garnishment in California.

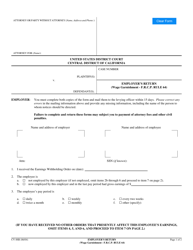

Q: Who uses Form STD.639?

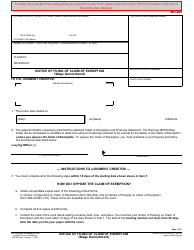

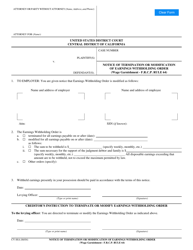

A: Form STD.639 is used by creditors to request the garnishment of an individual's salary.

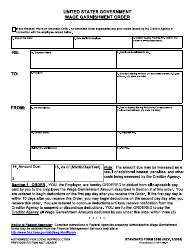

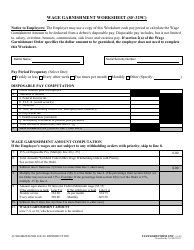

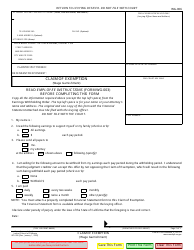

Q: What is salary garnishment?

A: Salary garnishment is a legal process where a portion of an individual's wages are withheld by their employer to pay off a debt.

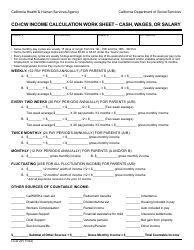

Q: What information is required on Form STD.639?

A: Form STD.639 requires information such as the creditor's name, the debtor's name, the amount owed, and the debtor's employer details.

Q: How do I fill out Form STD.639?

A: Form STD.639 must be filled out completely and accurately, providing all required information and supporting documentation as specified on the form.

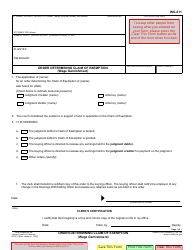

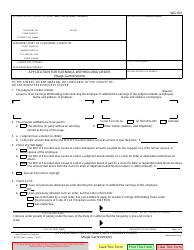

Q: What happens after Form STD.639 is submitted?

A: After Form STD.639 is submitted, the court will review the request and issue an order if approved, which will then be forwarded to the debtor's employer for implementation.

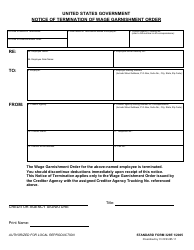

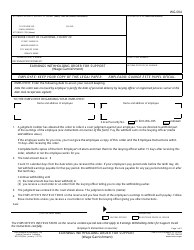

Q: How long does salary garnishment last?

A: The duration of salary garnishment depends on the court order and the amount owed. It typically continues until the debt is fully paid or a settlement is reached.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the California State Controller’s Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STD.639 by clicking the link below or browse more documents and templates provided by the California State Controller’s Office.