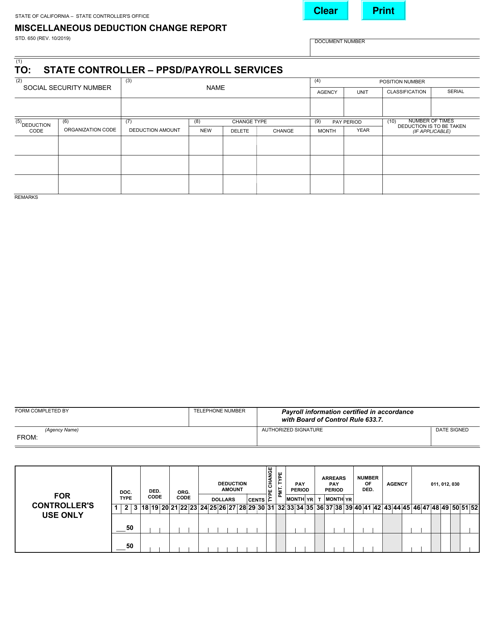

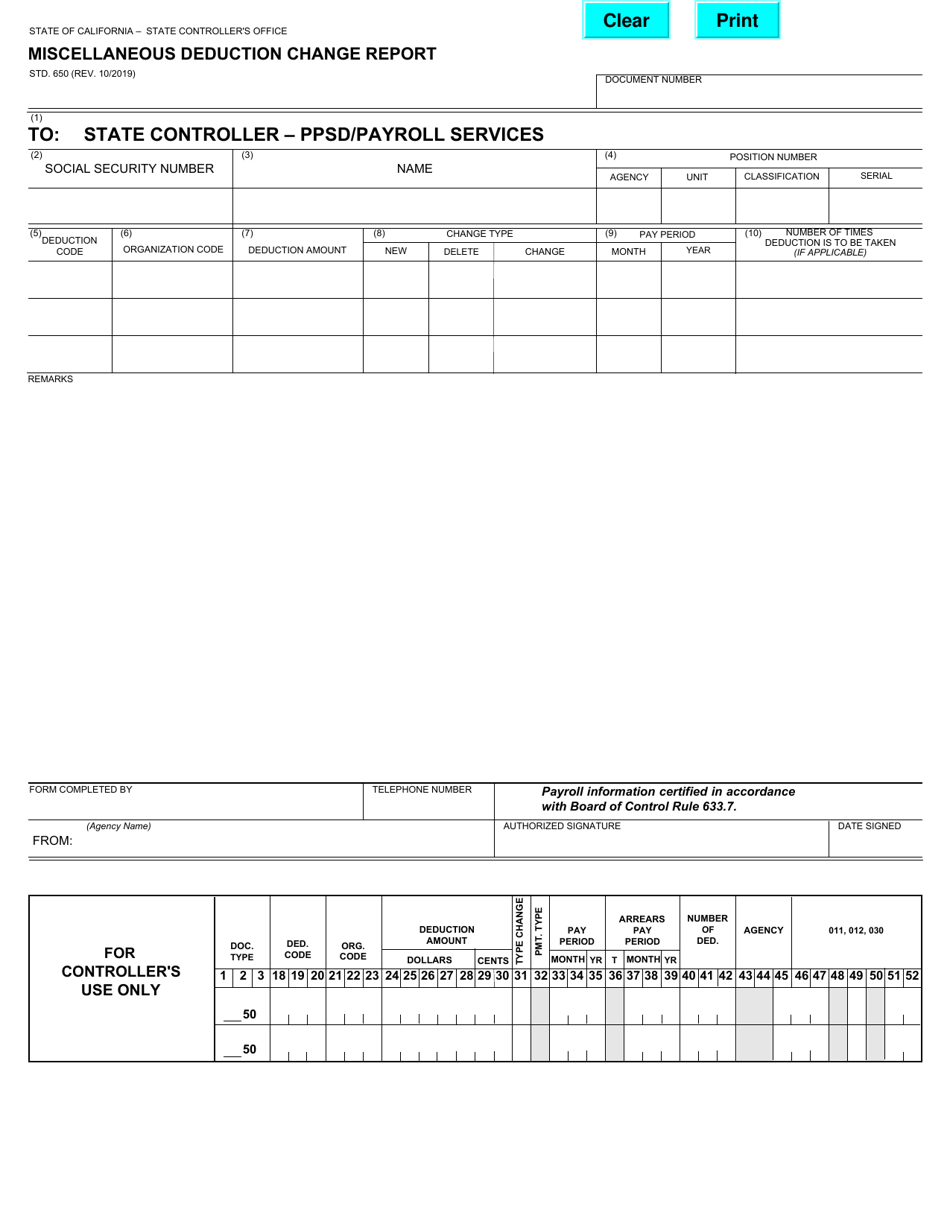

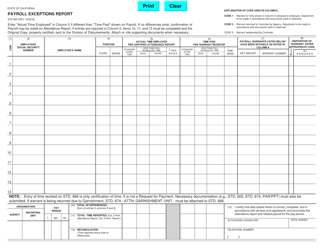

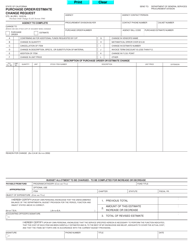

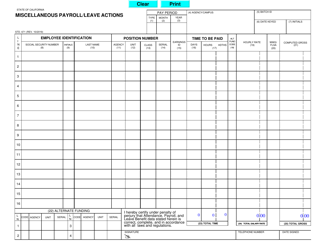

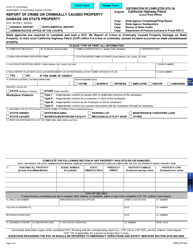

Form STD.650 Miscellaneous Deduction Change Report - California

What Is Form STD.650?

This is a legal form that was released by the California State Controller’s Office - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STD.650?

A: Form STD.650 is a Miscellaneous Deduction Change Report.

Q: Who uses Form STD.650?

A: Form STD.650 is used by taxpayers in California.

Q: What is the purpose of Form STD.650?

A: The purpose of Form STD.650 is to report changes to miscellaneous deductions.

Q: What are miscellaneous deductions?

A: Miscellaneous deductions are expenses or deductions that are not categorized under specific tax categories.

Q: Do I need to file Form STD.650?

A: You need to file Form STD.650 if you have changes to report on your miscellaneous deductions.

Q: When is the deadline to file Form STD.650?

A: The deadline to file Form STD.650 is usually April 15th.

Q: Can I e-file Form STD.650?

A: No, Form STD.650 cannot be e-filed. It must be filed by mail.

Q: Do I need to attach any documentation with Form STD.650?

A: Yes, you may need to attach supporting documentation for the changes you are reporting.

Q: What should I do if I made a mistake on Form STD.650?

A: If you made a mistake on Form STD.650, you should file an amended form to correct the error.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the California State Controller’s Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STD.650 by clicking the link below or browse more documents and templates provided by the California State Controller’s Office.