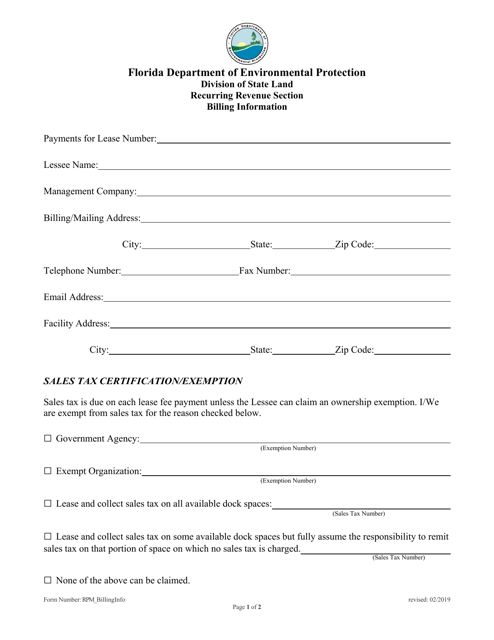

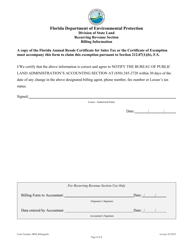

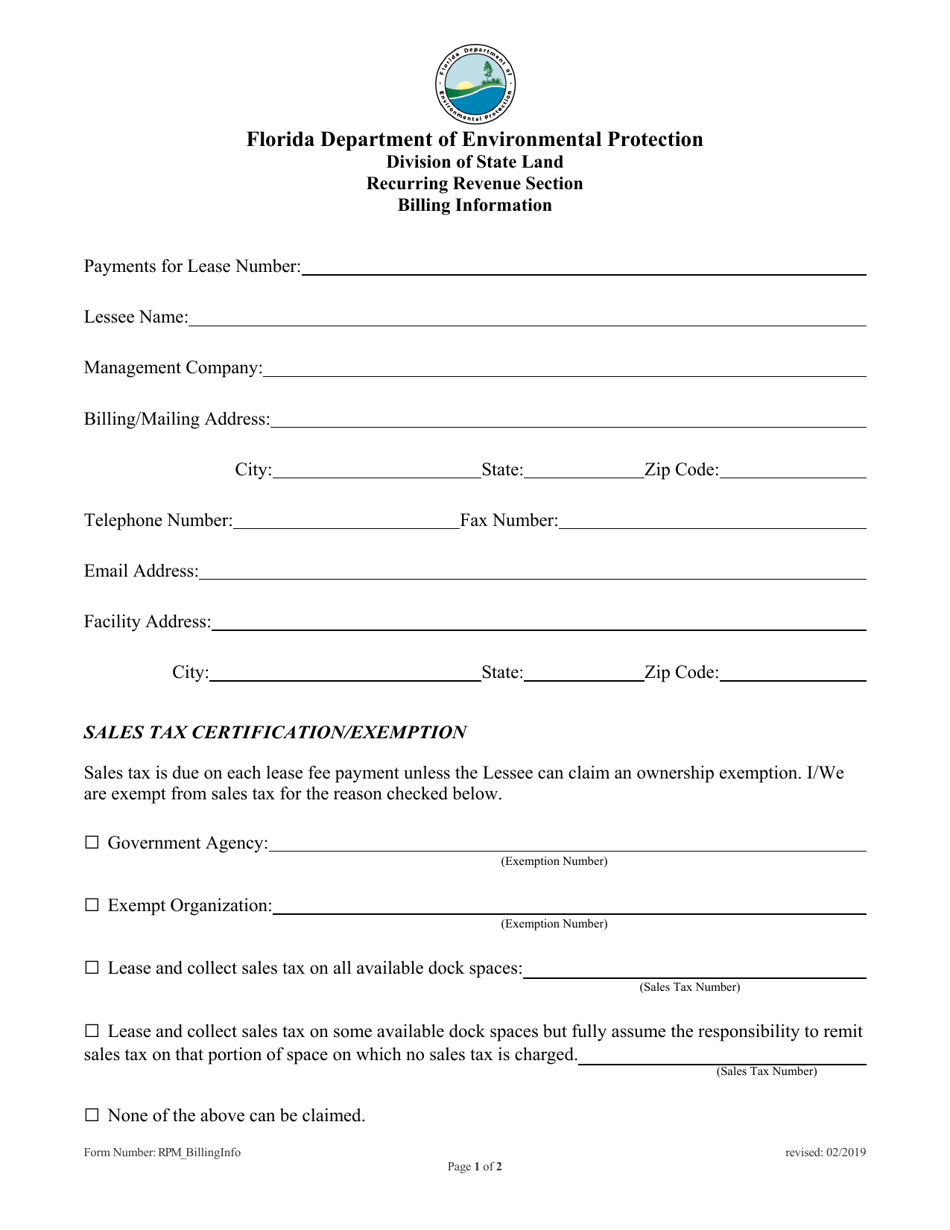

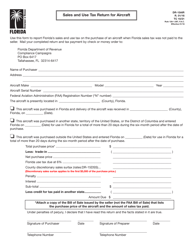

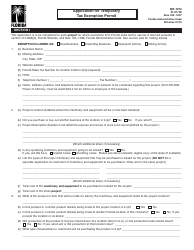

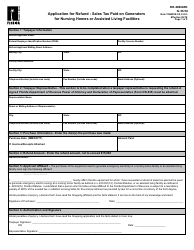

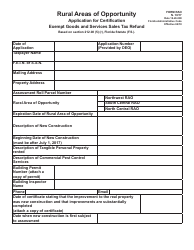

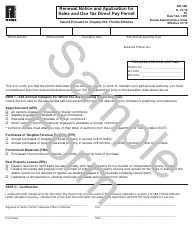

Sales Tax Certification / Exemption - Florida

Sales Tax Certification/Exemption is a legal document that was released by the Florida Department of Environmental Protection - a government authority operating within Florida.

FAQ

Q: What is a Sales Tax Certification/Exemption?

A: A Sales Tax Certification/Exemption is a document that allows certain individuals or organizations to make purchases without paying sales tax.

Q: Who can get a Sales Tax Certification/Exemption in Florida?

A: Various individuals and organizations can get a Sales Tax Certification/Exemption in Florida, including government agencies, charitable organizations, and certain businesses.

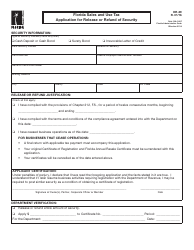

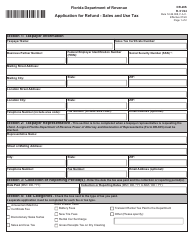

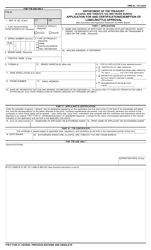

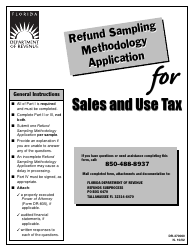

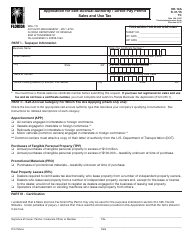

Q: How do I apply for a Sales Tax Certification/Exemption in Florida?

A: To apply for a Sales Tax Certification/Exemption in Florida, you need to complete and submit an application form to the Florida Department of Revenue.

Q: What are the benefits of having a Sales Tax Certification/Exemption?

A: The main benefit of having a Sales Tax Certification/Exemption is that you can make purchases without paying sales tax, which can save you money.

Q: How long is a Sales Tax Certification/Exemption valid for?

A: A Sales Tax Certification/Exemption in Florida is typically valid for a specific period of time, such as one year, but it may vary depending on the circumstances.

Q: Can I use a Sales Tax Certification/Exemption for personal purchases?

A: No, a Sales Tax Certification/Exemption is generally not meant for personal purchases, but rather for purchases made by eligible individuals or organizations for specific purposes.

Form Details:

- Released on February 1, 2019;

- The latest edition currently provided by the Florida Department of Environmental Protection;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Florida Department of Environmental Protection.