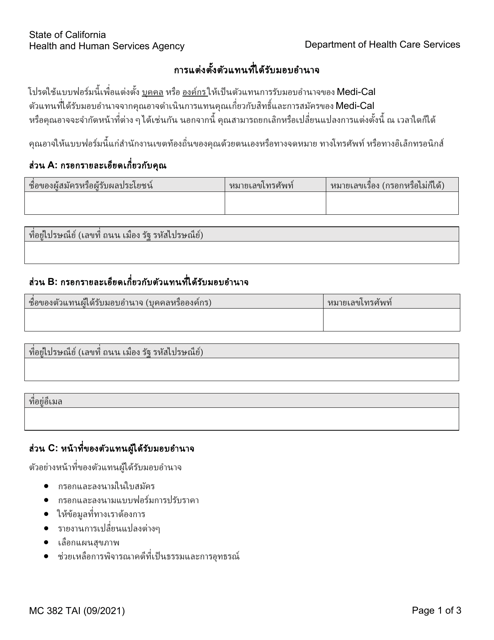

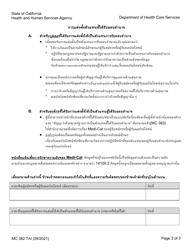

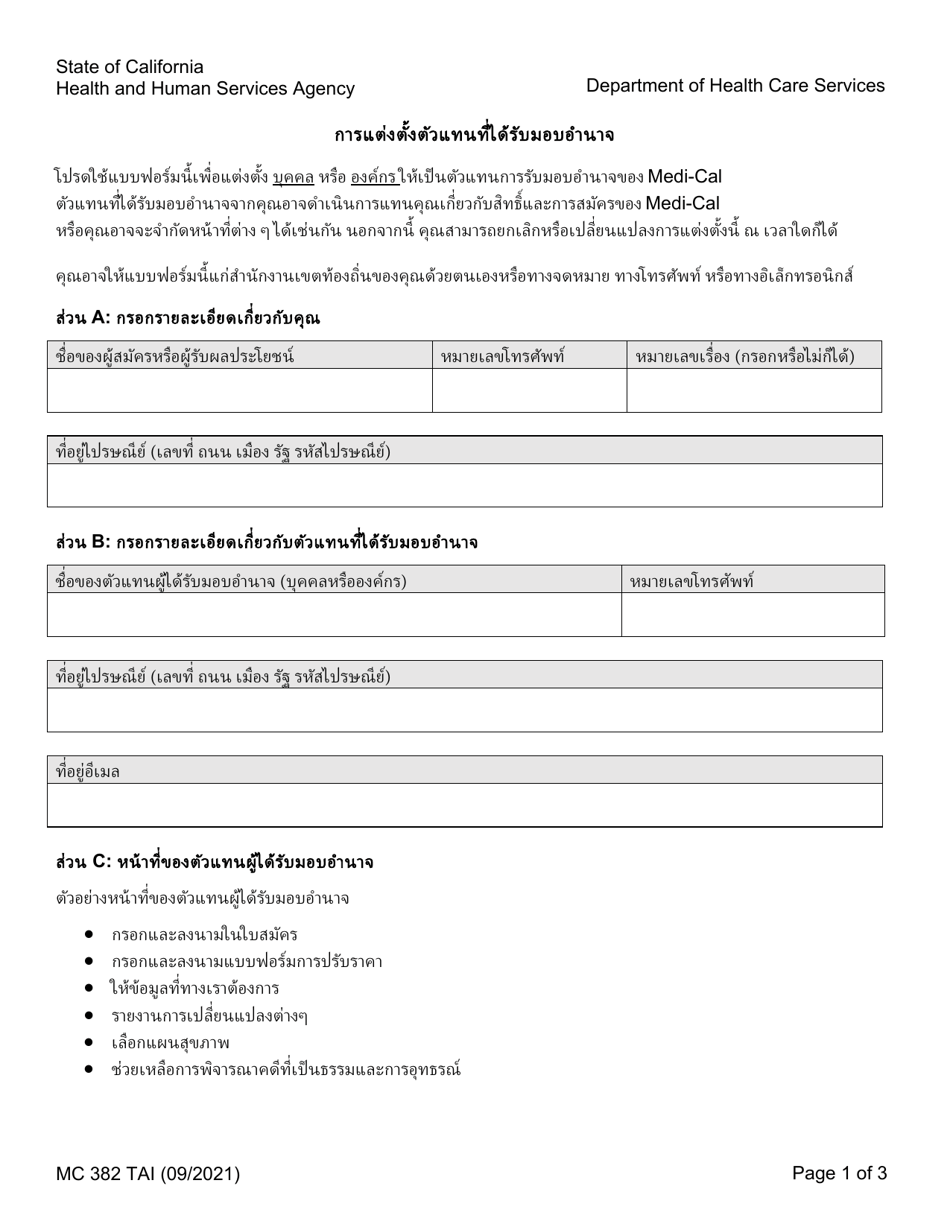

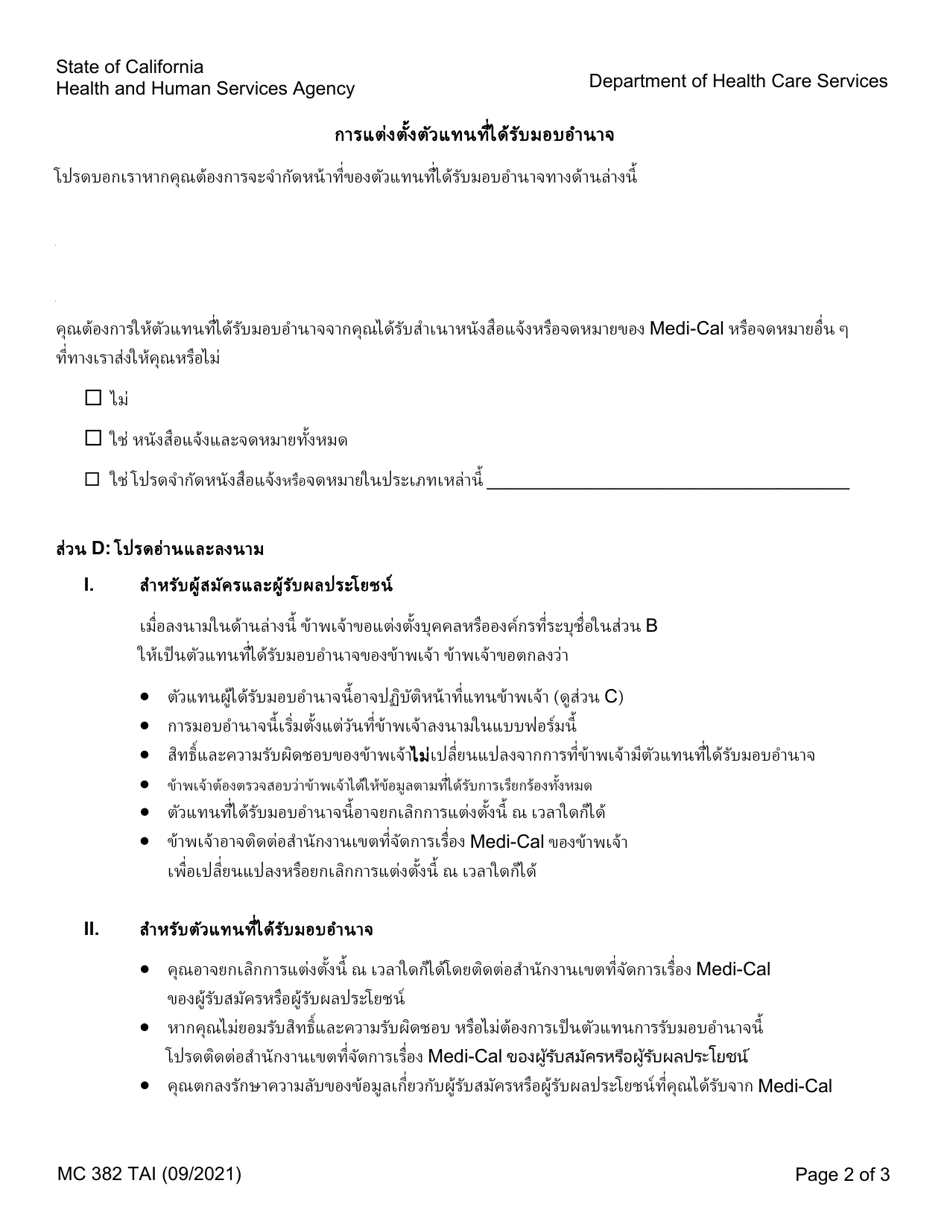

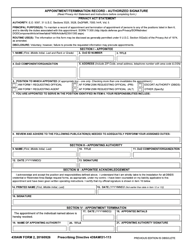

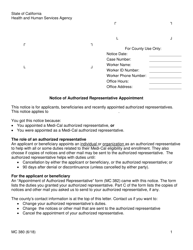

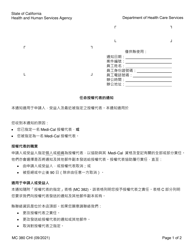

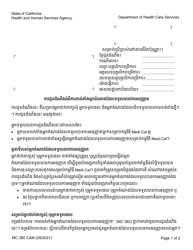

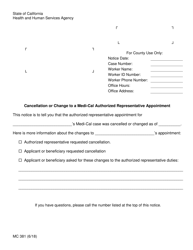

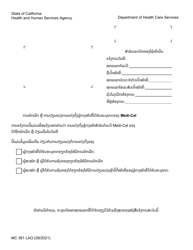

Form MC382 Appointment of Authorized Representative - California (Thai)

This is a legal form that was released by the California Department of Health Care Services - a government authority operating within California.

The document is provided in Thai. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

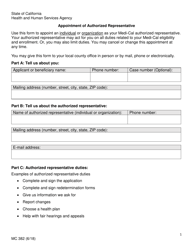

Q: What is Form MC382?

A: Form MC382, Appointment of Authorized Representative, is a form used in California to appoint someone as your authorized representative for certain tax matters.

Q: Who can use Form MC382?

A: Any individual or business entity who wants to authorize someone to represent them before the California Franchise Tax Board can use Form MC382.

Q: What is the purpose of appointing an authorized representative?

A: Appointing an authorized representative allows someone else to act on your behalf in matters related to your tax obligations, such as communicating with the California Franchise Tax Board and handling tax disputes.

Q: Is Form MC382 specific to a particular language?

A: Yes, Form MC382 is available in multiple languages, including Thai.

Q: Are there any fees for filing Form MC382?

A: No, there are no fees associated with filing Form MC382.

Q: What information do I need to provide on Form MC382?

A: On Form MC382, you need to provide your name, contact information, the name of your authorized representative, and the specific tax matters they are authorized to handle on your behalf.

Q: Can I revoke the appointment of an authorized representative?

A: Yes, you can revoke the appointment of an authorized representative by submitting a written notice to the California Franchise Tax Board.

Q: What should I do after completing Form MC382?

A: After completing Form MC382, you should keep a copy for your records and submit the original form to the California Franchise Tax Board.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the California Department of Health Care Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

Download a fillable version of Form MC382 by clicking the link below or browse more documents and templates provided by the California Department of Health Care Services.