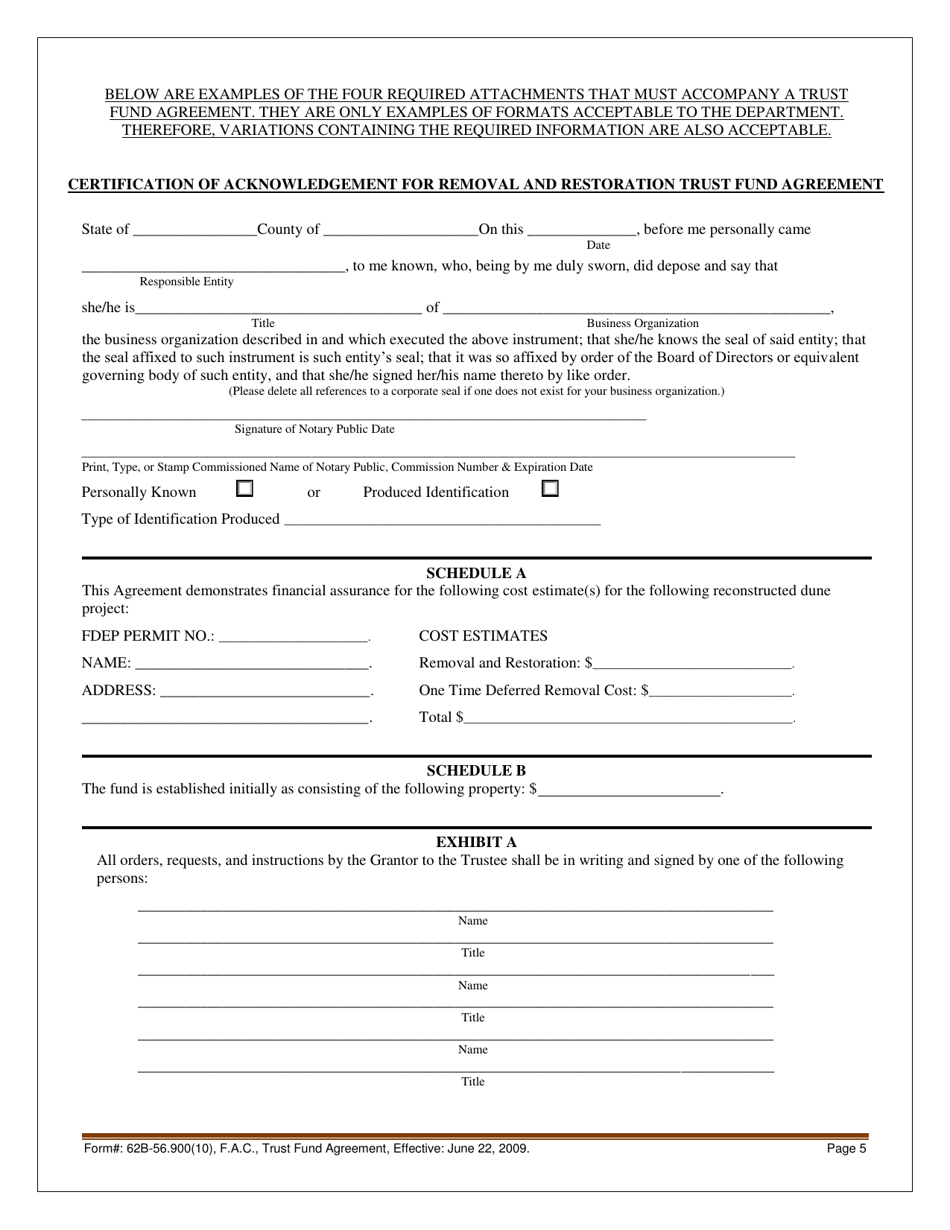

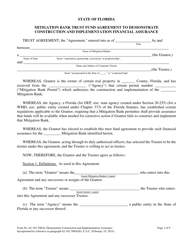

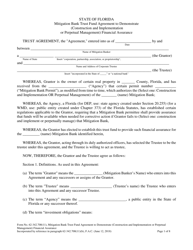

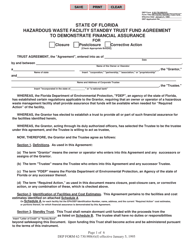

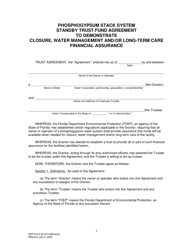

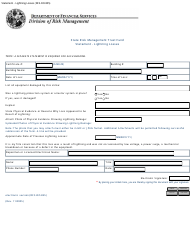

Form 62B-56.900(10) Trust Fund Agreement - Florida

What Is Form 62B-56.900(10)?

This is a legal form that was released by the Florida Department of Environmental Protection - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 62B-56.900(10)?

A: Form 62B-56.900(10) is a Trust Fund Agreement specific to Florida.

Q: What is a Trust Fund Agreement?

A: A Trust Fund Agreement is a legal document that establishes a trust fund.

Q: What is a trust fund?

A: A trust fund is a fiduciary arrangement where assets are held and managed by a trustee for the benefit of one or more beneficiaries.

Q: Who is the trustee in a Trust Fund Agreement?

A: The trustee is the person or entity responsible for managing the assets in the trust fund.

Q: Who are the beneficiaries in a Trust Fund Agreement?

A: The beneficiaries are the individuals or entities that will ultimately benefit from the assets in the trust fund.

Q: Why would someone create a Trust Fund Agreement?

A: People create trust fund agreements to protect and manage assets for the benefit of themselves or their beneficiaries, and to ensure that the assets are distributed according to their wishes.

Q: Is a Trust Fund Agreement legally binding?

A: Yes, a properly executed Trust Fund Agreement is legally binding.

Q: Are Trust Fund Agreements specific to Florida?

A: Form 62B-56.900(10) is specific to Florida, but trust fund agreements can be created in other states as well.

Form Details:

- Released on June 22, 2009;

- The latest edition provided by the Florida Department of Environmental Protection;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 62B-56.900(10) by clicking the link below or browse more documents and templates provided by the Florida Department of Environmental Protection.