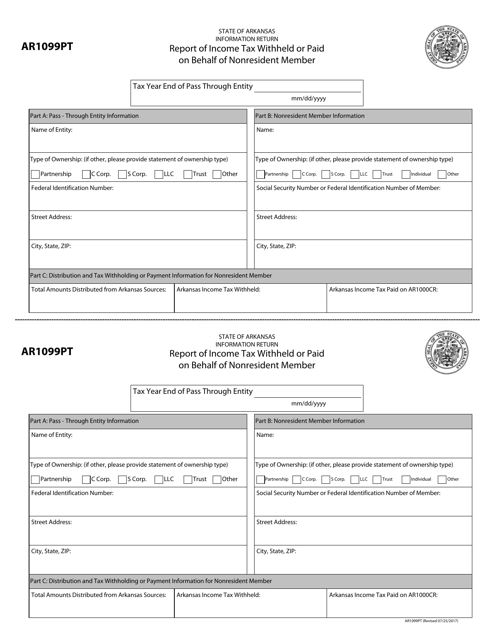

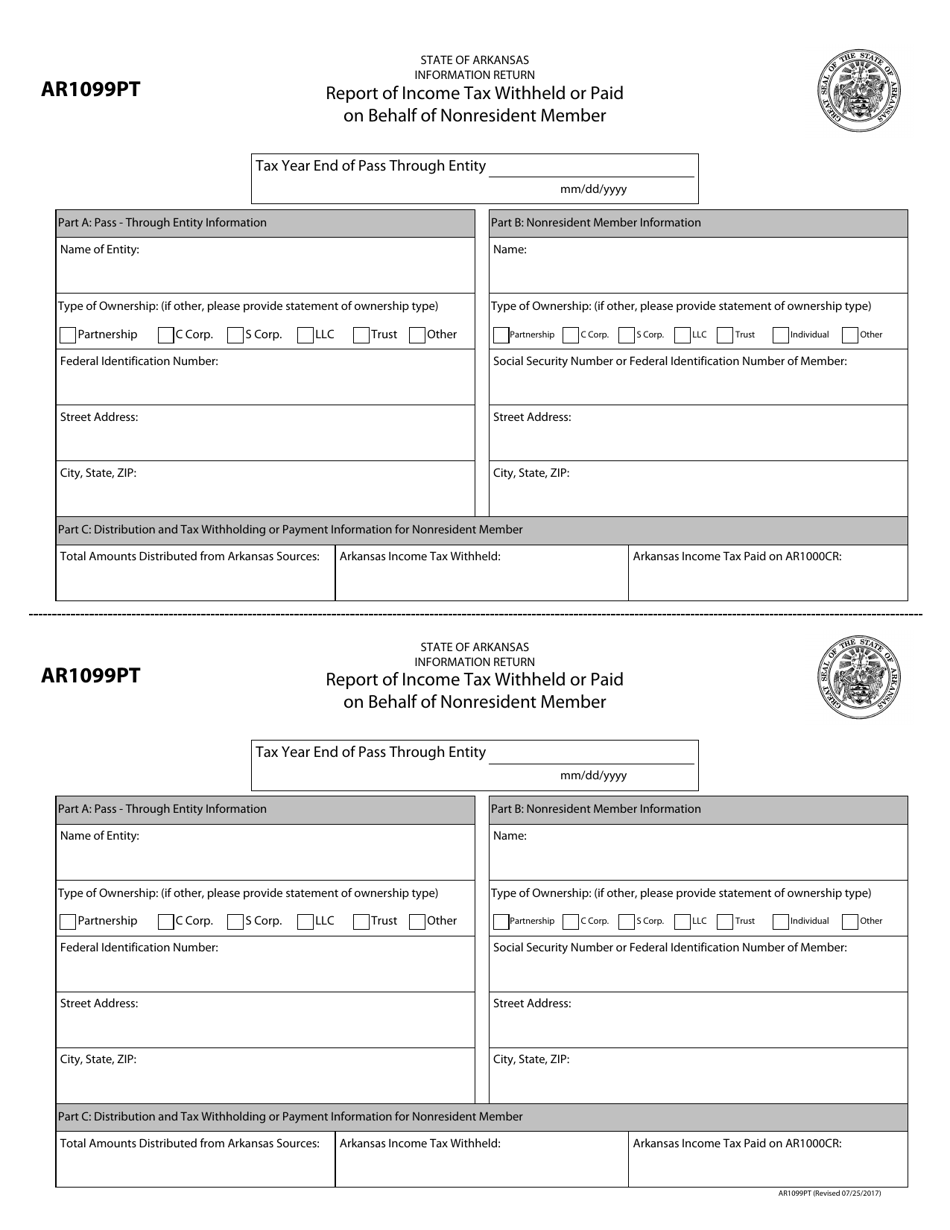

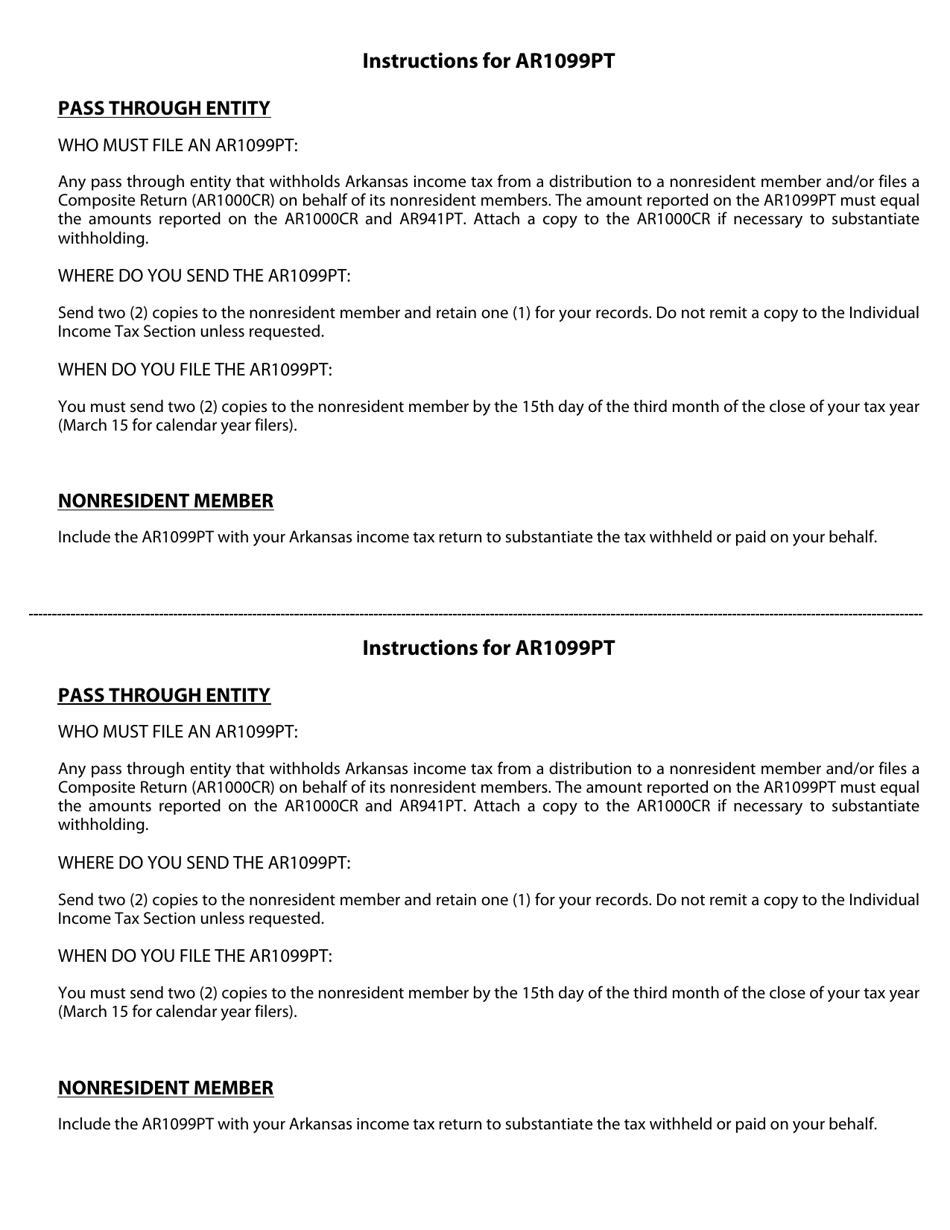

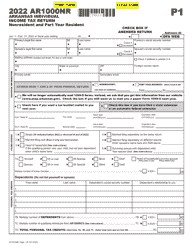

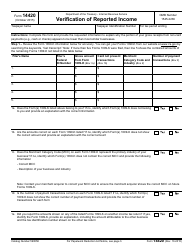

Form AR1099PT Report of Income Tax Withheld or Paid on Behalf of Nonresident Member - Arkansas

What Is Form AR1099PT?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form AR1099PT?

A: Form AR1099PT is a report of Income Tax Withheld or Paid on Behalf of Nonresident Member in Arkansas.

Q: Who needs to file Form AR1099PT?

A: Anyone who has withheld or paid income tax on behalf of a nonresident member in Arkansas needs to file Form AR1099PT.

Q: What is the purpose of Form AR1099PT?

A: The purpose of Form AR1099PT is to report the amount of income tax withheld or paid on behalf of a nonresident member.

Q: When is the deadline to file Form AR1099PT?

A: The deadline to file Form AR1099PT is typically January 31st of the following year.

Q: Are there any penalties for not filing Form AR1099PT?

A: Yes, there may be penalties for not filing Form AR1099PT or for filing it late. It is important to file on time to avoid penalties.

Form Details:

- Released on July 25, 2017;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1099PT by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.