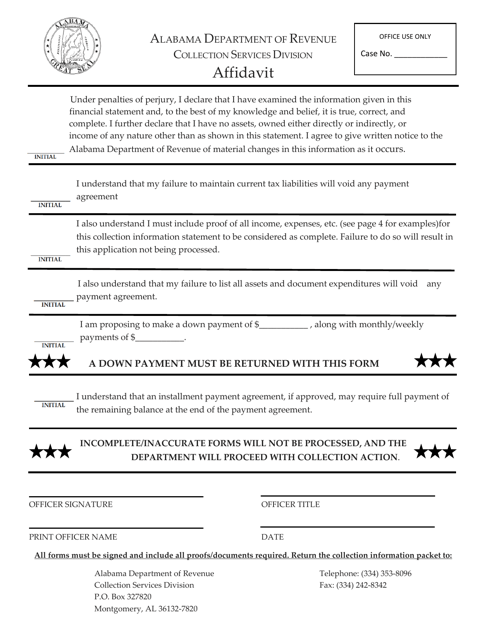

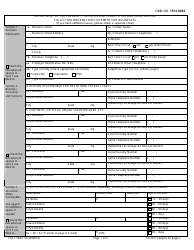

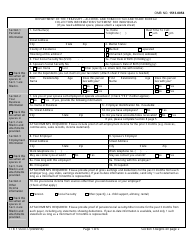

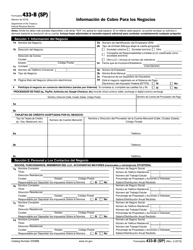

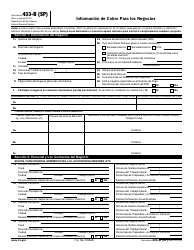

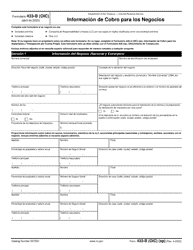

Business Collection Information Statement - Alabama

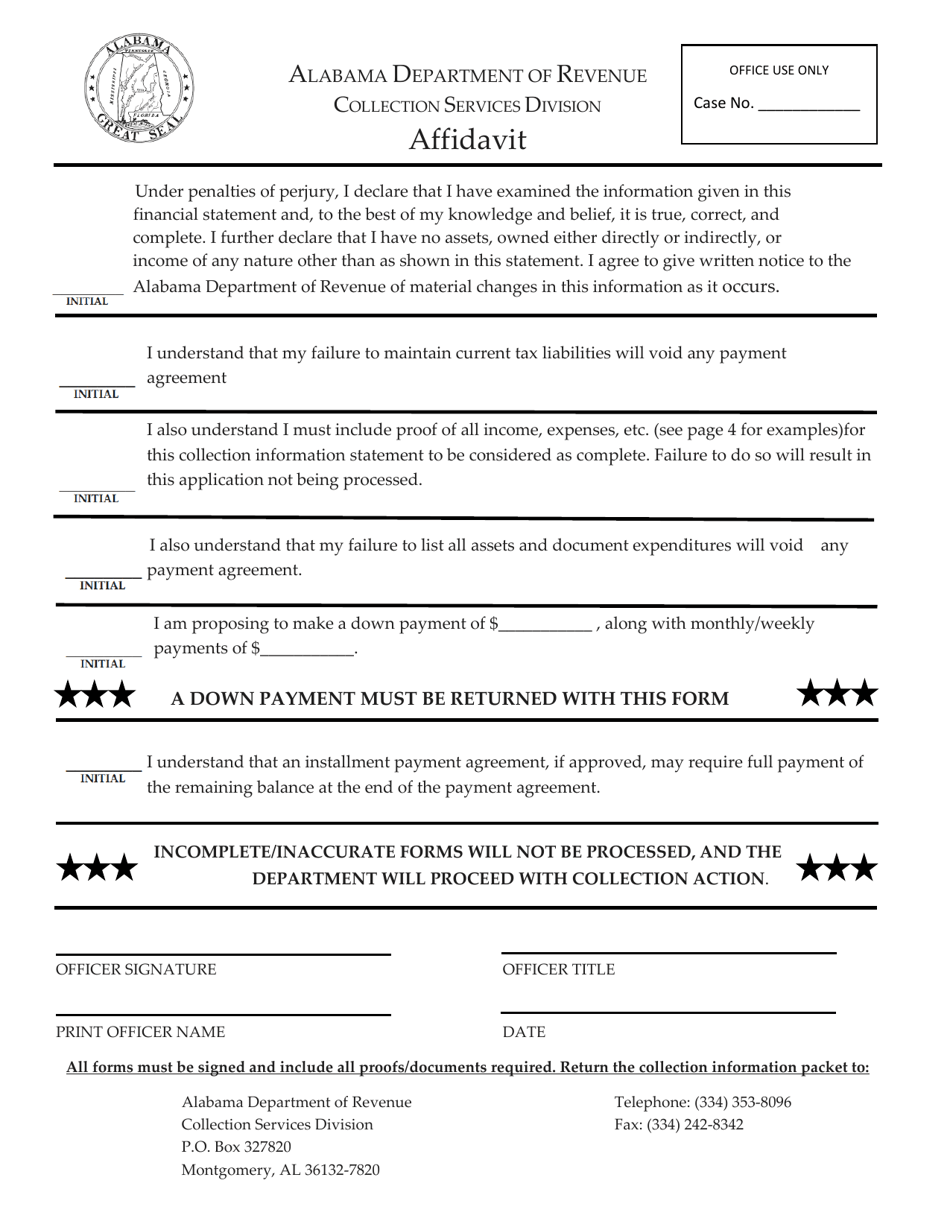

Business Collection Information Statement is a legal document that was released by the Alabama Department of Revenue - a government authority operating within Alabama.

FAQ

Q: What is a Business Collection Information Statement?

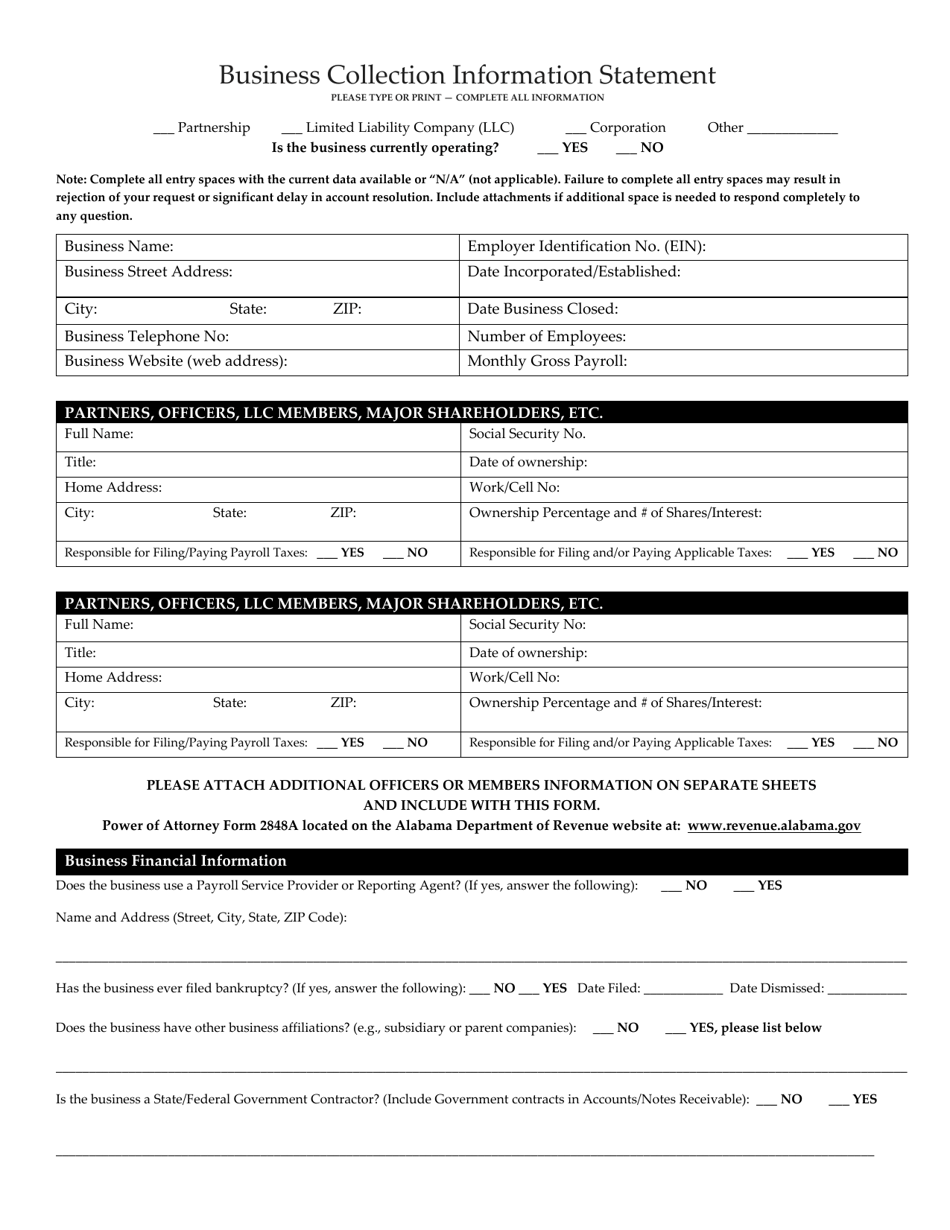

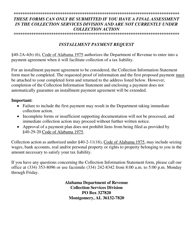

A: The Business Collection Information Statement is a document used by the Alabama Department of Revenue to gather information about a business's assets and liabilities.

Q: Why is a Business Collection Information Statement needed?

A: The Department of Revenue uses the statement to determine a business's ability to pay its tax liabilities.

Q: Who needs to complete a Business Collection Information Statement?

A: Any business that owes taxes to the state of Alabama may be required to complete this statement.

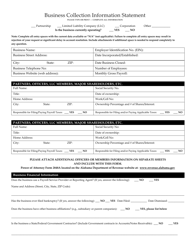

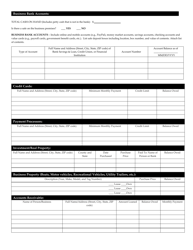

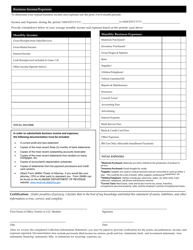

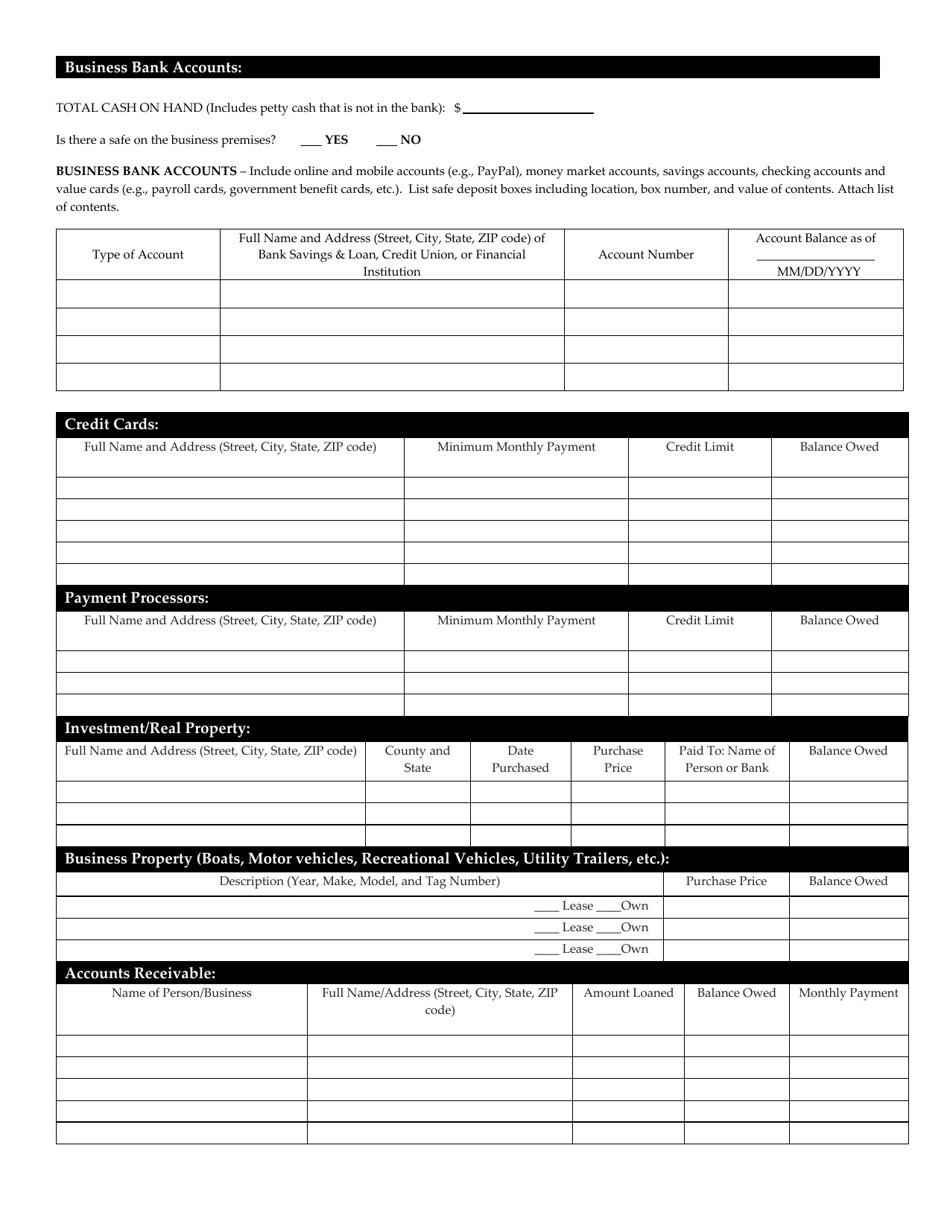

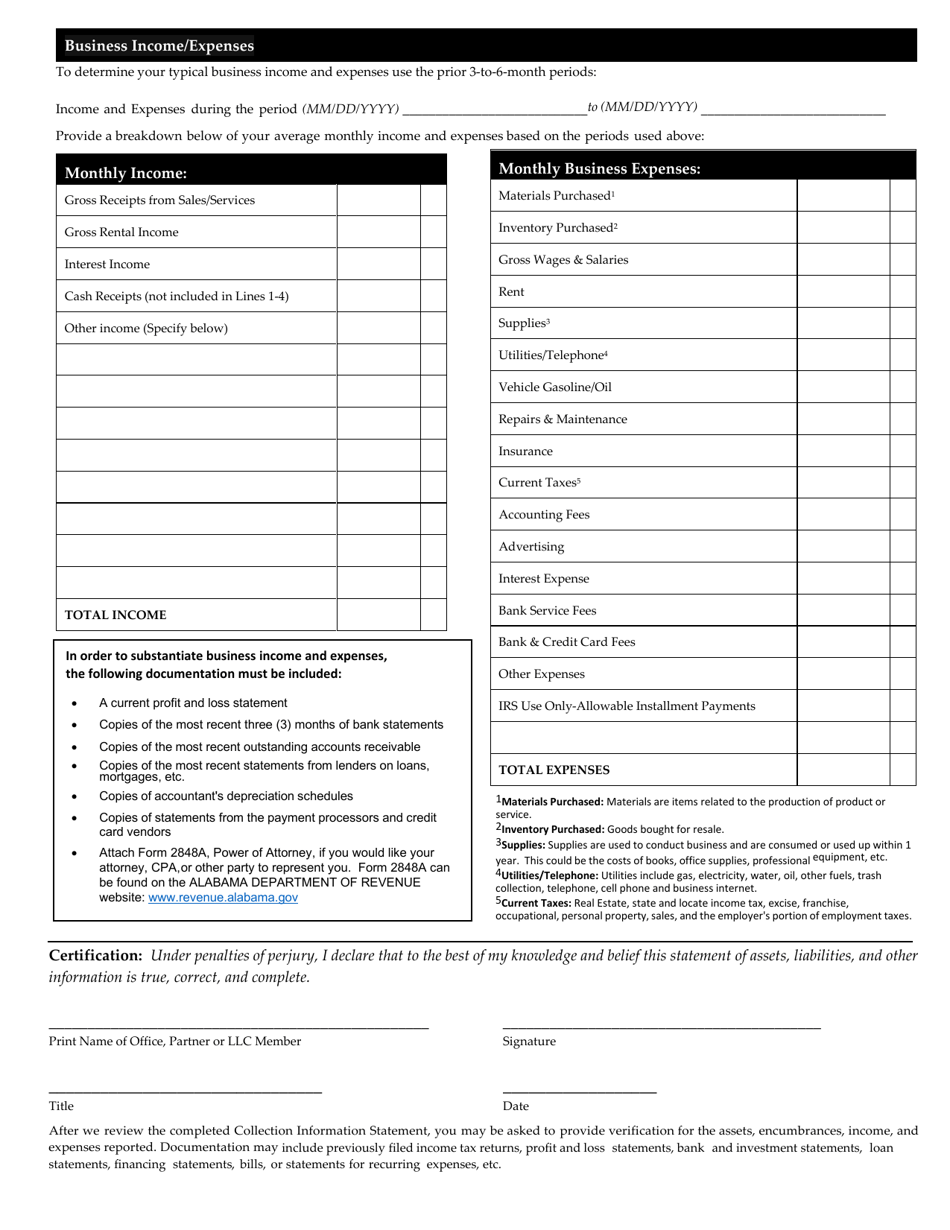

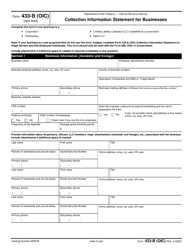

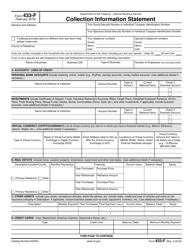

Q: What information is required to be provided in the statement?

A: The statement requires information about the business's assets, liabilities, bank accounts, and other financial information.

Q: Is the information provided on the statement confidential?

A: Yes, the information submitted on the statement is confidential and protected by state laws.

Q: What happens if I don't submit a Business Collection Information Statement?

A: Failure to submit a completed statement may result in penalties and interest on any taxes owed by the business.

Form Details:

- The latest edition currently provided by the Alabama Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.