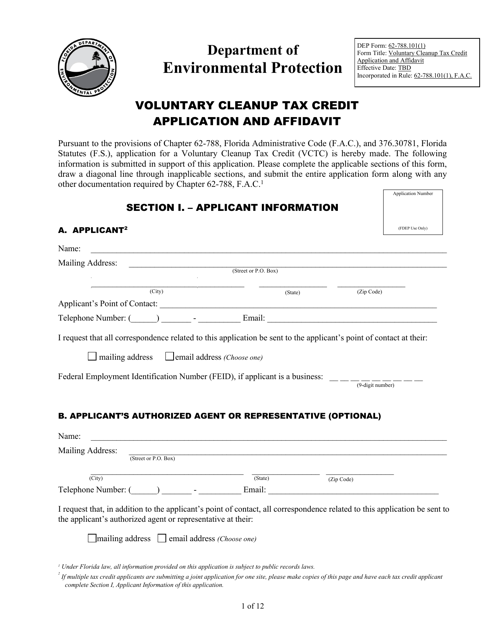

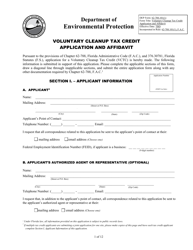

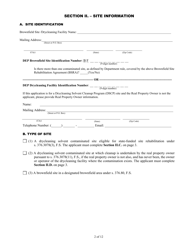

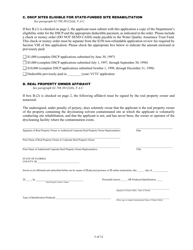

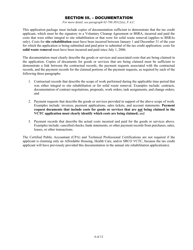

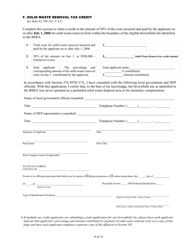

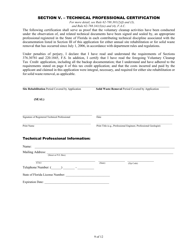

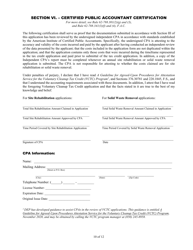

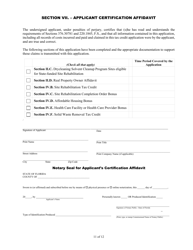

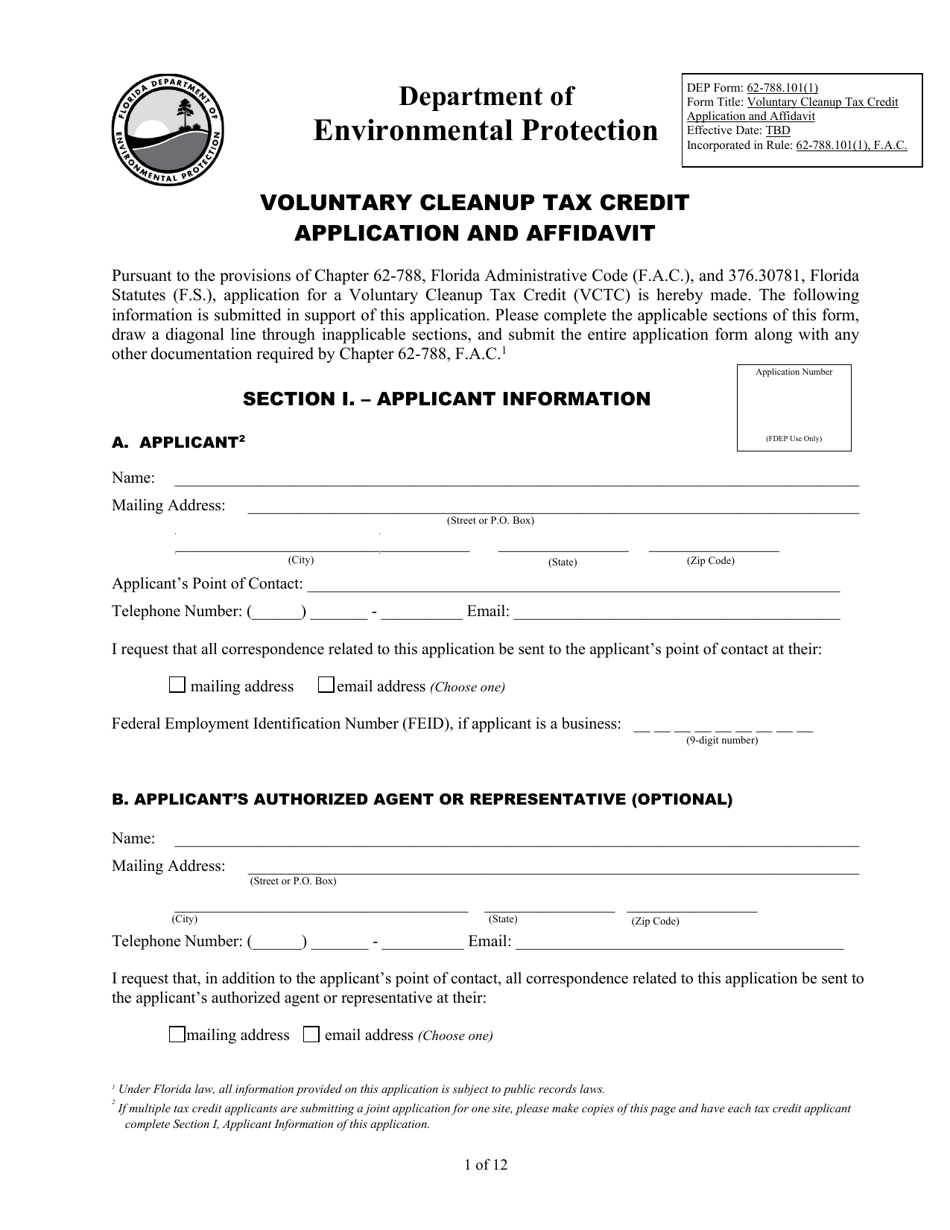

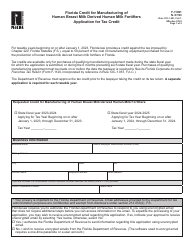

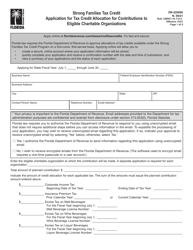

DEP Form 62-788.101(1) Voluntary Cleanup Tax Credit Application and Affidavit - Florida

What Is DEP Form 62-788.101(1)?

This is a legal form that was released by the Florida Department of Environmental Protection - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DEP Form 62-788.101(1)?

A: DEP Form 62-788.101(1) is the Voluntary Cleanup Tax Credit Application and Affidavit in Florida.

Q: What is the purpose of DEP Form 62-788.101(1)?

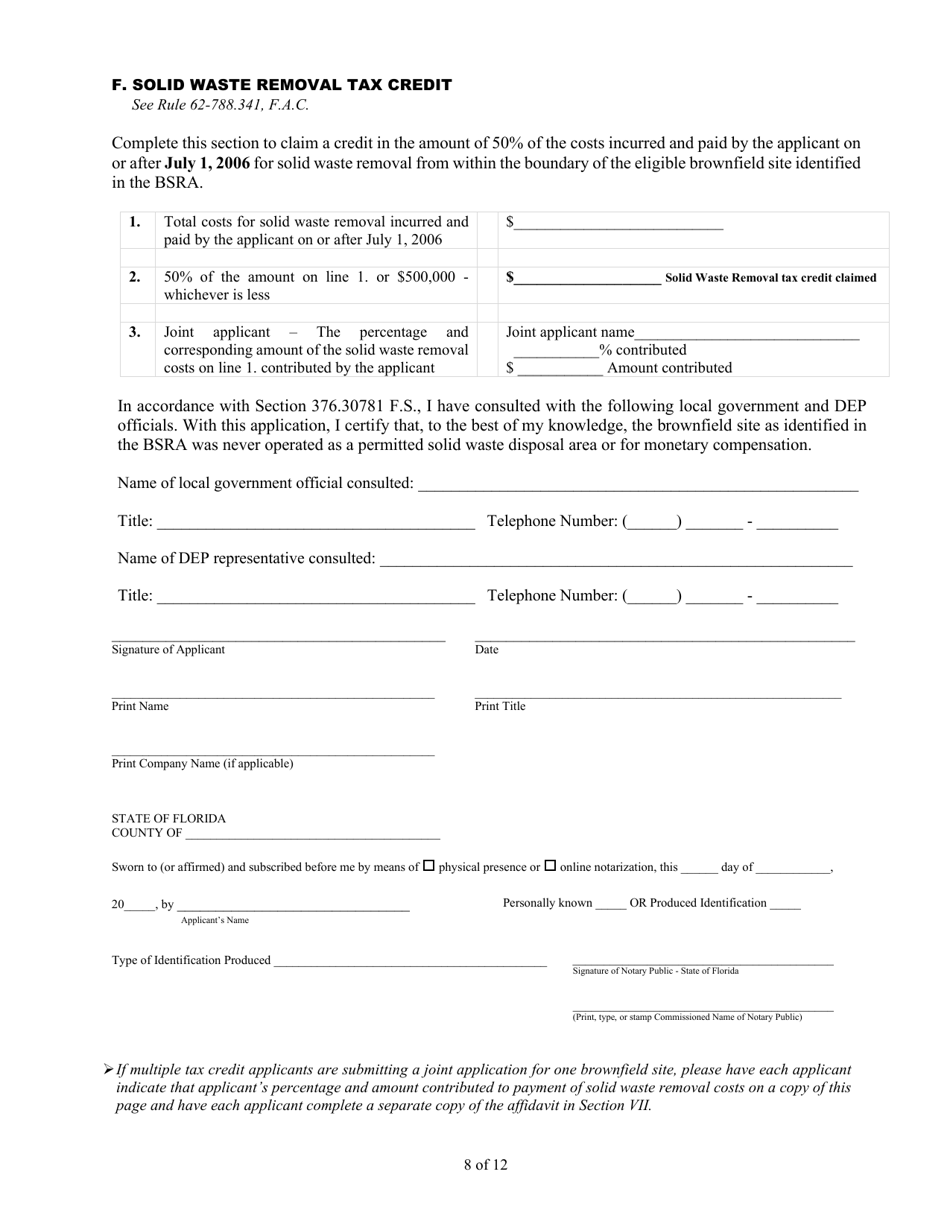

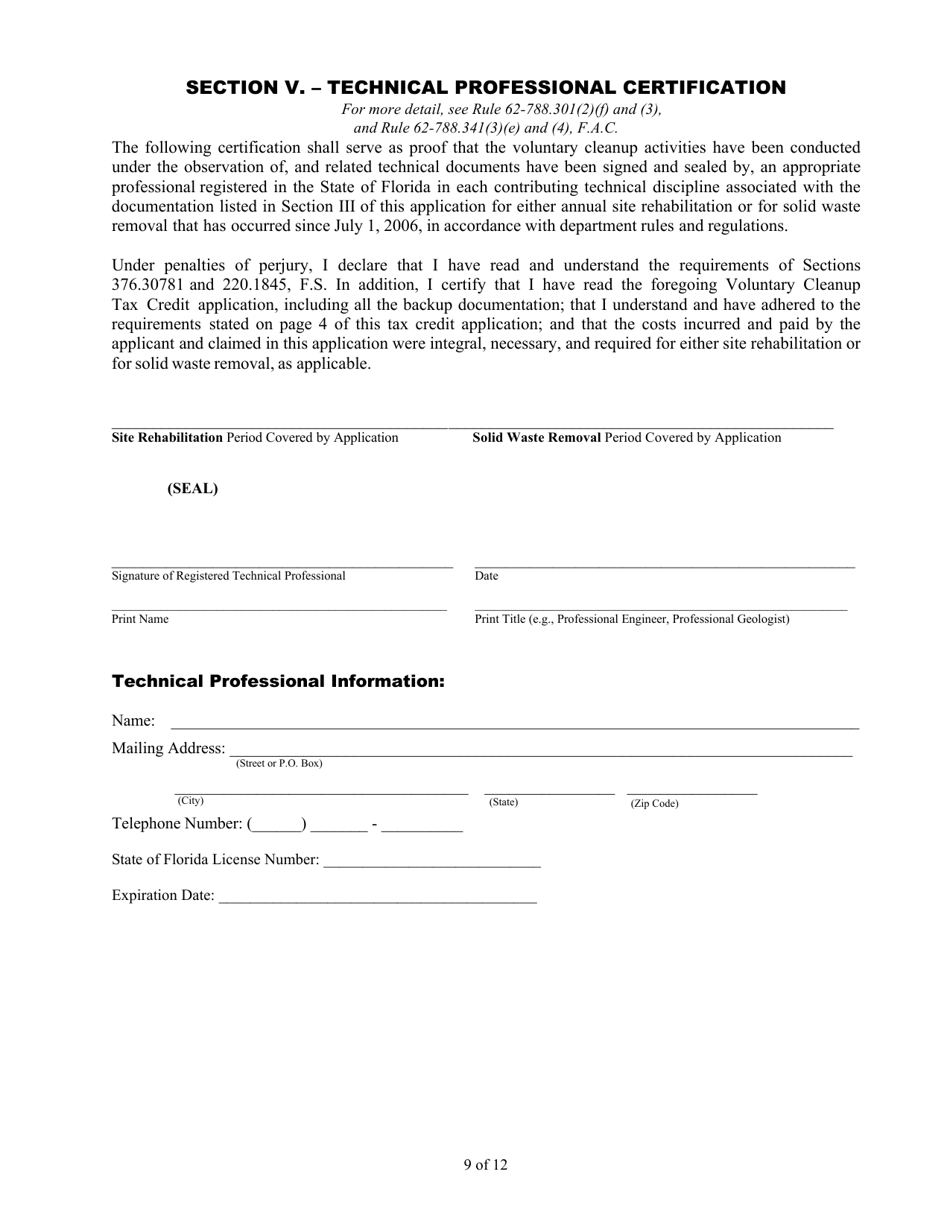

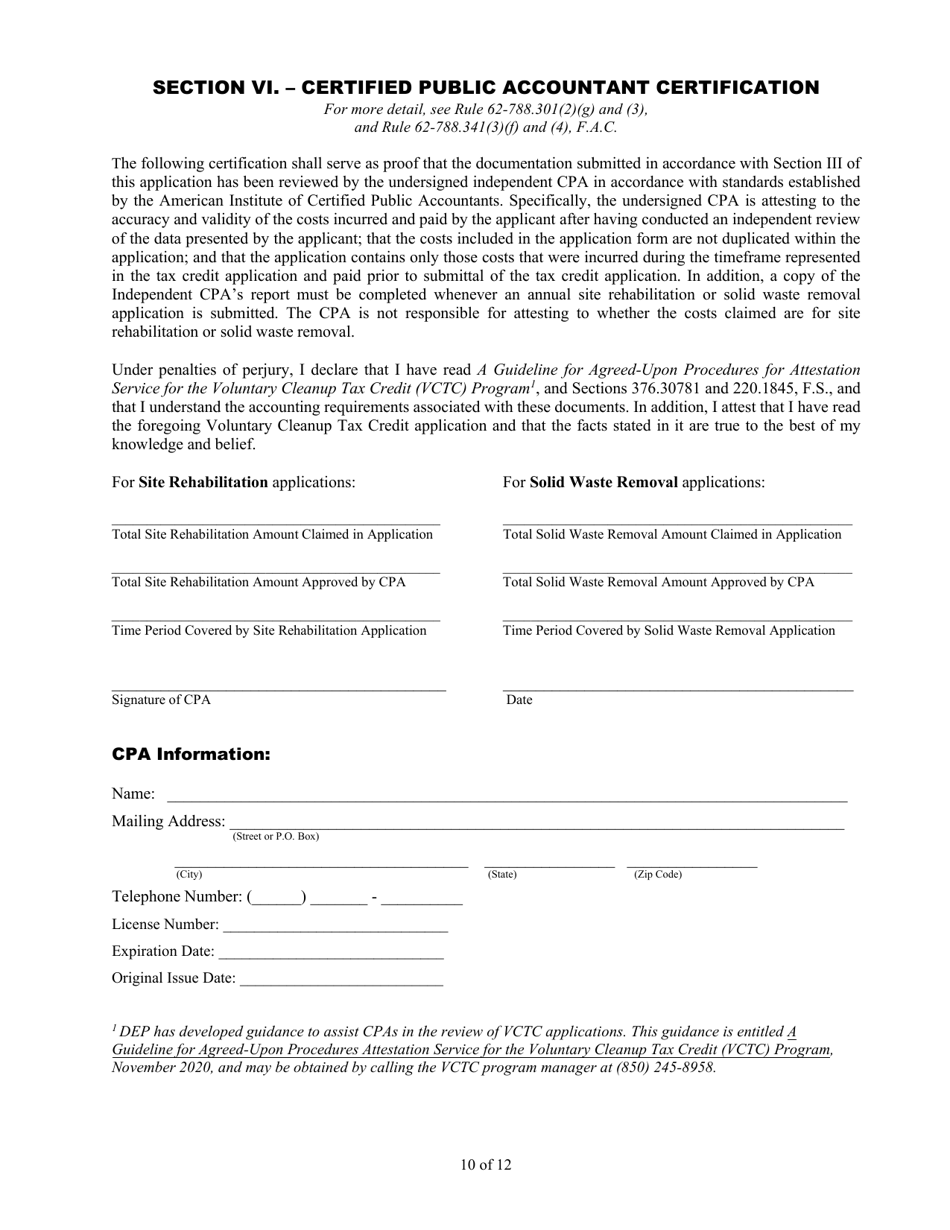

A: The purpose of DEP Form 62-788.101(1) is to apply for the Voluntary Cleanup Tax Credit in Florida.

Q: How can I obtain DEP Form 62-788.101(1)?

A: You can obtain DEP Form 62-788.101(1) by contacting the Florida Department of Environmental Protection (DEP).

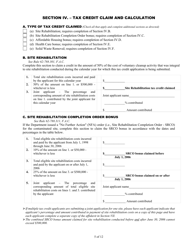

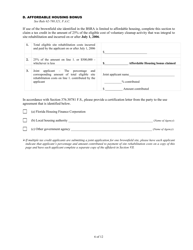

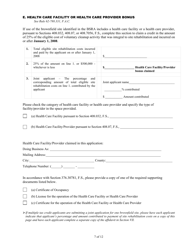

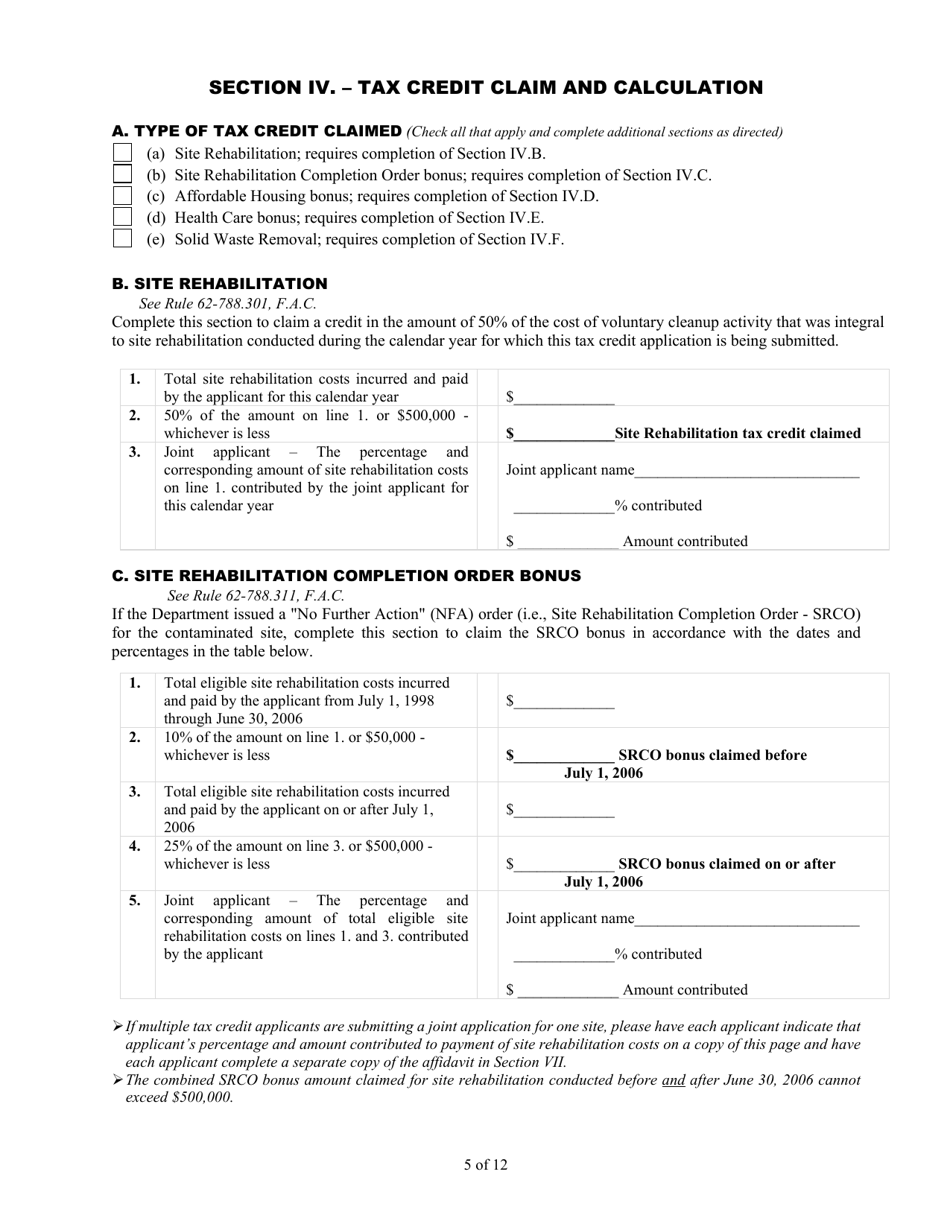

Q: What is the Voluntary Cleanup Tax Credit?

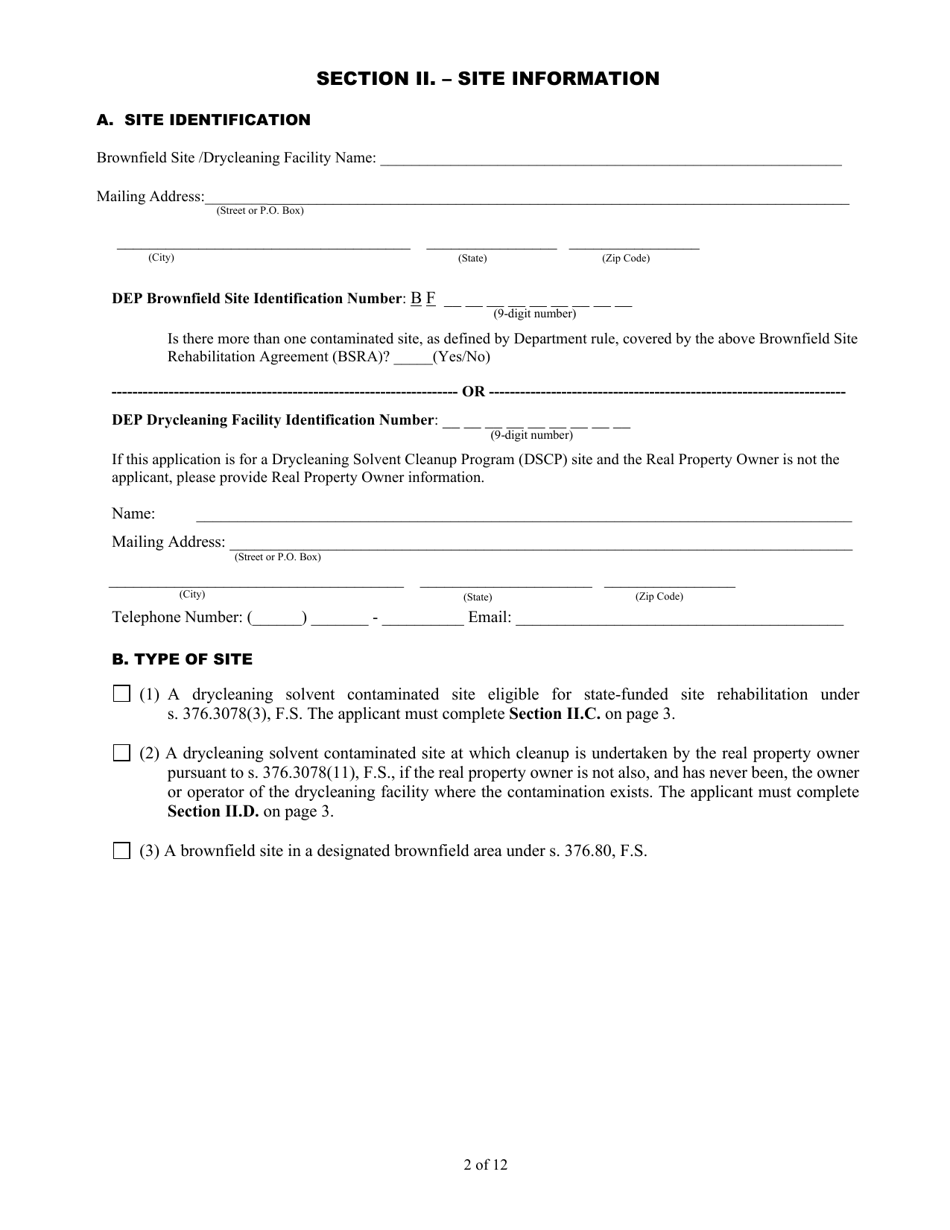

A: The Voluntary Cleanup Tax Credit is a tax incentive program in Florida that provides financial incentives for the voluntary cleanup of contaminated properties.

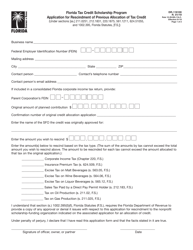

Q: Who is eligible for the Voluntary Cleanup Tax Credit?

A: Property owners, prospective purchasers, and brownfield site rehabilitation contractors may be eligible for the Voluntary Cleanup Tax Credit in Florida.

Q: What is the purpose of the Affidavit in DEP Form 62-788.101(1)?

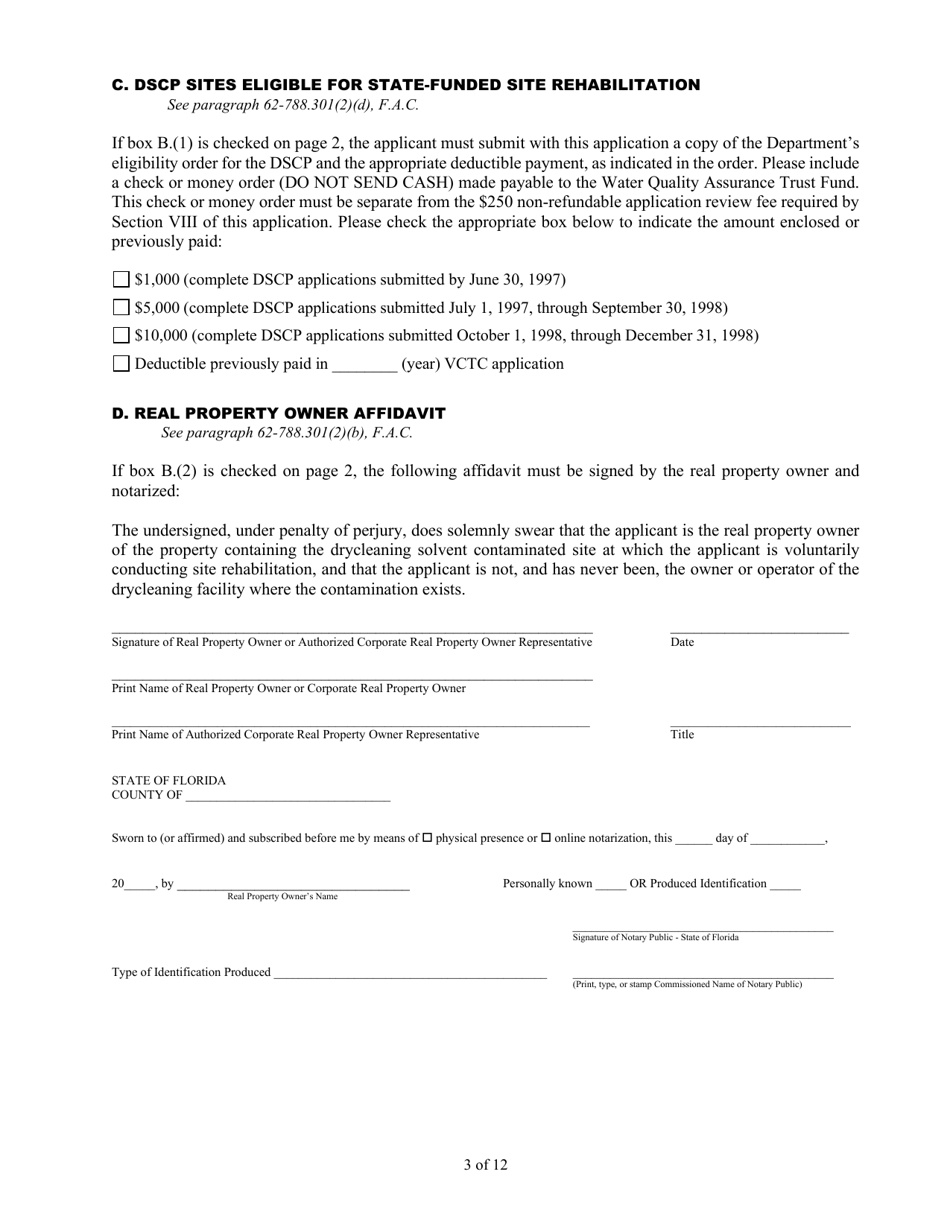

A: The purpose of the Affidavit is to provide a sworn statement regarding the accuracy and completeness of the information provided in the Voluntary Cleanup Tax Credit application.

Form Details:

- The latest edition provided by the Florida Department of Environmental Protection;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of DEP Form 62-788.101(1) by clicking the link below or browse more documents and templates provided by the Florida Department of Environmental Protection.