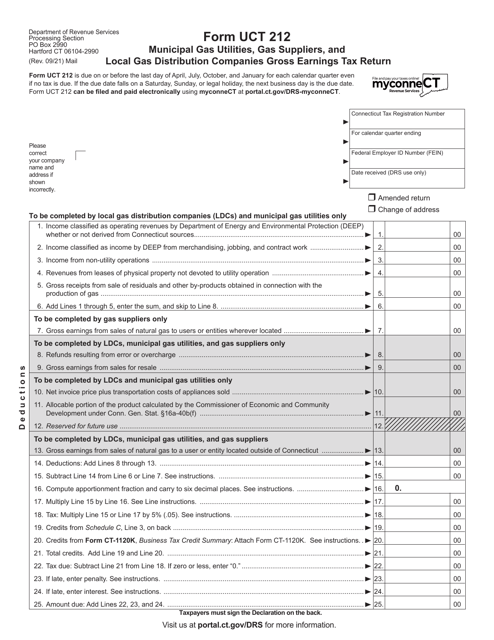

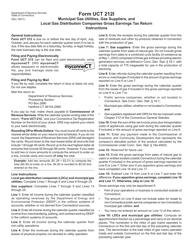

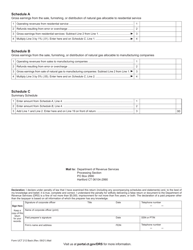

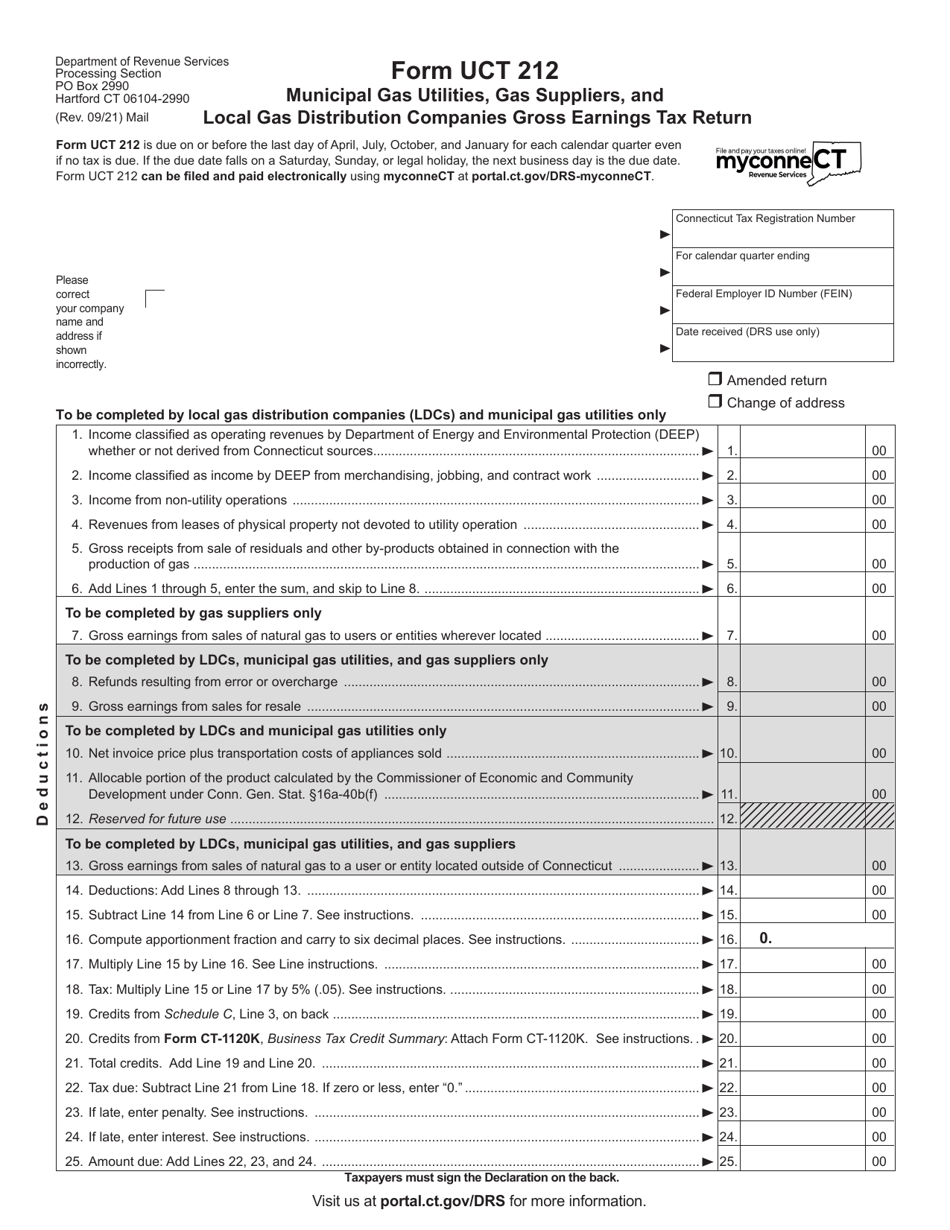

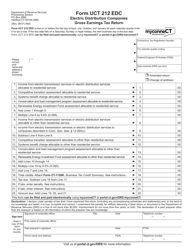

Form UCT-212 Municipal Gas Utilities, Gas Suppliers, and Local Gas Distribution Companies Gross Earnings Tax Return - Connecticut

What Is Form UCT-212?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form UCT-212?

A: Form UCT-212 is a tax return used by municipal gas utilities, gas suppliers, and local gas distribution companies in Connecticut.

Q: Who needs to file Form UCT-212?

A: Municipal gas utilities, gas suppliers, and local gas distribution companies in Connecticut need to file Form UCT-212.

Q: What is the purpose of Form UCT-212?

A: The purpose of Form UCT-212 is to report gross earnings and calculate the gross earnings tax for municipal gas utilities, gas suppliers, and local gas distribution companies.

Q: When is Form UCT-212 due?

A: Form UCT-212 is generally due by the last day of the month following the end of the calendar quarter.

Q: Is Form UCT-212 for gas companies located in Connecticut only?

A: Yes, Form UCT-212 is specifically for municipal gas utilities, gas suppliers, and local gas distribution companies in Connecticut.

Q: Are there any penalties for late filing of Form UCT-212?

A: Yes, there may be penalties for late filing of Form UCT-212. It is important to file the return on time to avoid penalties.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UCT-212 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.