This version of the form is not currently in use and is provided for reference only. Download this version of

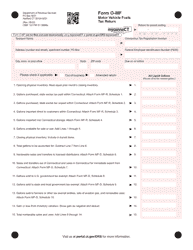

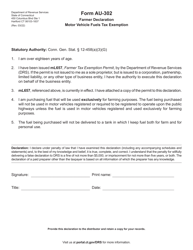

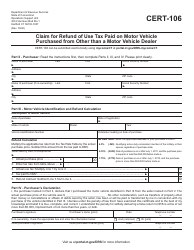

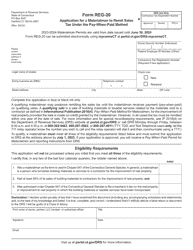

Form O-MF1

for the current year.

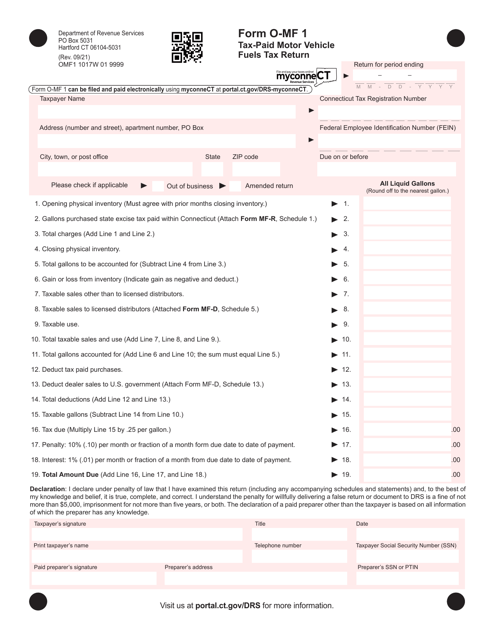

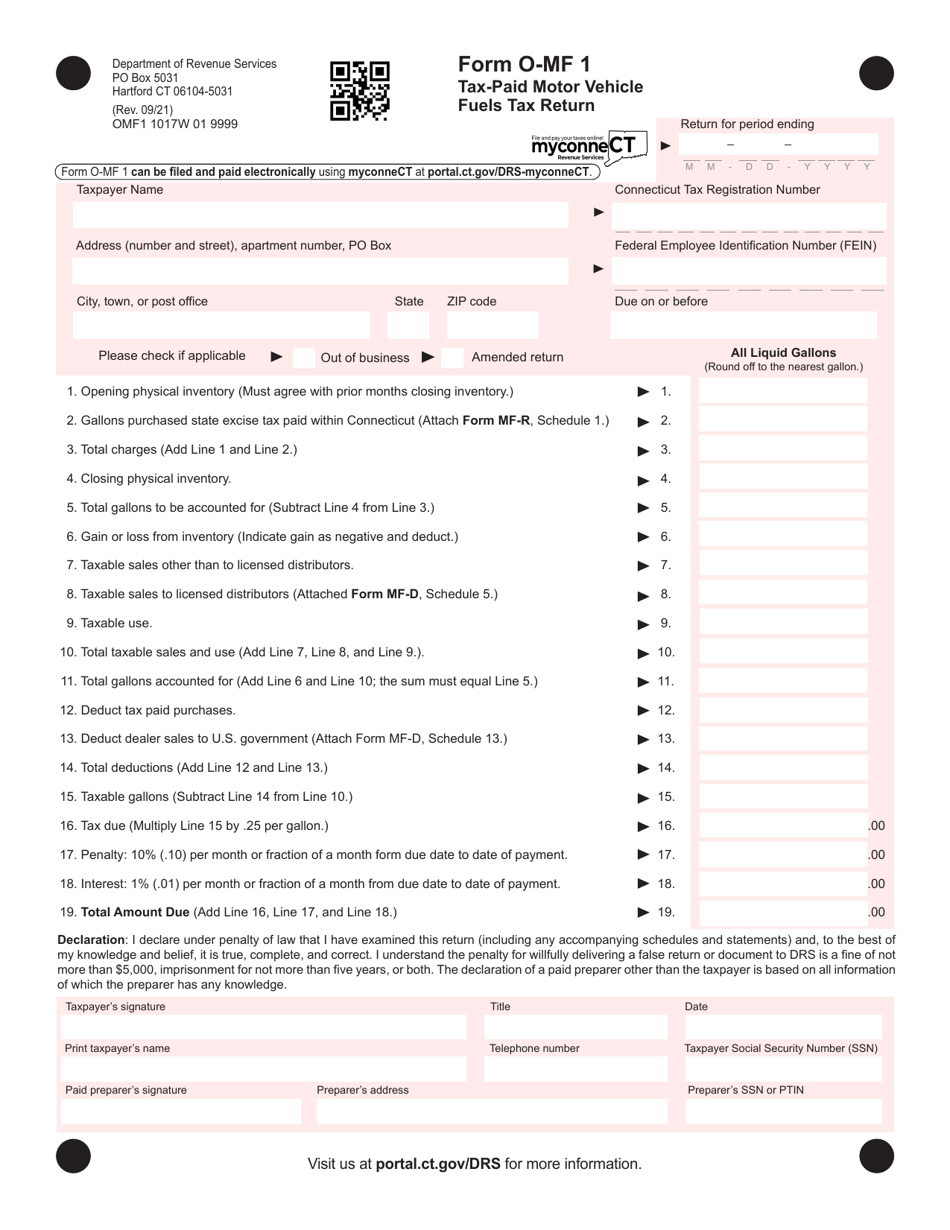

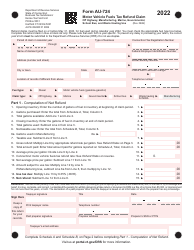

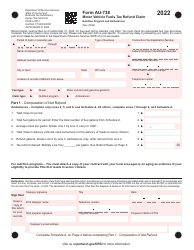

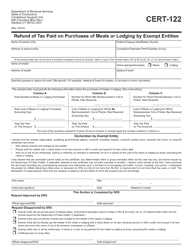

Form O-MF1 Tax-Paid Motor Vehicle Fuels Tax Return - Connecticut

What Is Form O-MF1?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form O-MF1?

A: Form O-MF1 is the Tax-Paid Motor Vehicle Fuels Tax Return for the state of Connecticut.

Q: Who needs to file Form O-MF1?

A: Anyone who sells or uses tax-paid motor vehicle fuels in Connecticut needs to file Form O-MF1.

Q: What is the purpose of Form O-MF1?

A: Form O-MF1 is used to report and pay the tax on motor vehicle fuels that have already been purchased tax-paid.

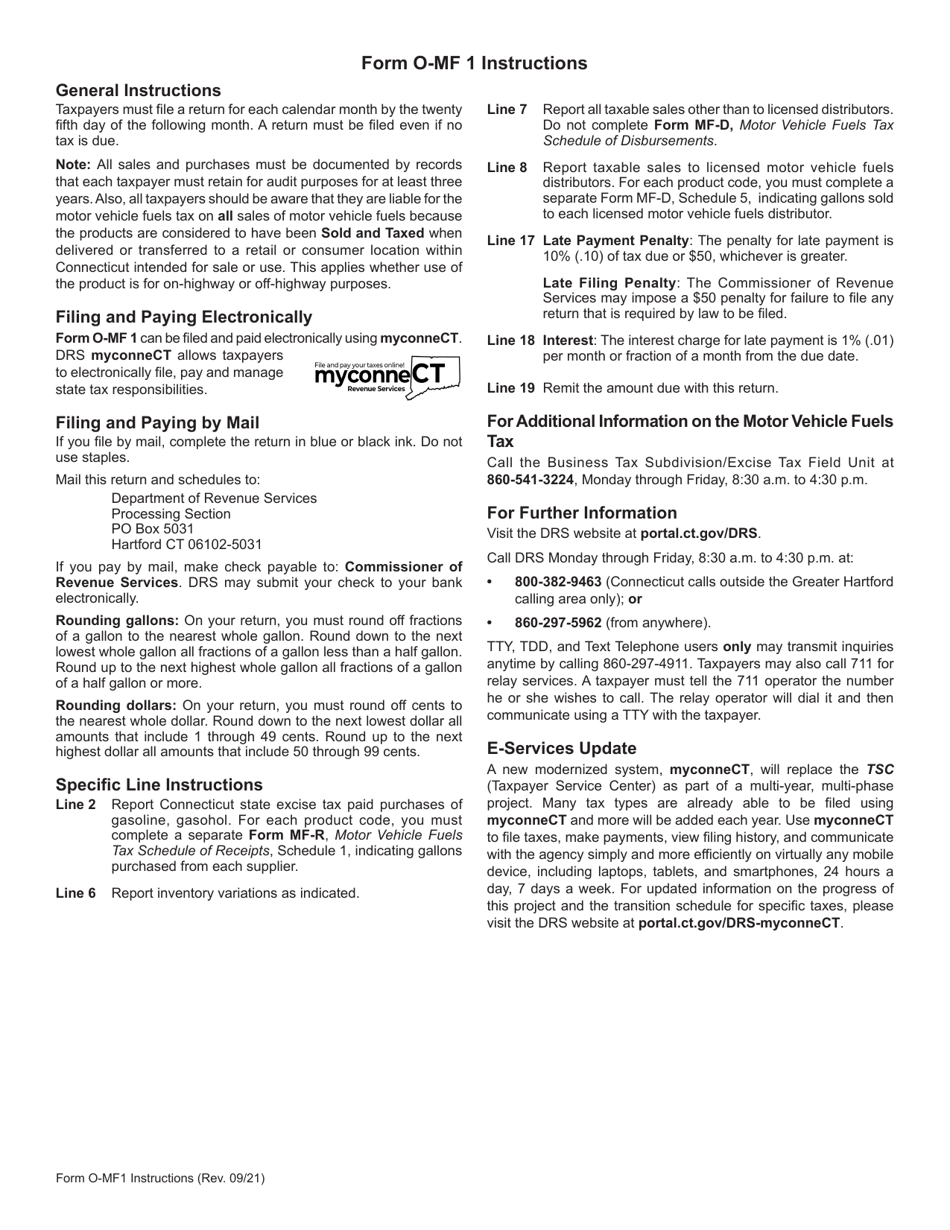

Q: When is Form O-MF1 due?

A: Form O-MF1 is due on a monthly basis, on or before the 25th day of the month following the end of the reporting period.

Q: Is there a penalty for late filing of Form O-MF1?

A: Yes, there is a penalty for late filing of Form O-MF1. The penalty is 10% of the tax due, up to a maximum of $500.

Q: Can Form O-MF1 be filed electronically?

A: Yes, Form O-MF1 can be filed electronically through the Connecticut Taxpayer Service Center.

Q: What supporting documents should be attached to Form O-MF1?

A: You should attach copies of purchase invoices, fuel delivery receipts, and other supporting documentation to Form O-MF1.

Q: How can I pay the tax owed on Form O-MF1?

A: The tax owed on Form O-MF1 can be paid electronically through the Connecticut Taxpayer Service Center, or by check or money order.

Q: What should I do if I have questions or need assistance with Form O-MF1?

A: If you have questions or need assistance with Form O-MF1, you can contact the Connecticut Department of Revenue Services for help.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form O-MF1 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.