This version of the form is not currently in use and is provided for reference only. Download this version of

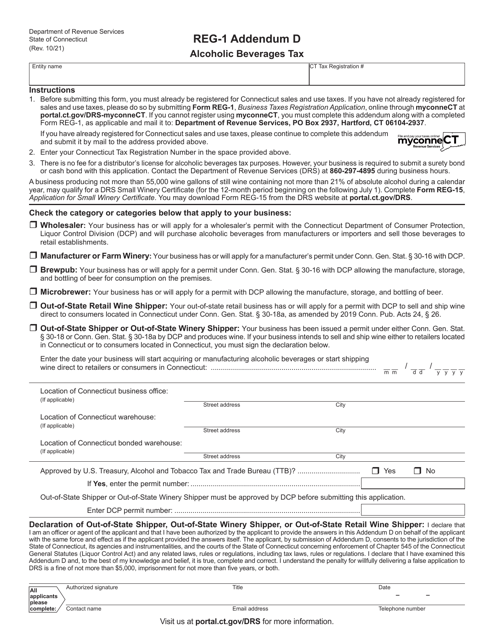

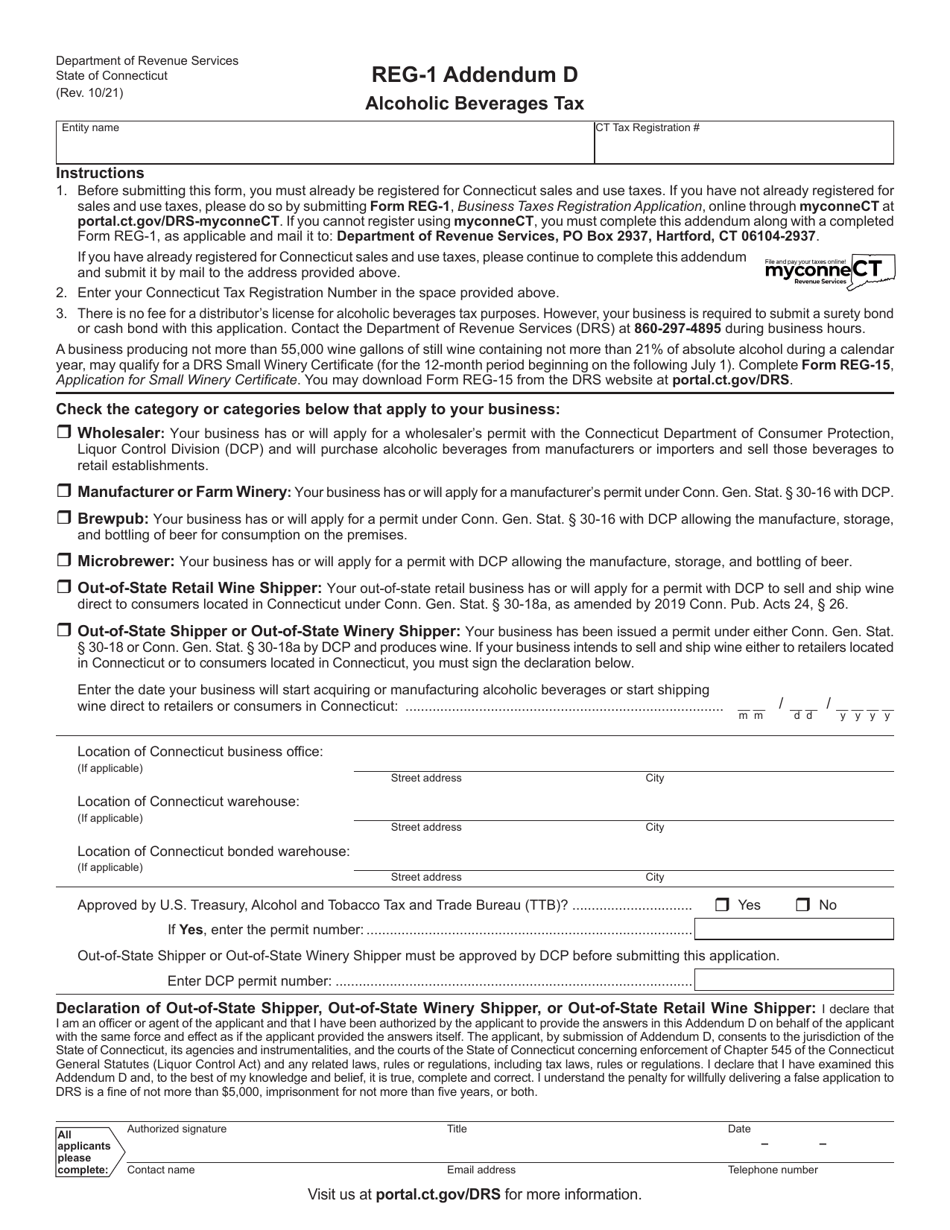

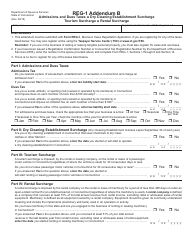

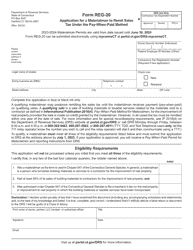

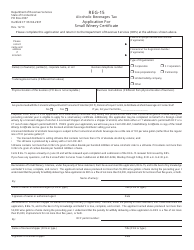

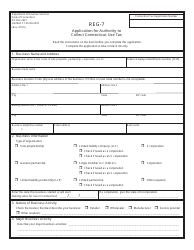

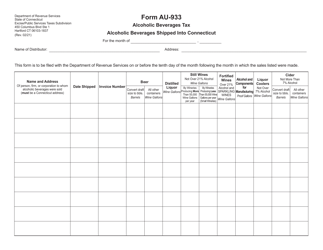

Form REG-1 Addendum D

for the current year.

Form REG-1 Addendum D Alcoholic Beverages Tax - Connecticut

What Is Form REG-1 Addendum D?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REG-1 Addendum D?

A: Form REG-1 Addendum D is a tax form used in Connecticut to report and pay taxes on alcoholic beverages.

Q: Who needs to file Form REG-1 Addendum D?

A: Any person or business that sells or distributes alcoholic beverages in Connecticut needs to file Form REG-1 Addendum D.

Q: What taxes are reported on Form REG-1 Addendum D?

A: Form REG-1 Addendum D is used to report and pay the Connecticut Alcoholic Beverages Tax.

Q: When is Form REG-1 Addendum D due?

A: Form REG-1 Addendum D is due on a monthly basis, with the due date falling on the last day of the following month.

Q: Are there any penalties for late filing or payment of Form REG-1 Addendum D?

A: Yes, there are penalties for late filing or payment of the Connecticut Alcoholic Beverages Tax. It is important to file and pay on time to avoid penalties.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REG-1 Addendum D by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.