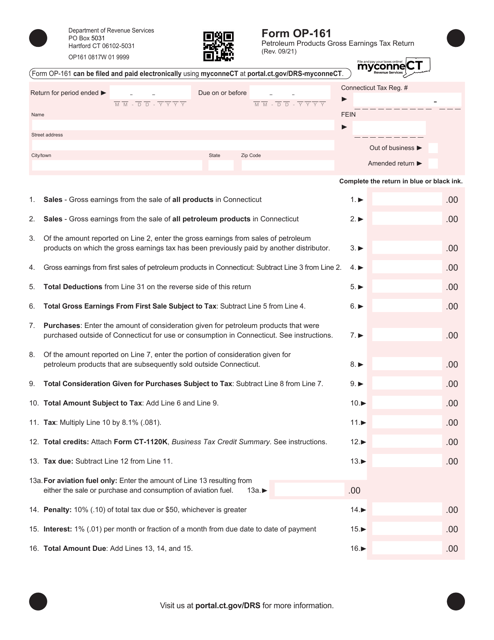

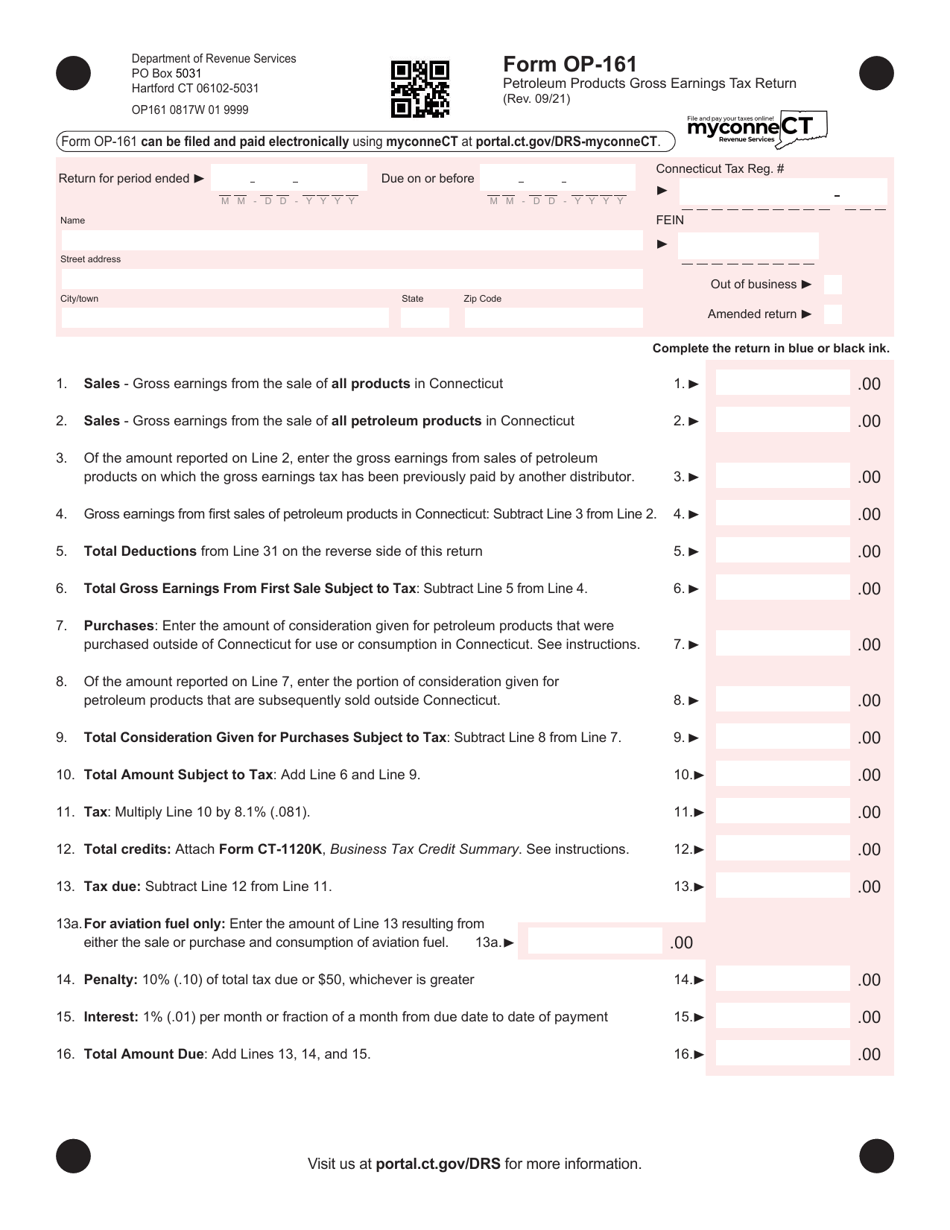

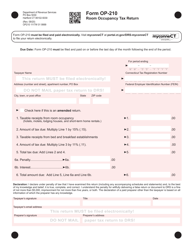

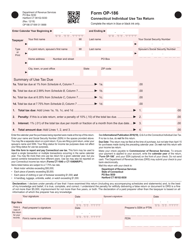

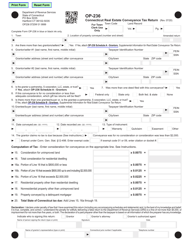

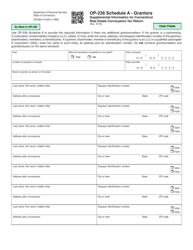

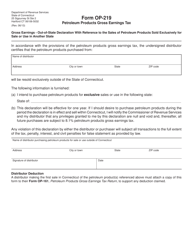

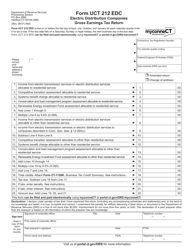

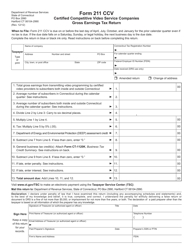

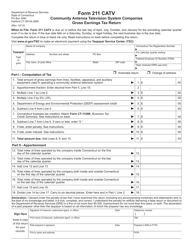

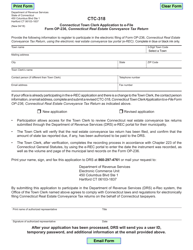

Form OP-161 Petroleum Products Gross Earnings Tax Return - Connecticut

What Is Form OP-161?

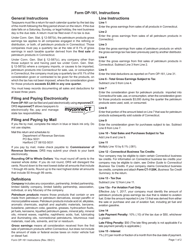

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OP-161?

A: Form OP-161 is the Petroleum Products Gross Earnings Tax Return specifically for the state of Connecticut.

Q: Who needs to file Form OP-161?

A: Any person or entity engaged in the business of distributing petroleum products in Connecticut is required to file Form OP-161.

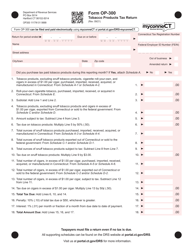

Q: What is the purpose of Form OP-161?

A: The purpose of Form OP-161 is to report and remit the gross earnings tax on the distribution of petroleum products in Connecticut.

Q: When is the deadline to file Form OP-161?

A: Form OP-161 must be filed on a quarterly basis, with the deadline being the last day of the month following the end of the quarter.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing. Failure to file Form OP-161 by the due date may result in penalties and interest being assessed.

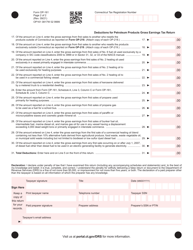

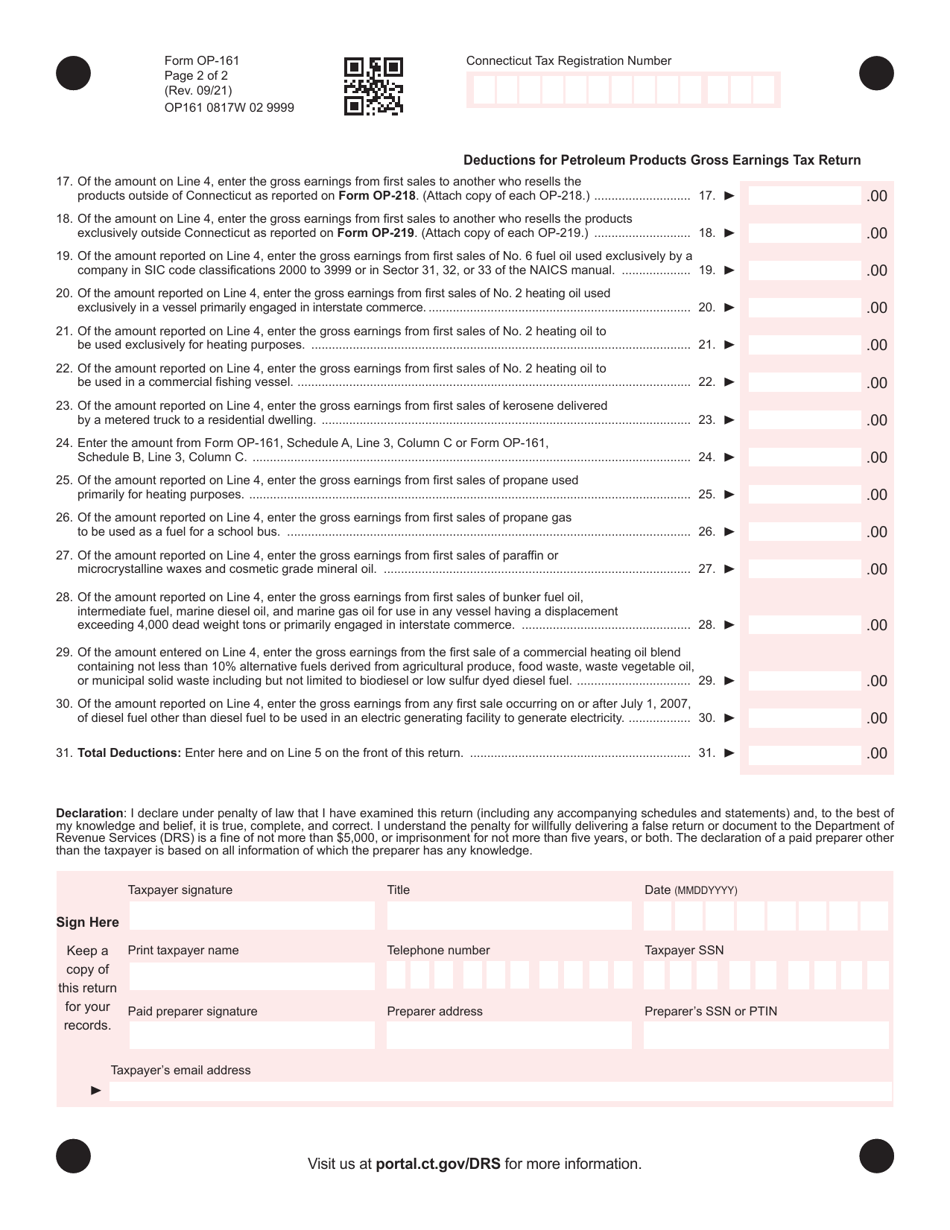

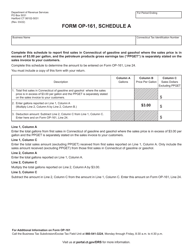

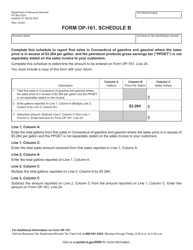

Q: Are there any exemptions or deductions available on Form OP-161?

A: Yes, there are certain exemptions and deductions available on Form OP-161. It is recommended to consult the instructions or a tax professional for specific details.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OP-161 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.