This version of the form is not currently in use and is provided for reference only. Download this version of

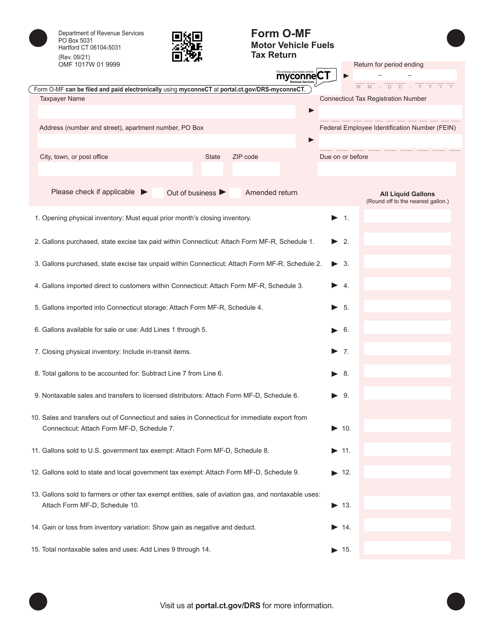

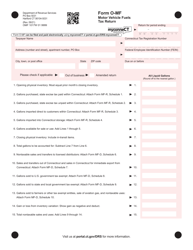

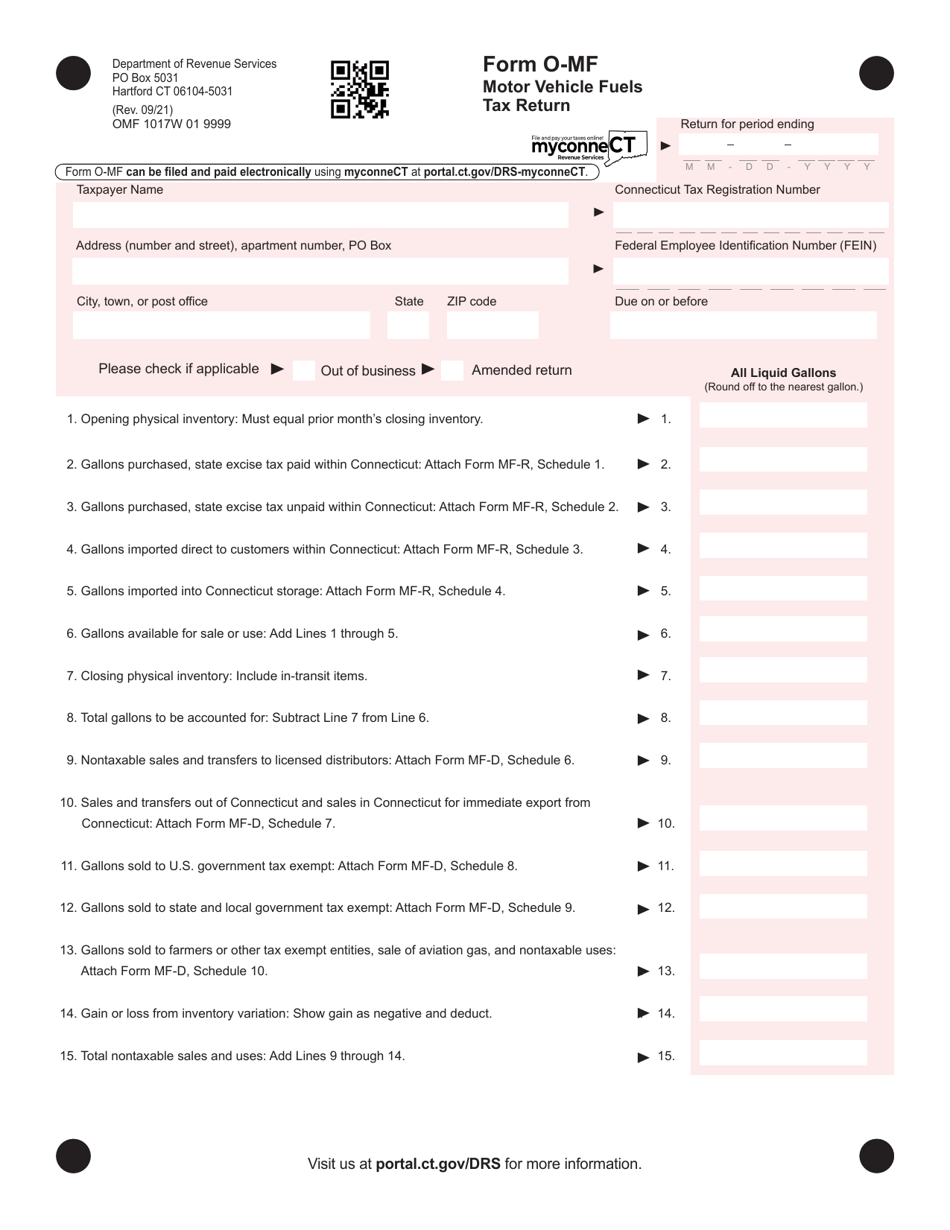

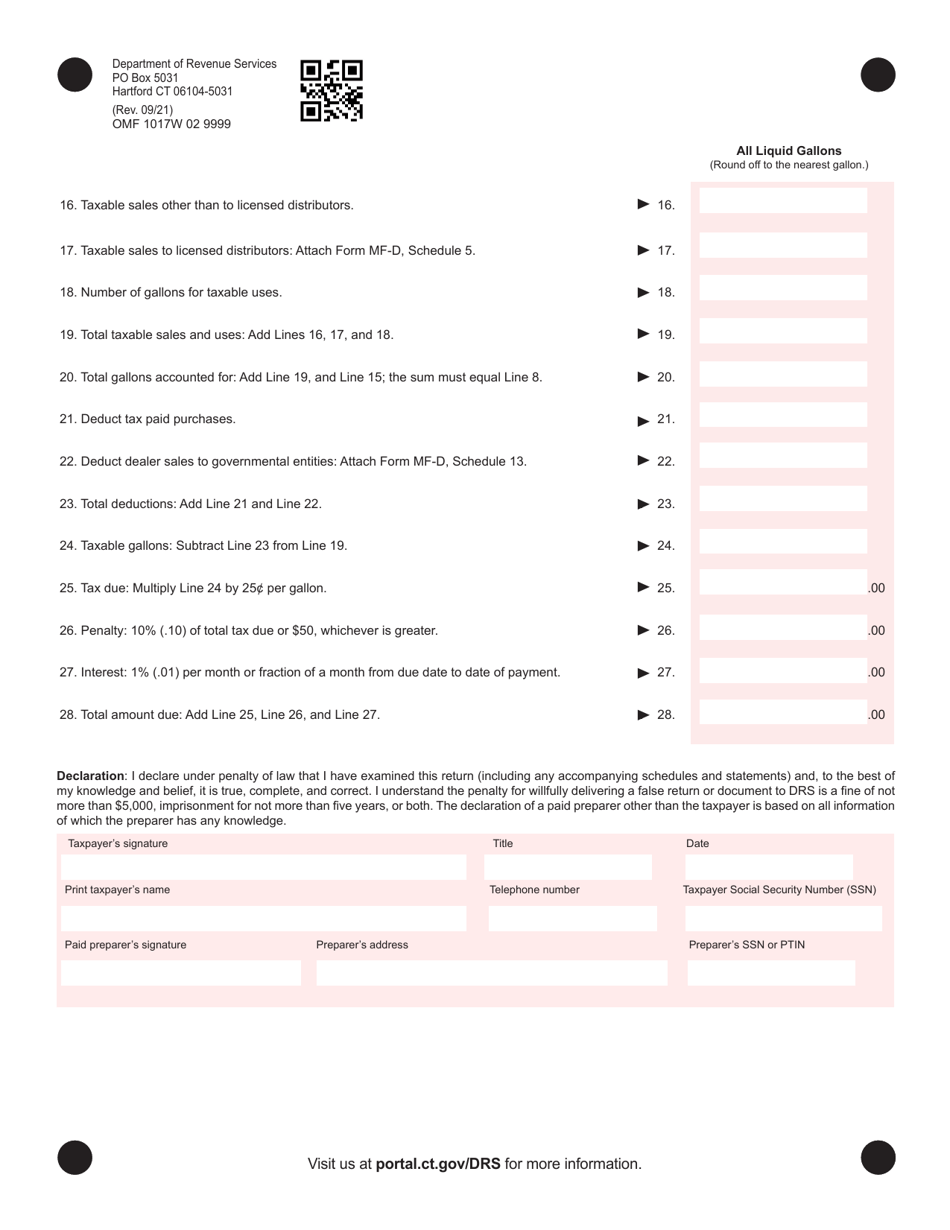

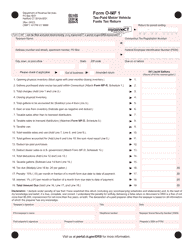

Form O-MF

for the current year.

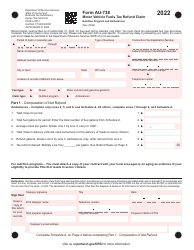

Form O-MF Motor Vehicle Fuels Tax Return - Connecticut

What Is Form O-MF?

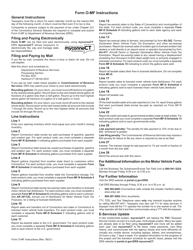

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the O-MF Motor Vehicle Fuels Tax Return?

A: The O-MF Motor Vehicle Fuels Tax Return is a tax form used in Connecticut to report and pay motor vehicle fuels tax.

Q: Who needs to file the O-MF Motor Vehicle Fuels Tax Return?

A: Any person or business that sells or distributes motor vehicle fuels in Connecticut needs to file the O-MF Motor Vehicle Fuels Tax Return.

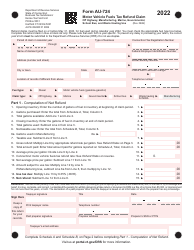

Q: What is motor vehicle fuels tax?

A: Motor vehicle fuels tax is a tax imposed on the sale or distribution of motor vehicle fuels, such as gasoline and diesel, in Connecticut.

Q: How often do I need to file the O-MF Motor Vehicle Fuels Tax Return?

A: The O-MF Motor Vehicle Fuels Tax Return is filed on a monthly basis. The due date for the return is the last day of the month following the reporting period.

Q: What information do I need to include in the O-MF Motor Vehicle Fuels Tax Return?

A: You need to include information such as the gallons of motor vehicle fuels sold or distributed, the amount of tax due, and any credits or deductions you are claiming.

Q: Are there any penalties for not filing the O-MF Motor Vehicle Fuels Tax Return?

A: Yes, there are penalties for late or non-filing of the O-MF Motor Vehicle Fuels Tax Return, including interest on any unpaid tax.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form O-MF by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.