This version of the form is not currently in use and is provided for reference only. Download this version of

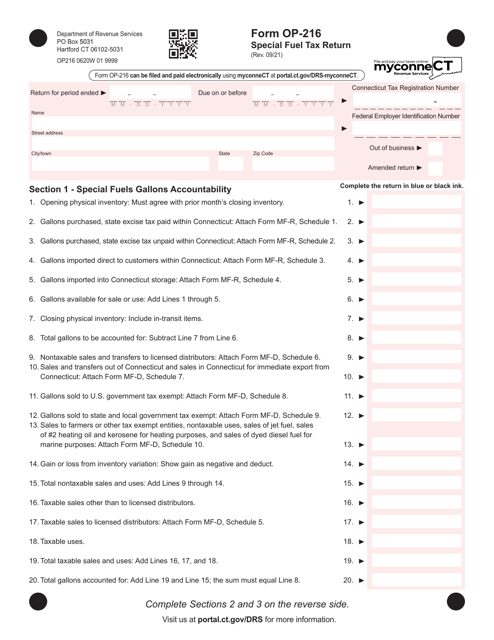

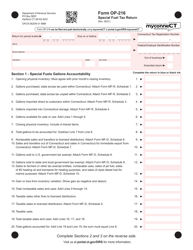

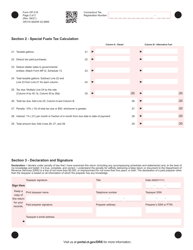

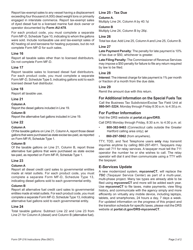

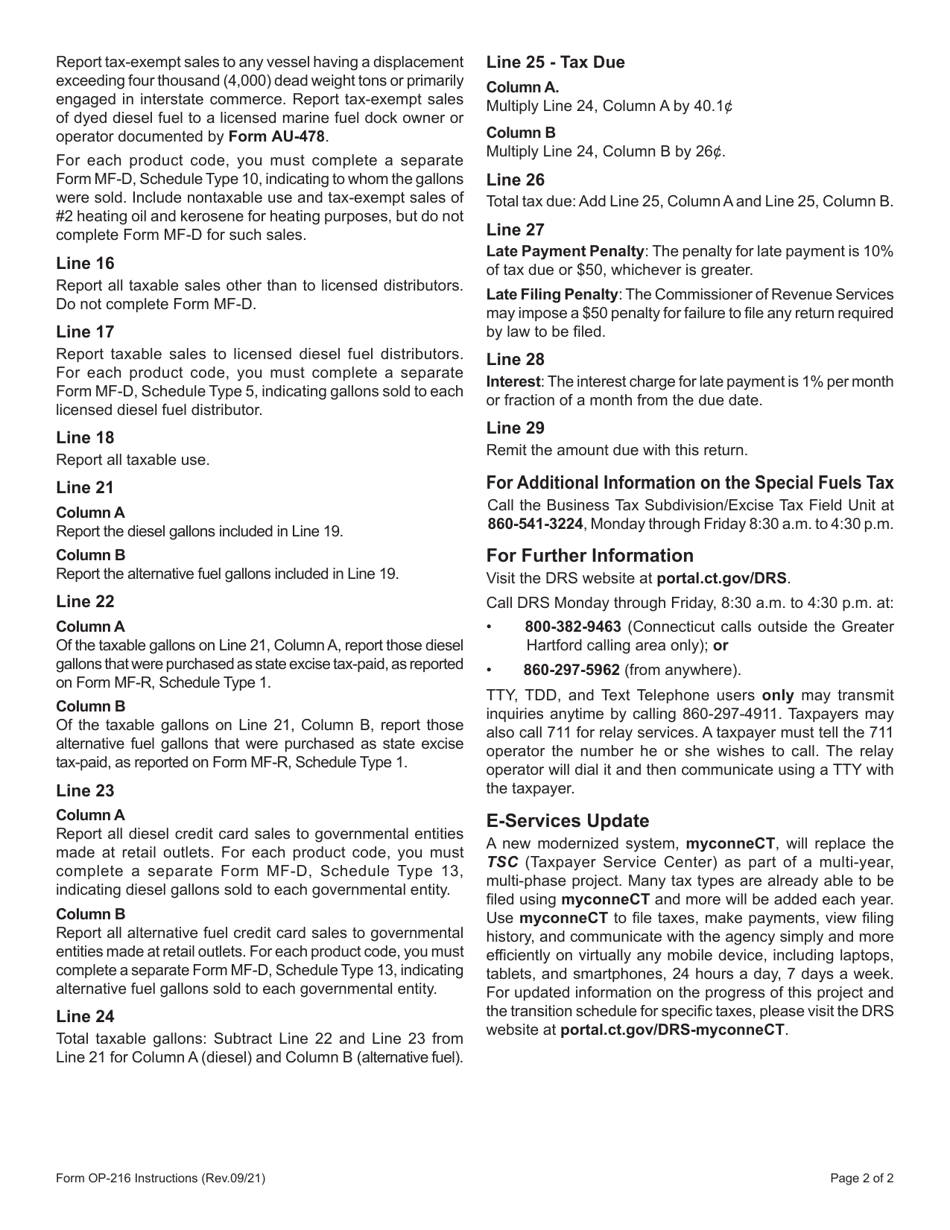

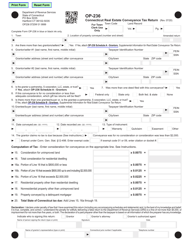

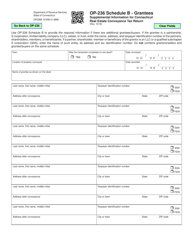

Form OP-216

for the current year.

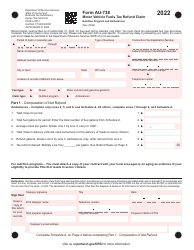

Form OP-216 Special Fuel Tax Return - Connecticut

What Is Form OP-216?

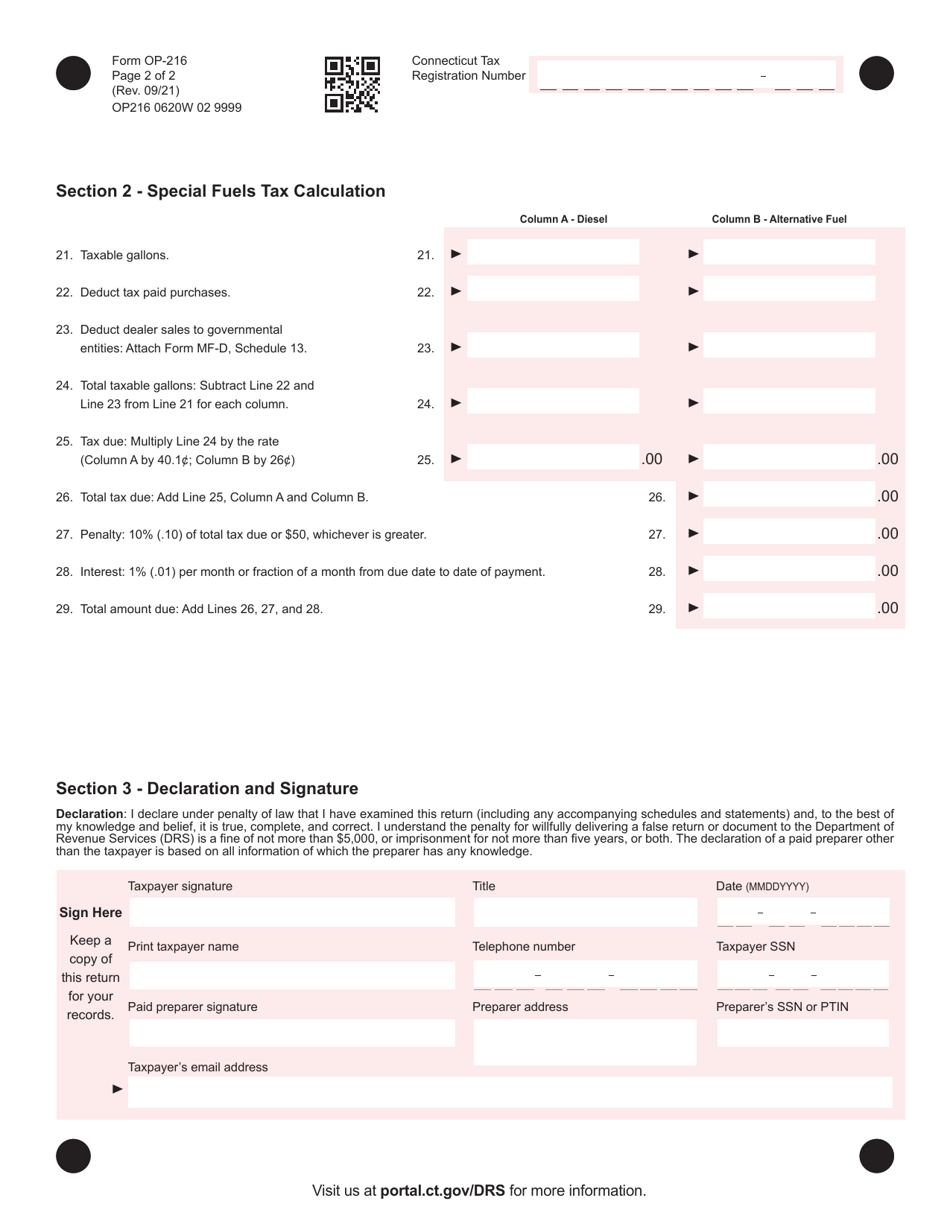

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OP-216?

A: Form OP-216 is the Special Fuel Tax Return used in Connecticut.

Q: Who needs to file Form OP-216?

A: Those who distribute or use special fuels in Connecticut need to file Form OP-216.

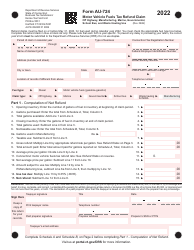

Q: What are special fuels?

A: Special fuels include diesel fuel, propane, natural gas, and other alternative fuels.

Q: When is Form OP-216 due?

A: Form OP-216 is due on a quarterly basis, with the due dates being April 30th, July 31st, October 31st, and January 31st.

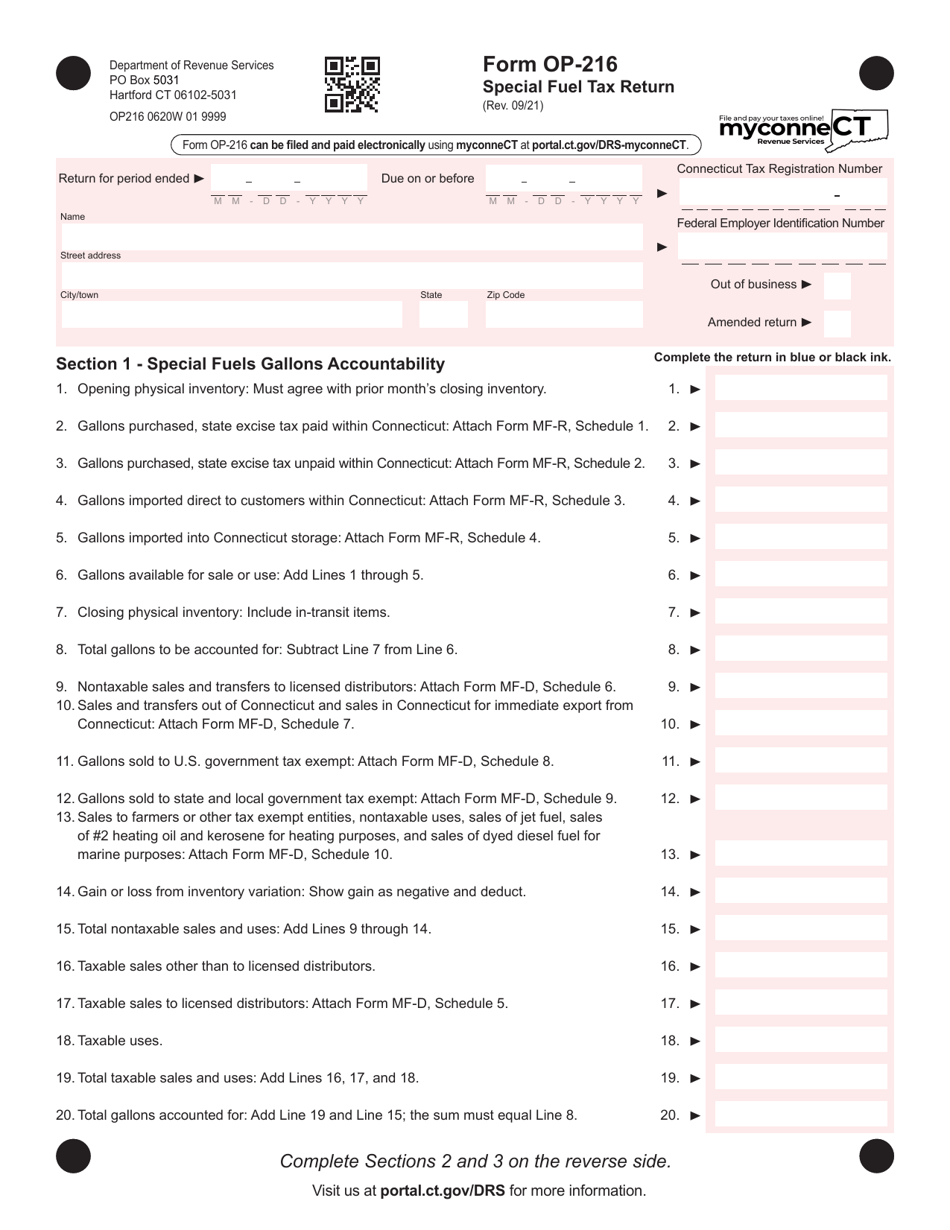

Q: Are there any penalties for late filing or payment?

A: Yes, there are penalties for late filing and late payment, so it's important to submit Form OP-216 on time.

Q: Is there an electronic filing option for Form OP-216?

A: Yes, you can electronically file Form OP-216 through the Connecticut Taxpayer Service Center.

Q: Do I need to keep a copy of Form OP-216 for my records?

A: Yes, it is recommended to keep a copy of Form OP-216 for your records in case of any future inquiries or audits.

Q: Is there any additional documentation required with Form OP-216?

A: In some cases, you may need to provide supporting documentation such as purchase invoices or records of fuel usage.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OP-216 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.